Update:

It’s been a crazy week. Welcome to the 500 new people who have joined this community since the last weekly mail on Saturday. We’re now a 1300 member family and only growing stronger! 🤓

Bank on Basak had it’s first live Q&A this week. Needless to say, it had a lot of hiccups. 🥺 I was overwhelmed by all those who watched it in entirety, despite the technical snags and later came out in support through personal messages and Twitter. I apologise to those who showed up but couldn’t watch and also to those who were expecting a recording (it was live-only). I promise to do better next time!

Bank employees get a hike!

3 years late. Like clockwork!

A bit of background here. There are two opposing parties involved in this.

Indian Banks Association (IBA): Formed just before Independence, this body represents all the major banks in India.

United Forum of Bank Unions (UFBU): This is an umbrella body of nine (🙄) bank unions in India, representing bank officers and workers.

These parties sign a deal known as the Birpartite Settlement (BPS) which remains in effect every 5 years. It’s simple really. Workers demand a lot, banks agree to some, eventually one group relents and the deal is signed. The 11th such deal was signed on 22nd July, 2020.

This deal applies from November, 2017 to October, 2022. Wait, that can’t be right. Why is it being applied retrospectively? Because it is late by 994 days!

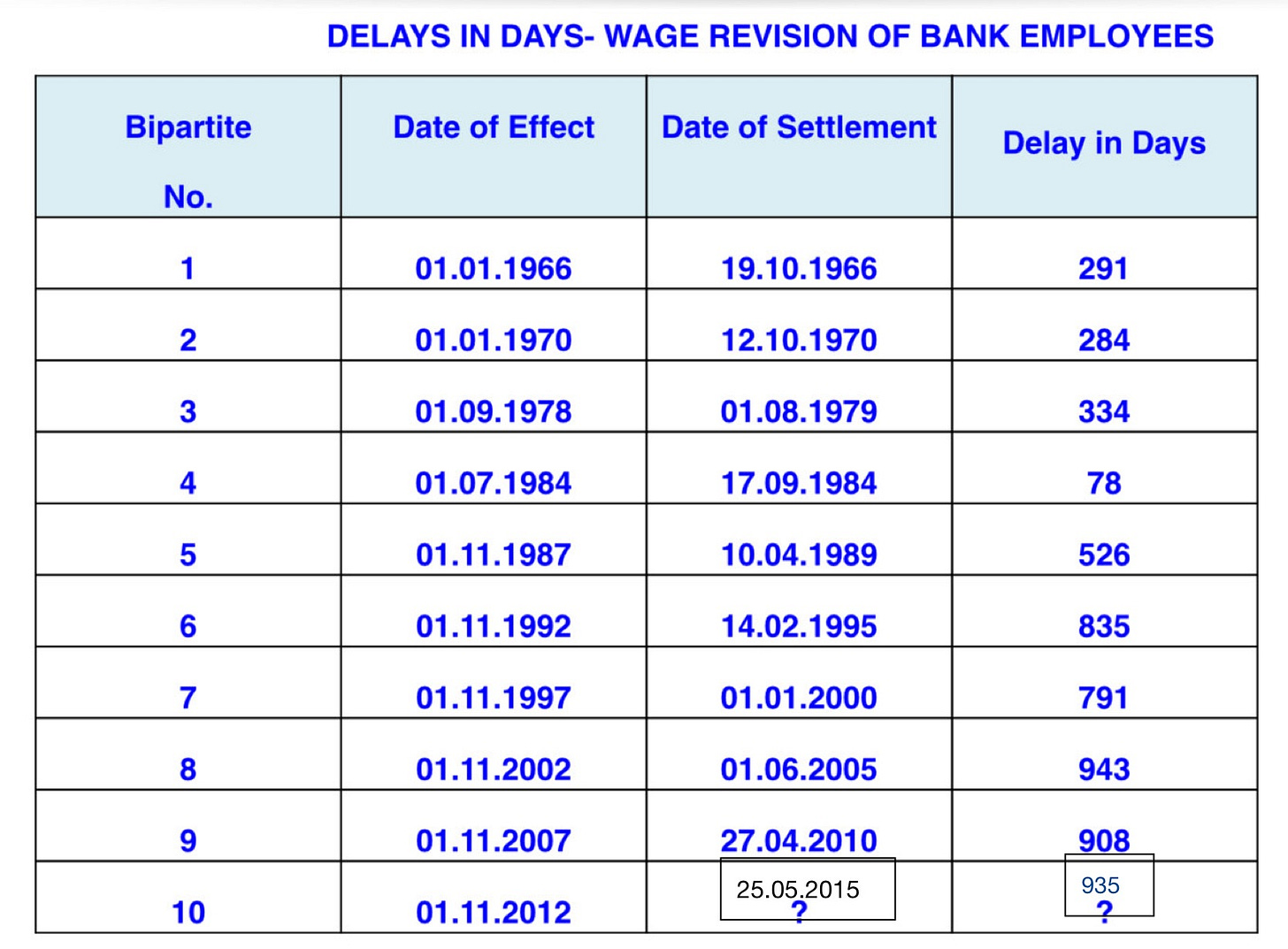

That made me wonder. Is this a norm or an exception? Then I found this:

Notice the disturbing increase in the delay in signing the BPS. This is a worrying sign, especially in an important sector like this, where employee morale is ideally on the lower end.

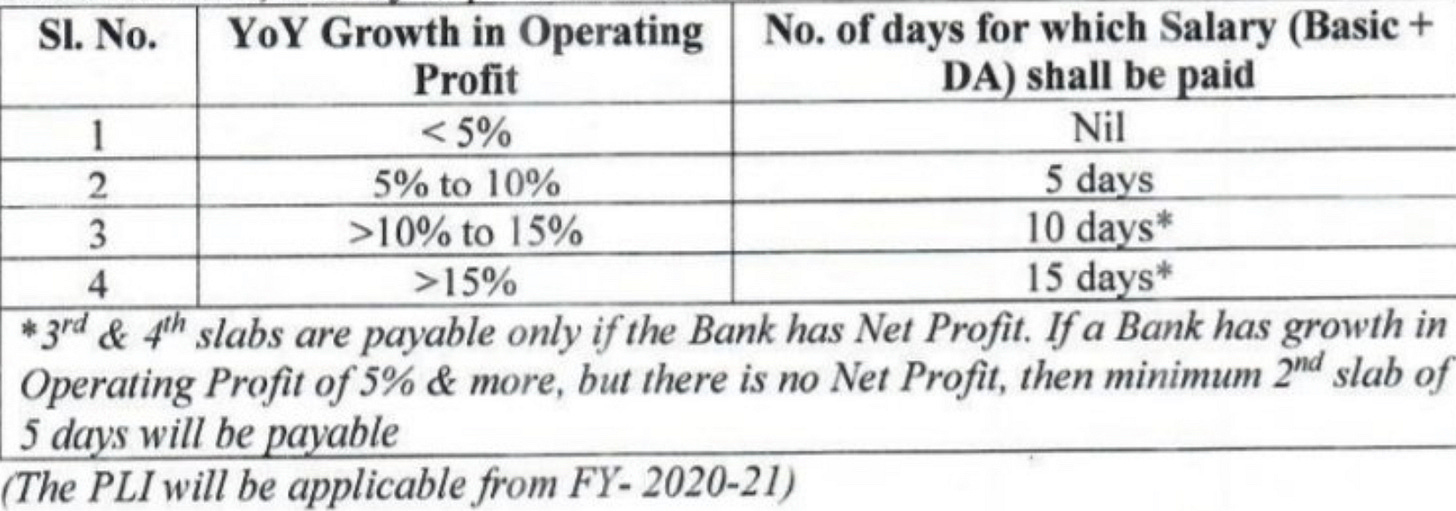

Almost every BPS has a landmark change. The 10th one introduced holidays on second and fourth Saturdays. The 11th one signed three days ago introduced PLI (performance linked incentive).

How will the PLI work? If public sector banks report operating profits of more than 5%, employees will get extra salary worth 5 working days. There are higher slabs, but those are dependent on net profits and not operating profits.

Here lies an important distinction. Despite the horrid profitability of PSBs, some of them do report operating profits some times. However, when you set aside these profits for possible bad loans (provisions), what you’re left with is net profit, which unfortunately, is mostly in the red.

