#17 Generational Shifts...

Weekly Report: 14th-18th Sep, 2020

Re-imagining the Credit Card

It might be surprising to some of my readers, but I don’t have a credit card. Yet.

Recently, my debit card’s chip malfunctioned and I couldn’t swipe it to withdraw cash. I was anyway going to get a credit card soon so I wondered if I could use it for the same purpose.

As expected, it’s not ideal.

Why should it be? As soon as you withdraw cash, banks charge you 40% annual interest rate (over and above the 2.5% flat fee). If you think this is common knowledge, Kunal Shah (founder of CRED) had mentioned in a recent podcast that 70% of its users didn’t know that credit card charges were so high.

For comparison, USA has much lower rates (16%-19%) whereas Brazil has skyrocket charges as high as 200%.

Here’s a chart from Bloomberg describing the average cash withdrawal through credit cards.

(Source: BQ)

Do you notice the anomaly?

There is a simple explanation. RBL Bank does not levy the massive interest (upto a period of 50 days). It only charges the flat fee. Human behaviour. Users jump at this opportunity.

But is this wise? Viswanath reports that Head of Retail at RBL, Harjeet Toor doesn’t see a problem in this, citing certain safeguards.

However, I did some digging. You can do this as well. Download their recent conference call transcript with analysts and type any keyword you’re looking for. As a thumb rule, the number of occurrence generally indicates how important it is for the bank. 😁

You can also check their Investor Presentation. In a span of just one year, while the industry grew only 5%, RBL’s credit card loan book grew a whopping 70%! This just shows how bullish they are on this segment.

(Source: RBL Bank)

The cash advance feature, coupled with their partnership with Bajaj Finance (since Sep 2018) is clearly paying off. If you notice in the picture below, September 2018 was the time when RBL pipped Kotak to gain market share in this segment. Considering it’s speed, it may soon cross Axis Bank as well.

(Source: Tijori)

In fact, “Credit Card” appeared 18 times in their most recent concall. The numbers reveal that out of their total credit card book, 22% of it is under moratorium, out of which they have provisioned (set aside money for losses) for only 10%.

In the words of management themselves,

“In our credit card segment, we were wary of an increase in the number of customers availing moratorium with the extension of moratorium and lockdown.”

Moreover, this huge focus in credit cards hasn’t really generated any income for the bank. In fact, it has gone down 37% as you see above (Of course, the industry figures went down as well)

I think Harjeet explains this in a very nice way when an analyst asked him if he should be worried if credit card customers continue to be in moratorium:

I think what you have to keep in mind is credit card is a product where you bill a customer. Customers pay you on due date because there is always a threat of a late payment fee which is levied. When the threat of late payment fee goes away, customers tend to miss their due date. And therefore, when they miss their due date, they come into moratorium. And then when the card gets blocked, they come back and pay again. That is why you are seeing a big churn happen and you are not seeing sticky customers who just continue to remain in moratorium.

So I’ve given you both sides of the argument. As a banker, would you be prudent (since credit cards are an unsecured segment and cash withdrawals are an emergency feature) or would you be smart to offer unique features to build your fee income?

Whatever, the case may be, RBL is daring to do something different. It would be interesting to see how it comes out through this crisis.

What’s up with RBI?

Can you believe it’s 2020 and Indian banks still manually report NPAs?

Of course, RBI always wanted them to automate the process. But banks didn’t.

The reason is obvious - Which bank wouldn’t want to downplay their bad accounts?

This is more evident in public sector banks because of their incentive structure and lack of accountability. Unlike private banks, public bank management is not motivated by what the markets think. Their seemingly fixed tenures (with no stock options) prompt them to kick the can down the road which makes NPAs the next CEO’s headache.

The existing process (in which the bank reports its NPA and RBI verifies it later) is clearly broken. Just look at the divergence. Even the largest lender of our country under-reported its NPA figures by a whopping ~₹12,000Cr!

(Source)

You might wonder, “How do these pass the system and the regulator in the first place?”

Well, when it comes to money, people can get creative. Before the 90th day of continuous missed repayments (after which it gets termed an NPA), a loan account is classified as “standard”. So some banks have this informal agreement with the corporate borrower (who is about to cross the 90th day of default):

“Hey man, why don’t you make a tiny payment? You don’t have to pay the full interest. Just pay a fraction so that I can show it my books that you haven’t defaulted and your account is standard. Cool?

