Yes Bank = State Bank of India?

Remember Yes Bank’s dramatic fall from the top? RBI had swooped in with a Reconstruction Scheme - a fancy word which essentially ensued change in management, board composition and a new set of “safe” investors - who would pump in money so that the equity capital of the bank is preserved - and it can continue to service depositors and lend money to others.

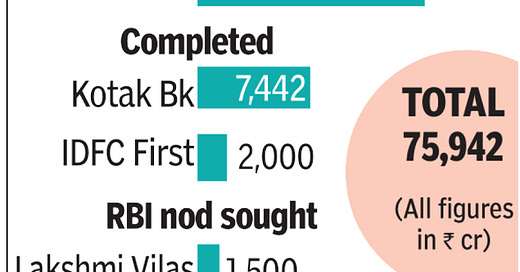

There were 8 prominent banks (check image) who had agreed to save Yes Bank - and while some of them had shamelessly sold part of their stake after just 14 days of their investment, others had held on it.

Image source: Yes Bank Investor Presentation (March 31st, 2020)

But there’s one bank who’s fiercely loyal. As per RBI, SBI is only supposed to hold 26% of Yes Bank within 3 years from it’s date of investment (March 2020). But SBI always goes over and above. Here’s top 3 reasons why Yes Bank is more SBI than itself:

Despite pumping in over ₹6000Cr to attain over 48% of the bank, it has now decided to invest ANOTHER ₹1760Cr in Yes Bank’s upcoming FPO (think of it like a second IPO).

The current MD & CEO of Yes Bank is none other than Prashant Kumar, who has spent over 36 years at SBI, his last role being the Deputy MD and CFO.

There are even reports now that Yes Bank is looking to sell some of it’s AA-rated wholesale loans to SBI as well. I mean, come on! If good loans are sold to others, what would the bank be really left with?

Let’s face it. Yes Bank needs money. Desperately. From it’s deposit base shrinking 54%, loan book shrinking 29%, total capital of only 8.5% (against RBI mandated 11.5%) and dangerous gross NPA levels of 16.8% (compare it with HDFC’s 1.26%), it needs a saviour.

From talent to money, SBI has been the go-to place for Yes Bank to survive. And, for all practical purposes, the private lender is already leading the life of an SBI subsidiary. The state-run bank should perhaps just increase its stake by 2%, and make Yes Bank a legitimate offspring.

Like they say, “Success has many fathers, but failure can get you a godfather.”

I wish I had a godfather like SBI too!

What’s up with RBI?

Our central bank didn’t release any exciting notification this week, so I thought I’ll cover the Governor’s Speech today as a bonus. If you want to watch the full 1 hour video, click here, if you want to read the 12-page transcript, click here; if you’re lazy to do either, that’s what Bank on Basak is for, right?

As goes with almost all Governor speeches, it went on a considerable time highlighting RBI’s achievements and actions up until that point. But we’re more interested in what lies ahead. So here are 3 key takeaways which I felt were important:

The Governor mentioned the necessity of a “Resolution Corporation” to deal with financial sector stress. Although it was a one-off mention, the significance is huge. This term came to prominence during 2017 when the infamous FRDI bill was announced. Among other things, the Bill proposed the concept of a “bail-in”: where depositors’ money is used to save the bank rather than the current “bail-out” mechanism: where money is brought from outside (such as the Government or other investors).

At that time, bank deposits were only insured upto ₹1 lac. The illusion of “safety” of bank FDs evaporated and there was a massive uproar from the public. The bill was so controversial that it was quietly dropped in 2018 and IBC (Insolvency and Bankruptcy Code) came into the picture. Now that the deposit insurance has been hiked to ₹5 lacs from ₹1 lac, reports of FRDI making a comeback is doing the rounds again.

The Governor mentioned the importance of banks conducting their own “stress test”: It is basically a simulation which predicts the impact on the balance sheet considering the present as well as a probable worse-case scenario. If this is made compulsory, it would go a long way in enabling the transparency of banks’ financial health. The US banks published their own last month and just look at the detail in which they declare their results. As we see from the picture below, some banks are more fortunate in raising funds than others because of investor interest. So the stress tests should enable RBI to take necessary steps to help the others.

Image source: Times of India

In the Q&A section, the Governor, although hesitant to delve deeper into it, hinted at RBI’s increasing use of Big Data Analytics and Market Intelligence to assess the asset quality of banks which would enable it to rely less on on-site surveillance (visiting the banks physically to check their balance sheets). Considering the huge plethora of financial institutions under it’s monitoring, RBI sure needs some fancy tech to help make it’s job easier.

Finally, each Governor Speech has a lot of famous quotes and here’s the one I liked the best:

“Being caught unprepared in the face of a shock may be regarded as a misfortune, but to be caught unawares more than once may be a sign of carelessness” - Oscar Wilde

Give me some videsi drama

This week, we talk about China.

Continuing from our last week’s videsi section, I highlighted the growing importance of CBDCs (central bank digital currencies). It seems China is getting a head-start on this.

A ride aggregator known as Didi Chuxing (China’s Uber) is testing this DC/EP (Digital Currency/Electronic Payment) with it’s 500 million users. It has no official name as of now, and as expected, the People’s Bank of China is silent on this.

Although being in the testing phase for months now, this marks the first official usage of the currency, set to replace part of the monetary base, such as cash in circulation (it will not be a complete replacement of bank deposits and balances).

This is a huge market. Over $8 trillion transactions were handled last year by Chinese payment firms (for reference, India only handled a little over $600 million txns for FY19-20). It also marks an important cross-road for the two incumbents in the country who have handled digital payments till now - WeChat Pay (Tencent) and Alipay (Alibaba) - if PBOC has their way, they might just force everyone to use their digital currency and wallet instead of any private companies - although I don’t see that happening.

Here’s a nifty chart which describes the current stance of central banks around the world:

Image source: Bloomberg

What’s India’s status? Our incredibly progressive government is considering banning cryptocurrency altogether. I had written a LinkedIN post on this recently in which Bloomberg editor Andy Mukherjee had supported my stance. Although the digital yuan is strictly NOT a crypto asset (blockchain might not be able to support the huge volume of China’s transactions), India should try to achieve a more balanced view.

Because China is not going to stop in it’s home country. It might just extend the technology to support other Asian countries - in a bid to counter USA’s growing dollar. Let’s hope India is not on the wrong side then.

P.S. Here’s an excellent FAQ on this subject in case you want to know more.

Still want more?

We’ve all been hearing that India’s forex reserves have crossed $500B mark for the first time (and keeps rising). Since it’s managed by RBI, here’s a two-part explainer on the same by Parth Srivastava

One of Europe’s largest private bank, Banca Generali subscribed to “Mafia Bonds” - what are these? Read here.

That’s a wrap for the week. What did you think? Good, bad, yuck? Let me know in the comments.

If you want to reach out to me for a detailed feedback, want me to cover a particular news, want to get featured, write a guest post or simply say hi, reach out to me at bankonbasak@gmail.com

In the meantime, tell your friends!

P.S. You can also connect with me on LinkedIN, Twitter (these are two places where I post whatever that interests me) or on Quora (where I try to help people with their queries related to the banking sector).