Quote of the Week

“Good loans are made during bad times and bad loans are made during good times” - CSB Bank

Bank Credit and an opportunity!

Is Adar Poonawalla’s side bet making good loans during a (really) bad time?

Let me explain.

Adar Poonawalla is the CEO of Serum Institute of India, a drugmaker, which is making headlines in it’s own right. A $10B (~₹75,000Cr) cash-rich company needs to maintain a robust Treasury department (which manages the extra cash). Different corporates invest the spare cash in different ways. Adar has been harping about acquiring a NBFC company since 2018. Even before he started it, he was always clear about it’s strategy. They started operations in 2019 (with an investment of about ~₹850Cr) as Poonawalla Finance.

Cut to today. It seems that they’ve already disbursed over ~₹1500Cr personal loans.

So what’s the big deal? Why am I talking about it?

Because it seems that they’re ticking all the right boxes. ✅

Ticket size is low (₹2L-30L) so that they’re not exposed to a single, large high-risk borrower

Borrower profile is established salaried/self-employed such as CAs, doctors, architects, Company Secretaries

The above two points have helped them develop a USP: No security, no guarantors, zero pre-payment charges (although no collateral loans are risky)

Low cost of borrowing: 7% - they are able to maintain this because of a high capital (76% compared to the minimum 15% required by regulators)

The most interesting aspect is that they’re targeting bank customers (by offering low interest rates of 10%-12%).

How have they been so successful in a span of just one year? It’s because they’ve learnt from all the past mistakes of IL&FS and other aggressive NBFCs that went bust. Adar has plans to grow this in a very systematic manner and invest about 4000-5000Cr eventually (initial plans include co branded credit cards and loan against property).

Do you know the other reason? Banks are simply not lending. In an earlier post, I had clearly explained where banks were keeping their excess money (short story: it’s in government and corporate bonds). But where do you get the data? If you’re looking to enter, or learn more about this business, how do you know which segment is growing (or not)?

Lo and behold! RBI data. I’ll show you how. I’ve analysed RBI data for August 2019 (page 74) and August 2020 (page 90).

(2019)

(2020)

Ignore the numbers (since they are not comparable due to crore and billions) - focus on the highlighted percentages. Compared to last year, non-food credit grew only by 6.7% compared to last year’s growth of 11.1%.

Note: Banks in India lend extensively to the Food Corporation of India (government-owned) to help them buy rice and wheat, directly from farmers. Once this lending is subtracted from overall gross bank credit, what remains is non-food credit. We do not consider food credit because it is dependent on government mandates, not market conditions.

If you click on the above links and go through the mentioned pages, you’ll find that personal loans only grew by 10.5% this year compared to last year’s 16.6%!

Now you understand why companies like Poonawalla are doing well in this space?

I’m sorry that our newspapers don’t sweat enough! But I hope this cover story helped you realise all that goes behind a success of a particular financial institution. It should also make you wonder about a few more things, like if we need more banks. Should more NBFCs be given bank license? What will be the advantage? Consequence?

Share this post on your social media channels, tag me and start the discussion!

What’s up with RBI?

By now, you must know what NPCI is.

According to their own definition,

We are an umbrella organisation for all retail payments in India. We were set up with the guidance and support of the Reserve Bank of India (RBI) and Indian Banks Association (IBA).

It was set up way back in 2008 to further the digital payment system in the country. Suffice it to say, it has grown extremely large since then. And complex. And opaque.

Can you imagine the concentration risk of running all of India’s digital payments? Just look at it’s portfolio. UPI alone processed ₹2.90 trillion value transactions in July, 2020.

Ofcourse, like with any company, CEO Dilip Asbe keeps claiming that they’re not a monopoly. And they keep claiming that there are no data security concerns despite multiple complaints of leaks.

Most importantly, being set up as a “not-for-profit” entity, it has allowed the Government to reduce all fees associated with payments (MDR is the technical term for fees charged by payment companies for processing transactions, which was brought to zero from Jan 1, 2020).

Enter NUE aka New Umbrella Entity.

All the problems that I just highlighted obviously didn’t go unnoticed by the RBI. They realised that NPCI was becoming a too-big-to-fail kind of entity. So early this year, it had released a draft framework for setting up an alternate entity.

