#8 Trouble brewing?

Weekly Report: 13th-17th July.

Minor announcements:

I published a book review this week. To avoid spam, I did not send out a mail. If you wanna check it out, click here.

My official email has now been changed to anirudha@bankonbasak.com. Say hi!

That’s all. 😄 Back to this week’s highlights!

Is everything okay at HDFC Bank?

Let’s get you up to speed first. HDFC Bank CEO Aditya Puri’s term is set to end this year, in October. Replacing him has NOT been easy. Why?

For starters, he has been leading the bank since it was incorporated in 1994. Basically, the guy has been single-handedly responsible for the bank’s dominance, longer than I have been living on this planet.

Forget India, it is one of the most highly valued banks in the world. So when a CEO becomes synonymous with the company, shareholders do NOT like change, especially if they think the successor is not worthy enough.

So as expected, there has been a lot of chatter about the successors. Since it is a D-SIB (Domestic Systemically Important Bank), which is basically a fancy name for “too big to fail”, it essentially means that RBI will need to approve the list that HDFC Bank sends them. The three faces you see below are the names that were sent to RBI by the Bank. (you can click on the image to enlarge it)

Image source: BloombergQuint

In March this year, another name popped up in the news as well.

Strange #1

In short, with 3 months to go for the change, it doesn’t look good that the final name hasn’t been announced yet.

Strange #2

Coupled with this, there’s been a recent spate of untimely top-level exits from the bank, which have strangely, not been reported to shareholders or the exchanges through any official communication.

Strange #3

The name you see in the middle in the image above, Ashok Khanna, was leading the vehicle financing arm of the bank before his quiet exit. As of this week, reports emerged that this division was under an internal investigation due to improper lending practices. The bank refused to share details of the investigation and attributed Khanna’s exit to a normal retirement which was due on March 31st, 2020.

Strange #4

This one’s slightly complicated. I’ll try to simplify it. There’s a NBFC in the commercial space who had borrowed from HDFC Bank (as well as other domestic banks). It also borrowed money (~210 crores) from a foreign bank and kept that amount in HDFC Bank as a fixed deposit for the time being.

Circumstances changed. The NBFC was not performing well. It faced several downgrades from rating agencies and also started defaulting on a couple of loans. Eyeing an opportunity, HDFC quickly collected the the money from the fixed deposit to settle the loans that it had personally lent to the NBFC (~260 crores)

Ideally, this is not fair. The FD is an asset, which should be divided representatively among all the domestic banks if the NBFC defaults. SBI Chairman Rajnish Kumar even publicly spoke against this, calling it a “selfish” move. Then Aditya Puri defended his action. Then the NBFC sued HDFC Bank.

All of this happened last year. Cut to today. RBI has looked into the matter, found foul play, and has demanded that HDFC return this money.

Conclusion

All of this does not bode well, especially for a bank which is regarded as extremely trustworthy and supposedly has the highest standards of governance. Let’s hope we get a fine successor who can shrug off Puri’s larger-than-life shadow and propel the bank to even greater heights.

What’s up with RBI?

This week, RBI released the Fair Practices Code for Asset Reconstruction Companies (ARC).

So what are ARCs?

Well the basic premise is this. When a borrower defaults, it had been the bank’s headache to recover these loans, which honestly, isn’t the banks’ primary job. Think about it. If a bank spends all the time trying to haggle with a defaulter, when will it focus on lending fresh money, accepting deposits and growing it’s footprint?

So in 2002, The SARFAESI Act (don’t bother about the full form, it’s quite long to remember) introduced the concept of Asset Reconstruction Companies - entities set up for the sole purpose of resolving loans.