These technical adjustments are also called ever-greening.

If this whole process is automated and system-driven, it won’t allow the management to make these adjustments.

So this week, RBI released a notification that mandates this automation by 30th June, 2021.

In fact, the central banks wants EVERYTHING to be automated starting from NPA recognition, provisioning (how much profits banks should set for bad loans), income recognition/de-recognition from impaired assets and also upgradation and down-gradation of accounts (from standard to NPA and vice versa). This has to be done everyday.

So will there be no exceptions?

Yes, there will. However, these will have to go through a two-level authorisation with proper audit trails so that they can be traced back to the person responsible.

Neat right? Hopefully, the creative people don’t find a way around this as well.

Give me some videsi drama

Today, let’s talk about a change in strategy that we’re observing in big banks.

Take Goldman for example. The bank is famous for its institutional clients. It was always synonymous with investment banking and being a bank for the wealthy and powerful. But lately, it has been trying to become more consumer-friendly and relatable.

It all started in 2016 with the launch of its retail brand Marcus (named after the founder). Two years later, it bought Clarity Money, a personal finance start-up. Nobody really knew what it did with that acquisition, until now. As of 2020, Goldman has launched Marcus Insights - a free financial management tool where you can link all your accounts to get a full picture of your finances.

Wait! Goldman and free? Yup. Don’t forget it can always use the data to tailor custom-made products for you. “If it’s free, you’re the product”

Is Goldman the only one?

Absolutely not. Wells Fargo has launched something called Clear Access Banking. To quote from Business Wire,

“Clear Access Banking is a new, low-cost, convenient bank account with no overdraft fees. Now available online and in branches, the new account is part of Wells Fargo’s broader effort to simplify its products and services, and make banking convenient and easy to understand.”

It is clear from the messaging that it is targeted for young adults. In fact, the $5 monthly fee is waived for users aged 13 to 24 years old.

Credit Suisse, another “bulge-bracket” (multinational investment bank) based in Switzerland, is on the way to launch a digital banking rival to the likes of challenger banks such as Revolut and N26. It is focusing more on a digital presence even as it plans to close a quarter of its physical branches to cut costs.

Do you understand the trend now?

The coronavirus has done a lot in accelerating plans of banks to adopt a digital-first approach. The reasons range from cutting costs to capturing a growing need (of millennials wanting easy, smart banking).