This week, the final framework was released. (yes, that is why we’re talking about it now)

So what are the major guidelines?

It will be a for-profit entity, unlike NPCI (this is good for the overall payment ecosystem because innovation without reward isn’t really motivating, is it?)

It will require a minimum paid-up capital of ₹500Cr and constant net-worth of ₹300Cr

It is expected to be interoperable with NPCI’s current infrastructure (this is good because despite all it’s flaws, NPCI has done a tremendous job with it’s innovations, so a new system which does not comply with NPCI doesn’t really make sense)

If you’re looking to apply, you can fill this form. But do note that you might be competing with the likes of PayTM, Reliance and ItzCash. 🙂

Now let us understand two important strategies that banks and the NPCI are employing to counter the problems.

Strategy 101: Faced with a twin roadblock of low revenue streams and impending competition, NPCI has launched it’s international arm (called NIPL) this week. It will have the goal of exporting the revolutionary UPI technology which even Google had recommended the US to build.

Strategy 102: Top private banks (HDFC, ICICI, Axis, Kotak) are quietly passing the MDR charges to customers. Although the government had forbidden banks and payment companies to collect this fee from merchants, there are costs of maintaining this infrastructure. Considering the rise in bank losses, it is not surprising that banks will want to recoup these losses.

This is a very exciting space and it’ll be interesting to see who finally gets the license to operate toe-to-toe with NPCI.

Give me some videsi drama

This week, we talk about China.

More specifically, about the country’s central bank, People’s Bank of China.

No, it is not about childish claims of boycotting it because of it’s investments in HDFC Bank and ICICI Bank.

We’ll talk about it because the Governor, Yi Gang, wants to adopt a “normal” monetary policy. Honestly, in 2020, nothing is normal. But what exactly does he mean?