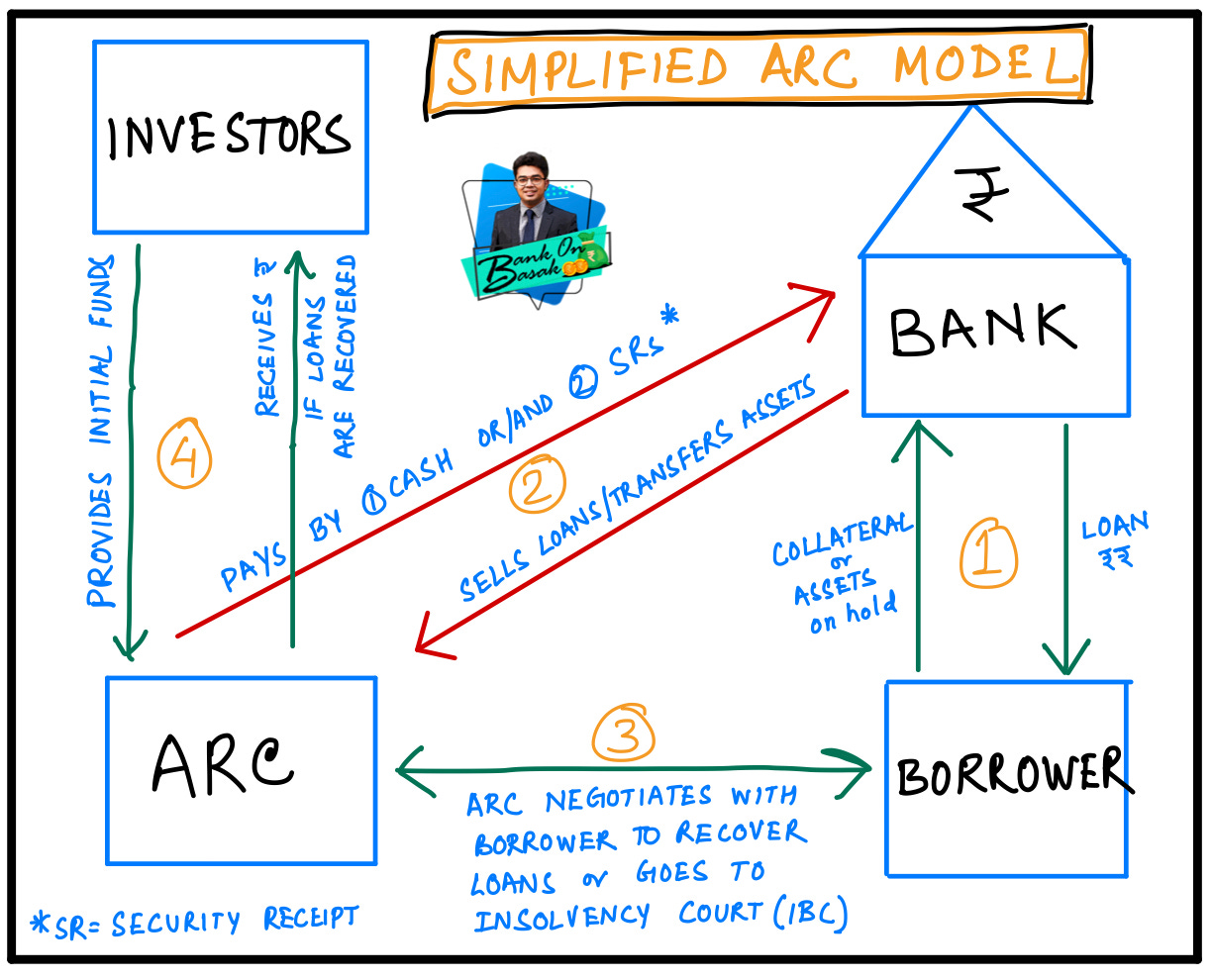

Based on popular demand from my last infographic (I don’t know how that horrible drawing got <800 likes on LinkedIN), here’s another one to explain the ARC model. Follow the numbers if it gets confusing.

The actual structure(s) is way more complicated. But the core idea is the same. The bank dumps the NPA account (and all the liens associated with it) to the ARC, collects the money and moves on with it’s business.

Is the model perfect?

Far from it. As of today, there are almost 30 ARCs in the country, with a collective asset base of over 1 lac crore. These numbers may seem it’s a booming business proposition, but in reality, it’s a nightmare. Up until the IBC (Insolvency and Bankruptcy Code) was launched in 2016, the loan recoveries were really bad. Coupled with this, the RBI keeps making regulatory changes in favour of banks (which automatically becomes against ARCs).

Let’s go back to the first sentence of this section now. RBI has brought in another change. The central bank noticed that some of these ARCs were conducting private sales and dealing with buyers who were potentially linked to the defaulter.

Imagine you’re a defaulter. Your assets are now with an ARC. You ask your distant rich cousin to invest in the ARC. So even if ARC recovers assets from you, it stays within the family. Neat!