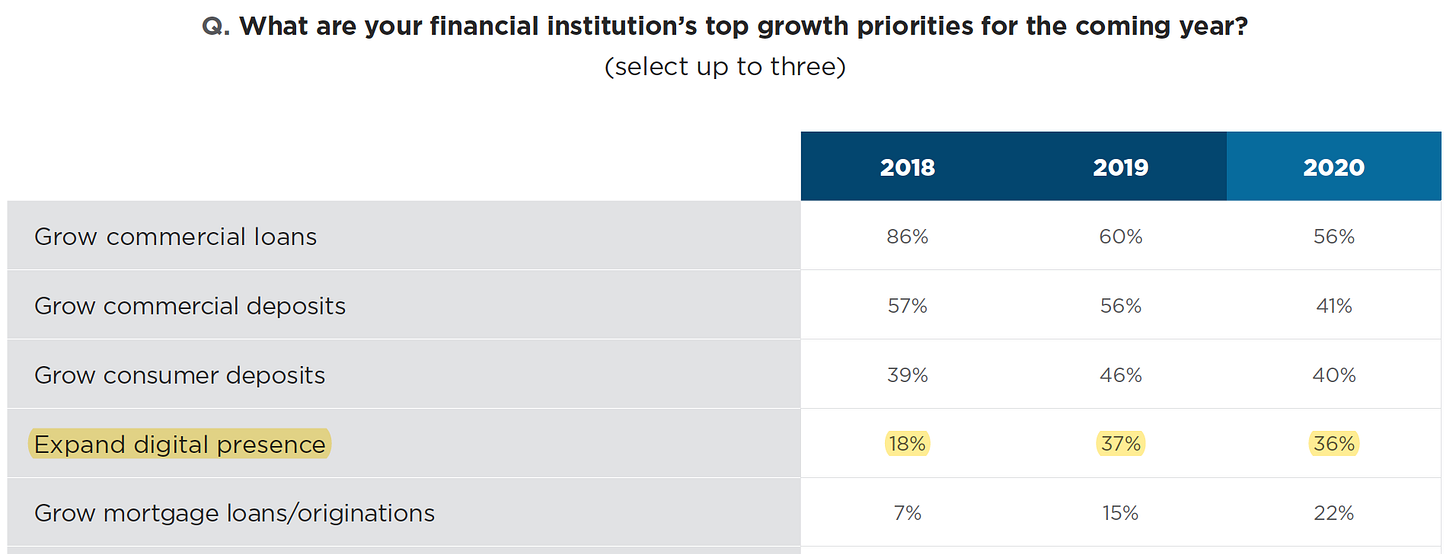

Cornerstone Advisors surveyed 300 senior executives of US-based mid size financial institutions and this was the result of a question. Notice the growing importance of expanding a digital footprint of banks.

It’s clear that despite all the new fancy neobanks, trust still matters. In the last 3 months, new accounts were mostly cornered by mega-banks, as we can see below:

An important quote I read recently comes to mind:

“Now that many consumers want to do all of their banking online, the pressure on banks to offer them an equal, if not better, mobile experience is high. Still, it’s only the largest of banks – here, defined as banks with over $10 billion in assets – that would even come close to being considered “full-featured” from a mobile banking perspective.” - Angela Strange

The big banks are simply lapping up a ready market. Those who are NOT tailoring their product for this crowd, is simply losing out.

What else happened this week?

International

Some more progress in diversity since last week. Thasunda Duckett was the first African-American named to JP Morgan’s Operating Committee (one layer below the Board of Directors). Next up? Central Banks (Gita Gopinath is the Chief Economist at the IMF)

Its a Wild Wild West with interest rates out there. US Fed is dumping “inflation targeting” and England is considering cutting interest rates below zero (you can read the justification here). For some context, India’s central bank still follows the concept of inflation targeting. Read this easy explainer to understand why it’s a bad tool.

After Spain, its Swiss banks which are merging now. Before 1998 there were three large banks in Switzerland—Credit Suisse, Union Bank of Switzerland (UBS) and Swiss Bank Corporation (SBC). Then in 1998, SBC merged with UBS. Now reports say that Credit Suisse and UBS may merge soon as well. Apart from the reasons I’ve highlighted previously, The Economist has out a piece explaining why European banks are merging.

After China, the European Central Bank wants to adopt a central bank digital currency (CBDC). I’ve talked about China’s goals here and here. Of course, now that more countries are adopting it, it makes sense for a company to capitalise on this. Enter MasterCard. It has launched a “testing platform” so that central banks can simulate the experience of going digital before launching it commercially. Smart, right? Also, CBDCs are the future.

National

Remember my YONO piece last week? I had mentioned that YONO wearables were yet to be launched. It seems they have now. SBI has partnered with Titan Watches to launch contactless payments on their smartwatches. Priced between ₹3k-₹6k, these NFC-enabled watches seem like a good entry into this budget segment.

This week, I’ve also written short pieces on government’s decision to infuse ₹20000Cr in public banks, strategy of small finance banks (detailed blogpost coming soon) and the concerns around PayTM’s removal from the Google Play Store.

That’s it for this week.

If you want me to cover a particular news, want to get featured, write a guest post or simply say hi, reach out to me at anirudha@bankonbasak.com

P.S. You can also connect with me on LinkedIN, Twitter (these are two places where I post whatever that interests me) or on Quora (where I try to help people with their queries related to the banking sector).

All views and opinions shared in this article and throughout this blog solely represent that of the author and not his employer. Since the author is employed by a bank, he has consciously chosen not to report any news related to his company to avoid conflicts of interest. All information shared here will contain source links to establish that the author is not sharing any material non-public information to his readers. His opinion or remarks on any news are based on the assumption that the source is genuine, thus he is not liable for any information that may turn out to be incorrect. This blog is purely for educational purposes and no part of it should be treated as investment advice. Using any portion of the article without context and proper authorisation will ensue legal action.

Regarding the manual process of recognition of NPAs... do you think this problem is mostly with PSU banks.. or even with top 4 -5 private banks