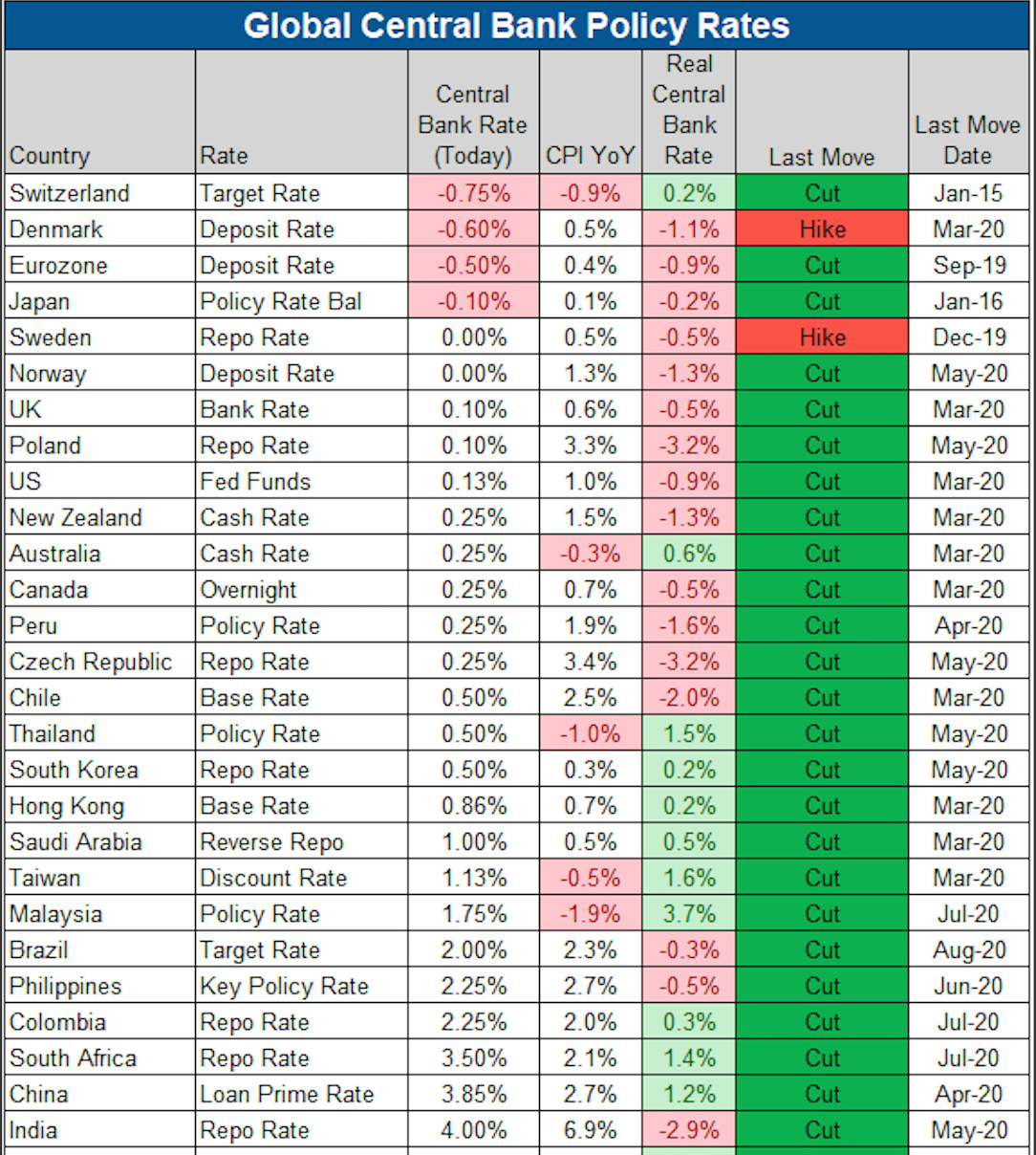

Consider this chart, courtesy Charlie from Compound Advisors. At the top of the table, replace:

“Central Bank Rate” with interest rate (say, on fixed deposits)

“CPI YoY” with inflation (the rate at which prices rise)

“Real Central Bank Rate” as the difference between the two - essentially, you would interest rates to be more, so that your investments grow in value, at a faster rate than the rise in prices. Simple!

Now look at the “Real Central Bank Rate” column. Look at all the countries in green. China is the only major economy which has a positive difference.

How is China able to do this? Now there are a lot of complex stuff (add to that, China’s disclosures are not really as transparent as other countries), but on a simplistic level,

