#16 YONO, Kamath and a Woman!

Weekly Report: 7th-11th Sep, 2020

You Only Need One… Startup!

SBI Chairman Rajnish Kumar made a bold claim this week:

“My valuation for YONO would be, may be, $40-$50B, given the valuations which startups get. The only thing is that because it is sitting in the bank, it does not get reflected in the valuations. It is the biggest startup by a legacy bank”

Let us find out if his statements hold any water. But first…

What is YONO?

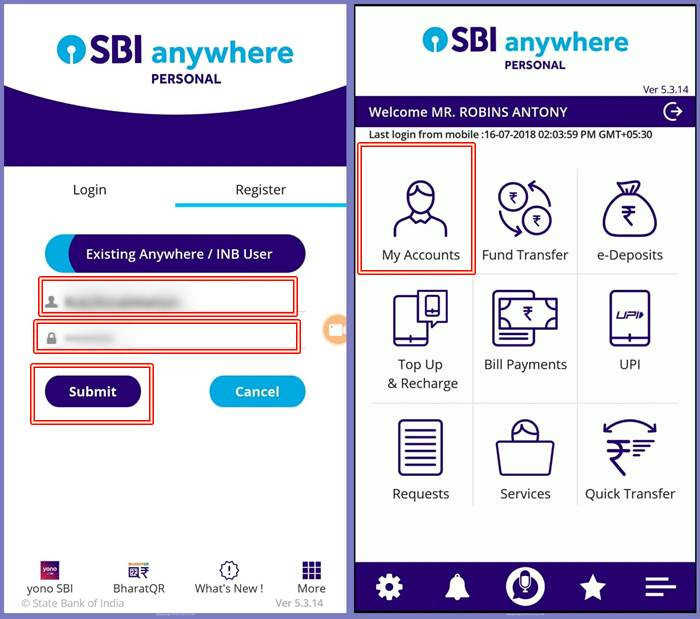

To put it simply, it is the digital banking arm of SBI. It was set up in 2017 by hiring a fancy consultant (McKinsey). However, it was mostly a re-design than something which was done from scratch. It was earlier called SBI Anywhere.

SBI Anywhere has now been fully phased out. It is now called YONO Lite (which looks exactly like the image above).

You might be thinking: “This looks just like another mobile banking app. Why should it be valued so much?”

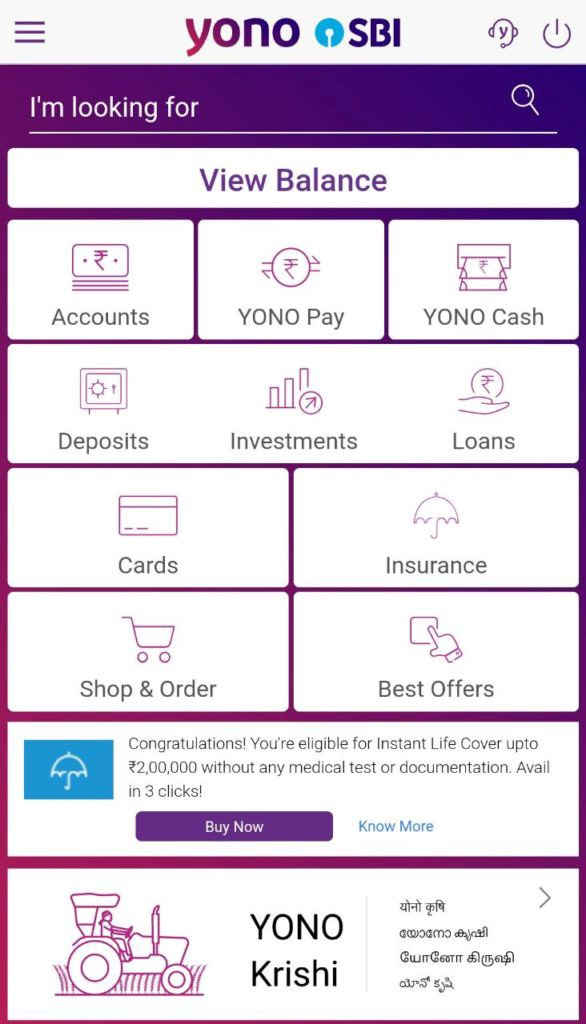

Well, the actual (primary) app is much more interesting.

YONO, true to its name, offers EVERYTHING that you would expect from a savvy financial institution - loans, insurance, cardless ATM cash (YONO Cash), credit card management, payments, recharges, mutual funds (SBI MF only) and even stocks (through SBI CAP).

