#24 Whatever works...

SBI Q2 results, the new Co-Lending Model and Onyx!

Who’s the biggest of them all?

SBI, the largest lender of our country, published its Q2 results this week.

I rarely focus on short-term results in this newsletter, so I’ve removed the P&L statement, but rest assured, there are tons of information to analyse in the balance sheet itself!

SBI is so large that it can be singularly considered as a soft benchmark for the banking industry.

Just consider its closest competitor, for example:

Loans (as on 30th September, 2020)

SBI: ₹23,83,624 Cr (~23% market share)

HDFC: ₹1,038,335 Cr (~10% market share)

Deposits (as on 30th September, 2020)

SBI: ₹34,70,462 Cr (~25% market share)

HDFC: ₹1,229,310 Cr (~9% market share)

Notice the stark difference in the numbers. It almost seems that SBI is double or triple the size of HDFC. But as they say,

Bigger isn’t always better. 😎

Let’s look at the Q2 results to understand this:

As you can see in the YoY (year on year growth) column, deposits have grown way faster than the their loans have (14% vs 6%). I’m sure we have all read some version of this in the news. Here’s a sample headline:

The crux of the article is this: Due to severe uncertainty, individuals have become more risk-averse and have been flocking to banks to keep their deposits. Additionally, due to the uncertainty around moratorium and businesses slowing down, banks have faced difficulty identifying credit-worthy (and willing) borrowers.

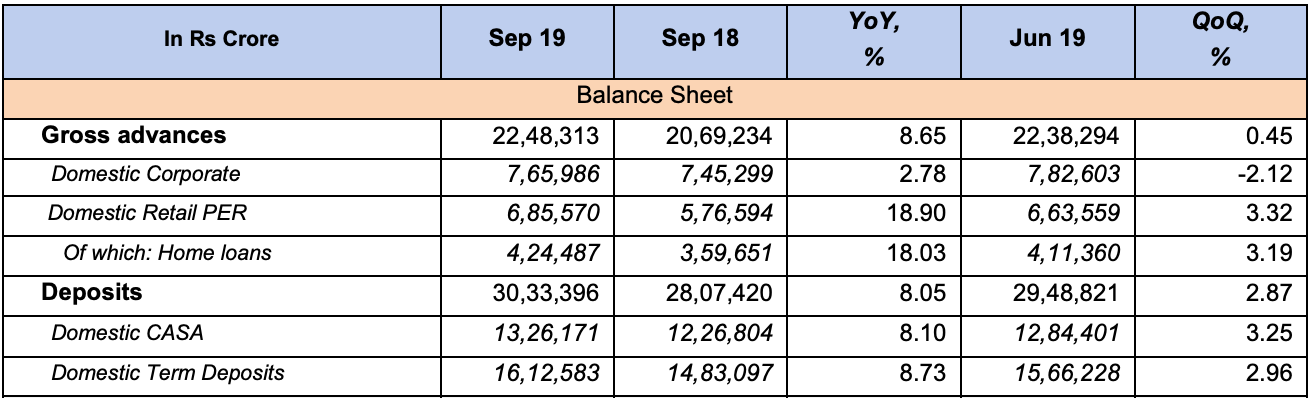

SBI is the classic flag-bearer of this situation, which is now reflecting in their numbers. For comparison, this is their quarterly results from exactly a year ago:

Notice how the deposit and loan growth is stable and closely linked to each other (~8% in both cases).

Why did I mention HDFC earlier? Because despite the difficult conditions for the overall banking industry, it has still able to grow its loan book at ~16% (albeit, over a lower base) while its deposits grew at ~20%.

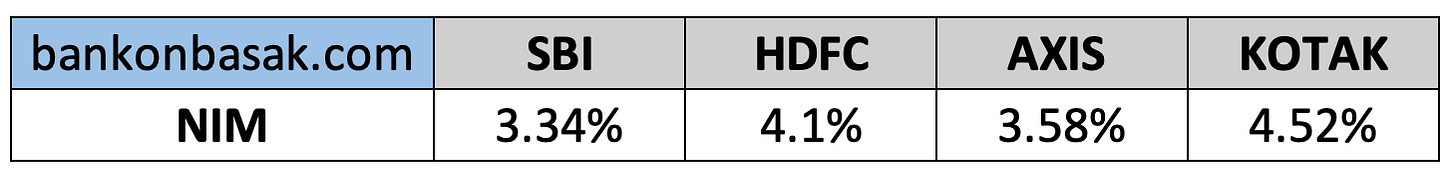

The ratio that best captures the effect of this difference is known as NIM (or net interest margin) - on a simplistic level, it measures the difference between the interest income generated on its loans and the amount of interest paid out to their depositors. When you have more deposits (compared to loans) just lying around in your bank, you incur costs to service these deposits (think of the interest you receive on your FDs) and thus NIM reduces (also called NIM compression). You could have earned additional interest income if you had lent out these deposits to other people.