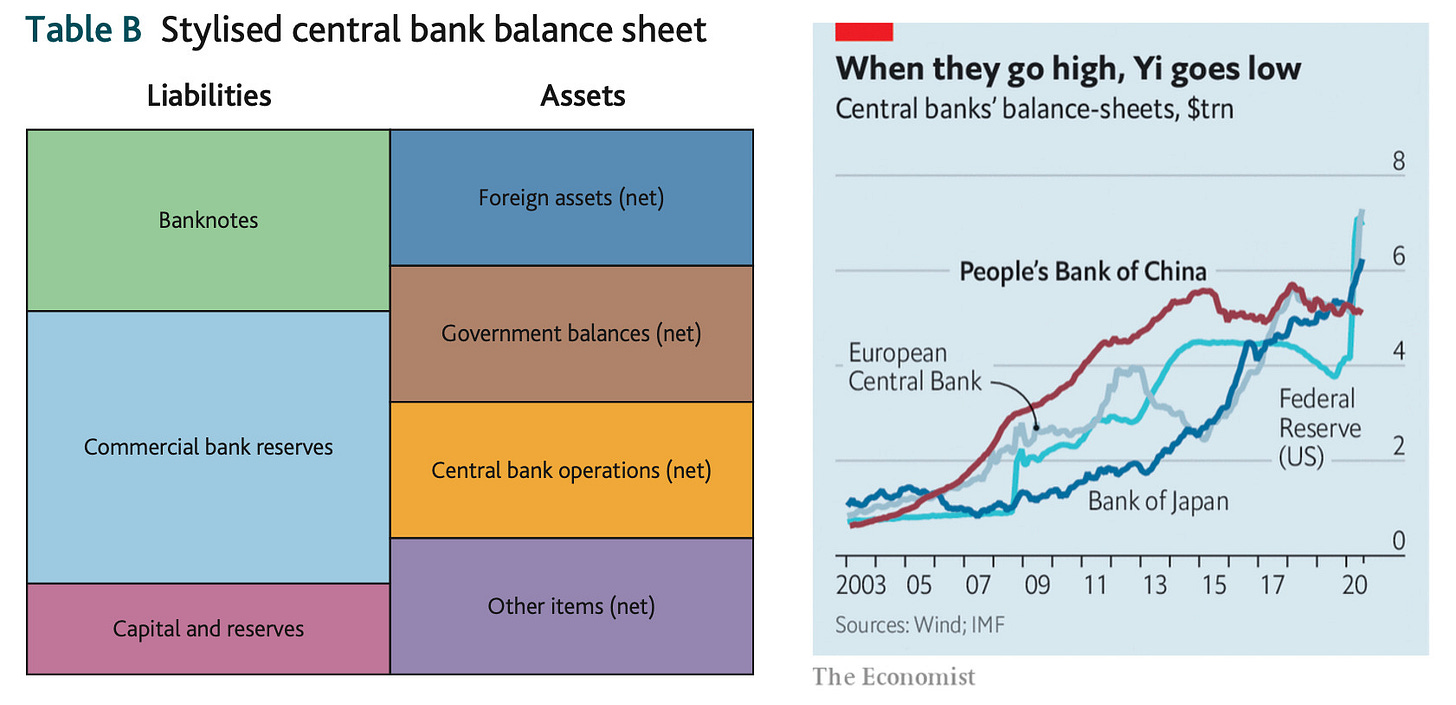

It is not expanding it’s balance sheet as quickly as other countries. When does a central bank balance sheet expand? One of the ways is buying government bonds and corporate papers (check the left image below). In exchange, money from the central bank flows into the economy. (more money for people generally promotes consumption which promotes inflation). Cool? As you can see below (image on the right), China’s assets have shrunk whereas that of USA, Japan and Europe have increased.

Another smart strategy, that I’ve talked about before (skip to the videsi section) is the adoption of digital yuan (Chinese currency). Apart from the obvious benefits, digital currency means greater control, tracking and collection of taxes. The 2022 Olympics will be held in Beijing. This means more international visitors. Ideally, you need to have an account with a Chinese bank if you want to use Alipay/WeChat to make payments there. But with China’s own digital yuan, you don’t have that requirement.

I hope you understand where I’m going. Both reasons (stable currency + digital currency) are China’s master plan to make the entire world use Yuan as the reserve currency, not the US Dollar. Far-fetched?

Only time will tell.

What else happened this week?

International

Citibank made a blunder. Ofcourse, banks make mistakes all the time. But what if that’s a $900M goof-up? Well, that’s bound to make headlines. Apparently, it transferred a huge sum to the lenders of one of it’s clients out of it’s own pocket. It’s hilarious actually. This article does a good job explaining the background.

National

Yes Bank sold it’s entire equity stake in CG Power. Why was a bank holding shares of a power generation company in the first place? Well, the bank had lent money to the promoters who had pledged (kept collateral) their equity portion in the company. When they couldn’t pay back the loan, Yes Bank had “invoked the pledge” - technical term which means they owned the promoter’s equity stake. They’ve been selling parts of it since one year, having exited completely this week.

RBI also released a national strategy for financial education this week (a collaboration with SEBI, IRDAI and PFRDA). I did not cover it because of paucity of space but you can read more about it here. I keep complaining to everyone that even in my MBA, I was not taught about basic (but important) stuff about managing personal finances. So I’m just happy that finally, there is a push towards more financial literacy in the country and I hope it is implemented effectively.

If you’ve reached here, you’re awesome! Rather than more subscribers, what makes me happier is when existing ones take out the time to read till the end! As a token of appreciation, here’s an excellent presentation if you want to understand how PE/VC investors look at the fintech space. Enjoy! 😎

If you want me to cover a particular news, want to get featured, write a guest post or simply say hi, reach out to me at anirudha@bankonbasak.com

P.S. You can also connect with me on LinkedIN, Twitter (these are two places where I post whatever that interests me) or on Quora (where I try to help people with their queries related to the banking sector).

Boring, yet an important disclaimer: Views/opinions expressed in this article are solely my own and not of my employer.

Amazing. Very lucid and engaging too.. (apart from the obvious- informative)

Awesome edition! Loved it!