The curious case of bank branches

Just like ATMs, the debate of bank branches have been lingering for quite some time now, especially after Covid-19 and the Fintech boom; the eternal question being,

“Do we even need bank branches these days?”

It doesn’t help when clickbait-y news articles such as these start circulating around:

Let’s focus more from an Indian context.

As per RBI data, apart from India, Bangladesh and Vietnam, all major economies have shown a downward trend in the number of branches.

However, if you look at this more closely, this was primarily driven by public sector banks, who’s branches grew by 16% in 2020-21. Overall, the growth is still stagnating.

This is apparent when you read conference calls as well.

Over the last couple of quarters, Federal Bank has been explaining how their FinTech partnerships are helping them save costs with respect to running or opening a new branch.

Based on their inputs, this is how they look at it:

A new branch takes minimum 18 months to break-even (revenue equals cost)

The expected outcome from their FinTech partnerships is equivalent to opening 2000 new branches. They’ve also said, “when we grow 25% in incremental deposits [through FinTech partnerships], it is almost like adding 300 branches.”

When the common theme is to slow down branch expansion, why did this become a hot topic again?

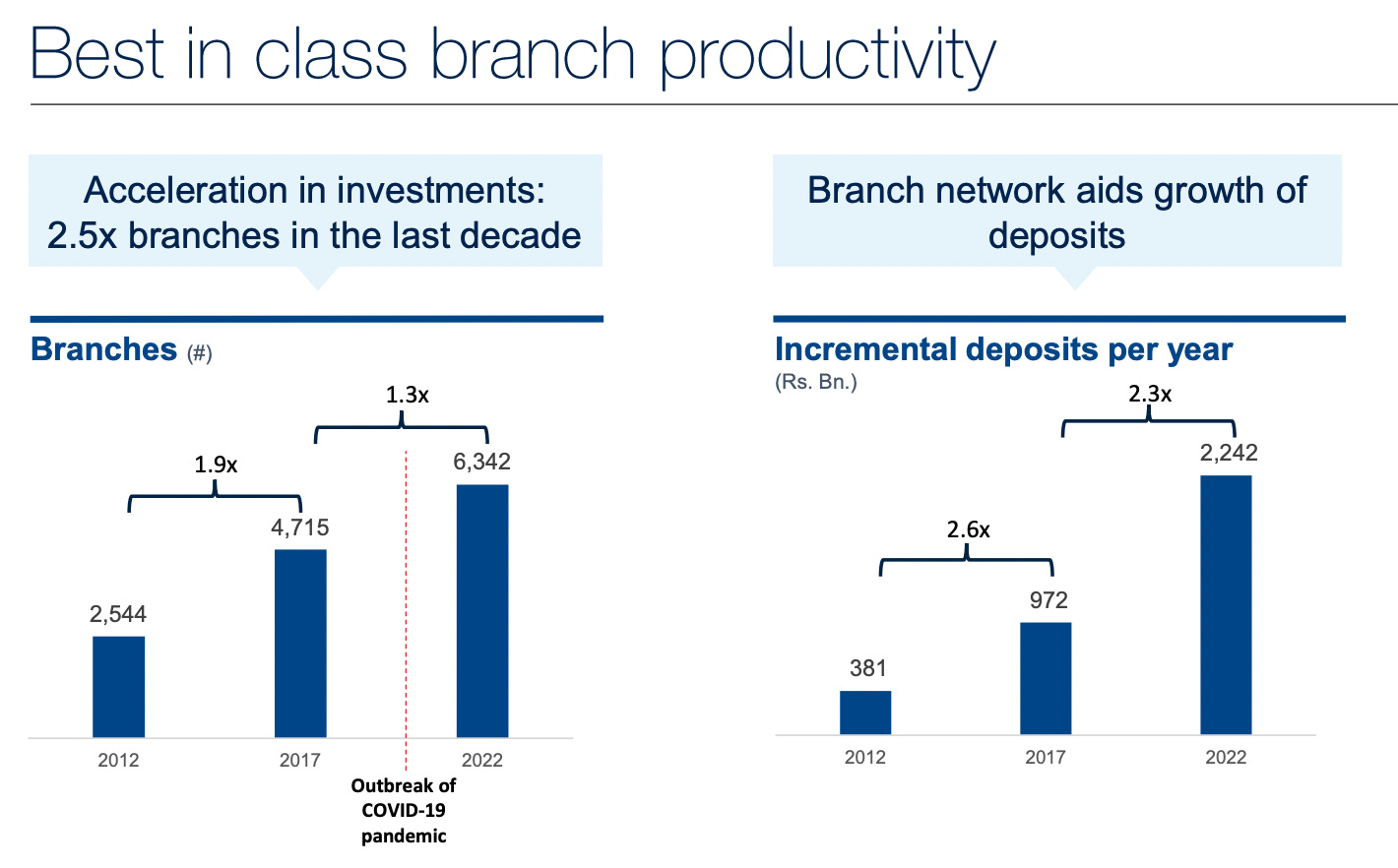

Well, last week, the top guy at HDFC Bank, in their annual analyst conference, mentioned that they’re going to add about 1500-2000 branches a year, for the next three years. 🤯

Their rationale is simple - branches help bring deposits and strengthens the liability franchise of the bank.

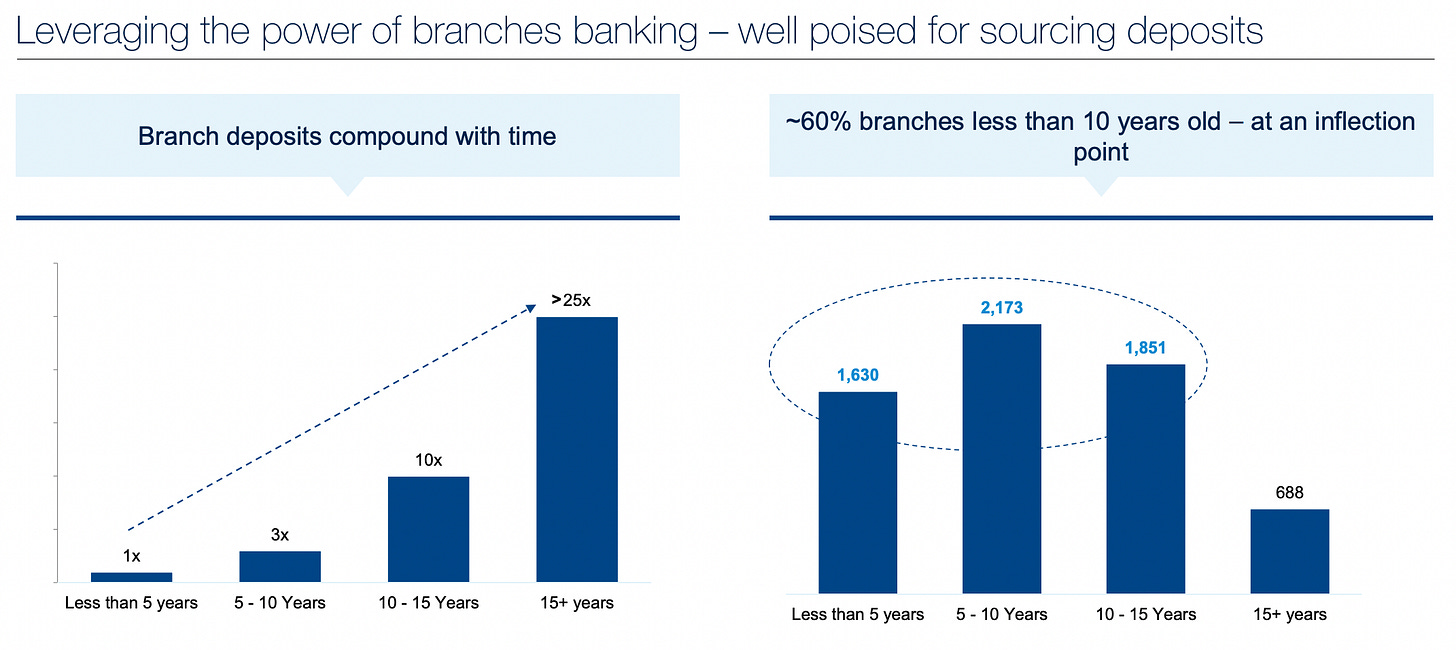

In fact, the older the branch, the better the deposit mobilization i.e. deposits compound over time. It’s like wine. With 11% of their branches being more than 15 years old, I think they’ve realized the importance of this vintage.

