Financial institutions like banks and NBFCs tend to have very traditional sources of income and revenue.

Just as an example, consider banks which have a significant presence in the south. Don’t be surprised if you see a large exposure to gold loans.

While some smaller private banks still manage to grow well despite the large concentration in certain products, public sector banks (PSBs) typically tend to struggle.

The article by Scroll talks about the many perils of lending by PSB, but the following excerpt is a good summary:

“In a world flush with cheap capital from pension funds, sovereign wealth funds, private equity investors.. many of India’s startups and business groups are choosing to exit the borrowing system of public banks, preferring to raise capital from foreign sources.. rather than subject themselves to the politicised financing that often accompanied the public sector banks’ debt.”

(Of course, there are always exceptions like SBI).

Let’s consider another scenario. Here’s an opinion piece by a retired banker.

Talking about our Prime Minister’s plea to banks to finance start-ups so that they can build the country’s balance sheet, the author writes,

“The proposal to finance start-ups out of deposits mobilised by commercial banks is a dangerous one. There is no doubt that start-ups are good and required for the economic growth of the country, but financing them out of banks’ deposits is an entirely different proposition.”

While the former does highlight how startups have access to capital, that may not always be “cheap”. Founders, reluctantly, have to dilute their stake (and a lot of rights) just to get access to the money - of course, there are multiple lawyers involved and one round of funding could take months to close.

The second article talks about how bankers, despite a push from the government, remain reluctant to lend depositors’ money to startups. The core issue remains - “risk”. Most bankers neither have the proficiency nor appetite to evaluate startups’ balance sheets.

What if there’s something in the middle?

That neither requires companies to dilute “equity” or raise “debt”. That provides instant capital.

Introducing BridgeUp.1

BridgeUp’s pitch is that for companies, revenue is their best asset. Especially if it’s recurring (fixed cash flows over a period of time).

Business Model

Before we deep dive into BridgeUp’s business model, we need to understand that it’s a marketplace… a broker… a matchmaker. As it comfortably sits in between, it enables business to be conducted by the parties on either side.

Sell Side (Borrower)

It seems this is the segment that the website primarily pitches to.

“Access instant capital by encashing your recurring revenue

contracts and receive upfront payments.”

Let’s start with a simple example. Take this newsletter.

Of course, it’s free. I don’t take money from readers (not even from folks who voluntarily offer to buy me a coffee). However, I do earn when brands decide to feature their products at the top. This is sporadic and unpredictable.

But what if it was actually predictable?

What if I had a constant (say monthly) stream of revenue from brands looking to collaborate? BridgeUp could then possibly help me raise upfront capital based on these “guaranteed” recurring revenues that I receive from my clients.

Sounds too good to be true?

This is exactly what Anthony Pompliano (who runs a popular crypto newsletter) did through Pipe, which is what BridgeUp is trying to do here in India.

Of course, BridgeUp isn’t targeting niche customers like myself.

Their sell-side clients could be any private or public listed entity, which has some sort of predictability embedded in their cash flows.

Based on their website,

If you notice, all these sectors have some form of recurring revenue:

B2B and/or Enterprise SaaS: Monthly, quarterly or yearly payments

Services Companies: Digital marketing companies, IT services, etc., have contracts with their clients which pay out periodically

Insurance - premiums

OTT - monthly/yearly subscriptions on Hotstar, SonyLiv

Online pharmacies - patients who have chronic ailments and order the same set of medicines every month

Ed-Tech - recurring fees for platform access

Media - Consider all these premium media publications (Ken, Morning Context, CapTable) and the yearly subscriptions they charge

How does this work exactly?

In a world of cheap capital, I think the best value that BridgeUp brings to the table is convenience.

