Introducing fuzz

Re-imagining Finance for India, with AI

Hello everyone!

It’s been a while since Bank on Basak has landed in your inbox. However, it still holds a special place in my heart. In fact, when I moved out of the banking industry and in to capital markets, this newsletter was the first place I announced the early access to our product (Dhan).

Since then, Dhan has grown multifold to reach the #9th largest trading and investment platform in India. We wanted to differentiate by building for serious traders in the market and our growth is a testament of this focus.

Now, there is a similar shift that we’re seeing, happening at a pace greater than anything we’ve ever witnessed, leading us to ask new questions such as,

“Is this article written by AI?” (it’s not)

There are also some questions that remain perennially and stand the test of time, such as,

“What is EBIDTA?”

Today’s post is announcing an opportunity to solve for both.

“What” are we trying to solve?

Finance has always been gate-kept. It starts from high school when you take a specific stream of study to pursue a career in finance (I didn’t) - and continues till post graduate programs like MBA, where finance clubs gate-keep students to join them based on their prior professional or academic experience in finance. The “prior experience” itself is a never-ending feat, where aspirants take years to pass competitive exams.

Being a fresher with a Microbiology background, I barely managed to land a role in finance. However, I quickly realized that this asymmetry extends to the professional world as well, in which investment bankers and large institutional investors have access to expensive tools and paid research that retail investors do not have access to.

A Bloomberg terminal costs ₹30,00,000. That’s just an annual “subscription” fee. Sometimes, a good equity research report is completely inaccessible to retail investors, irrespective of the cost, as these are usually offered as a bundle with other high-value client offerings, such as large brokerage deals.

This information gap has been highlighted by independent researchers multiple times across the years.

So “how” can we mitigate this information asymmetry?

As per the paper,

“The use of big data, artificial intelligence, and machine learning can help in analysing vast amounts of information, leading to more accurate and real-time insights”

At Raise (my company), we’ve always strived to build financial products that make our users smarter and participate in the markets in a more efficient way than ever before, using technology and product.

With Dhan, ~45% of our user base use features and controls that either allow them to stay ahead of the market, or achieve favourable outcomes. This is in stark contrast to what has been the industry average (10%), reported by regulatory bodies.

With Upsurge, we’re trying to make you smarter by teaching you from finance and market veterans, removing the information gap that exists between experts and beginners.

With Filter Coffee, we’re helping you become smarter each day by making complex news more digestible and accessible.

Our next product is a leap from traditional ways of removing asymmetry and trying to reduce the gap “on-tap” - whenever the user requests for it.

Introducing fuzz

fuzz is an AI-first approach to solving India’s information asymmetry in the field of finance. We’re trying to shape the future of financial research in India with AI.

Why Finance?

There are a couple of reasons why we stuck to finance:

Raise as an organisation, has a deep domain expertise in the field of finance. While we’re only four years old, our founders and senior team members have a cumulative experience of over 250+ years in this field - and because of the nature of all our businesses, we track markets possibly more than any other fintech.

There are enough tools in the market to address a little bit of everything for everyone, but not everything for a small portion of the population. In fact, fuzz is already in the hands of select folks who track public markets and multiple tenured research analysts have said,

“It frees up a lot of time for us, which otherwise went into making morning call notes, finding the exact quote from concalls or gathering ratings for companies”

Why AI?

Raise has always focused on three simple, yet foundational pillars - product, customer experience and technology. Within technology, we’ve always strived to build the “right” infrastructure to support the product. For Dhan, it was building the system from scratch that supports millions of trading orders each day, in an era where most companies still outsource it to a vendor. In fact, Amazon (AWS) wrote a case study on it. We’re taking a similar approach for AI.

We’re in this for the long-term; we’ve carved out a separate entity - Raise AI Possibilities Private Limited that will focus on elevating user experience across all Raise businesses, leveraging AI.