To pre-empt the question regarding why they’re choosing the brick-and-mortar route in a digital age, CEO Sashidhar had to say,

“Frankly, India’s demography is different from anywhere else. Today, the average distance between branches is 6-7 kms, even within our own… all of us in this room, we all agree that we don’t travel 5-7 kms to go to a branch.. we want the concentration to come down.”

With 50% branches in SURU (semi urban and rural), the bank wants to double down on this - a few days prior to the analyst conference, it announced “Future Ready” project, a plan to open 1060 branches in these SURU regions. It does this through “catchment scoping” - a method of assessing the potential and awareness about the bank brand and offerings in nearby areas.

Social media was divided. While a set of folks believe that digital banking is the future, a few others point out that financial inclusion is best done through touch and feel.

Anand here as even explained how HDFC is able to grow at a faster rate than Federal (at a 9x base) solely because they understand the power of distribution.

Another difference between Federal and HDFC is that the customers it is trying to target through their FinTech partnerships is driven by interest rates, whereas HDFC has made it categorically clear that sourcing new deposits will be branch-led and not rates-led.

So is Federal doing something drastically different, or -

Does all large private banks follow the same strategy?

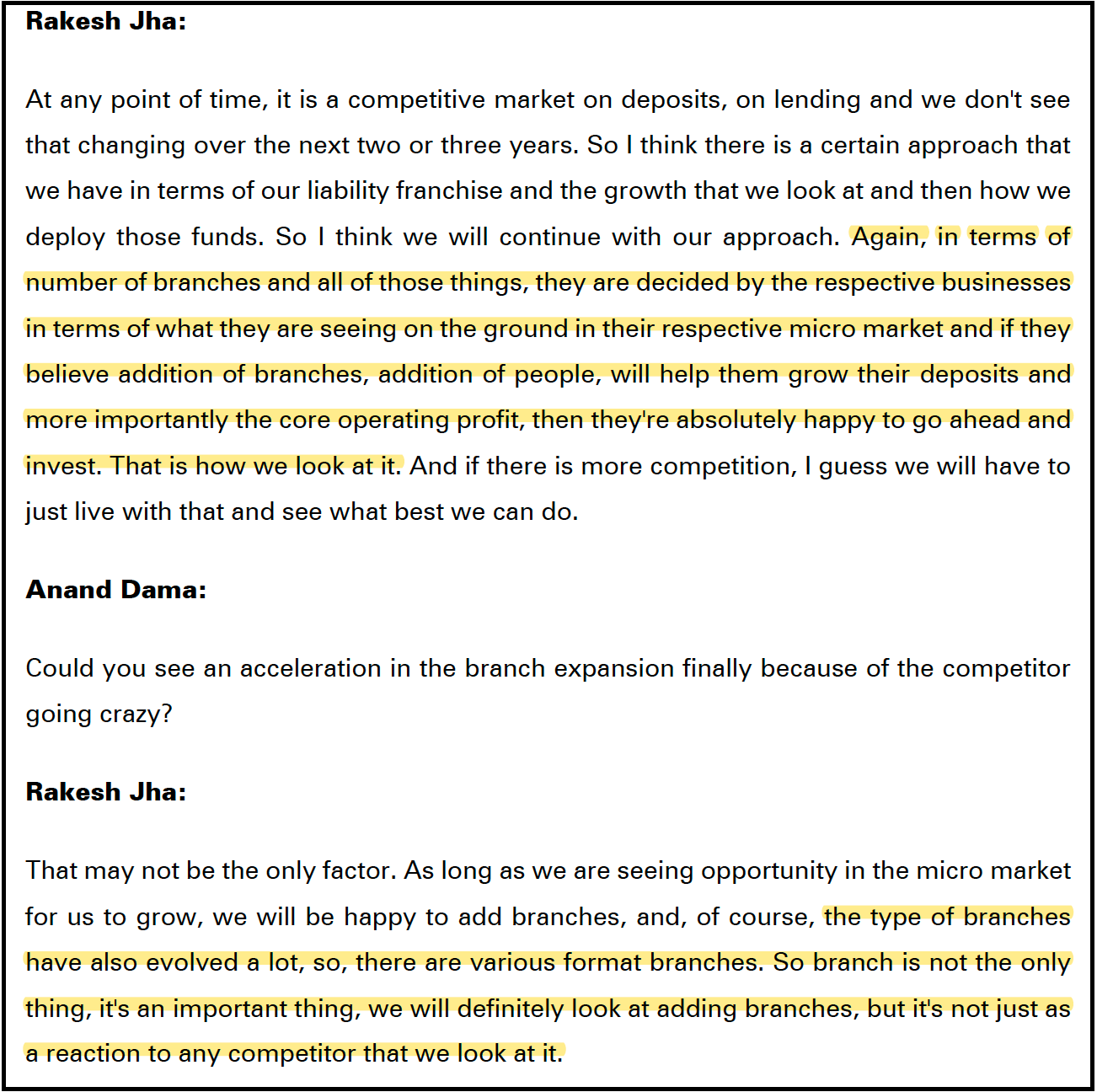

Here’s ICICI Bank, explaining how branch expansion decision lie with respective business heads to decide after observing the their own market:

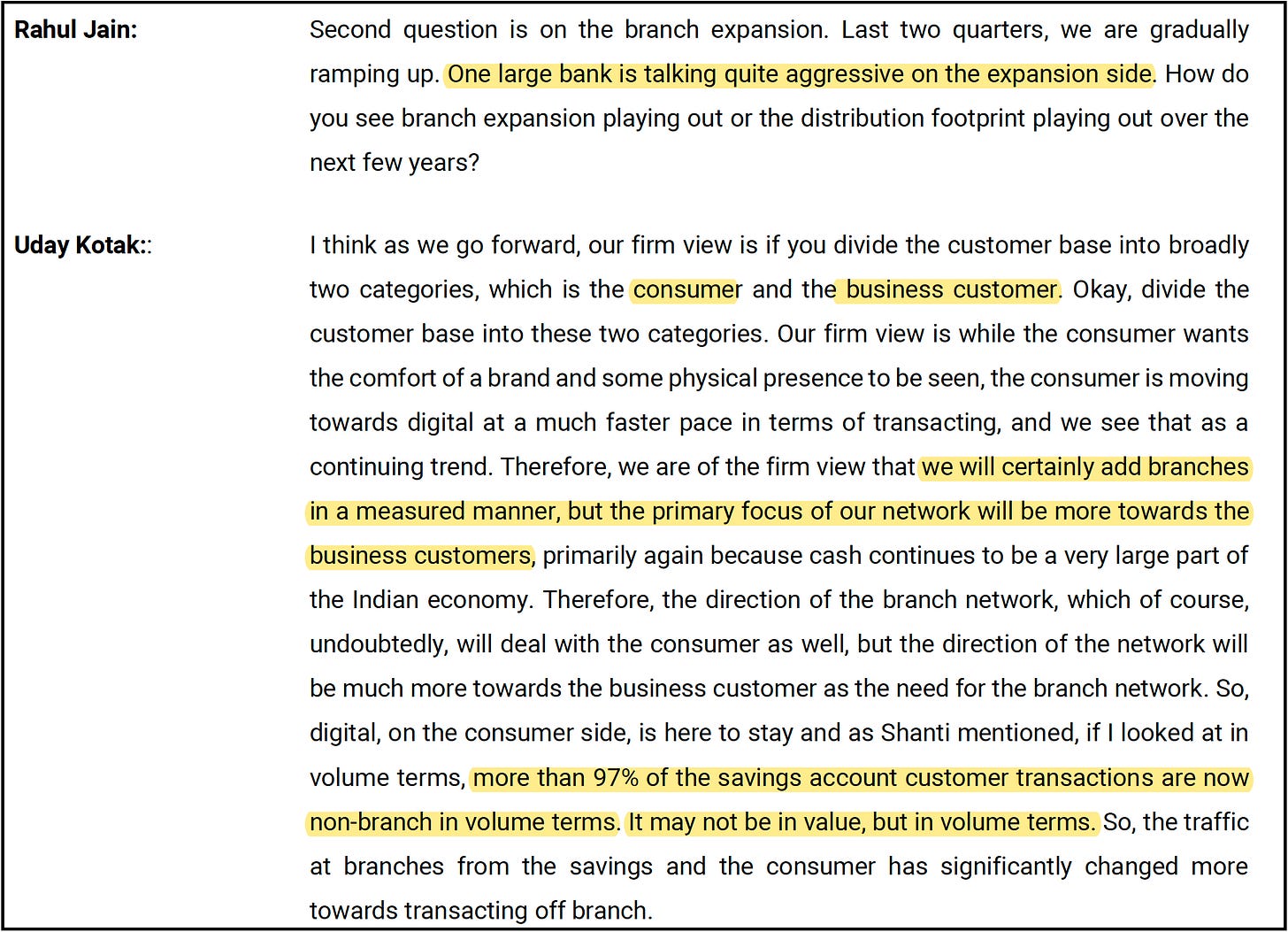

When Kotak was asked the same thing in their analyst conference, Uday Kotak had a slightly nuanced answer.

According to him, individual customers are slowly moving towards digital transactions - so their branch efforts are going to be inclined towards the business customers.

In fact, during my time at ICICI, I remember colleagues telling me that one of the first questions that a prospective business customer asks the bank representative is - “how far is the nearest branch?”

Kotak also has a lower penetration in SURU regions (34%) compared to the other three top private banks (HDFC at 50%, ICICI at 50% and Axis at 46%)