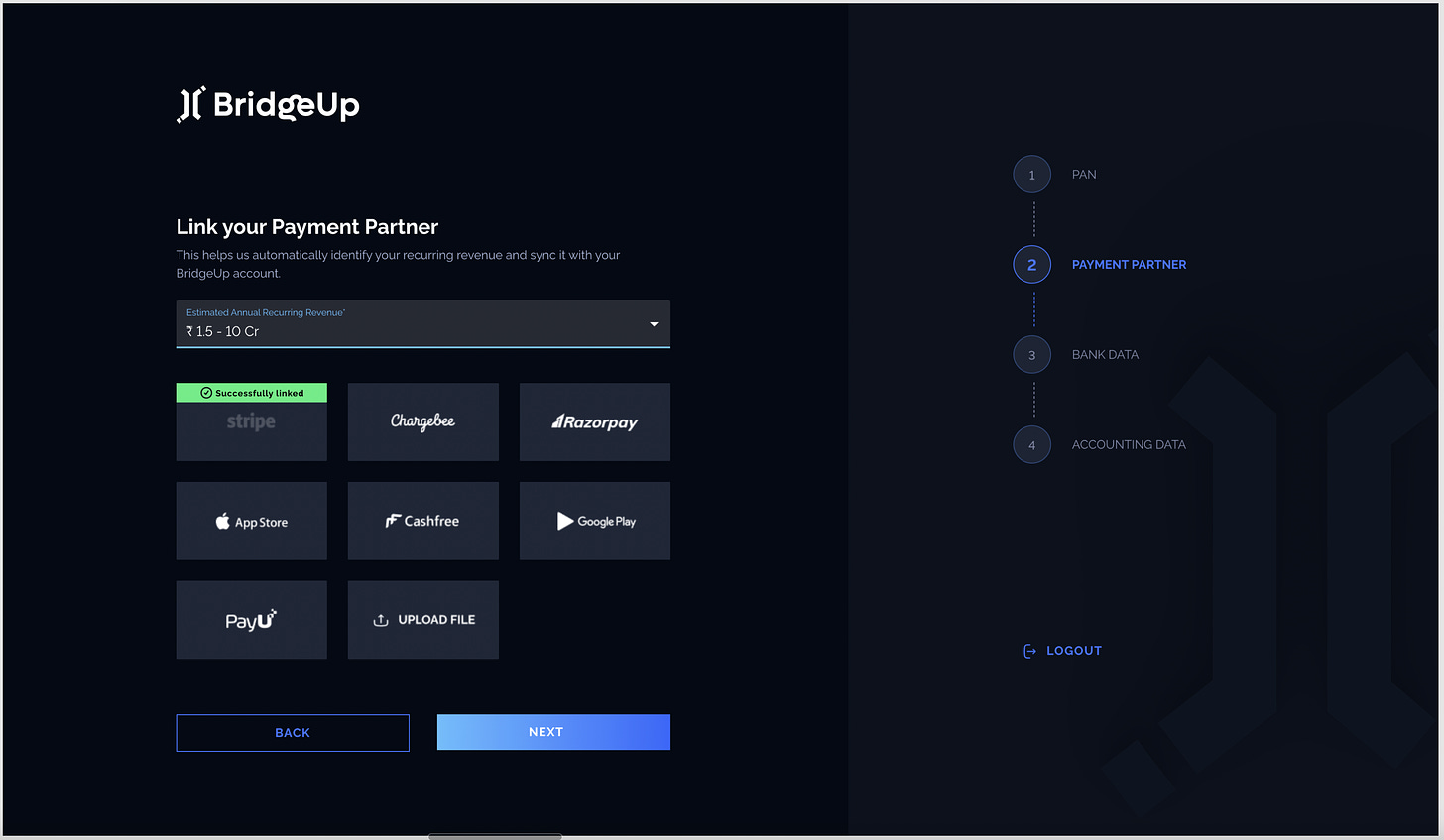

Consider the huge time spent by lawyers and accountants digging into your books before investors/bankers give you money for your business - compared to a simple 4 step onboarding process that BridgeUp has.

If you have genuine recurring revenue, what’s there to hide?

Take any Indian startup with Razorpay as their payment partner (quite common these days) - they can simply link it and BridgeUp will automatically pull up transaction history for all their clients.

Same goes for bank statements (automatically fetched for banks on the Account Aggregator system) as well as accounting statements (automatically fetched from any accounting solution such as Tally).