Could this have been done better through stock options?

Honestly, I don’t think it would’ve made much of a difference. Investors are aware of the fact that public sector banks are simply vehicles through which the government implements social schemes and the share prices reflect that. Why would an employee want to own a battered stock anyway?

Is this hike further going to affect the profitability of these banks?

Not necessarily. Apart from the PLI, there is a fixed wage hike of 15%. The overall wage bill as of March 2017 was ₹56,000Cr. A 15% hike roughly translates to an additional ₹8,000Cr in wages per year. Although the number seems huge, most banks were already expecting this and had provisioned for it.

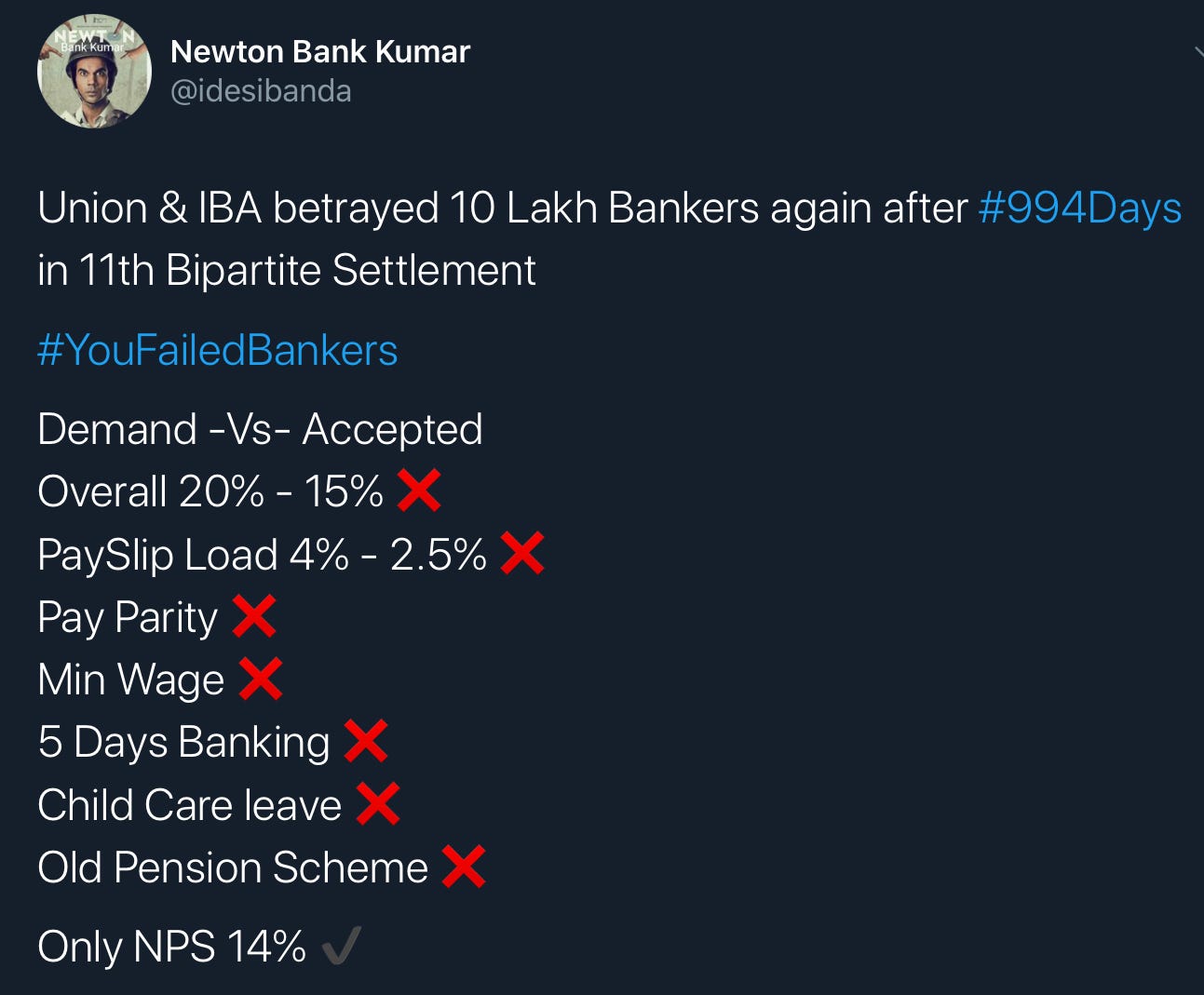

This wage hike has been consistently ~15% in the last four BPS. Despite this, unions are never happy:

