What’s up with RBI?

If you recall my first “Hold it” post, I had briefly explained the background of the MPC. Here’s an excerpt to refresh your memory:

The RBI Monetary Policy Committee met from 4th-6th August, 2020 behind closed doors to decide what the policy rates are going to be for the next quarter. This was the 24th meeting since the committee was formed in 2016, consisting of three internal (RBI) and three external members. With this meeting, the committee comes to an end of its four year tenure (2016-2020). Considering the difficulty in finding new external members amidst a crisis, RBI has requested the Government to extend their tenure.

Well, fast forward to today. The Government did not extend their tenure. In fact, the Government delayed the appointment of the new members, who were to preside over the meetings for the next four years. Result? The policy meeting got postponed as well.

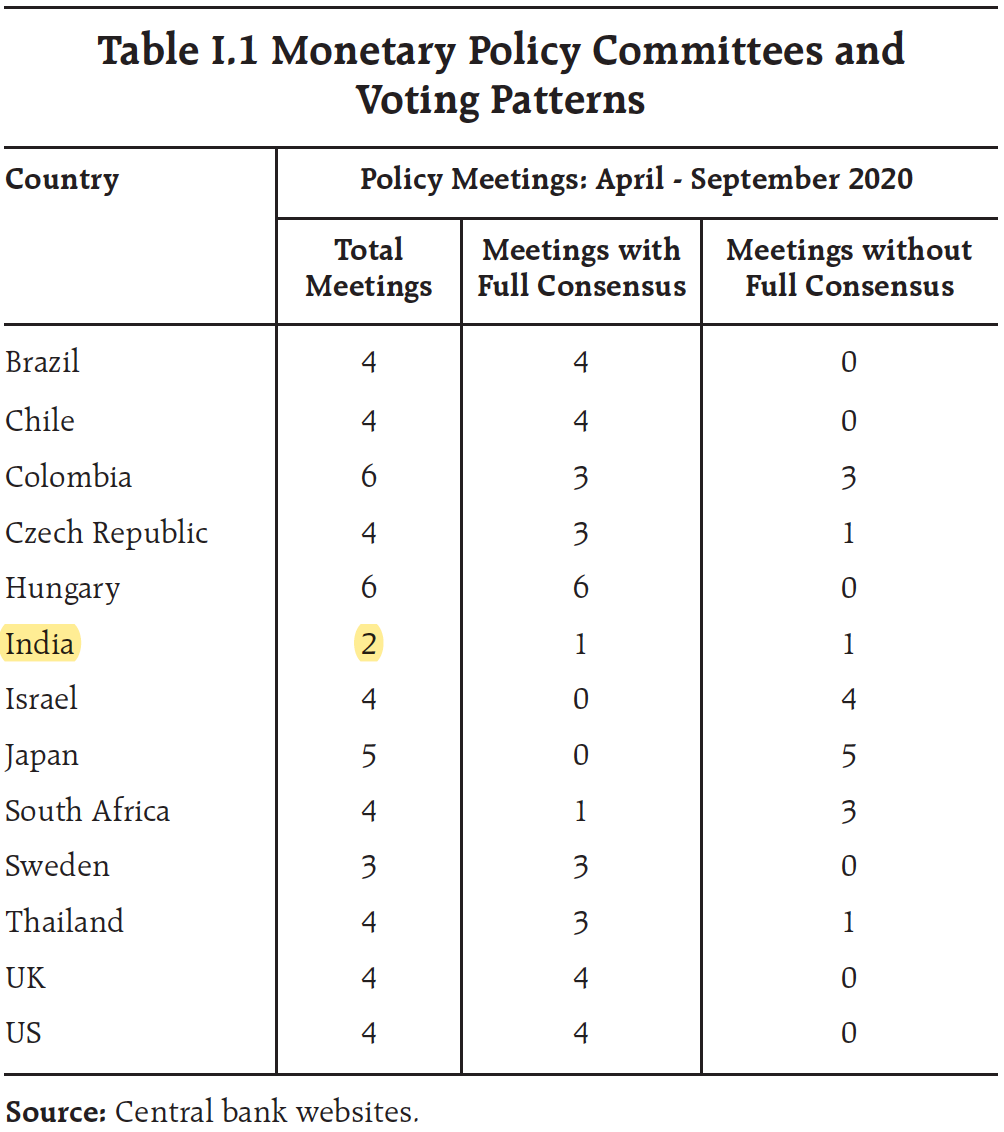

If you think that’s no big deal, look at the data below. India is the only country in this list which had less than 3 meetings in the last six months.

