Hey everyone,

Starting a new series where I dive deep into a particular market, where digital banking adoption is reported to be on the rise. Let me know if you want to read more of these.

Today’s focus is on the Hong Kong market, which piqued my attention after reading an article on the Wall Street Journal.

Before we understand what the article points towards, let’s try to understand Hong Kong’s banking landscape.

SponsoredToday’s post is powered by Vested.

Vested allows you to invest in US stocks right from India. Create an account in minutes, load up your wallet and invest in any listed US stock of your choice - even fractional shares.

Start with as little as $1 dollar.

Hong Kong’s Banking Structure

Hong Kong’s population is tiny. Based on estimates, it is about 75 lacs. However, what’s interesting is that there are over 170 licensed banks catering to this tiny population - resulting in the fact that only 5% of their population remain unbanked today.

Compare that to India - we have about 138 “scheduled” banks for a population ~200x that of Hong Kong. Of course, a large part of our population is also catered by banks which do not make it to this list, such as co-operative banks, but that doesn’t help the fact that our percentage of unbanked remain as high as 20%.

Despite the abundance of banks, HK’s banking is dominated by 3 major banks - HSBC, Bank of China (HK) and Standard Chartered Bank.

Did you know that these are the only three banks which has the authority to issue bank notes (cash) in HK?

Unlike India and most other sovereign nations, where the central bank (RBI) has the sole authority to print notes, a few countries like HK, UK and Macao allow commercial banks to issue banknotes.

HK is not only “overbanked”, but is also considered a very important financial hub, with their banks posting millions of dollars in profit each year.

Of course, these numbers don’t mean anything on first glance. So for comparison, The most profitable bank in India generated ~HK$ 31,000 million in profits last year.

Lenders in this autonomous Chinese territory are exceptionally profitable, thanks to a wealthy customer base and high population density, which allows banks to operate with relatively few branches.

The important aspect of highlighting these figures is to ask - how does a virtual bank compete in such a competitive banking landscape?

Regulation

The de-facto central bank authority of Hong Kong is HKMA (Hong Kong Monetary Authority).

The way HKMA has introduced virtual banks in the region has garnered some mixed opinions.

While everyone appreciated the speed (it announced virtual banks in 2017 and started providing licenses by 2019), the structure and the scope has been questioned by a few.

A research paper on this topic noted that HKMA did not consider the suggestion of lowering the minimum capital requirement for these branchless banks and kept it at par with other licensed banks, at HK$ 300 million. For comparison, the minimum regulatory capital for UK neobanks is only ~HK$ 45 million.

The paper stated that HKMA also did not set clear expectations or make suggestions for the innovative financial services that virtual banks could provide.

Broadly HKMA wanted these players to promote the application of fintech and innovation, offer new customer experience and promote financial inclusion, covering retail and SME segments.

This is quite vague to be honest. For example, I think we over-use the phrase “financial inclusion” as it can mean different things for different nations.

For India, RBI had a somewhat clear purpose of financial inclusion when it incorporated small finance banks, by restricting three-fourths of their advances to the priority sector and certain restrictions in the location of bank branches.

In an interview, former co-founder of Mox, one of the virtual banks currently operational in HK, defined financial inclusion as,

“serving everyone equally.. in Hong Kong, people are not unbanked.. they are underbanked. Are the current options providing you an easy way of growing your HK $500?” (loose translation)

This particular interpretation wouldn’t have arised at all if only HKMA had been more clear. Similarly, there are consequences for keeping the high regulatory capital as well, which we will now understand as we understand the background of the virtual banks in HK.

The Virtual Banks in Hong Kong

There are 8 virtual banks in HK.

Before we dive into the leaders (Za Bank and Mox Bank), let’s understand their background.

As you can see, most players are backed by known names from the industry, worth billions of dollars. I believe this is a direct result of the high capital barrier.

While this ensures some sort of trust for customers, it prohibits young FinTech companies to innovate in this space.

