#14 Not Risk-Averse, But Prudent

Weekly Report: 24th-28th August, 2020

Banker’s Round-Table

On Thursday, Business Standard held back-to-back webinars with the RBI Governor, couple of CEOs of public/private/foreign banks, and a final one - just with SBI Chairman Rajnish Kumar and HDFC MD, Aditya Puri. I attended the 4 hour marathon, so you don’t have to.

Here are the concentrated insights:

First up, RBI Governor Shaktikanta Das narrated his speech. He mentioned two things, that the moderator, Tamal Bandyopadhyay, relayed to the next panel:

Banks are being overly risk-averse; this could be self-defeating as it would affect bank profits

The current steps towards bank consolidation is a step in the right direction

I really enjoyed this discussion, as it was a diverse panel, represented by heads of public (PNB, Union), private (Axis, IDFC, IDBI) and foreign (Citi) banks.

Tamal: Moratorium ends on 31st August, and as CNBC reported, almost 31% of banking systems’ loans were under it, so what did bankers have to say?

Union Bank: “Moratorium not a good way to check our loan book, because good quality borrowers (who don’t need it) are also availing it. We expect them to pay back at the earliest”

This was a common feeling echoed by the others too, some even went on to say that moratorium 2.0 (extended moratorium) was better than 1.0, as less borrowers opted for it

Now I should caution you to take these sentiments with a pinch of salt. Considering it is entirely a banking panel, I’m sure you’d understand that there’d be biases, with each bank downplaying it’s weakness. In fact, there has been no guidelines on how to calculate the % of loan book under moratorium. IDFC head Vaidyanathan actually said,

“We had calculated our moratorium to be 28% of the loan book, but following SBI Chairman Mr. Rajnish’s definition, it actually came to 15%.”

Now that’s a wide variation!

Tamal: Are public banks forced to do ECLGS? Why are private banks shying away from it?

To understand the bankers’ response, we need to understand the context.

ECLGS (or Emergency Credit Line Guarantee Scheme) was announced during the #Aatmanirbhar package by the government, for the MSMEs. In essence, banks were mandated to lend to this segment so that they could keep their businesses afloat during this crisis.

Do note that this is a very important segment for India, as it contributes ~30% of the GDP, with the Government wanting to bring this share to 50%.

But you should ask - what’s in it for banks?

For starters, loans advanced under this scheme are 100% guaranteed by the Government - so banks don’t have to worry about NPAs

Interest rate is 9.25% - Imagine earning such a high risk-free rate on your investments

