#4 Capital Capital, where are you?

Weekly Report: 15th-19th June.

Quote of the Day

“Banks are in a Catch-22 situation. If banks don’t give credit, there is a risk of failure of organisations. If banks lend too much, lending might take a hit on the balance sheet” - Padmaja Chunduru, CEO, Indian Bank

Will Lakhsmi Vilas Bank rise from the ashes?

This time, it has received an offer from Clix Capital to buy close to 45% of the bank, which stands to around ₹2300Cr today. Of course, anything that happens with banks in India needs the blessings of our very own RBI (which is awaited).

In fact, the last time LVB tried to raise money by merging with IndiaBulls Housing Finance, RBI refused it without providing a reason.

We need to ask three questions here:

Why did RBI refuse?

Why is LVB so keen on raising money?

What are the benefits of a merger between a bank and a non-bank (financial corporation)?

1️⃣ It’s not that RBI doesn’t give a thumbs-up to these kind of mergers. Just look at the GRUH Finance-Bandhan Bank merger, Capital First-IDFC Bank merger or the Bharat Financial Inclusion-IndusInd Bank merger. All of them passed RBI’s lens. So what gives? Well, unlike the others, IndiaBulls has been known to be… shady.

2️⃣ LVB is keen on raising money because quite honestly, it isn’t doing well. Just look at the massive amounts of NPA (non-performing assets) and low capital it has. For reference, HDFC Bank (as of Dec 2019) had a gross NPA of 1.42%, net NPA of 0.48% and a Capital Adequacy Ratio of 18.5%.

Image source: Quarterly Results of Lakshmi Vilas Bank

Okay, I know I’m comparing an Iphone to a Jio feature phone, but even the prescribed RBI minimum is 9%, well above what LVB currently has. In fact, this forced RBI to put it under its Prompt Corrective Action (PCA) framework, which essentially puts strict limits on the bank’s powers, such as adding branches, lending to corporates and distributing dividends, all of which erode capital. Short story: If a bank is under PCA, it cannot grow. Hence, LVB is trying to shore up its reserve, all in the hope of coming out of this.

3️⃣ Finally, a bank and a NBFC merger is a win-win thing. The bank gets access to a wide geographical base, a diverse loan book and ofcourse, deep pockets (in some cases). For the NBFC, on the other hand, it’s the easiest way to get it’s hands on the coveted banking license (back door, you could say?)

So now you know.

Here’s wishing second time’s the charm for the 94-year old bank.

Raising capital is an eternal task…

ICICI Bank divests (sells) almost 4% in it’s general insurance arm, ICICI Lombard for ~₹2250Cr. Earlier in its Q4 results, the bank had announced that it would look at opportunities to strengthen it’s balance sheet. I guess this fits the bill.

Yes Bank is planning to raise $1B (~₹7600Cr) to raise Tier-1 core capital from ~6% to ~10%.

SBI recently said it will seek shareholders’ approval in mid-July to raise up to ₹20,000Cr equity capital through various means in the current fiscal.

Now in the case of LVB, we understood the need to raise capital. But why do strong banks such as HDFC, ICICI, SBI need to raise money?

Image source: quickmeme (unlike the one above, this was a ready meme 😂)

Explain please: You see, COVID is a dangerous substance, not just for humans, but banks as well. The true impact of borrowers not being able to repay the interest/principal on loans will only be captured in Q2 results, which ends on 30th June. Banks fear that NPAs will rise. So they keep aside capital (provision) to cover for these loans which they think will turn bad. If they provision from their current capital base, their Capital Ratio goes down, which, for a good bank, is really something to be proud of. So you could say they’re building a “war chest” to… yes, prepare for a war (loans gone bad).

What’s up with RBI?

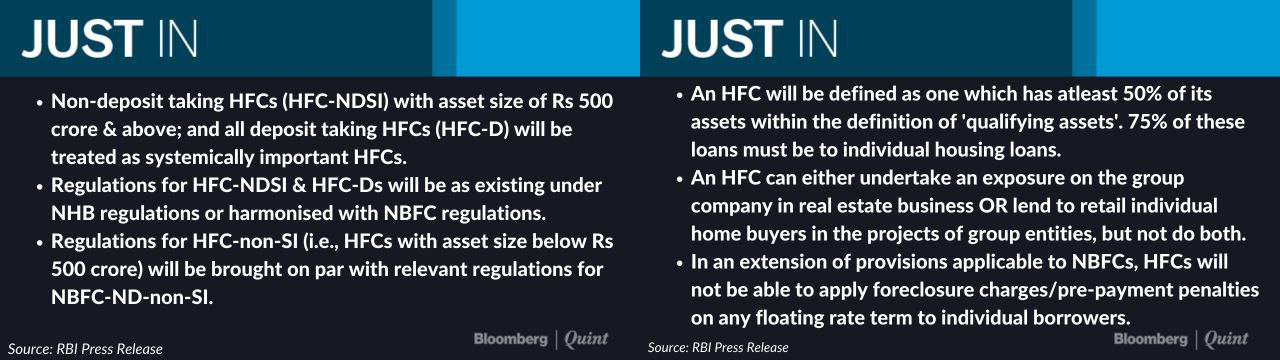

This week, RBI proposed some nifty changes to the regulations that apply to Housing Finance Companies (HFCs). Last year, the Government in its Budget, transferred the powers of regulating these entities from the National Housing Bank (NHB) to RBI. Why? Well, NHB is the primary lender to this companies. So it’s kind of a conflict of interest if they set the rules too.