Here’s the list of NIM for the major banks across India for your reference.

*Note: NIM is dependent on other factors as well.

Now, let’s dig in a bit more in its loan book.

Look at the growth in Personal Retail Loans compared to the other segments. When you look at this data, it isn’t surprising when the new Chairman (Dinesh Khara) comments,

“Retail will be our major lever going forward”

So what do their Retail Personal Loans comprise of?

Apart from the obvious bumper growth in gold loans like most other banks, SBI has been doing well on Home Loans, where the average ticket size is also larger (₹25-28 lakh).

Xpress Credit are loans to Salaried Employees who maintain their salary accounts with the bank. You can read the full details of this loan from their official page. These are easier to monitor for the bank (if you employer has reduced your salary or you’ve lost your job, SBI would be the first person to know about it) and hence the NPA figures are one of the lowest in this segment as well.

Finally, how can we forget the bank’s star kid - YONO?

I was just comparing this data with the last time I had written on YONO and I just had one thought - YONO is a beast. 64000 daily registrations (out of which 21000 are new accounts)! It has doubled the growth of Q1 across all segments. Although I still wouldn’t accept the valuation that SBI Officials claim for YONO, the progress in digital banking is indeed remarkable, considering the legacy infrastructure that comes with SBI.

This is a very important chart. As you can see, we are slowly moving towards an era where branch dependency is shrinking. The coronavirus has instilled a fear with ATM usage as well - its share has been captured with YONO and internet banking - this is why you see such a huge surge in its growth.

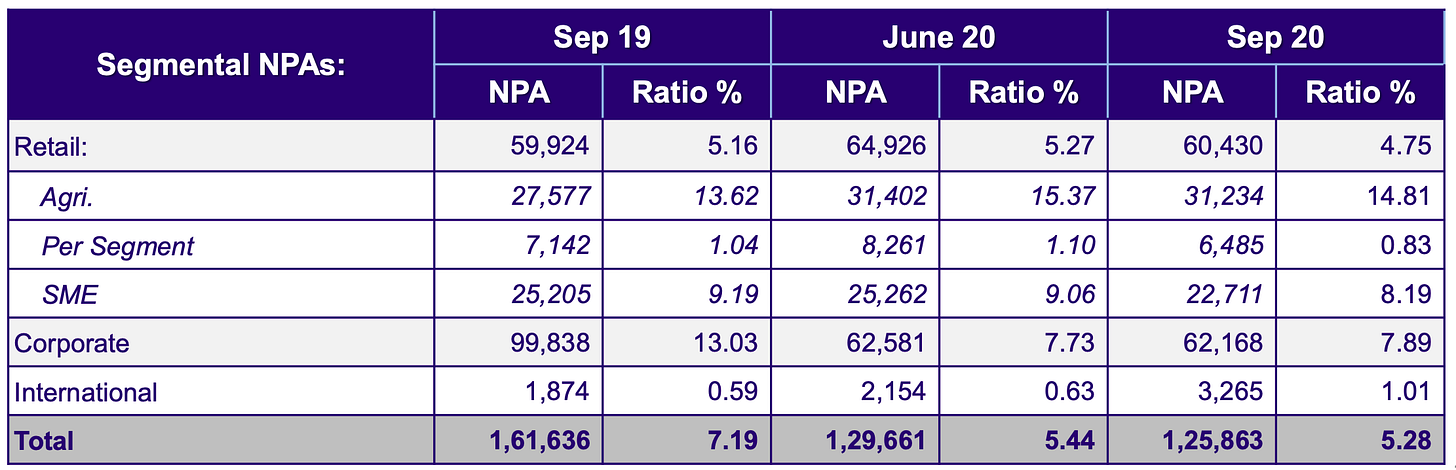

So what are the concerns?

Apart from the large moratorium book, analysts were concerned about the unnaturally high NPA figures in the agriculture segment, especially since it is traditionally not considered a very high-risk category.

My take: SBI management have been known for brushing off the true impact of bad loans in their books for a really long time. Q3 would help us understand more on this.