So who are the 3 new members?

As expected, the new members all come from an academic background, with IIM A scoring twice (Professor Dholakia in the previous one and Professor Varma in the new one). If you read their backgrounds, you may find that the other two members have a different one (diversity is the goal, right?)

However, as a member of the Finance Commission clearly points out,

“I do not see much change in the composition. In the previous group, you had a macroeconomist (Chetan Ghate), macro-modeller (Pami Dua) and regional economist/public finance expert (Ravindra Dholakia). Now you have Ashima Goyal (macroeconomist). Shashanka Bhide (macro-modeller) and JR Varma (financial expert)”

Of course, we will know exactly how they think when the minutes of the meeting are published. But everyone is still interested to know more about them.

Why is that?

Because when you know their viewpoint, you can guess how they might vote in meetings - will they cut rates? Will they support a rate hike? What is their priority? Is it growth of the economy, or controlling inflation? Or both?

All of these viewpoints have a cascading effect on banks, financial institutions, companies and the stock market. Now you know why each MPC meeting is widely discussed, even though they essentially do the same job every quarter.

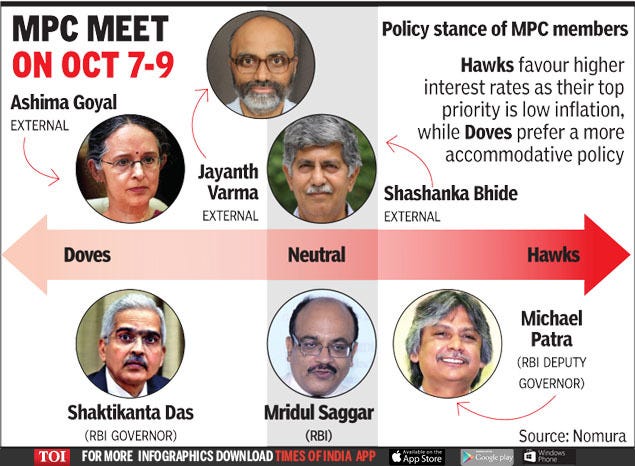

On mainstream media, you might encounter terms such as “dovish”, “hawkish” or “accommodative” quite often. Doves, synonymous with peace, are quite accommodative: They will support rate cuts to expand the economy. Hawks are the complete opposite. I found this neat infographic which explains these terms and also the respective members who fall under those buckets:

Policy Outcome

There is NO CHANGE since the last quarter, so basically that gives me the freedom to reuse my Excel table:

If I have to quote from the official notification,

All members of the MPC – Dr. Shashanka Bhide, Dr. Ashima Goyal, Prof. Jayanth R. Varma, Dr. Mridul K. Saggar, Dr. Michael Debabrata Patra and Shri Shaktikanta Das – unanimously voted for keeping the policy repo rate unchanged and continue with the accommodative stance as long as necessary to revive growth on a durable basis and mitigate the impact of COVID-19 on the economy, while ensuring that inflation remains within the target going forward.

One phrase stands out: “continue with the accommodative stance as long as necessary”

That’s essentially code word for “we will keep interest rates low for a very long time”

Rate cuts and sustained low interest rates favours a certain section of people (corporates, government, fund managers) more than others (individuals like you and I). If you want a deeper understanding on this, I highly suggest you read this explainer.

Other Announcements

RTGS (Real-Time Gross Settlement) facilities would be made round-the-clock (24x7). Earlier, it was allowed only from 7am to 6pm and not on bank holidays (alternate Saturdays and all Sundays). These are high value transactions (over 2 lacs) that happen between banks. It’s a positive measure considering social distancing norms. Its also a step in the right direction of making India a truly advanced payment-oriented economy. Last year, RBI had made NEFT transactions round-the-clock, and the number of transactions per month did increase. Expect to see the same for RTGS.