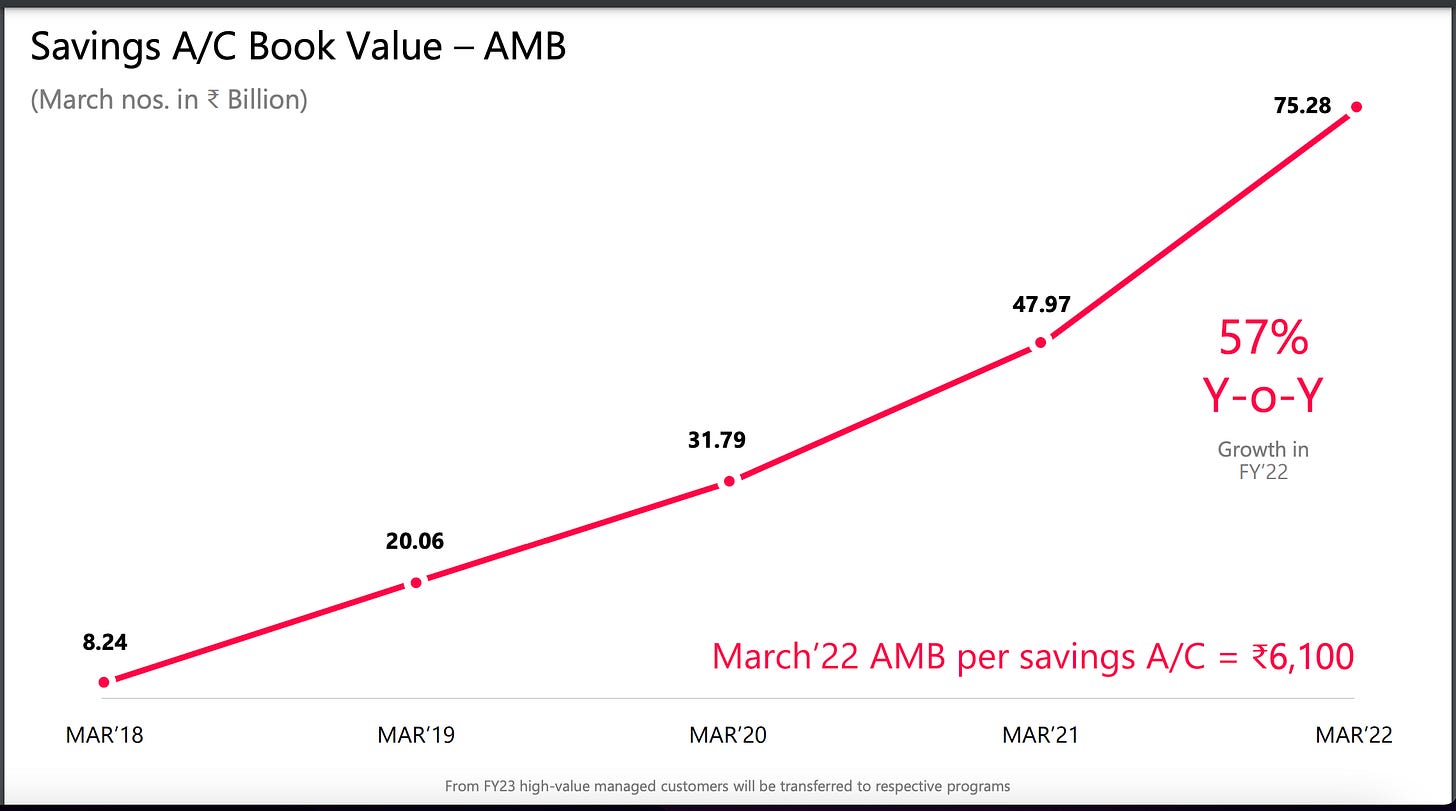

On a related note, Uday Kotak’s son, Jay Kotak, recently came into the spotlight with 811 - the bank’s digital initiative. It’s a great presentation, filled with quotes from management books; but that did not stop people noticing that the savings book was ₹75Bn (or 7500 crore), which is only 6% of their overall savings book (₹124,472 crore).

Or the fact that average monthly balance for these “digital” customers is only ₹6,100.

So does branches still bring in the better set of customers?

What about public sector banks?

A close competitor to Kotak’s 811 would be SBI’s YONO - but I couldn’t find enough data on the latter to make a like to like comparison. Sad that SBI didn’t reveal the important numbers in their latest Annual Report.

SBI, the banking behemoth with over 22,000 branches, is still adding new branches every year, albeit at a much lesser pace than it used to (less than 100 a year).

It also doesn’t talk much about branch expansion, branch productivity and the likes.

On the other hand, Central Bank of India has apparently decided to shut down 600 branches by 2023 (13% of it’s total base).

It all comes down to how the bank is performing. Central Bank is loss making and has been pulled up by RBI.

Summary

I’ve tried to highlight how different banks are approaching this strategy. While some have been able to maintain costs and are confident on their distribution scale, some take a calibrated call depending on business requirements, whereas others follow a FinTech partnership model.

It is important to note a few high-income areas are still branch-led, such as wealth management, life insurance, gold, business banking.

In fact, branches act as collection centre as well.

While investing in technology is non-negotiable today, a scaled down version of the branch (small, automated) are being considered to bring down costs as well.

If you have any interesting tidbit to share here, do comment below.

That’s it for this week.

P.S. I love feedback. If you want me to cover a particular news, want your brand to get featured, write a guest post or simply want to say hi, do reach out to me at anirudha@bankonbasak.com or LinkedIN or Twitter. Meanwhile, please like this post and share it around?

All views and opinions shared in this article and throughout this blog solely represent that of the author and not his employer. All information shared here will contain source links to establish that the author is not sharing any material non-public information to his readers. His opinion or remarks on any news are based on the assumption that the source is genuine; thus he is not liable for any information that may turn out to be incorrect. This blog is purely for educational purposes and no part of it should be treated as investment advice. Using any portion of the article without context and proper authorisation will ensue legal action.

Loved the piece! Could you add one piece on home loans as a product for private banks?