#32 Peeking into the year ahead...

Deep-dive into RBI's Report on "Trend and Progress in Banking"

Hey there!

You survived 2020! So did most banks.

But will they survive 2021?

Don’t blame me for starting the year in a pessimistic tone!

That’s exactly how you feel when you read the first page of the report.

A Gloomy Future

For each of the different types of banks in the country, RBI had some really dark thing to opine:

Banks: “An analysis of published quarterly results of a sample of banks indicates that their GNPA ratios would have been higher in the range of 0.10% to 0.66% at end-September 2020.”

Small Finance Banks (SFB): “SFB’s which were earlier micro-finance institutions, continue to have significant exposure to unsecured advances even as they strive to diversify their portfolio”

Payment Banks: “Their business model depends on investment income to meet costs. But yield on Government securities have fallen to their lowest levels in 16 years impacting their interest income”

Co-operative Banks: “The share capital of co-operative banks is contributed by members, each of whom is entitled to one vote irrespective of the extent of shareholding. This, coupled with the absence of a secondary market for share trading, has made mobilisation of share capital by co-operative banks difficult.”

NBFCs: “Sources of funds, especially for small and midsized NBFCs, dwindled on reduced risk appetite of banks for low rated and unrated exposures. Financing conditions facing them were further affected by redemption pressures of the mutual fund industry”

All about NPAs

Here are all the mentions about NPA in the report.

Even we consider only emerging countries, India has one of the highest NPA ratios.

According to RBI, “Although it is difficult to isolate the impact of mergers from other forces acting concomitantly, the improvement in provisions helped in containing the net NPA ratios”. I don’t quite agree though. All of these “forced” mergers only pull down the public sector bank which has been trying its level best to maintain a clean book. This is how the government rewards them.

As expected, India gets a bad name because of public banks mostly. They pull up the overall GNPA of all the banks in the country. Mergers don’t help. Public banks need to be managed professionally, like private banks.

Unlike agriculture and industry, which are cyclical in nature, retail and services have been fairly stable in terms of NPA ratio.

Within industry, “Construction and power sectors were saddled with problems related to land acquisition, delay in getting various clearances, long gestation periods, contractual issues and cost overruns, and consequently had high NPA levels. In the gems and jewellery sector, NPAs increased with the exports declining during 2019-20”

Incentives…

“Public banks pull up the overall GNPA of all the banks in the country” - I feel that these two charts reinforce my statement in a self-explanatory manner:

This is just sad:

Retail Payments

Retail payments has seen a massive growth since the beginning of lockdown. These two parameters are such an important indicator to track that they made it to the top-weighted parameter to compute the digital payments index (more on this below).

Financial Inclusion

As I’ve mentioned earlier, this is one topic that I’m really passionate about.

(If you’re squinting to observe the image below, a handy tip is to click on it to enlarge)

Notice in (a) how the growth in bank branches has been fairly flat in the past two years.

In (c), India is pretty non-existent in terms of loan accounts with commercial banks per 1,000 adults. That doesn’t sound right, does it?

That is because most of the loan penetration in the retail segment is not through “commercial banks” - rather it is through non-banks or players in the unorganised sector (money-lenders)

PMJDY: Pradhan Mantri Jan Dhan Yojana is a National Mission for Financial Inclusion to ensure access to financial services, namely, a basic savings & deposit accounts, remittance, credit, insurance, pension in an affordable manner. Under the scheme, a basic savings bank deposit (BSBD) account can be opened in any bank branch or Business Correspondent (Bank Mitra) outlet, by persons not having any other account.

There are zero-balance accounts, with a free Rupay debit card provided along with it.

As on December 2, 2020, these are the official figures:

Accounts opened: 41.4 crore

Total deposits: 1.30 lakh crore

However, as you can see, even though the intended penetration has been successful (with nearly two-third are operational in rural and semi-urban areas), usage of these accounts remains a concern, with lacklustre growth in the average balance in these accounts.

Scheduled Commercial Banks (SCBs) generally prefer playing safe.

As you can see, more than half of the incremental branches are opened in Tier 1 cities because of course, that’s where the money is. This is the primary reason why RBI promoted Small Finance Banks.

Payment Banks

How are the last few standing (seven as of now) doing?

Although the report does not focus on individual balance sheets, it is quite evident that, on an aggregate level, payment banks are yet to turn profitable.

“The limited operational space of these banks, coupled with high initial costs in setting up of the infrastructure, implied that the initial years would be invested in expanding their customer base and they will take time to break even”

That’s all folks.

I could cover only so much as the coverage was bound to get image-heavy. Hope this summary saved you the trouble of going through a 230-page report.

What’s up with RBI?

Digital Payments Index

Remember the tagline “Cash is King, but Digital is Divine”?

As corny as it might sound, RBI’s push for digital has been fairly obvious by now. Back in February 2020, it had hinted that it will come out with an index that captures the extent of digitisation in the country!