In an alternate COVID free world, the stalemate between IBA and the unions would have been further delayed by strikes. Considering the health risks on employees and also the impact on bank profitability, COVID actually helped them reach a middle ground. Can you believe it that the negotiations had started with a fixed 2% hike?

Look I get it. The system is not perfect. Employees are not always favoured. But this is not to say that all the union demands are logical. For example, even with the advent of digitalisation, industry veterans believe that a 5 day working week is not feasible for large swathes of our rural population who still rely on branches for daily banking needs.

To top it all, there is ONE fear that unites all these unions: PRIVATISATION. This fear has spawned multiple Facebook groups with thousands of members and Twitter profiles such as the one above with over 16000 followers.

Now with reports arising that the government is looking to reduce public banks to 4-5 from the current figure of 12, their fears are only going to get the better of them!

Note: This deal mostly applies to public banks and is optional for private and foreign banks.

P.S. A special shout out to Rupinder for his inputs on this section!

What’s up with RBI?

I’ve been so used to reading the monochrome RBI reports that I get unusually excited when they publish a flashy one. 😅

I’m talking about the report on the analysis of the QR code.

Image: Sample QR code

This was submitted by a high-level committee formed last year, under the chairmanship of IITB Professor Deepak Pathak. Why was this required? Primarily for the following reasons:

To examine and review the current system of QR codes in India for facilitating digital payments

Analysis of benefits arising out of a common QR code

Assess the scope for improvement in existing QR codes and suggest measures towards adoption of Bharat QR as a convergent which would be future-proof

This is not sudden. RBI has been focusing on digital for a long time. Despite myriad attempts, rise of cash has been difficult to stifle in India. In fact, increase in currency in circulation in the first four months of 2020 (₹2.66T) has been higher than the increase in entire 2019 (₹2.4T). This has led RBI to coin the phrase “Cash is King, but Digital is Divine”. I’m not kidding. 😂

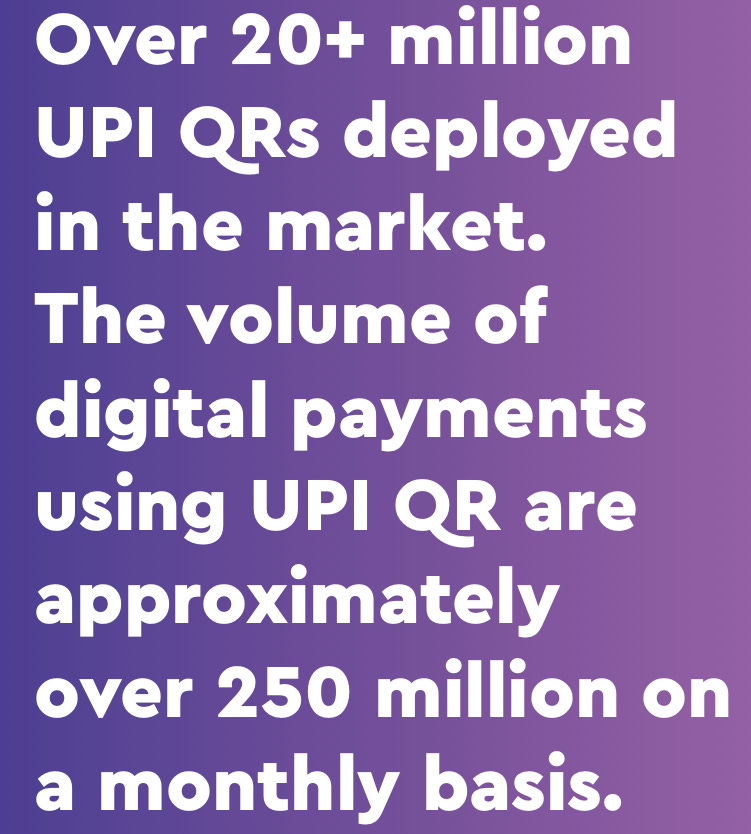

So as with any report, you need to show the huge potential market in bold to make your point:

So what did it find?