So some of the major changes are:

An ARC must publicly auction for assets from the banks

T&C of the sale must be consulted widely with ALL investors

It also prohibits ARCs from harassing defaulters and requires them to set up a grievance redressal forum

With that, we demystify another difficult RBI notification. Onto the next!

Give me some videsi drama

This week, we’re back with USA.

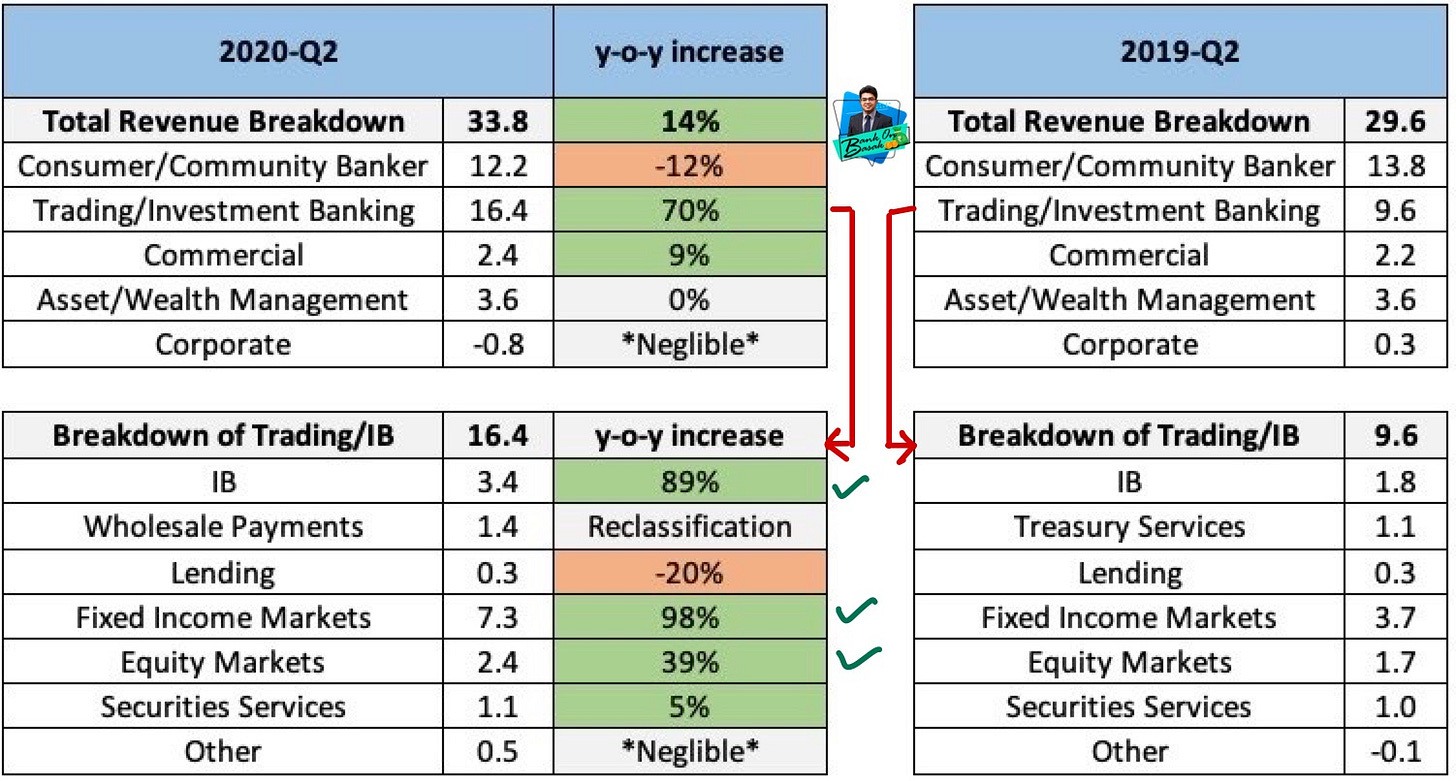

All the major US banks released their Q2 earnings report. Here’s JP Morgan. (all figures in $B)

Do you notice something?

Almost the entire growth in their revenue can be attributed to their trading division (fixed income and equity). Not just JP Morgan, all the major banks in the US reported higher income from trading bonds.

