#35 The Niche Players - Part 1

A deep-dive into NBFCs.

This week, RBI released two excellent articles on topics in which I get the most queries about:

Yes, the credit card piece will come soon as well. :)

But for today, we’ll focus on NBFCs. Small Finance Banks (SFB) are coming next week, just in time before the SFB IPO season.

Let’s dive in.

What’s the issue with NBFCs?

Okay, this has been a long time coming now.

It all started with IL&FS and DHFL saga. To provide a recap, here’s an excerpt from a Finshots article:

“On September 4th 2018, IL&FS, one of the largest NBFCs in the country, broke the cardinal rule of the Banking Industry. It defaulted on a series of repayments and confessed that it had run out of money.

The banks and the fund houses that had loaned generous sums to the company were stunned. They stopped extending new loans to other Non-Banking Financial Institutions almost instantaneously. The ensuing tremors shook up an entire industry. Many small and mid-sized NBFCs went bust. Even the big ones — most notably, DHFL went belly up within just one year.”

The incident was big enough for the central bank to sit up and take notice. Of course, as an organisation already befuddled with the Indian banks’ unending dramas (Yes Bank, Punjab & Maharashtra Cooperative Bank and Lakshmi Vilas Bank crisis), the solution to the problems posed by NBFCs kind of got a backseat.

Why wouldn’t it? If you look at the law, RBI isn’t supposed to scrutinise NBFCs as hard as it does banks. This is one of the reasons why co-operative banks were brought under RBI’s ambit.

Meanwhile, industry experts kept addressing the urgency. Consider ex-Chief Economic Advisor Arvind Subramanian’s paper last December. Here’s an excerpt:

After demonetization, considerable amounts of cash made their way to banks and mutual funds, which in turn on-lent a considerable portion to NBFCs. And as the economy started to recover after the demonetization and GST shocks, much of these funds were lent out.

And what happens when you don’t put these lending monsters on a leash?

In case the image is not scary enough, let me put this into context using RBI’s own words:

“In the last five years alone, the size of the balance sheet of NBFCs (including HFCs) has more than doubled from ₹20.72 lakh crore (2015) to ₹49.22 lakh crore (2020)”

“Over the last decade, NBFCs have witnessed phenomenal growth. From being around 12% of the balance sheet size of banks (2010), they are now more than a quarter of the size of banks.”

“NBFCs were the largest net borrowers of funds from the financial system, with gross payables of ₹9.37 lakh crore and gross receivables of ₹ 0.93 lakh crore as at end-September 2020.”

I made a chart to help you understand exactly how big NBFCs have become:

So here’s the gist of the problem:

“If NBFCs are slowly becoming as large as banks, why should they be regulated any differently than banks?”

Even though the question might be simple, the answer isn’t. (is it ever?)

Think of why NBFCs got such lenient framework in the beginning. The purpose of these entities were to provide a “spare tyre” to the economy. The lighter and differential regulation provided operational flexibility to NBFCs and helped them develop sectoral and geographical expertise, extending loans to every nook and corner (and Tom, Dick and Harry) of the country, whom the banks otherwise wouldn’t touch (because of high risk, high cost or low profitability).

If any new player, wanting to serve a particular niche in the market, extending credit to the last mile - were to be immediately regulated like a bank (which comes with a LOT of compliance costs) - wouldn’t they think twice before starting up? This is the exact essence that RBI wants to preserve.

So this whole regulatory “arbitrage” is by design, not by mistake.

However, times change. Rules become old, which were, if you can believe it, was majorly last changed in 2006 and marginally in 2014.

So now, RBI has decided (this is in a discussion phase right now) to tweak them again, with a plan to introduce a scale-based approach to address the increasing size.

Before we break down this solution, let us understand a few terms first.

We talked about the importance of size a while ago. A major consequence of size is “systemic importance” - a term you’ll often find RBI using. In a nutshell, it means that the financial company is so inter-connected among all other institutions in the economy, its failure would hold devastating ripple effects across the entire economy.

RBI themselves had put out an illustration explaining the same. Obviously, banking is the heart of the system. But NBFCs are no small player as well. Look at how it is connected with everyone:

Now obviously, this illustration is not all-encompassing i.e. it doesn’t really hold true for everyone. For instance, even though banking is at the centre, not ALL banks are “systemically important” - in fact, only three are (this list is updated every year, however, it has been the same since 2017)

