#1 Understanding the week gone by...

Reading time: 8 minutes.

Banking had a busy week.

Let’s get into it, shall we?

Kotak Mahindra Bank raises ₹7,442 crore via QIP

Wait!

What’s a QIP?

Imagine you want to raise money from people. You do an IPO. What if you’re already listed in the markets? Well, you do a FPO (follow-on public offer). What if you don’t want to go through the hassle of stringent regulations? Then, you do a qualified institutional placement (QIP). With the assumption that institutional investors are more sophisticated than retail investors, you’d have to go through less reporting requirements.

So who are these institutional investors? Can we find out?

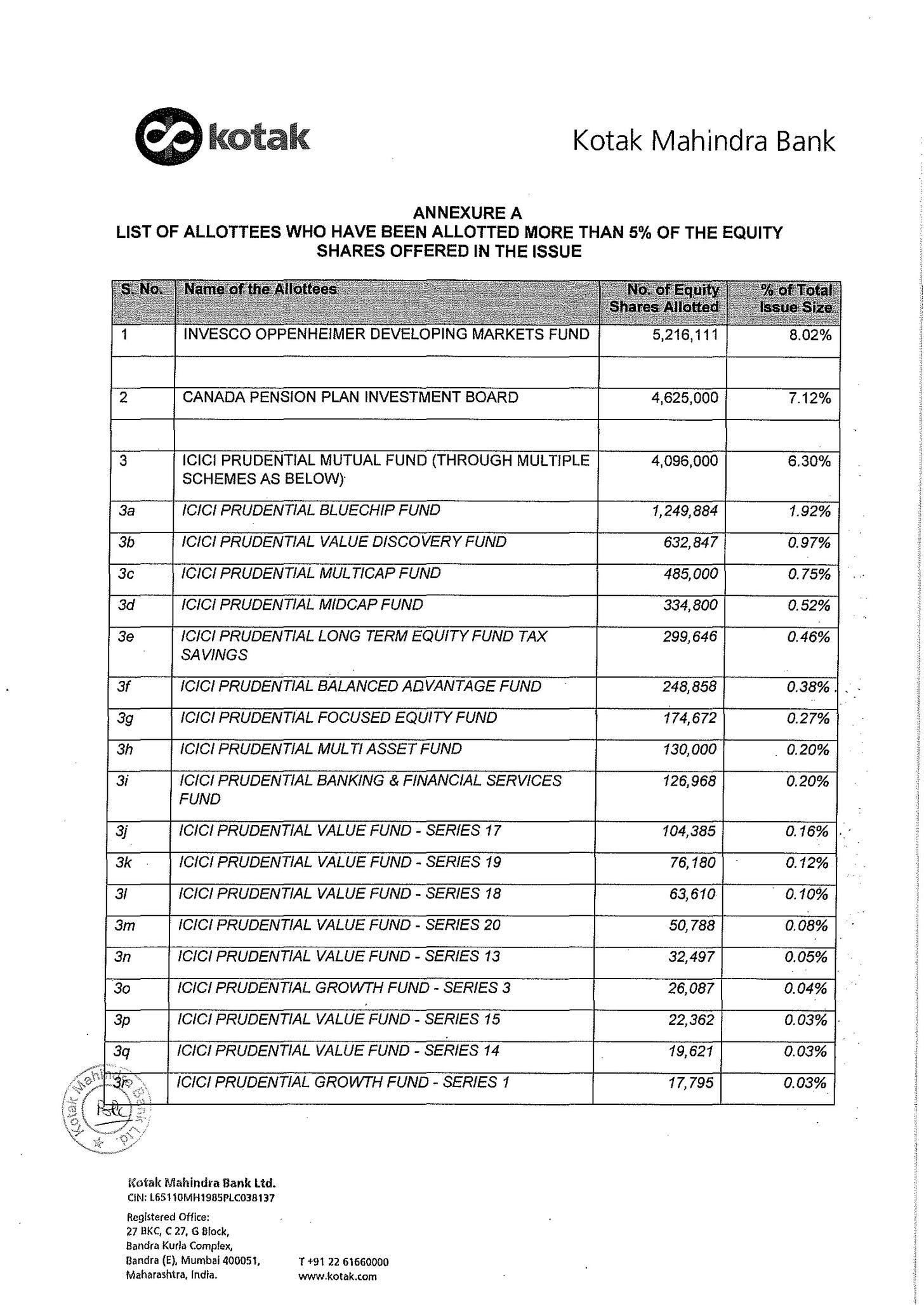

Yes! SEBI wants companies to disclose the details of anyone who has bought more than 5% of the entire QIP amount. Here’s the screenshot from the exchange filing:

As you can see, three names pop up: Invesco (an American investment firm), a Canada pension fund and the asset management arm of ICICI. Nothing suspicious. You see a lot of ICICI because they redistributed the amount to 18 of their mutual fund schemes.

But the real question is why? Why did they raise money?

The official reason is,

“our Bank intends to use the Net Proceeds to augment its capital base and to strengthen its balance sheet, which would assist our Bank in dealing with contingencies or financing business opportunities (which may either be organic or inorganic), or both, which may arise pursuant to the economic events driven by the outbreak of COVID-19”

So why now?

Best guess, the management may feel that the the situation in the financial space is going to worsen before it gets back up. Q2 results would provide a more holistic view of the COVID impact. So let’s raise money while we can!

Side note: This capital raise is NOT a dilution of stake. In case you missed it, Uday Kotak has been mandated to reduce his personal stake by RBI to 26% from the current 29.92% by September, 2020. That’s a story for another day!

Maruti just wants to sell cars!

And they’re taking the help of ICICI Bank and HDFC Bank!

What are the banks offering?

Innovative (desperate?) financing solutions.

What are they?

Flexi-EMI: Pay less now (atleast for the first three months till you survive COVID), pay high later