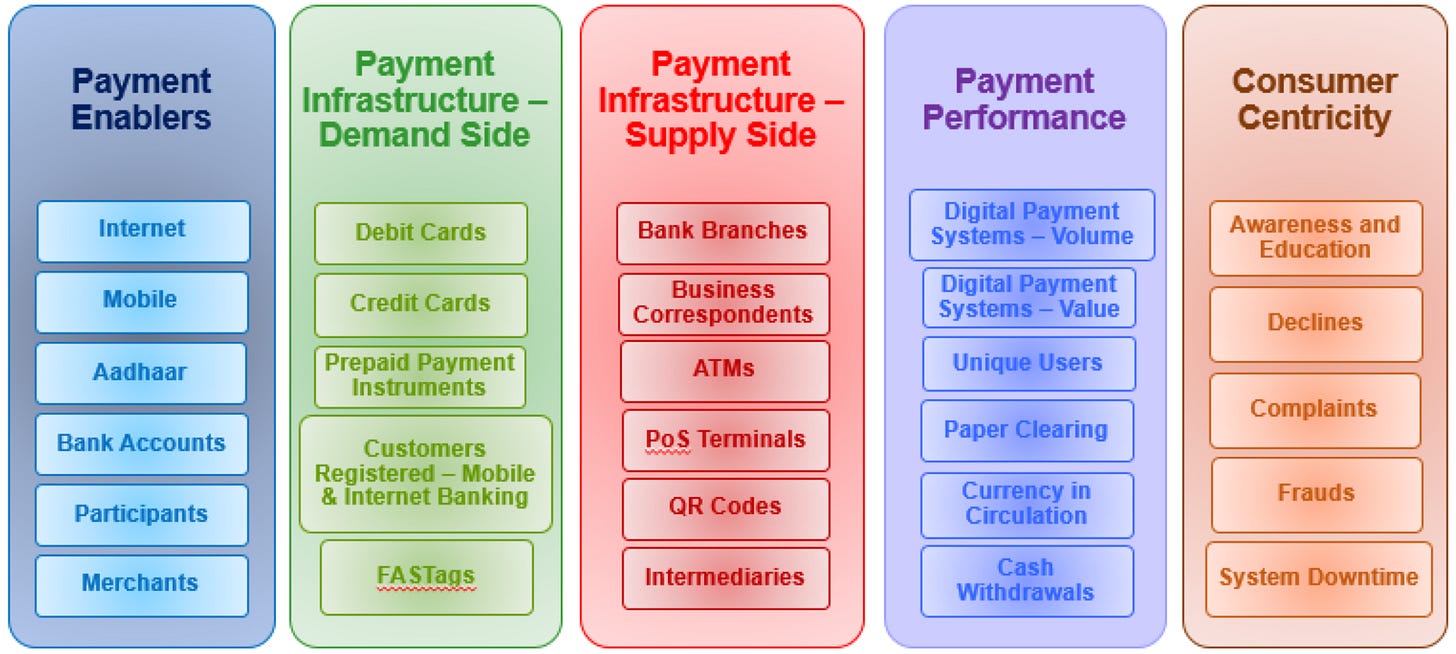

It has assigned weights to the different parameters based on their importance:

Payment Enablers: 25%

Payment Infrastructure (Demand Side): 10%

Payment Infrastructure (Supply Side): 15%

Payment Performance: 45%

Consumer Centricity: 5%

The concept is simple. Payments might be one word but it encompasses a broad range of definitions, all of which may or may not be important from a regulator’s perspective. For example, RBI would be more keen on broadening the base and curbing exchange of cash - thus Payment Performance, which includes “Unique Users” and “Currency in Circulation” and “Cash Withdrawals” - have the highest weightage!

The base period (the date from which the index starts) has been kept at March 2018. So, the base value on this date is 100.

DPI for March 2019: 153.47 (53.47% growth over previous year)

DPI for March 2020: 207.84 (35.43% growth over previous year)

DPI for March 2021 would be published around July/September 2021.

I love feedback. If you want me to cover a particular news, want to get featured, write a guest post or wanna simply say hi, do reach out to me at anirudha@bankonbasak.com or LinkedIN or Twitter. Meanwhile, like this post and share it around?

All views and opinions shared in this article and throughout this blog solely represent that of the author and not his employer. Since the author is employed by a bank, he has consciously chosen not to report any news related to his company to avoid conflicts of interest. All information shared here will contain source links to establish that the author is not sharing any material non-public information to his readers. His opinion or remarks on any news are based on the assumption that the source is genuine, thus he is not liable for any information that may turn out to be incorrect. This blog is purely for educational purposes and no part of it should be treated as investment advice. Using any portion of the article without context and proper authorisation will ensue legal action

RBI guidelines state that 25% of both SFB and Universal bank branches should be in rural areas (< 10000 population). Unfortunately, the SCBs are well above that level. Close to 30% IIRC. Hence, the incremental branches are in Tier - 1. To balance out the unit economics, it is only fair that banks take that route. Can't blame them.