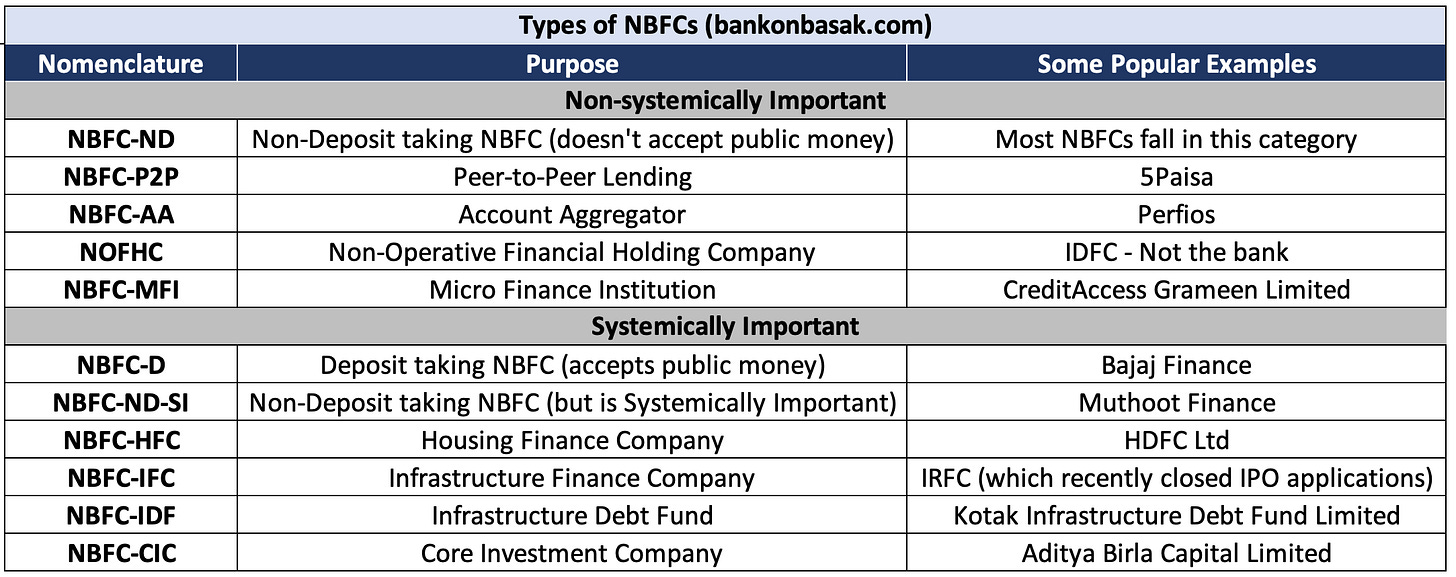

Similarly, not ALL NBFCs are systemically important. Although the criteria for banks are more rigorous, any NBFC which does not accept public funds OR are extremely small OR do not really play a significant role in credit intermediation - are the ones that are treated as non-systemically important.

Here’s a useful chart I made to help gauge a sense of the space:

Now that we’re clear of the terms, let’s go back to the pyramid chart.