Balloon EMI: Pay less throughout the tenure of the loan, pay a really huge sum as the final installment

Step-Up EMI: Pay less now, slowly increase that over the year (say, 10% every year)

If you still didn’t get the hint, they’re basically making it as easy for you to pay as they can.

As you can expect, this has a mixed response. RBI doesn’t like this. They think that it increases the likelihood of default. (What if that last balloon payment is too much for you?)

Some “experts” think otherwise. Their rationale is to keep the economy moving!

What do you think? Let me know in the comments!

The Curious Case of Moratorium

Soon after the pandemic started, the RBI came out with a lot of measures to ease up the liquidity in the system. One of them was allowing all lending institutions to offer a three-month moratorium on loan repayments, from 1st March.

Considering COVID being an unstoppable beast, they extended it for another three months.

Once the quarter results trickled out, we realized the impact on their loan books. Here’s a graphic from The Ken to visualize the same:

So what do you infer from this?

This is only after the Q1 results. Q2 is going to be way worse.

NBFCs (non-bank finance corporations) are at a greater risk than their traditional counterparts. Why? The borrower class of banks are not only of a higher credit profile (think of their own account holders, salaried, businessmen with a great CIBIL score) but also someone who can tide over this storm easily. Whereas, NBFCs typically lend to people who otherwise won’t get the same loan from a bank.

To top it all of, “moratorium” is such a difficult word to understand. Assem Dhru, MD & CEO of SBFC Finance Pvt Ltd, puts it beautifully,

Introducing “What’s up with RBI?”

In this section, I will decode all the important press releases from the central bank! If there’s any particular thing you want decoded, you can always drop a mail and if I cover it, I’ll feature your question here!

For this week, I guess the hot story which the papers ran was the ₹4 cr fine slapped by RBI on Citibank. Why?

Well, the bank did not obtain certain declarations from the borrowers during current account opening. Is this common?

Yes! Just look at the number of fines by RBI in two days!

Well, atleast someone’s keeping an eye on the bad boys, eh?

Introducing “Give me some videsi drama!”

