#22 Surveys are important!

Weekly Report: 19th-24th October, 2020

Happy Dussehra to all!

I know the editions have been coming super late at night these days (only reason I haven’t pushed them to the next day is because I want to live up to my promise of not missing a Saturday for a year)!

In the past couple of weeks, I’ve shifted cities (Kolkata to Mumbai) and zeroed in on a new place here, hence the delay - I will try to do better from the next edition! :)

P.S. Bank on Basak has a custom domain now! - It means “substack” will no longer appear in the URL links!

Cheers!

The Legend Steps Down

On Monday, Aditya Puri will formally hand over the reigns to Sashidhar Jagdishan - the new CEO.

Just imagine yourself in his shoes for a second. I’ve been the President of a tiny club during my MBA and a simple thing like passing the baton to someone else hurt. I simply can’t fathom what he must be going through - building the biggest private bank from scratch, leading it for 26 years and then finally having to move on!

No wonder the Mumbai HQ went all out:

“Over 1 lakh employees of the bank will reportedly congregate (of course, virtually) to bid adieu to the outgoing CEO. Several teams at the bank are believed to be working relentlessly to ensure a decorous farewell.”

Being one of the most widely tracked stocks (a record 56 analysts track it globally - most being Alibaba at 64), a lot has already been spoken about its keyman risk - it is when a business becomes overly reliant on a particular individual(s).

However, people fail to realise that the technology, the entire management team and the internal processes - all remain the same.

Here’s an excerpt from it’s recent Q2 conference call.

“Almost all of the year-on-year and quarter-on-quarter accretion in the book came from top half of the 10 point internal rating scale which has served the Bank well over the years.”

The management has harped on this rating scale for years now. It is a proprietary one and they’re very proud of it - since its on the basis of its effectiveness that has allowed them to lend prudently over the years, with minimal risk.

There are other instances where it gets clear that Aditya Puri has taught the team well. Here’s Rahul Shukla, Group Head - Corporate and Business Banking:

“CASA growth for the businesses showed strong growth. The growth is a result of, one, of course, secular market share shift that we see in the sector. But for us, we do slightly better because of our adherence to our institutionalized sales process drilled into our heads by Mr. Puri that balances growth from penetration, new acquisitions, geographic expansion, collaboration with branch digitization, wallet sizing, full suite of superior products, in the backdrop of a very strong focus on credit compliance and controls architecture. Apologies; there is no other way that I can explain this.”

There are more examples such as these. Additionally, Sashidhar has been mentored by Mr. Aditya right from the beginning. I’m sure we all realise how important the role of a mentor becomes in our lives.

In any case, it’s only a matter of time before we learn how the bank performs under him in the next couple of quarters. The commentary from the management feels like the bank was completely immune to the 25% drop in GDP.

But will it continue its legacy of being a 20% bank?

P.S. Ganesh (equity-research professional) has analysed HDFC Bank for his clients (I’m one of them). I really liked his comprehensive coverage and if you want access to the full report, you can click here. Note that this is not a sponsored recommendation.

What’s up with RBI?

3 months ago, RBI published a report analysing the future of the QR code infrastructure in the country. I had covered the details of the report here.

This week, RBI finally enforced some of the recommendations of the report:

If you want the TLDR version, here it is:

RBI is phasing out proprietary QR codes by March, 2022. Also called “closed-loop” QRs, these are codes which only accept payments from the app that appears in the branding - for example, a QR code sticker with a PayTM branding would only accept payments from “PayTM Wallet”.

Instead, RBI is only allowing inter-operable QR codes to be present in the country - these are codes which accepts payments from any UPI app.

Kind of like this:

My take: Honestly, this was one of the most easiest recommendations from the report to implement. Even PayTM will face minimal impact since it had already stopped focusing on closed loop QRs to keep up with its competitors. Sadly, the most important suggestion from the report (withdrawal of Zero MDR) was ignored for now. Without MDR (Merchant Discount Rate - a tiny fee that merchants paid to banks), innovation may suffer in the digital space. There were other novel ideas from the report as well - common yellow pages kind of registry to verify genuine QR codes, removing a few layers of friction for merchants with respect to KYC onboarding, offline QR codes for low ticket payments - all of which seemed to take a backseat as well.