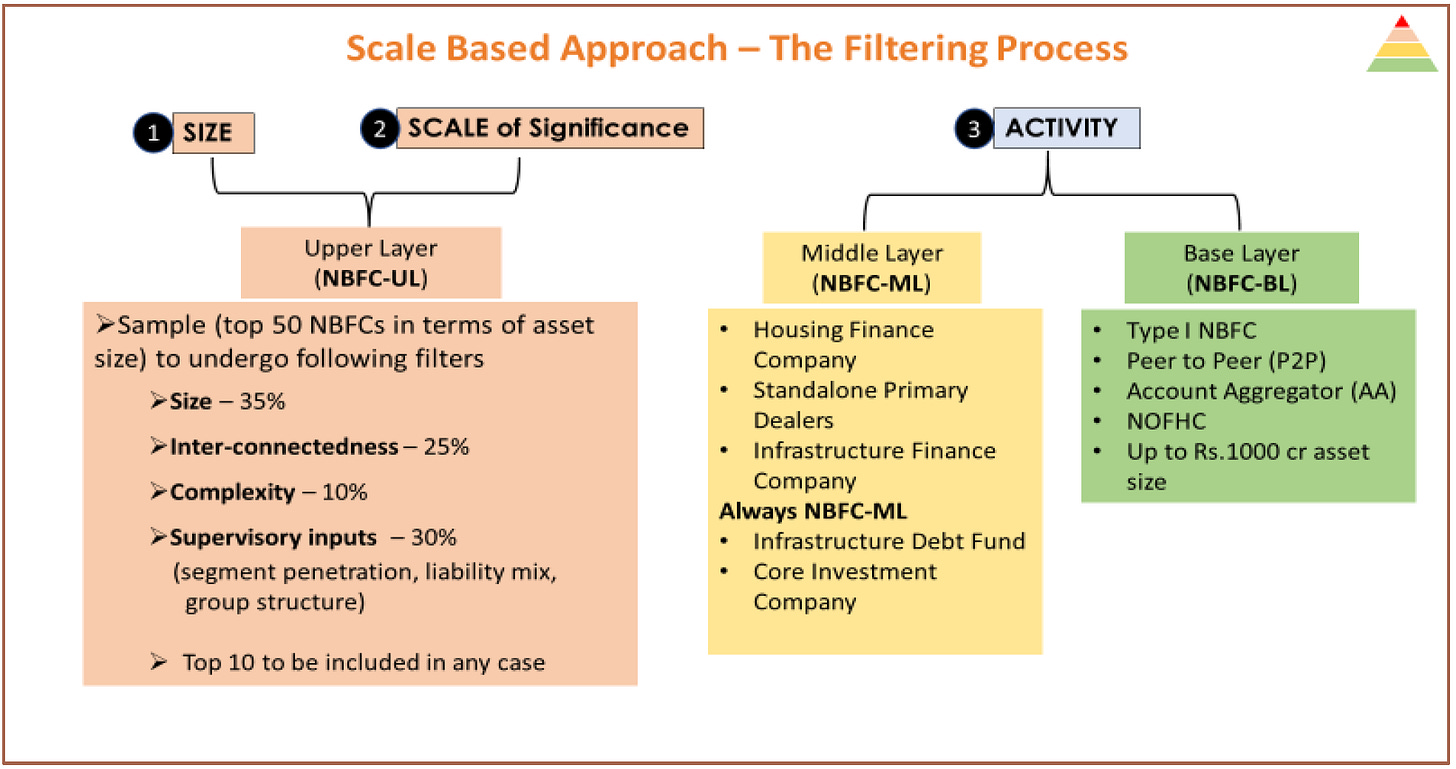

RBI wants to divide all these NBFCs (there are over 9000 in the country) into four different buckets - the more systemically important the NBFC, higher the regulation.

So all those non-systemically important ones will go into the base layer (BL). The systemically important ones will go to the middle layer (ML).

Just to be clear, after the 2014 revision, there are already two layers of regulation in place for NBFCs (depending on systemic importance), both of which will apply to the BL and ML respectively.

So what’s new?

The Upper Layer.

As of today, there is no parallel regulation for this cohort. It hasn’t been decided yet, but it’ll definitely be bank-like, albeit with “suitable and appropriate modifications”.

Here’s how the filtering process will look like:

Imagine the Upper Layer to be similar to the list of systemically important banks in India - however, instead of three, there’s going to be a lot more NBFCs in this layer, preferably around 20-30.

Here’s a key point: The Top 10 NBFCs (by asset size) will NOT undergo the filtering process and will be DIRECTLY included in the Upper Layer, just for the sake of their huge size.

P.S. The discussion paper goes into a lot of details structuring the filtering process, timeline for implementation and the works - for the simplicity of this article, we will not cover those.

Wait, what about the Top Layer?

That’s going to be empty for now.

This Layer was mainly created for emergency purposes - in case a NBFC from the Upper Layer becomes extremely risky during any point of time - they will be pushed to this layer. Of course, there’ll be higher regulation. RBI’s logic for creating a layer even before a NBFC qualifies for it is this:

Suppose you’re the owner of a NBFC in the Upper Layer. You know there’s another layer of regulation waiting for you incase you grow your business in size and complexity. You can be better prepared for the same, introducing the required measures in advance.

Anything else I need to know?

Srinivas was kind enough to highlight a point I almost missed:

IPO Financing

You might be aware that you need to bid for stocks you want to purchase before they hit the market. One of the recent IPOs that closed its subscription was Indigo Paints.

As you can see, there are different categories of investors. Generally, to get a confirmed subscription, retail investors (like you and I), bid amounts in the range of ₹15,000.

However, to get a confirmed subscription in the HNI segment, you need to bet big, usually above ₹1 Cr for high-demand IPOs. Most people do not have such cash lying around in their savings account. So they borrow money specifically for this purpose (short-term, for 7-14 days). NBFCs offer loans as high as ₹25 Cr in these cases. Why? Because Indian IPOs are kind of a lottery. If you get an allotment, you can return the loan (with interest) and still make profits. If you don’t, well, you only have to pay a tiny sum as interest. And the NBFCs earns interest in either case. Neat arrangement, right?

This is why the HNI segment gets the highest subscription in most IPOs (check the third column in the image above).

Well, RBI has proposed that no NBFC can lend more than ₹1 Cr now. (FYI: banks have a limit of ₹10 lacs only, hence people usually flock to NBFCs for this)

Will this move put a stop to investors trying to game the IPO allotment process?

That’s it for this week.

Do let me know if you’re actually enjoying these single-topic deep-dives or if you’d prefer the previous format of:

A cover story

What’s up with RBI?

Give me some videsi drama

More Bank on Basak

As always, if you want me to cover a particular news, want to get featured, write a guest post or wanna simply say hi, do reach out to me at anirudha@bankonbasak.com or LinkedIN or Twitter. Meanwhile, like this post and share it around?

All views and opinions shared in this article and throughout this blog solely represent that of the author and not his employer. Since the author is employed by a bank, he has consciously chosen not to report any news related to his company to avoid conflicts of interest. All information shared here will contain source links to establish that the author is not sharing any material non-public information to his readers. His opinion or remarks on any news are based on the assumption that the source is genuine, thus he is not liable for any information that may turn out to be incorrect. This blog is purely for educational purposes and no part of it should be treated as investment advice. Using any portion of the article without context and proper authorisation will ensue legal action.