So here’s some background on this. For a while, at the start of the crisis, it looked like a lot of companies would not be able to make interest payments on their bonds. Thus, bond prices went down. Then the Fed (US central bank) intervened. How? By pushing a lot of liquidity in the system (just like the RBI did here in India, but on a way bigger scale). Thus, companies could suddenly pay their interest again, people calmed, bond prices went up again.

Who benefits from this volatility? You guessed it. Banks.

So does that mean all is well with US banks?

No. Just because their revenues are up, doesn’t mean their profits are as well. Although JPMC recorded a profit of $4.7B, it was a drop of 51% y-o-y. For some, it’s quite the opposite. Q2 marked Wells Fargo’s first loss since 2008. And it’s third loss in 100 years. To be fair, WF doesn’t have a prominent investment banking arm like JPMC or Citi.

Why are they making such huge losses? Well, you can attribute that to a similar story that is playing in India (and world over). People are deferring payments on their loans. Many believe that customers wouldn’t be able to pay up when their interest/principal is due. So banks provision, or set aside, a part of their profits (consider it as an accounting loss) assuming that these loans will turn bad.

How much did JPMC provision? A whopping $10.5B. This is $9B more than they did last year. Which is extremely smart.

If you’re a CEO, you might as well take big loan write-offs now, when everything is bad anyway and when you have huge trading profits to offset them, so that you can have better earnings later.

Yes Bank survives… for now.

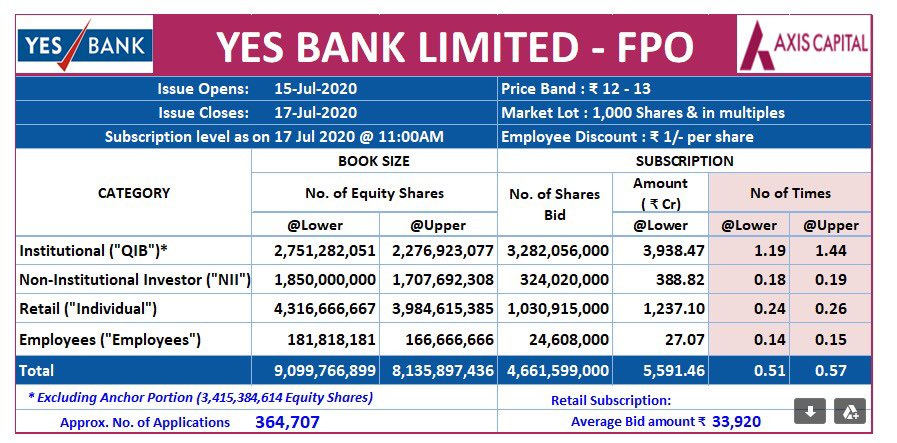

So the Yes Bank FPO finally closed yesterday. The issue got subscribed 95%, crossing the 90% mark that needed it to be successful.

After my Yes Bank cover story last week, I’ve been bombarded with mails and LinkedIN DMs asking if one should subscribe to it. Although personally, I’m positive about the long-term future of the bank, I generally prefer not commenting on equity markets as I’m not a registered investment advisor, although they’ve been tons of material out there strictly asking retail investors to stay away.

Well, it seems the common folks paid heed to the advice. Retail is not fully subscribed, while institutional is over-subscribed. I think this is the first time I’m seeing this.

A lot of different opinions have been floating around Twitter. But one caught my eye. Do you notice the least subscription is in which category?

What does it say about a company who’s own employees are not optimistic about it’s future?

Still want more?

Indian banks are in for a ₹20-trillion hole - the author of the book review I posted above, wrote this Mint piece - consider it as a 10 minute snapshot of the book.

Anuradha Kumari is doing us all a huge favour by de-mystifying the Indian Fintech Space. She has undertaken a mammoth task of publishing it over four parts, two of which has already up on her blog. Go check it out!

That’s a wrap for the week. What did you think? Good, bad, yuck? Let me know in the comments.

If you want to reach out to me for a detailed feedback, want me to cover a particular news, want to get featured, write a guest post or simply say hi, reach out to me at anirudha@bankonbasak.com

In the meantime, tell your friends!

P.S. You can also connect with me on LinkedIN, Twitter (these are two places where I post whatever that interests me) or on Quora (where I try to help people with their queries related to the banking sector).