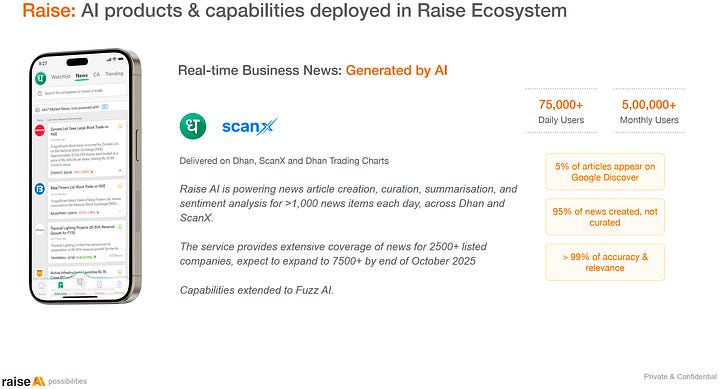

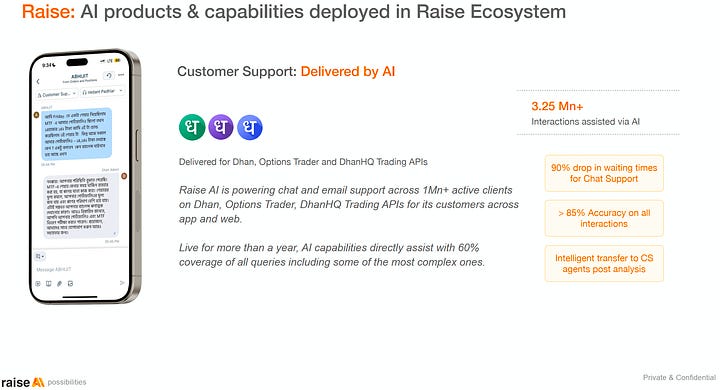

In fact, over the past year and a half, Raise AI has silently been building it’s expertise by launching products for it’s flagship products and scaling them to achieve the desired efficiency and experience that is competitive and in line with global standards.

Why India?

Raise has always been proud to “Build in India, by Indians, for India.” Our efforts to travel the entire country to speak and connect to our users is a testament to those words.

We believe there are far too many global tools that cater to everything for everyone. They’re always built keeping US audiences in mind and their newly driven efforts to focus on India comes from a misdirected sense of greed towards usage metrics that they’ve not achieved in any other country in the world. These efforts shall always remain shallow when it is about understanding the pulse of the country.

So how is fuzz different?

Unlike other platforms, fuzz has been built keeping finance as default. We may therefore not choose to answer generic questions as that would not be our expertise.

If you’ve read till here and you’ve experimented with a few tools in the market available right now, you would realise that far too many times, you have been exasperated by:

Surface level citations from web search or news blurb that are not grounded in facts

Blocked by paid tiers when you’ve questioned the model too hard or requested for “Deep Research”

fuzz is solving for both. We aspire for a state where the majority of our sources are backed and linked to the source, for you to quickly pull up and reference. Additionally, all our searches are “Deep Research” by default - because we’re solving for quality; and because good research takes time.

It’ll be our goal to keep fuzz free as long as possible because we don’t want folks to take shortcuts when it comes to finance, money or markets.

So whether you’re an investor tracking stocks, a student studying economy, a trader trying to backtest a strategy, or a finance professional seeking quick insights, fuzz is here to help – your India-first AI co-pilot in the world of finance.

fuzz is in beta, and I’m inviting you to be among the first to try it out. As a beta release, it’s completely free to use – I want all of you to experience fuzz and help us improve it with your feedback. Simply sign up and join the waitlist below to request access.

We’ll be onboarding users gradually, but subscribers to Bank on Basak get priority access. Simply comment below/reply to this email/reach out to me so that I can quickly find your email address.

That’s it for now.

P.S. I love feedback. If you want me to cover a particular topic, want your brand to get featured, write a guest post or simply want to say hi, do reach out to me at anirudha@bankonbasak.com or LinkedIN or Twitter. Meanwhile, please like this post and share it around?

All views and opinions shared in this article and throughout this blog solely represent that of the author and not his employer. All information shared here will contain source links to establish that the author is not sharing any material non-public information to his readers. His opinion or remarks on any news or topic are based on the assumption that the source is genuine; thus he is not liable for any information that may turn out to be incorrect. This blog is purely for educational purposes and no part of it should be treated as investment advice. Using any portion of the article without context and proper authorisation will ensue legal action.

Hi would like to access Fuzz

Waiting for the priority access