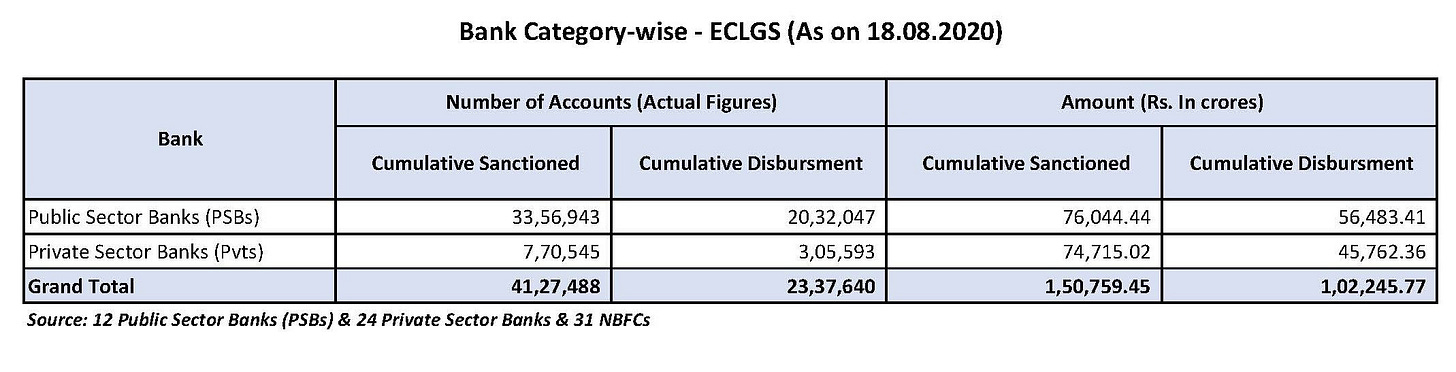

As of 18th August, over ₹1.5 lac crore has already been sanctioned by banks (total limit ₹3 lac crore):

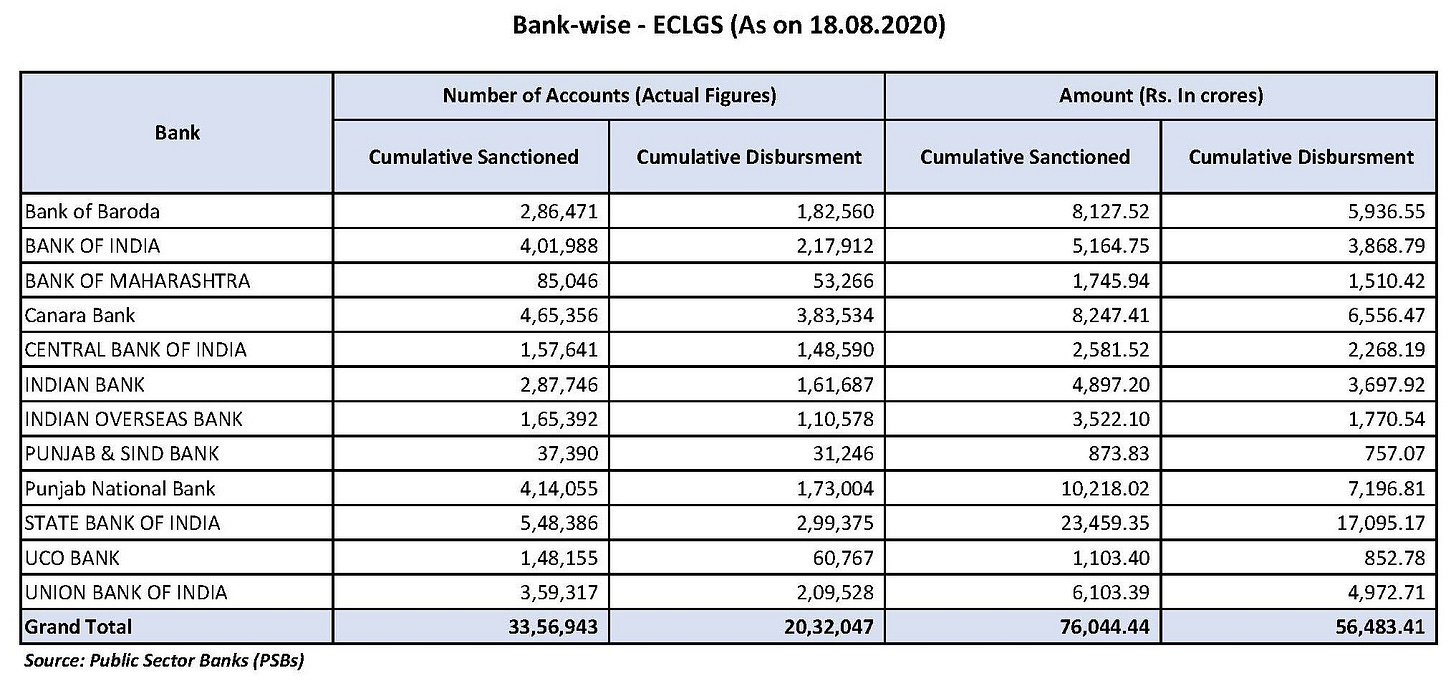

You even have the breakdown for public banks:

Since private banks are not entirely under the ambit of the Government, they are not required to disclose their figures like public banks. So as an overall picture, you see that private banks have disbursed ~₹10000Cr less than public banks. Now do you understand Tamal’s question?