Further reading: Deepak (ex-PayTM VP) has published an article which explains how “merchants” are recognised in UPI P2M transactions. There is an infographic in the article which explains the concept lucidly.

Give me some videsi drama

This week, we’ll not talk about a particular bank.

Instead, let us dive deep into a biennial survey conducted by the FDIC - Federal Deposit Insurance Corporation - an institution that provides deposit insurance to US citizens. (kind of like DICGC in India).

(Published on 19th October, 2020 - Source)

Why are we doing this?

Because surveys are important. Apart from general knowledge (which is always good), it helps you get a clearer picture of where the industry is lagging/leading, what the market size/opportunity and how to build better products.

For example, right at the beginning, the survey puts this graphic:

This is the most important measure for any country - it is dual measure of the penetration of financial inclusion and also the progress that banks have made over the years. A record 95% of US households now have at least one bank or credit union (think of like a local community bank) account.

However, if you look into the details, there’s deeper issues in diversity here as well - 14% of African-American households and 12% of Hispanic households did not have bank accounts in 2019 - compare this to white households, less than 3% were unbanked.

FYI - India unbanked figures are as high as 20% (as on 2017)

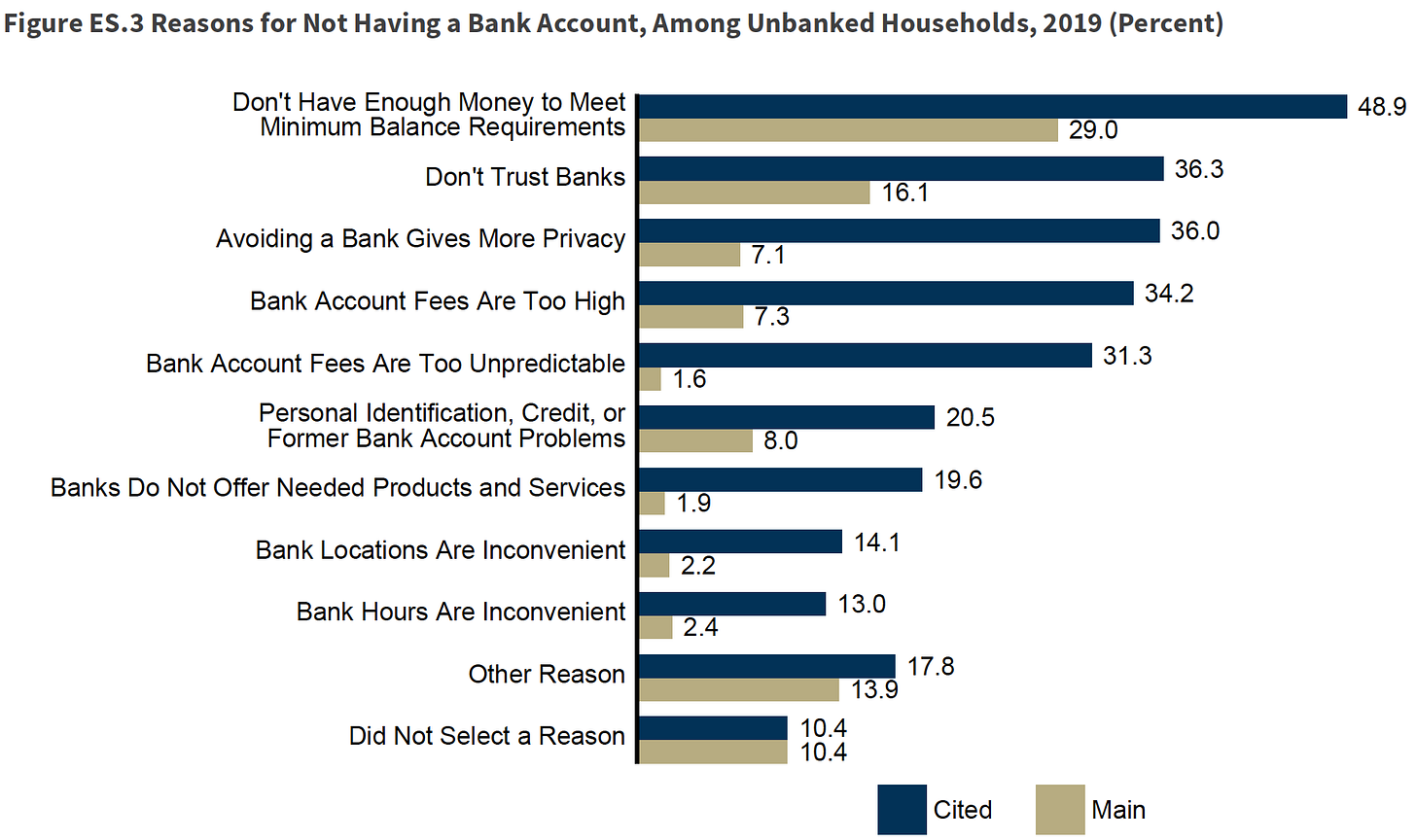

So what’s the reason for those 5.4% people in America to not own an account?

As you can see from the data, the most common reason that was highlighted by the participants was not having enough money (zero balance accounts solve this, however, awareness is low). Apart from the trust and privacy issues, a concerning reason is around fees - I have previously highlighted how U.S. banks are notoriously opaque in their fee structure for common services like an overdraft.

Here comes the interesting part:

Look the growth in internet banking. To be more precise, online banking has actually faced a de-growth. It’s Mobile Banking that is cornering more than one third of the US market.

As is obvious, millennials are mostly driving this growth. This is why you see so many neobanks coming out with only an app and no website.

What are the non-bank use cases?