Exports get a relief. How? Since 2016, exporters were automatically put on a caution (warning) list if any shipping bill against them remained open (uncleared) for more than two years. Even banks had the liberty to recommend exporters to be put on this list. Now if exporters wanted to remove their names from this list, they had to manually visit the banks. Sometimes, it remained non-updated due to various other errors. Being on this list is bad for business. Even if they had cleared their dues, they can’t do new business if they’re still on it. RBI has now removed the automatic process and made it manual. What this will essentially do is make banks engage proactively with exporters before recommending their names. Exports had contracted big time since the lockdown. Hopefully, this measure will ease them out.

Small businesses and individual borrowers have reason to cheer as RBI has now allowed banks to lend more to these segments (7.5Cr from 5Cr) without increasing the risk weights. Increasing risk weights causes banks to charge a higher rate of interest, which is bad, both for borrowers (more expensive loans) and banks (have to set aside a larger capital for these loans). Now they don’t have to, just in time for the festive season.

Continuing with the theme of risk weights, RBI has made it lenient for housing loans as well. How does this work? Earlier, retail housing loans depended on two factors: LTV ratio (say if property value is X, you will get a loan of Y% of X. Y is the LTV ratio) and size of the loan. RBI has now removed the criteria of size. So big-ticket loans (say above 75 lacs), where the risk weight was higher, will attract the same risk weight as lower value loans. Big ticket house loans comprise only about 12-15% of the total house loan portfolio of banks (as per Ecowrap). This segment will hopefully get a boost now.

I have deliberately excluded all bond market related measures from this edition because of lack of email space. I know I have been receiving requests for the same. Don’t fret, I plan to cover each monetary policy announcement henceforth, considering RBI is doing a tremendous job with every meeting. So I will explain everything related to our central bank being the debt manager of the government, in an upcoming post. Stay tuned.

Did you like this coverage? Could I make it easy to understand? Do you like to read about RBI? Or only banks? I need feedback as I may inadvertently increase the complexity without realising it. Let me know in the comments or by replying to this mail. :)

Close your eyes for 20 seconds. Take a break. We could all use one.

Give me some videsi drama

This week, we talk about Morgan Stanley.

BIRTH

To understand it’s birth, I will shamelessly reproduce content from my #5th post:

Right after the financial collapse that led to the Great Depression (1929), the US government passed the Glass-Steagall Act (GSA). It mainly served to separate the commercial and the investment arm of banks to minimize conflicts of interest: in simple terms, banks used depositors’ money to invest in stock markets when they were rising pre-Depression. Post 1929, when markets crashed, the banks lost a lot and depositors wanted their money back. GSA aimed to prevent this.

Among other things, it led to the following outcome:

JP Morgan’s grandson and Harold Stanley separated the investment banking (IB) division from JPMC and formed Morgan Stanley in 1935. JP Morgan retained the commercial banking division.

Of course, it had a great run since then. Over the years (1935-1996), it became a formidable name in investment banking and trading securities. It handled debt offerings of General Motors, AT&T and IPOs of companies like IBM. It even credited itself for building a computer model for financial analysis, way before the Bloomberg Terminal got famous.

Then in 1997, it acquired Dean Witter, a stock brokerage firm catering to retail clients. You see, IB and trading are both very volatile businesses. It’s unpredictable too. You don’t know when the next company is going to file for an IPO (impacts IB). You don’t know when the markets are going to go up (impacts trading). Compared to this, retail brokerage and asset-management are relatively “safer” and “predictable” businesses, even though they’re less profitable.

That is why MS continued to deploy a high-risk high-reward strategies, even moving into the sub-prime mortgage business, which eventually led to its downfall in the 2008 crisis.

It’s amazing how two major regulations led to the birth and re-birth of the company.

RE-BIRTH

Post the Great Recession, it took help from the Government and transformed itself into a bank holding company. It essentially meant that MS needed to maintain a higher capital buffer and undergo stricter regulation (take less risks basically). To make you understand this point, this was the situation in 2008:

Today, Goldman Sachs has $1 of capital for every $22 of assets; Morgan Stanley has $1 for every $30. By contrast, Bank of America’s has less than $11 for every $1 of capital.