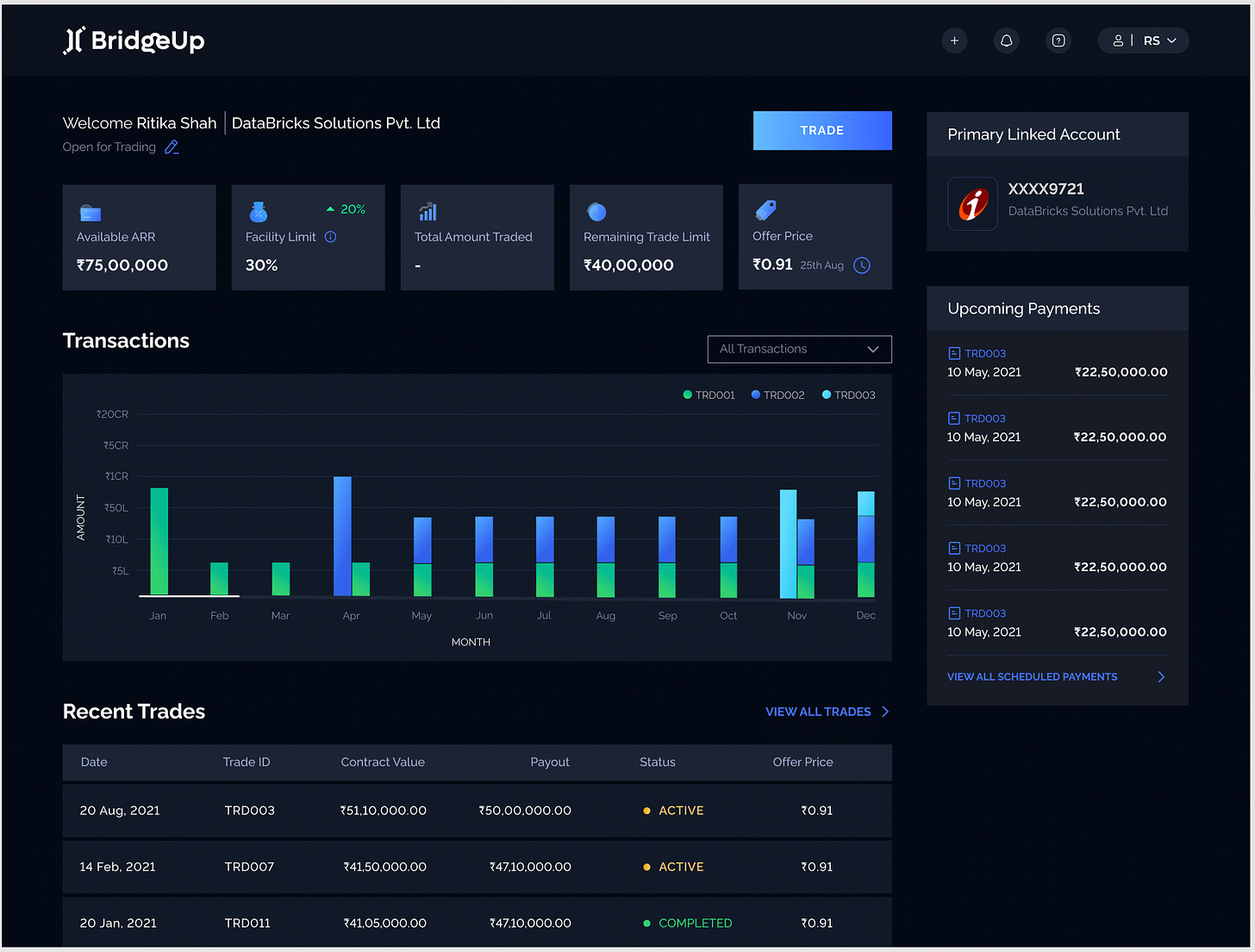

Hereon, BridgeUp’s algorithm starts running and within just 48 hours, you get your own sweet dashboard with a visual representation of your cash flows and a bid for your recurring revenue.

Without going into too many details, let’s consider SonyLiv as an example of a sell side customer. SonyLiv has tons of paying customers (17.9 million as per media reports). All of these details are already fetched, as explained above. SonyLiv can then decide to “trade” these customers. A selection of “X” number of tradeable customers will make up a “contract”.

Buy Side (Lenders)

Who do you think are buying all these contracts?

Exactly!

This is where the financial institutions/investors (or the buy side) come in.

Let’s take the example of a NBFC which is keen to invest. It can log into BridgeUp and browse through contracts from SonyLiv (and all the other sell-side players on the platform).

If they like the results of the analysis carried out by BridgeUp on Sony Liv’s recurring revenues, they can proceed to “bid” for these contracts. In most cases, a multitude of other investors bid for the same SonyLiv’s contract and that ensures that SonyLiv receives the best bid (offer) price, displayed at the top right of their dashboard.

Creating competition amongst the financial institutions for high growth companies with predictable revenues like SonyLiv allows these companies to receive the most competitive price (cost of capital) as opposed to a fixed (mostly non-negotiable) price generally offered by lenders or other revenue based financing (RBF) companies.