P2P Payment Service (think PayPal, Venmo, CashApp, Apple Pay) have become fairly popular in the last two years. In fact, this segment did not even make an appearance in the 2017 survey - and now, it’s the highest!

Finally, how can we ignore credit?

Credit card usage is the only segment which showed a positive growth.

I tried to distill the 86-page survey in the best way I could. Hope you learnt something! It would surely be interesting to go through a similar comprehensive report on India as well.

What else happened this week?

International

Goldman Sachs, was criminally charged in connection with a multibillion-dollar fraud involving a Malaysian govt investment fund. As per the latest information, the bank will pay ~$4.8B in fines globally, plus forfeit about $600M in ill-gotten fees & revenue. This is one of the largest fines ever by any company, let alone a bank! Here’s the official apology letter from the CEO. If you’ve read my piece last week, you’ll understand why Goldman wants to move away from this business to become a more “conventional bank”.

National

The Supreme Court saga draws to an end. The Government has come out with details on how the compound interest (or interest on interest) scheme would work. As expected, it would be applicable for specified categories, irrespective of whether borrower availed of moratorium or not - for loans below Rs 2 crore, which were not NPAs as on Feb 29. The scheme is to be implemented by Nov 5. For all the details, read here.

That’s it for this week.

Reach out to me at anirudha@bankonbasak.com, my LinkedIN or Twitter. Meanwhile, share this around?

All views and opinions shared in this article and throughout this blog solely represent that of the author and not his employer. Since the author is employed by a bank, he has consciously chosen not to report any news related to his company to avoid conflicts of interest. All information shared here will contain source links to establish that the author is not sharing any material non-public information to his readers. His opinion or remarks on any news are based on the assumption that the source is genuine, thus he is not liable for any information that may turn out to be incorrect. This blog is purely for educational purposes and no part of it should be treated as investment advice. Using any portion of the article without context and proper authorisation will ensue legal action.