It is now a race towards to the bottom, with the larger players spending the most in customer acquisition, with minimal sources of revenue and large losses.

So why does Wall Street Journal feel differently?

Like all newspaper headlines, it merely prompts you to read the article, which clearly writes how these banks are yet to catch up to their traditional peers.

Here’s an excerpt,

“As of Sept. 30, the eight digital banks collectively had 1.1 million accounts in a city of 7.4 million people, according to the Hong Kong Monetary Authority. Total deposits at the eight banks add up to around 24 billion Hong Kong dollars ($3.08 billion), accounting for just 0.2% of the city’s total. That reflects how the average account balance at a digital bank tends to be smaller than the average account balance at a traditional consumer bank.”

The article does go on to highlight all the stuff that these new players are doing to catch and retain customer retention.

For example, Za Bank’s PowerDraw gives users a chance to win upto 200% cashback on their spending transactions. Some users have liked these game-like features which are meant to drive engagement.

Here in India as well, gold-saving app Jar is trying to achieve the same thing, nudging people to spend more, so that they can… save more?

Credit card bill payments app CRED has a separate screen for playing jackpots. Companies pay CRED to get featured here.

Other virtual banks provide the usual - higher interest rates, faster and online onboarding, swanky numberless credit cards (HK has a low penetration of debit cards) etc.

A few others are trying to bring in nifty loan practices from their parent company. For example, Ant Bank in January rolled out a loan program aimed at small-business owners that offers flexible terms such as the ability to pay off the loan’s interest first before settling the principal when the debt matures. WeLab offers flexible loans and group saving plans that allow users to earn higher interest rates as more users place deposits.

But is all of this enough to retain users? Or even bring in new ones?

Virtual banks, if they want to crack the retail population, need to garner enough users so that at scale, the unit economics makes sense.

The other way to get new users is to expand to the Greater Bay Area, which has 10x the population of Hong Kong.

The two leading virtual banks in HK

ZA Bank, backed by ZhongAn Insurance, is interestingly a much smaller business than PingAn Insurance, which is backing PAO Bank (PingAn OneConnect). It would seem that the latter should also be the bigger virtual bank.

However, ZA not only had a headstart (first virtual bank to launch), but it was also the only one which had a mandate to deploy cash payouts during coronavirus. The quick branchless account opening process made people sign up just for the payouts.

As of today, ZA boasts over 500,000 accounts.

Meanwhile, it’s close competitor Mox, is backed by Standard Chartered. So Mox never had an issue with establishing “trust”. It’s website clearly indicates the name of the parent company. The best part about Mox though is that despite having a traditional bank as their backer, it did not build its systems using the CBS (core banking system) - instead, it adopted blockchain and smart contracts to build it out from scratch.

As per the interview cited earlier, Mox has about 200,000 customers today.

OG Rahul Mathur (CEO of Verak Insurance) has been tracking these exact companies since March, 2020.

Summary

Considering RBI hasn’t even published a discussion paper (NITI Aayog had to do that) on neobanks, HK has shown massive speed in adopting and launching it.

However, more deliberations on their objectives and goals would have been appreciated.

For example, Singapore has launched two separate digital bank license (one for retail and one for SMEs) in order to keep a narrow focus on the outcome of introducing these banks.

In the next episode, we’ll dive deep into Singapore’s virtual banks. Stay tuned.