Now that the reign is with RBI, it will seek to bring the HFCs at par with NBFC regulations. Although this definitely means stricter norms, it also means that it will become easier for them to raise capital now because of the transparency. Atleast, that’s what Gagan Banga, MD of Indiabulls Housing Finance feels so. Getting into the good books of the teacher, eh?

Also, in case you’re interested, here’s the snapshot of the change in rules:

Image source: Bloomberg Quint

Give me some videsi drama

This week, we’ll talk about Challenger Banks.

Although having different monikers (neo-banks, digital-only banks), the name mostly originates in small, recently formed retail banks in the UK. As the name suggests, they’ve come about to “challenge” the traditional big banks (in the UK, that’s Barclays, Llyods, HSBC and Royal Bank of Scotland) in their operations, if not scale. And who are the top Challenger Banks in that country? - Revolut, Starling and Monzo.

So are they doing a good job? Peter Ramsay of Built for Mars, finds out. He has conducted an excellent study on the UX (user experience) of Challenger Vs Traditional Banks and uncovered some neat information:

As a first glance we see, on average, it takes 2X the number of clicks to open an account in a Traditional Bank vis-a-vis Challenger Banks. What’s worse, you can’t even open an account through the bank’s app for any of the traditional banks (except Barclays).

Peter goes on to explain the other benefits of a challenger bank - in how faster it is to make a payment or freeze your credit card. It’s a fascinating case study and you should read all the chapters if you’re interested.

But the question we ask on Bank on Basak, is everything good about them?

Henry Fudge, CEO of 220 Bank, a digital bank for the elite, feels otherwise.

Take Monzo, for example, as seen above. It’s next funding round (investors pumping in money) is apparently at a 40% discount to the £2Bn valuation (~₹19000Cr) it was expecting.

Fudge explains,

£461m is the total value of customer deposits on Monzo Balance Sheet for 2019, for context of how small this is in the colossal world of banking, JP Morgan Private Bank has a minimum deposit requirement of $10 Million (~₹76Cr). That means the smallest 47 clients of JP Morgan dwarf Monzo’s entire 3.5 Million users deposits.

So should these challenger banks mindlessly chase scale (customers) or should they focus more on the value that each client brings?

And that’s exactly what 220 Bank and others (such as Alpian) are focussing on - Neo-style Private Banking for the Rich and Famous. These players primarily want to target young millionaires who hate travelling to the bank and want something more modern, more mobile.

The key bottleneck in financial institutions, as always, remains trust. Once they cross that, we will hopefully, see a new dawn in banking.

Note: Hat tip to Rahul Mathur for this section.

Movers & Shakers

Two major shuffles happened this week.

Pralay Mondal, previously Head of Retail Banking at Axis, has joined CSB Bank as President (Retail, SME, Operations and IT). Mr. Mondal, an IITK-IIMC alumnus, has >30 years of banking experience in Yes Bank, HDFC Bank as well as Standard Chartered. No gossip here, I promise! 🙈

Former Governor of RBI, Urjit Patel, who came in after Raghuram Rajan and before Shaktikanta Das, has been appointed as the Chairman of the National Institute of Public Finance and Policy (NIPFP) for a 4-year term. NIPFP is an economic think tank that conducts research on past, present and future Indian public policy-making.

Side note: The Director of NIPFP is Rathin Roy, whom I came across in this excellent video, where he explains how the numbers in the Union Budget don’t really add up. Also, Urjit Patel allegedly resigned from the seat of Governor because of differences with the Government when they wanted the RBI to fund the fiscal deficit, which Urjit did not agree to. I’ll let you add 2+2 now. 😉

Still want more?

Read this insightful Atlantic piece by Frank Partnoy explaining CLOs (collaterized loan obligations) and how US banks are exposed to it. It is ironical that even after that 2008 crisis due to similar instruments (CDOs, where D stands for debt), banks are still loading up on CLOs and trying to hide them by off-balance-sheet items. (15 minutes)

Read this profile on Challa Sreenivasulu Setty who has been collecting debts since the age of 12 and still does the same job, forty-two years later, as the MD of SBI who’s primary task is to recover the bad loans of the country’s biggest lender. (5 minutes)

That’s a wrap for the week. What did you think? Good, bad, yuck? Let me know in the comments.

If you want to reach out to me for a detailed feedback, want me to cover a particular news, want to get featured, write a guest post or simply say hi, reach out to me at bankonbasak@gmail.com.

In the meantime, tell your friends!

And stay safe!

Great newsletter for anyone interested in finance, even a little bit. Awesome

Hands down my favorite comment was "D for Debt", love the use of memes to make banking regs fun!