Here are the top suggestions:

RBI should completely phase out closed-loop QR codes. Ever notice a PayTM branded QR code at your nearby shop? Which only accepted payment from PayTM wallet? Yup. That’s the one. This makes sense. If you’re trying to make more people adopt something, an open loop (inter-operable) QR code which supports multiple payments will be more appreciated.

There are broadly two types of interoperable QR codes - Bharat QR and UPI QR. So the committee recommends both to be widely used so that there isn’t concentration risk by using only ONE type of QR for all payments. Now this is tricky. While the former is mostly used by merchants, the latter is used by merchants as well as for person-to-person transactions. BUT both of them are developed by NPCI. Isn’t that a concentration risk in itself?

Withdraw Zero MDR (Merchant Discount Rate) - This is a tiny fee that the merchants used to pay banks for accepting payments from customers through digital means (cards, UPI, QR codes). In a move that upset almost everyone in the industry, our Finance Minister had banned everyone to collect MDR from either merchants or customers.

The committee wants a controlled MDR which is high enough to incentivise new players and low enough to motivate merchants to adopt digital payments.

There were other minor (but important) suggestions as well, such as a common yellow pages kind of registry to verify genuine QR codes, removing a few layers of friction for merchants with respect to KYC onboarding, offline QR codes for low ticket payments.

If you have any awesome suggestions, make sure to drop them at dpssfeedback@rbi.org.in by 10th August, 2020.

P.S. RBI also released it’s second most important publication yesterday. Based on reader feedback on Twitter, I’ll come out with a detailed simplification on this in an upcoming post.

Give me some videsi drama

This week it’s Lebanon.

What does a balance sheet of a company indicate? A snapshot of its finances? A strength of its assets, right?

What does a balance sheet of a central bank indicate? More than anything, it represents the strength of an economy, something which Lebanon 🇱🇧 hasn’t been doing really well on, since the last year.

It’s been exposed this week that the Central Bank of Lebanon (BdL) governor Riad Salame has artificially inflated BdL’s assets by $6B! 🤯

The Governor’s justification? It was a “seigniorage on financial stability”

Seignorage came from the old French word “seignior” aka Feudal Lord, who, during the Middle Ages, had the right to print money.

Now when a central bank prints money, it is supposed to record it as an income. But BdL was recording it as assets, hence the inflated amount!

“This financial engineering, we were forced to do it to buy time for Lebanon…” - Riad Salameh, Governor, Banque du Libon (BdL)

We learn two things from this episode:

There is no global standard for central bank accounting. Corporates world over follow IFRS/GAAP accounting, Indian companies follow IAS, but it seems central banks are at the mercy of Governors and their Governments!

If you’re not USA, you can’t print money freely without consequences. Why? Because it is not a global currency, investors worry about your solvency and eventually the people of your country will pull you up!

Whats the latest update? Lebanon was waiting on the IMF (International Monetary Fund) for a rescue. But now that these irregularities are out of the closet, it may not look at the country very kindly. Oops!

Still want more?

The Ken had an interesting story this week on FX-Retail: a retail forex trading platform launched by RBI last year to lower costs and make it more transparent. But adoption has been unusually low. Why? Read here.

The Global Fintech Fest happened this week. If you have time, I recommend registering here and watching a replay of all the videos. OR you can read about the important announcements by following this tweet thread. Pay attention to UPI Autopay and WhatsApp Lending. 😲

My laptop died this week, so I had to type this entire post on my mobile. Please excuse any typographical or formatting errors. 🙈

If you want to reach out to me for a detailed feedback, want me to cover a particular news, want to get featured, write a guest post or simply say hi, reach out to me at anirudha@bankonbasak.com

In the meantime, tell your friends!

P.S. You can also connect with me on LinkedIN, Twitter (these are two places where I post whatever that interests me) or on Quora (where I try to help people with their queries related to the banking sector).

awesome 🙌

🙌🙌