RBI has been busy this week, so I’ve moved up this section because [A] it’s important and [B] I know some of you don’t read till the end. 😒 So here goes..

“Lending is the future”.. but at what cost?

Covid has wreaked havoc with people’s personal finances. With mass layoffs, some are in dire need of cash. As they say, one man’s misery is another man’s fortune. Cue lending apps, which have proliferated over the past couple of years. As of yesterday, even Google Pay wants to enter the SME lending space. With one click of a button, you have access to liquid cash on the go (albeit it comes at a cost of non-transparent methods to calculate interest, which sometimes, shoots over 30%)!

What’s worse, is the way they’re recollecting the money:

Image source: Message received by a Cashbean customer as shared on Twitter

This is just one app. Social media is replete with similar messages of harassment, phone calls, threats of police action. With opaque grievance redressal forums, gullible borrowers had nowhere to turn.

Armed with a list of measures, the regulator wants these apps to fall in line.

Some of the steps it has taken are:

The name of the partner bank or NBFC has to be clearly disclosed on the website/apps of these lending platforms - this will not only allow borrowers to complain directly to the partner but also allow RBI to have them accountable (since RBI does not regulate the lending platforms)

The lending apps will need to send a sanctioned letter before the execution of the loan agreement on the letterhead of the partner bank or NBFC - this will not only force the partner to verify the T&C of the loan, but also make the loan details transparent, all the while slowing down the process of fund disbursement.

There are other minor measures as well, but hopefully, RBI has tightened the purse. 😎

Side note: This regulation will apparently not affect genuine lenders who were anyway practicing these in letter and spirit, as claimed by MoneyTap co-founder, Anuj Kacker.

Side note 2: This problem is not limited to India alone. Okash, a lending app in Kenya, threatens to notify everyone on your contact list if you fall back on your payments! 😱

The end of Co-operative Raj?

So the Finance Minister’s Office sent this out this week:

Image source: PIB India

Let’s not deny it. This was needed.

The recent PMC Bank crisis is still fresh on our minds.

Here’s the TLDR version.

The bank had advanced over 70% of its loan book to just one shady borrower, who on defaulting, caused a bank run (a condition where depositors rush to withdraw money fearing default, but the bank can’t pay since most of the depositor money is tied up in loans).

RBI had stepped in, at first, allowing depositors to only withdraw ₹1000, then ₹25000, then ₹50000, and finally ₹1,00,000 as of last week (yes, this has been going on for nine months)

You know what’s worse?

Even though the bank deposit insurance was hiked from ₹1 lac to ₹5 lacs this year, you’ll only be eligible for it if the bank goes into liquidation, not when it is placed under suspension, like in the case of PMC.

Take this data for instance, the DICGC (the governing body in charge of the insurance) collected ₹88523Cr as premiums from all the banks under it since its inception, but only paid out ₹296Cr

PMC Bank is just once instance. As of 2020, RBI had placed 44 co-op banks under it’s watch.

Till now, these banks have taken advantage of the situation that RBI doesn’t monitor them with the same scrutiny as Scheduled Commercial Banks (SCB). But will this really help? We need to ask some questions.

RBI already has a buckload of banks under it’s arm, despite that, a few slip by (Yes Bank anyone?). Having the same manpower, will it be able to do justice with this additional burden?

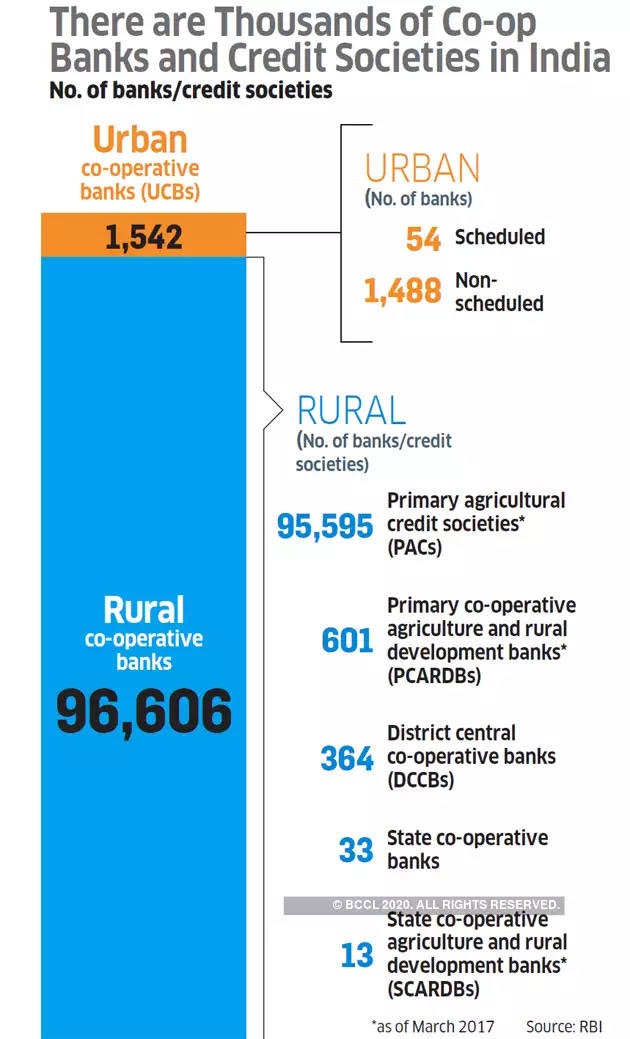

The government only mentions 1482 urban co-op banks in it’s announcement. Who’s left out? The picture below does a good job in highlighting that. Do they not matter? Or are we still going to turn a blind eye to the politicians who use the deposits of rural countrymen as loans to advance their private projects?