Goldman and MS were both investment banks. Bank of America was a proper commercial bank. Do you understand the consequence now? Less risk, less reward.

So what did MS do exactly? It curtailed its profitable trading business, it embraced the retail brokerage business and started providing advice to wealthy clients.

The transformation was dramatic.

CEO James Gorman, who took over in 2010 (and still helms the post today) knew that it would be extremely difficult to grow a retail and wealth management arm from scratch.

So he did it through acquisitions. He was responsible for acquiring Smith Barney (another retail brokerage firm) in 2012.

Cut to 2020

MS bought E*Trade (another retail brokerage yes!) in February, 2020 for $13B.

Two days ago, it announced that it would acquire Eaton Vance (an investment/wealth management firm) for $7B.

Spending $20B in one year is a huge thing, even for MS. Analysts think Gorman has overpaid, but the man thinks otherwise.

Even though the bank did transform and shed its image of an IB right after 2008, obtaining a peak at 2012, you can see below how its growth in the wealth management space has lagged since then.

Will this double bonanza speed up this growth? Will Gorman go down as the best dealmaker of his time?

Only time will tell.

Initially I had planned to only highlight the Eaton Vance acquisition news. However, keeping up with the theme of this newsletter to explain the strategy of banks, I took some time in building the context. Hope you liked it. Do you want to read something similar for Goldman? Or any other foreign bank? Let me know in the comments.

What else happened this week?

International

Each week, I try to highlight racial and gender discrimination/upliftment in banking. JP Morgan has announced that it will spend a whopping $30B over the next five years to close the racial gap. For context, this amount makes up ~90% of what the other Fortune 100 companies have committed since May, 2020 (George Flyod incident). Surprisingly, the the next two largest contributors are also banks (Citi and BoA), however, it pales in comparison ($1B) to JPMC. The money will mostly go towards new housing loans for Black/Latino people, affordable housing and small business lending. Last week, I said that I was extremely disappointed with JPMC. Is this their way of coming back into my good books?

National

I wrote about HDFC Bank’s Q2 numbers and the importance of the Credit-Deposit ratio of the banks in our country.

In line with the festive season, HDFC Bank and Bank of Baroda. It is important to understand that their strategies are very different. While BoB is offering a vanilla waiver of 0.25% interest rates for NTB (new to bank) customers, HDFC is focusing more on the rural side, partnering with VLEs (village-level entrepreneurs). According to their spokesperson, “60% of India lives in semi urban and rural areas and with VLEs as our partners, we have been able to go deeper into the hinterland and take banking products to rural India”. HDFC also tied up with Apollo Hospitals through which its customers can avail unsecured loans of up to ₹40 lakh to pay for medical expenses incurred at the healthcare chain.

Short stories: India Post Payments Bank gets a new CEO, CARE upgrades IDFC Bank’s rating from Negative to Stable, loans get cheaper, Central Bank wants to get strict with its non-performing employees (wow!).

That’s it for this week.

If you want me to cover a particular news, want to get featured, write a guest post or simply say hi, reach out to me at anirudha@bankonbasak.com

P.S. You can also connect with me on LinkedIN, Twitter (these are two places where I post whatever that interests me) or on Quora (where I try to help people with their queries related to the banking sector).

All views and opinions shared in this article and throughout this blog solely represent that of the author and not his employer. Since the author is employed by a bank, he has consciously chosen not to report any news related to his company to avoid conflicts of interest. All information shared here will contain source links to establish that the author is not sharing any material non-public information to his readers. His opinion or remarks on any news are based on the assumption that the source is genuine, thus he is not liable for any information that may turn out to be incorrect. This blog is purely for educational purposes and no part of it should be treated as investment advice. Using any portion of the article without context and proper authorisation will ensue legal action.

Brilliant work man. So easy to understand. Shouldn't the low rates help not only the corporates but the economy as a whole?

Thank you, Aniruddha for the weekly Economy digest. You have written in a very lucid manner.