In this section, we will focus on what international banks are up to. It’s imperative we understand what happens on a global scale because it provides us perspective on the Indian scenario as well!

Here’s an interesting tweet that caught my eye!

So what’s happening here?

The European Central Bank is trying to explain us how negative interest rates are good for the economy!

To which the guy, who has retweeted it, Keith Dicker, explains how it isn’t, in this excellent piece.

It’s a long read, but here’s an image from it, where you can visualize the secular theme that the world is currently going through right now!

Just think of the situation. You are giving the bank money to keep your money! Alternatively, the bank is giving YOU money if you borrow from them! What?

Does this affect us? Keith warns us.

“And as for investors who continue to hug their bank stocks for their precious dividends - beware. As markets continue to shift as we expect, many banks will require additional bailouts from public purses. And as the public has become less tolerant for bailing out monopolistic, levered companies - there will absolutely be conditions attached to handouts.”

Sound familiar? Let’s hope our big old RBI knows what they’re doing!

Movers & Shakers

Banks Board Bureau has recommended new appointments for SBI, IOB and the Central Bank!

All that’s fine. But who’s Banks Board Bureau?

Set up in 2016, its an autonomous body of the Government of India tasked to improve the governance of Public Sector Banks, recommend selection of chiefs of government owned banks and to help them in developing strategies and capital raising plans. Bet you didn’t know that!

In other news, KV Kamath, former ICICI boss and considered the king of India’s retail banking, stepped down as the President of the New Development Bank of BRICS countries after his 5-year tenure.

Wait wait! That’s too many words. Well, I always hyperlink new words in case readers want to know more about it, but here’s the short form,

New Development Bank is a multi-country bank established by Brazil, Russia, India, China and South Africa (BRICS) to fund sustainable development projects that positively impacts the member countries. It’s headquartered in China, but the idea was conceived by India.

So what has it achieved in 5 years?

This article does a fair job in outlining them. It says,

NDB was created to help fill this funding gap in the BRICS economies. Fast forward to 2019 and three achievements are worth highlighting. These are: a loan book of $10.2bn, one AAA and two AA+ international credit ratings and the successful launch of capital-raising activities in local currencies.

Back up please. Weren’t we talking about KV Kamath?

Yes, if you want to know about his illustrious (and you should), read this article by Tamal Bandyopadhyay. He does a better job than I ever could.

The Yes Bank saga continues…

Yes Bank has had a busy week.

First, it announced that it acquired close to 25% stake in DishTV through invocation of pledged shares. English please? Well, Yes Bank claimed that DishTV had availed loans from Yes Bank by offering shares of DishTV as collateral. Now, that DishTV couldn’t seem to pay them back, Yes Bank “invoked” them - thus, allowing them to use those shares to gain stake in the company. Let’s be clear. This is NOT ideal. A bank’s first priority is to recoup the loans in the form of interest + principal. Why would it want a stake in a company that isn’t even related to its business? Well, we will have to see how this drama unfolds since DishTV has denied this claim.

Second, Madhu Kapur and family give up their status as “promoter shareholders” and want to be now re-classified as just plain old vanilla shareholders. But wasn’t Rana Kapoor the promoter? Yes. So was late Ashok Kapur. Madhu Kapur is his wife. After years of struggling to get control of the bank from Rana, they finally let go. Guess they don’t like the bank anymore. Who does?

Third, the current management team of Yes Bank has agreed to make 30% of their total CTC (cost to company) as a variable pay. Think about it, the bank was already struggling to get back on its feet BC (before Corona, dumbo!). With COVID, things are about to get a whole lot worse. Let’s link our compensation to performance then?

Let’s hope the bank can move past all of this again.

That’s a wrap for the week. What did you think? Good, bad, yuck? Let me know in the comments.

If you want to reach out to me for a detailed feedback, want me to cover a particular news, want to get featured, write a guest post or simply say hi, reach out to me at bankonbasak@gmail.com.

In the meantime, tell your friends!

And stay safe!

Great info about yes bank missed it !!!

Good well articulated article

nice article