Then there are things that you would not expect - in-app shopping, an exclusive offers page and YONO Wearable (yet to be launched)

Let’s get into the numbers now, shall we? (all data as on 30th June, 2020)

As you can see, YONO has a whopping 2.4 Cr registered users, out of which, 29L registered in Q1 itself (Apr-Jun ‘20)

There are two primary types of loans that it sells through YONO:

PAPL aka Pre-approved Personal Loans (I talked about the opportunity here)

AGL aka Agriculture Gold Loans (I talked about the opportunity here)

It’s actually a smart strategy. These two segments have a huge demand and they’re basically able to do it in a faster way through YONO.

GMV stands for Gross Merchandise Value (it just means the total merchandise value sold in a given period). The term is commonly used for online retailers. To provide a comparison, Flipkart’s GMV for FY19 was over ₹80,000Cr. Compared to that, YONO’s numbers appear miniscule.

There are some more numbers here:

Considering these figures, it’s safe to assume that even though the cross selling opportunity has been decent (look at cross sell box), YONO has been successful in only one segment: loans. With disbursements close to ₹20,000Cr, it has easily recouped the ₹800Cr investment in YONO.

But is that valuation justified? India’s highest valued startup (Flipkart) is at $25B. PayTM comes a close second at $16B. Although in a similar space, it would not be a true comparison since PayTM is not allowed to lend: the sole basis of YONO’s supposed valuation.

As per a discussion with Arti, closer comps would be Freecharge, but Axis Bank had paid a measly $60M for it back in 2017. Another meaningful comparison could be MobiKwik (backed by Bajaj Finance) which is valued slightly over $300M. It had plans to disburse loans worth ₹1500Cr in FY20. Since YONO has disbursed 10x that amount, should it also be valued at 10x ($3B)?

Valuation is an art. However, even abstract art has a price. With all the evidence in front of us, it seems Mr. Rajnish meant to say ₹40B and not $40B.

Despite the off-handed comments, it is undeniable that YONO is an excellent example of what our public sector banks could achieve in digital banking, coming toe-to-toe with private banks. Maybe other public banks could learn from this? I have used Bank of Baroda’s internet banking as well and it is a pain every time. Do you have a similar experience?

What’s up with RBI?

Last month, RBI had set up a committee under KV Kamath (ex-President, New Development Bank) to formulate the exact contours of the MSME restructuring that was announced because of C-19. At the onset, let me clarify two common misconceptions about this committee:

The restructuring applies only to borrowers having stress due to C-19

It does not apply to the restructuring that was announced for personal loans

It applies to those borrowers considered as standard (not an NPA) and with arrears (pending dues) of less than 30 days as on March 1, 2020

Early this week, the committee came out with the full report.

What’s the purpose of the committee?

All the sectors affected by C-19 may not come out unscathed after all of this ends. If they require any help, a resolution plan (solution strategy for stressed loans) needs be set up by the bank(s) who have exposure to the entity. So the first step of the committee was to identify the sectors affected, which they did:

It’s a powerful chart. Kudos to the committee for coming out with this under a tight deadline of 30 days. As per the analysis, an incredible 72% of the banking sector loans have been affected by C-19!

The second step was to recommend sector-specific ranges for certain financial parameters that would act as the boundary (upper and lower limits) for the resolution plan. These were the financial ratios they selected:

Page 14 of the report contains the exact limits set for these ratios for each (total 26) identified sector. (From the list, it seems real estate has been given a higher priority due to the severe stress it is facing)

It is important to note that apart from this, the committee has asked banks to follow a simple bucket approach of classing such loans into mild, moderate and severe. Among other things, this will help analysts better evaluate the true impact on a bank’s loan book.

Now what?

All restructured loans (re-negotiated to favour the borrower) through the resolution plan (RP) must maintain these ratios by 31 March 2022 and on an ongoing basis thereafter. The RP must be invoked (request for processing) by the last day of 2020. If invoked, it must be implemented within 180 days. This strictness is just to ensure banks do not do as they please to hide the true impact on their books!

As usual, there are criticisms with the ratios and inclusion/exclusion of some sectors. Be that as it may, considering all the effort that went into this, let’s hope that unlike last time, this restructuring does not come back to haunt the banking sector for years to come!

Give me some videsi drama

Observe this picture.

If the irony of this image isn’t lost on you, it wasn’t on the government either. Last year, at a hearing, Congressman Al Green unabashedly pointed out that all seven US bank CEOs present in the room were male and white. He went on to ask them if they thought that their next successor was going to be a female or a person of color. Shockingly, none of them raised their hand. You should watch the 2 minute video. (it was painful to watch)

What’s surprising is that even the current Citgroup CEO Michael Corbat didn’t raise his hand.

Cut to a year and a half later. Jane Fraser has been named the next Citi CEO, replacing Corbat when he retires in February 2021.