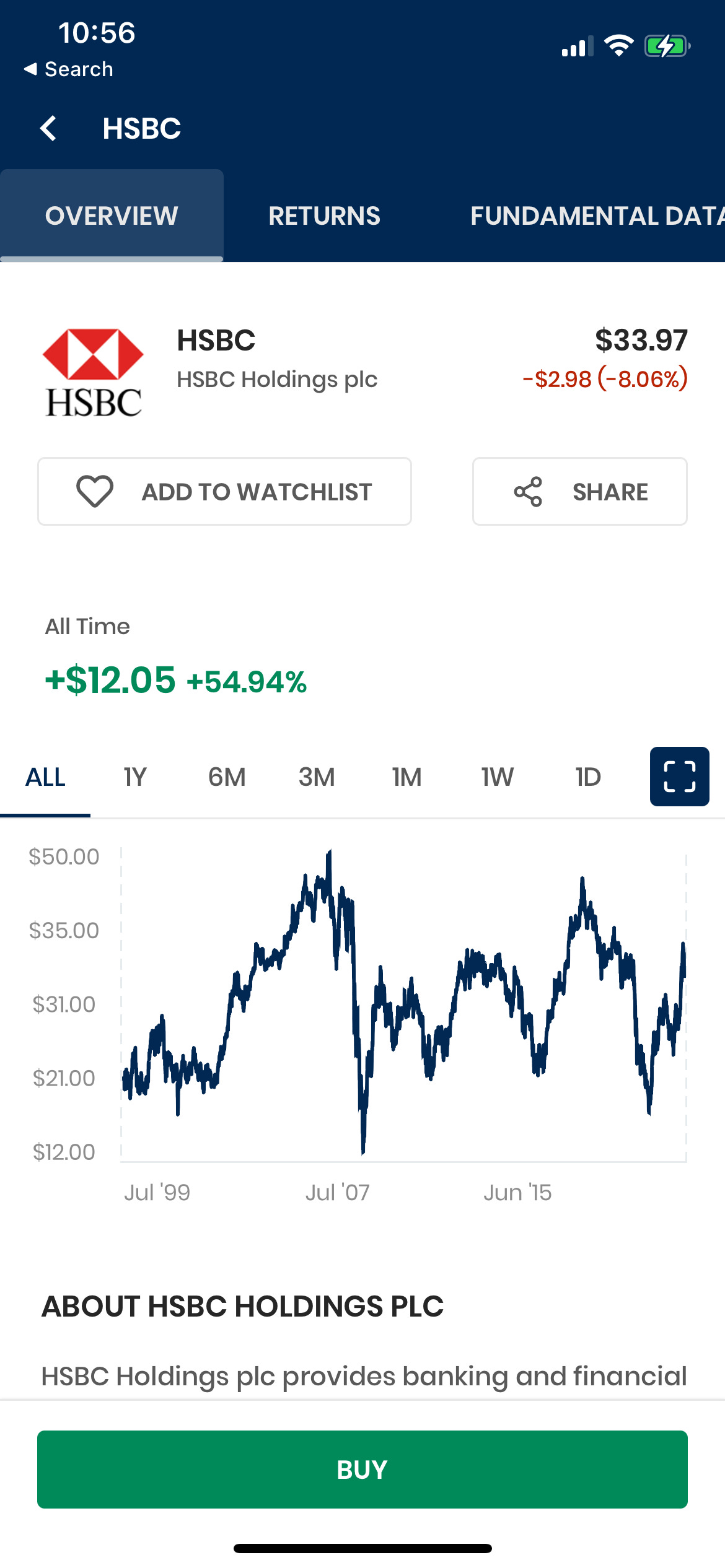

Unfortunately, HK’s digital banks are not listed on any exchange (in case you wanted to get in on the action early). However, the traditional ones with all the profits sure are.

On Vested, you can view all the details of any US listed stock, including their fundamental data, ratios, as well as the trending news.

That’s it for this week.

P.S. I love feedback. If you want me to cover a particular news, want your brand to get featured, write a guest post or simply want to say hi, do reach out to me at anirudha@bankonbasak.com or LinkedIN or Twitter. Meanwhile, please like this post and share it around?

All views and opinions shared in this article and throughout this blog solely represent that of the author and not his employer. All information shared here will contain source links to establish that the author is not sharing any material non-public information to his readers. His opinion or remarks on any news are based on the assumption that the source is genuine; thus he is not liable for any information that may turn out to be incorrect. This blog is purely for educational purposes and no part of it should be treated as investment advice. Using any portion of the article without context and proper authorisation will ensue legal action.