Ofcourse, the private bankers brushed it aside, with IDFC even giving their figures (₹1400Cr), which seemed greater than at least two public banks (Sind and UCO).

I fully expect private banks to come close to public banks soon, because of the attractiveness of this scheme. Banks have somewhere to lend, MSMEs get the much-needed relief. Win-win!

Tamal: Do you have any grievances/requests from the RBI?

Unsurprisingly, almost all banks in unison said that they were very happy with RBI’s decisions.

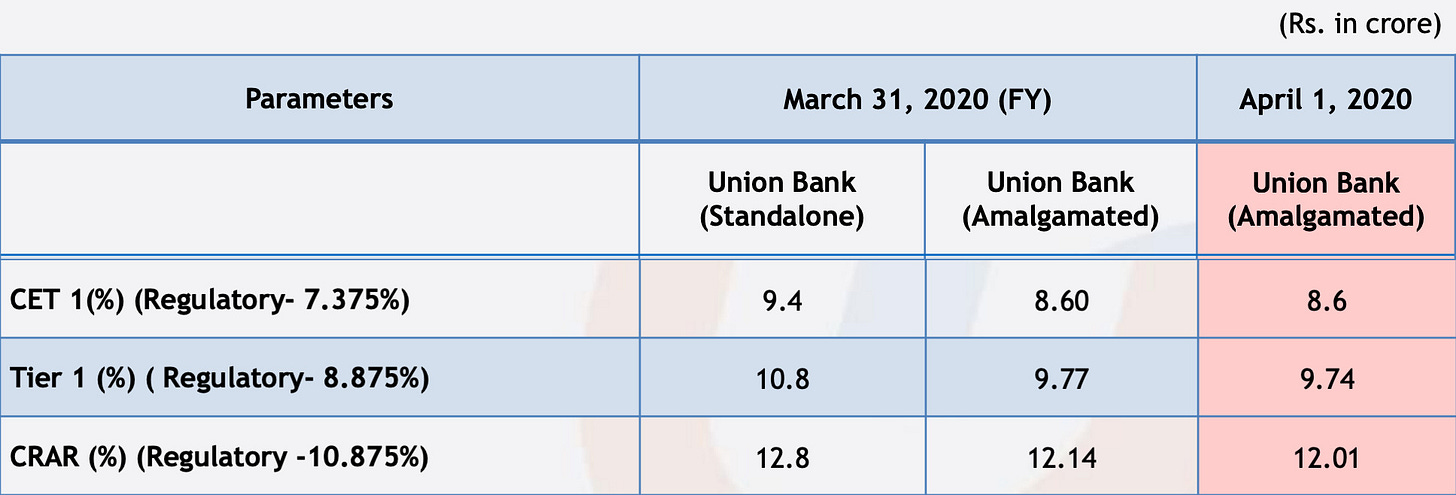

However, Mr. Rajkiran (Union Bank) couldn’t help himself. He sheepishly admitted that he would be happier if RBI could relax some of the capital requirements of banks during this crisis.

After the government merged Andhra and Corporation Bank with Union Bank on 1st April, look how dangerously close the bank has come to the regulatory minimum (image below). It’s the same story with PNB. Unlike private banks, public banks (except SBI) haven’t really been too lucky in raising funds in this environment.

Finally, we come to the last discussion. I really enjoyed this one for two reasons:

Both of them are officially retiring on October 2020

I really liked observing the calm nature of Mr. Kumar (“For me, SBI is everything”) and the boisterous nature of Mr. Puri (“My legacy will be a Covid-free balance sheet”)

If you want to watch it yourself, you can do so here (the video will automatically play from this segment)

I’ve said it before, despite it’s unique features, banking is still a business. It’s the way you look at it, your demeanour, risk framework and strategy that differentiates it.