Image source: An excellent coverage on co-op banks from Economic Times (Oct ‘19)

The final question we should ask is, “Do we even need co-op banks?” - Although the number of banks are huge, they account for less than 4% of the assets of SCBs. Can this small subset not be serviced by SCBs setting up branches in these remote locations? Can we not leverage the rise of digital banks and payment banks to access their needs?

RBI is worried of Payment Frauds… & rightly so!

This week, the central bank released not one, but two full-blown notifications, sensitising and spreading awareness about the rampant increase in payment frauds through digital means. I tweeted about it recently when even an advisor to banks fell prey to it:

But the RBI can only do so much. It needs a collective action from the companies (like PayTM) as well as TRAI (the regulatory body which controls the DND service of SMS).

In the meantime, be alert folks!

Google Pay became illegal… almost!

In what could only be termed as hilarious, Google Pay was trending on Twitter for all the wrong reasons:

Image source: Twitter

In response to a PIL, RBI had informed a High Court that “Google Pay is a third party app provider and does not operate any payment systems.”

This is true. What is NOT true is how social media/news outlets misinterpreted this statement to mean something completely different. Let’s take this opportunity to clear our basics:

Google Pay is NOT a Payment System Operator (PSO) just like RBI mentioned. The National Payments Corporation of India (NPCI) is the PSO which has the exclusive permission from RBI to authorize all UPI participants in India.

Google Pay is a Third Party App Provider (TPAP) operating under the UPI framework of NPCI. Again, exactly what RBI mentioned in the press statement.

UPI is regulated by NPCI, which in turn, is regulated by RBI.

Here is the press release explaining the same. Apart from other things, it definitely helped us see all the live players in India currently:

Now look at the current market share of these players to understand the market concentration:

Now who would gain the most from such fake news about GPay spreading? 🤔

Give me some videsi drama

Let’s understand Volcker rule today.

But before we understand it, we need to travel back to 1933. Right after the financial collapse that led to the Great Depression (1929), the US government passed the Glass-Steagall Act (GSA). It mainly served to separate the commercial and the investment arm of banks to minimize conflicts of interest: in simple terms, banks used depositors’ money to invest in stock markets when they were rising pre-Depression. Post 1929, when markets crashed, it caused a bank run. GSA aimed to prevent this.

Cut to 1999. USA passed the Gramm-Leach-Bliley Act (GLBA). I’ll spare you the details, but it is most famously known as a repeal of the GSA.

This decision costed them dearly, with the Great Recession (2008) happening primarily because of the very thing that the GSA was supposed to prohibit.

The regulators needed to do something. They came out with a comprehensive set of rules wrapped up in what is famously known as the Dodd-Frank Act (DSA). Volcker Rule is section 619 of the DSA, essentially the same thing that GSA does, just under a different name.

So why am I talking about it now?

Because as of this week, the regulators are considering relaxing Volcker Rule.

Banks are AGAIN going to be able to invest in risky ventures like VC/PE firms. It also makes changes to margin requirements (proportion of money banks are supposed to set aside when they make such risky investments). Impact? Collectively, it could free up an estimated $40B that banks can now use to earn more profits. This margin was supposed to act as a cushion to their capital when they faced losses. Now it’s gone.

Obviously, banks are super happy, with shares of major banks rising away.

All of this is happening in the midst of the Federal Reserve (US central bank) shouting “Banks are healthy, can easily tackle coronavirus”, without really commenting on the individual stress tests of banks.

Let’s pray all this obliviousness doesn’t come back to haunt us again.

Still want more?

Goldman Sachs created a complete font for themselves, and they named it… wait for it - Goldman Sans 😂 It’s free to download from here - but there’s a caveat - you can’t use it to talk shit about the bank!

Just like the Federal Reserve, even RBI wants Bank CEOs to conduct stress tests. A stress test is a simulation under various scenarios to check if a bank can survive a particular threat to it’s capital base.

That’s a wrap for the week. What did you think? Good, bad, yuck? Let me know in the comments.

If you want to reach out to me for a detailed feedback, want me to cover a particular news, want to get featured, write a guest post or simply say hi, reach out to me at bankonbasak@gmail.com

In the meantime, tell your friends!

And stay safe!

P.S. You can also connect with me on LinkedIN, Twitter (these are two places where I post whatever that interests me) or on Quora (where I try to help people with their queries related to the banking sector).

The relaxation of Volcker Rule indeed is risky , but isn't it the last resort the banks could rely upon in these testing times ?? Clearly I don't have that amount of insights into this but isn't there a high probability that this risk will average out ?? Yes we could lose everything if it doesn't but isn't it still better than going into another recession ??

I liked the GPay goof up. For a newbie like me, this is a bit dense (though you have actually simplified much of it). Keep writing Anirudha bhai