Once SonyLiv accepts the offer, a successful trade occurs - money from the investor goes straight to SonyLiv’s bank. SonyLiv will now just make monthly payments to the investor.

Where does BridgeUp make money in this?

The best part about this platform is that BridgeUp takes a flat percentage fee of the traded value of the contract - so you’re never in for a surprise. Also, no haggling with VCs for lower dilution or with bankers for lesser interest payments or pledging collateral.

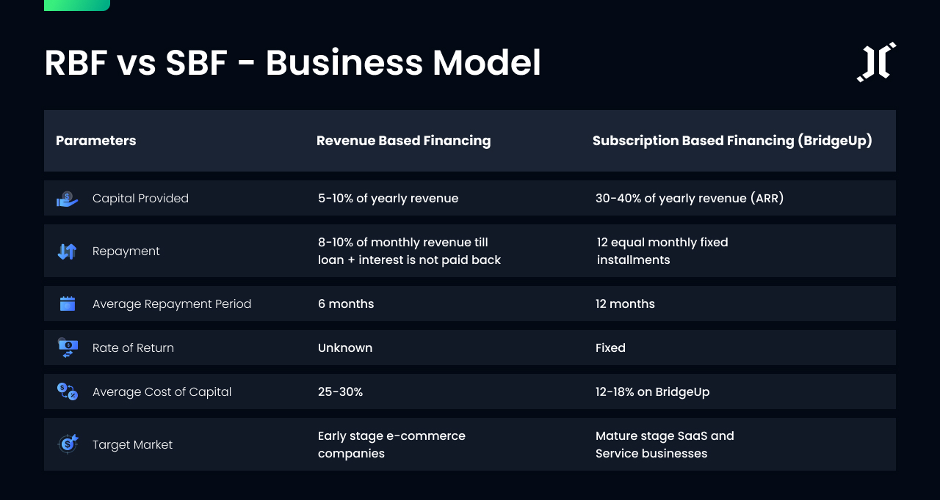

This is unlike RBF, a concept which had also recently picked up in India. RBF companies like Velocity usually take a percentage of your future revenues along with the principal repayment and interest.

Take this screenshot from their FAQ section:

As you can see, the problem with RBF is that for companies which have growing recurring revenues (for example, number of people subscribing to SonyLiv can go up next month), they can never accurately estimate the quantum of revenue that they would have to share with the RBF platform on an ongoing basis. For high growth sectors like SaaS and others mentioned above, RBF simply does not make sense as their monthly repayments would increase in proportion to their revenues. 🤷♂️

BridgeUp, on the other hand, is more like subscription based financing (SBF).

Final Thoughts

By acting as a true marketplace, BridgeUp is basically facilitating the transaction (matching the borrowers and lenders), but without the judgement. Here is why it makes sense for both parties:

For the lender:

Recurring revenue is an unbiased honest source of cash flows

Lender has access to a new asset class (recurring revenue) with fixed returns which remain unaffected by fluctuations in equity markets

A detailed analysis (checking actual cash flows, operational metrics, BridgeUp Score) is already done by BridgeUp

For the borrower:

For SonyLiv, this entire process is digital, quick and easy. Finance team can own this end to end without bothering other stakeholders

SonyLiv can choose to trade it’s best customers to get the best offer price

Money hits your bank account in less than a week from signup.

No equity dilution or pledging collateral for the companies or its founders

Considering there’s no real competitor to BridgeUp’s business model in India, the company has huge potential in changing the way companies with recurring revenue raise money.

That’s it for this week.

P.S. I love feedback. If you want me to cover a particular news, want your brand to get featured, write a guest post or simply want to say hi, do reach out to me at anirudha@bankonbasak.com or LinkedIN or Twitter. Meanwhile, please like this post and share it around?

All views and opinions shared in this article and throughout this blog solely represent that of the author and not his employer. All information shared here will contain source links to establish that the author is not sharing any material non-public information to his readers. His opinion or remarks on any news are based on the assumption that the source is genuine; thus he is not liable for any information that may turn out to be incorrect. This blog is purely for educational purposes and no part of it should be treated as investment advice. Using any portion of the article without context and proper authorisation will ensue legal action.

Disclaimer: Today’s post is a paid collaboration with BridgeUp. However, I wouldn’t have written about it if I didn’t see promise in the way it will change the investing landscape. As markets (both public and private) turn frothy, recurring revenue is truly… your best asset.