If you want this newsletter to focus more on the the above factors and less on news, do comment or reply to this mail. Although I’ll still be covering news, I’ve realised strategy is long-term, and news is short-term. Let me know what you think (also drop in suggestions)

What’s up with RBI?

RBI finally released it’s Annual Report this week.

In an earlier post, I had explained how RBI has transferred only ₹57128 crore to the Government this year, even though many had expected it to be higher, considering how fiscally constrained our Government has become due to all the Covid-related measures it has announced.

I also outlined the ever-raging debate from people who think the RBI should not transfer excess to the Government. For today, let us ignore both and neutrally observe the balance sheet and what it contains!

When you read “RBI Balance Sheet swells by 30%” in the newspaper, this is the data you must refer to. As you can see below, the assets portion has increased by 30% (41,029*1.3=53,347). So why did it increase so much?

Refer to the highlights above; the investments (and the appreciation of value) of gold and foreign assets really make up a chunk (over 70%!) of the balance sheet. Domestic investments make up a measly ~30%.

Let’s quickly come to the income statement now.

Their income this year didn’t really rise much (~2.3%). But notice the expenditures.

Provisions is the highest expenditure. This is the so-called reserve (or Contingency Fund) for emergency purposes. Whatever remains by deducting expenditures from income, is called the surplus and is transferred to the Government. Do you understand the importance of Contingency Fund now? It is the “only” expenditure that is under RBI’s control. The more it sets aside for this emergency fund, lesser the money for the Government.

Hope you liked this inside peek. In case you’re wondering “If these are only two pages from the Annual Report, what do the rest of the >300 pages contain?”

Well, half the annual report talks about the economy, and the other half is basically RBI boasting about all the ways they help in managing the economy.

If all this was too simple for you and you want a slightly deeper take on it, you can read this (however, please be cautioned that this author doesn’t really like the RBI, so you might not get a balanced view).

Give me some videsi drama

Today, we talk about The Federal Reserve’s (US Central Bank) Monetary Policy Speech!

If you’ve seen this face this week and couldn’t understand what’s going on, I’m here for you!

First, we need to understand a concept called inflation targeting.

This is basically a tool in which central banks publicly set an explicit target for the inflation over the medium-term to maintain price stability of goods and services. Their primary focus will be to do mumbo jumbo with economics so that inflation doesn’t cross this self-imposed limit.

A lot of counties follow this; developed countries like UK, US have targets of 2%, while emerging countries like India have a target of 4%. In fact, UK was the first to adopt this way back in 1992. USA adopted it much later in 2012. India, as usual, was the last to adopt it, in 2016.

Now USA is slightly tweaking their definition.

Instead of inflation “targeting”, they will follow inflation “averaging”, which means they will not lose their minds when it breaches the 2% target.

Question is: Why are they doing this?

I think I’ll quote from the speech directly here:

“The persistent undershoot of inflation from our 2 percent longer-run objective is a cause for concern. Many find it counterintuitive that the Fed would want to push up inflation. After all, low and stable inflation is essential for a well-functioning economy. And we are certainly mindful that higher prices for essential items, such as food, gasoline, and shelter, add to the burdens faced by many families, especially those struggling with lost jobs and incomes. However, inflation that is persistently too low can pose serious risks to the economy. Inflation that runs below its desired level can lead to an unwelcome fall in longer-term inflation expectations, which, in turn, can pull actual inflation even lower, resulting in an adverse cycle of ever-lower inflation and inflation expectations.”

Long story short,

The Federal Reserve is worried about deflation (opposite of inflation which is never good). Imagine this. If you’re a business selling goods, would you be happy with falling prices?