And just like that, Wall Street will have its first woman as the CEO of a major bank!

If readers here in India are having trouble relating to this news (ideally, they should not, I have highlighted the importance of this nomination here), here’s an inspirational story of another woman closer back home, right from my hometown.

Nandita Bakhsi is the CEO of Bank of the West, a subsidiary of BNP Paribas. Her background? Bachelors in History from Calcutta University (same one I studied from) and a Masters in International Relations from Jadavpur University (also in my hometown but I was too dumb to get into it). After that, she moved to the US following her husband who was getting a PhD. Determined to work, she found a teller job at a bank close to her home. The rest is history. You can read about her journey to the top post here.

Want some more? American Banker lists out the Most Powerful Women in Banking every year. This is the 2019 list.

If it isn’t obvious by now, I am way too excited about this. As Indians, we may have been used to women CEOs in banks (Shikha Sharma, Chanda Kochhar, Arundhati Bhattacharya), but it is amazing to see this generational shift abroad. Just the other day, I was reading an article about how to support black-owned banks. In fact, Bank of America Corp. recently invested $50 million in three Black-owned banks as part of its $1 billion pledge over four years to advance racial equality.

I am optimistic about the future.

Why shouldn’t I? Doesn’t this image look a LOT better? 😊

What else happened this week?

International

In light of C-19, the US Government had launched a program called Economic Injury Disaster Loans (EIDL) which allowed small grants and loans to employees and businesses. Considering the government was so generous in doling these out, there has been multiple reports of frauds associated with it, mostly from individuals who didn’t need or qualify for it. JP Morgan found that their own employees committed fraud: they even had the guts to keep the money in JP Morgan bank accounts! Of course they fired those employees and now, they’re looking for potential frauds in other government programs as well.

National

As promised, here’s the follow-up to last week’s Supreme Court case on the issue whether banks can levy interest on interest on the loans during the moratorium period: The Court has given two weeks time to the Centre and RBI to submit a final proposal. The next hearing will be on Sep 28 and until then, the prior order (that no account will be declared as NPA) will continue. Taking this cue, the Finance Ministry has formed an “expert committee” (yes, the government’s answer to any problem) to come out with a solution within a week.

That’s it for this week. Here’s something for those who stuck till the end👇🏾

I came across two webinars recently, related to the banking sector. Unfortunately, both of them are paid, but here’s the details for those interested:

Valuation of Small Finance Banks in India - conducted by FinShiksha. (₹350) [Live event on Sep 19, 4PM]

How to analyse the banking sector? - conducted by Finsense Gurukul and JST Investments. (₹200) [Live event is over; link provided for recorded webinar]

Disclaimer: Although I personally know the founders of both these educational organisations, I am not affiliated with them. Thus, I do not guarantee the authenticity of the information provided by them through these webinars. If you are hesitant to pay, both of them have tons of free content on their respective platforms which are just as informative.

If you want me to cover a particular news, want to get featured, write a guest post or simply say hi, reach out to me at anirudha@bankonbasak.com

P.S. You can also connect with me on LinkedIN, Twitter (these are two places where I post whatever that interests me) or on Quora (where I try to help people with their queries related to the banking sector).

P.P.S. I think the previous disclaimers were purely drafted; so I changed it up a bit (read below). If any lawyer is reading this, reach out to me with your suggestions please?

All views and opinions shared in this article and throughout this blog solely represent that of the author and not his employer. Since the author is employed by a bank, he has consciously chosen not to report any news related to his company to avoid conflicts of interest. All information shared here will contain source links to establish that the author is not sharing any material non-public information to his readers. His opinion or remarks on any news are based on the assumption that the source is genuine, thus he is not liable for any information that may turn out to be incorrect. This blog is purely for educational purposes and no part of it should be treated as investment advice. Using any portion of the article without context and proper authorisation will ensue legal action.

Interesting Stats. The most interesting stats is the INR 800 crs Investments. Where can we verify this ?

Very well written about YONO. But it is missing one of the USPs of yono i.e. YONO cash. SBI was the first bank to start this. Now, other biggies like ICICI has started this too, but still YONO is better in this tech as of now. It allows customer to withdraw cash from atm without using the physical card. It is safe considering the of late card skimming incidents. Having worked with the YONO platform, I can say that SBI is very aggressive about the YONO platform. YONO platform is not only limited to the app. There is a YONO portal in branches. Most of the non banking transactions like cheque books requests, KYC etc are now being done through YONO portal in the branch. I think this is SBI's first product where it has undertaken 1 year closed user group testing before the actual launch. SBI is also developing its own loan underwriting engine.In future, SBI may integrate it with YONO.