They have limited scope to cut interest rates (if you recall the chart from my last post, US policy rate was at 0.13% and inflation was at 1% as on March). As you can see, they are dangerously close to 0%. Any fall in inflation will force them to bring policy rate below 0% as well, which is crazy.

They want to focus on lowering unemployment (which is at an all-time in USA right now) more than they want to control inflation.

In any case, the Fed is not worried much because, in the last few years, it has failed to manage inflation not because it rose above it’s “target” (like we’re facing in India now) but because it has remained well below it.

The true question is - will it work?

Well, how can I say, when the man himself is unsure!

“Time is going to tell” - Jerome Powell.

Movers & Shakers

So there’s been some re-shuffle at the top management at SBI.

The bank has a couple of MDs and one Chairman, who gets selected from the pool of Managing Directors. There were rumours that current Chairman Rajnish Kumar would get an extension considering the Covid uncertainty. However, after a round of interviews yesterday, Banks Board Bureau (head-hunter for public banks) recommended Dinesh Kumar Khara (senior-most MD) for the position.

In case you didn’t notice, Ashwani Bhatia was just put into the MD shoes this week, having led SBI Mutual Fund for the last two years. If all this is confusing, I made a nifty chart for you guys!

Rajnish Kumar had joined the bank as a PO (Probationary Office) in 1980. Dinesh Khara joined as a PO in 1984. Imagine how long you have to stick around in SBI to become a Chairman! Start now folks!

*MD Arijit Basu is set to retire next month.

*The final appointment is pending Government approval.

What else happened this week?

International

We all love transparent banking don’t we? But it’s common knowledge that the top US banks generally fleece their customers through expensive overdraft (credit) charges. Some reports claim the top 4 US Banks earned over $8B through this route, mostly exploiting lack of customer awareness and skipping user consent. This week, TD Bank had to pay back $97M to clients and an additional $25M in penalty fine for this very reason. Sooner or later, the law catches up to you!

National

What do you do when RBI pushes you to lend but you don’t want to? You tighten your lending requirements. Bank of Baroda is doing exactly that. “Till July, BoB offered the lowest home loan rate (6.85%) to borrowers with a minimum Cibil score of 726. However, from August, BoB borrowers must have a Cibil score of 775 or more to get the lowest rate (7%).”

Remember Nirav Modi? Punjab National Bank has received ~₹24Cr from that case in the first tranche, expects another 50Cr. Just to refresh your memory, the original fraud was around ₹14,000 crore!

Last week, I had written extensively on the NPCI and NUE, the new umbrella entity being formed as a potential competitor to the former. Apart from PayTM and Reliance, another big player is rumoured to launch it - none other than SBI. Also, here is an interesting contrarian piece which opines that instead of another NPCI, maybe what we rather need is a supervisory body to keep an eye on it.

That’s it for this week. Congratulations, you survived 10 minutes! Let me know what is the one new thing you (hopefully) learnt from this episode, please? 😊

If you want me to cover a particular news, want to get featured, write a guest post or simply say hi, reach out to me at anirudha@bankonbasak.com

P.S. You can also connect with me on LinkedIN, Twitter (these are two places where I post whatever that interests me) or on Quora (where I try to help people with their queries related to the banking sector).

Boring, yet an important disclaimer: Views/opinions expressed in this article are solely my own and not of my employer.

Thanks for this Anirudha!!

Just a small correction, if you may allow about "Interest rate is 9.25%" for ECLGS scheme:

For ECLGS, max. interest rate will be 9.25% during the tenure of loan. There are many corporates which I know have availed these credit lines at even below 8.5% levels and many who availed it in July may have even availed it at 8% level.

For an example, you may look at: https://www.indianbank.in/departments/ind-gecls-covid-19/#:~:text=Rate%20of%20interest%20will%20not,entire%20tenure%20of%20the%20loan.&text=Helpline%20Numbers%20%26%20Email%20ID%20for%20queries%2C%20facilitations%20and%20Grievances.

Thanks again!!