What’s up with RBI?

RBI put out a draft notification around co-lending by banks and NBFCs to the Priority Sector.

But in order to unwrap it, we need to go back in time (not much, I promise).

Back in 2018, RBI had put out the first notification around co-lending (it was called co-origination at that time). The basic premise was that certain types of NBFCs would take money from banks they partnered with - and lend that out to the credit-starved, ignored portions of the country.

It was kind of a win-win situation for both parties:

For NBFCs, it is an asset-light model as they were only required to share 20% of the risk of the loan going default (the rest of the risk had to be borne by the partnered bank). They could earn decent fees by doing what they did best - extend credit to Tier II and Tier III markets.

For banks, the 80% risk was worth it, compared to the costs they used to save for sourcing these loans. Remember, these were Priority Sector Loans (PSL) - something that they just couldn’t ignore (scheduled commercial banks needed to have 40% of their loan book extended to PSL as per RBI guidelines).

Did it work? For a while. You could read the occasional NBFC partnering with a bank such as this:

What went wrong?

It is easy to blame the virus for everything, but banks were wary of lending to NBFCs for a really long time, before covid-19, even before the IL&FS default. Sometimes, this even came at the cost of not meeting their PSL targets.

Of course, covid did make the situation worse.

RBI tried a lot of things to fix this. One of the most recent measures, as you would have probably heard in the media - was TLTRO. Without expanding the short-form or going into the details, TLTRO was basically cheap (low-interest) money offered by the RBI to the banks to specifically lend to NBFCs.

Banks reluctantly signed up for the scheme (RBI received bids for only 50% of the amount that it was offering under TLTRO). To make things worse, banks did not even use the amount they did sign up for. Yesterday, RBI put out a notification mentioning that banks can return the money if they haven’t used it. Such a waste of effort.

Enter CLM (Co-Lending Model)

We come back to the topic we started with. RBI has tweaked the original 2018 notification in a last-ditched attempt to save face.

So what are the changes?

The scheme is now open to all NBFCs - not to the selective few like last time

NBFCs do not have to wait for banks to get their initial funds. The can directly source the loans and transfer it immediately to the bank - the technical term for this is Direct Assignment. If the bank likes the risk-reward ratio of that particular loan, it can pick it off from the NBFC’s book and transfer it to theirs’.

Will this create more competition in the market, where the best NBFC sources the best loans and manages to sell it to the highest bidder - or will credit continue to lack in the country? I think we can only take a call next year, when the scheme is active in full force.

Shout out to Sandeep Srinivasa (Founder, RedCarpet) who took out the time to explain the context and background for this RBI notification.

Give me some videsi drama

When big banks adopt a technology which has been around for a long time, it means two things:

They’re late to the party (Duh!)

The technology is only going to get much much bigger in the future

Yes, I’m talking about blockchain (or distributed ledger), the underlying tech behind popular cryptocurrencies such as Bitcoin and a host of other things.

For a bank whose founder had commented just three years ago that he would fire any trader caught trading Bitcoin, it is surprising that JP Morgan would suddenly make a U-turn.

The bank’s digital currency JPM Coin (announced February last year) is going to be used commercially for the first time by a large client to send payments across the world.

This has become so serious now, that the bank has created a new business unit which will exclusively focus on its blockchain and digital currency efforts.

Titled “Onyx”, JPM now has an exclusive website for it. Here’s a sample screenshot from the same:

Is JPM the only one?

Just this week, Singapore’s biggest bank DBS launched their own crypto-currency exchange. However, the bank soon deleted their official statement, but not before some smart folks grabbed a screenshot:

My take: This is huge. When the biggest banks are gearing up for launching their own platforms, that is just to shield themselves from potentially getting disrupted by newer players. JPM’s endorsement is a huge boost to the confidence of other players in the market, which will not only improve the competitiveness of the entire system but also help in making crypto mainstream.

What else happened this week?

International

Each week, I try to highlight racial and gender discrimination/upliftment in banking. Barclays is launching a 12-week virtual accelerator programme designed to help early-stage tech businesses founded by black entrepreneurs. After 12 weeks, a demo day will see founders present their business to potential clients and investors.

National

It seems that the Government can’t help itself when it comes to interfering in the day-to-day operations of banks. Of course, since it has little leeway with private banks, the usual target is often public sector banks. Recently, Bank on Baroda made some changes with regard to the number of free cash deposits and withdrawals per month (The number of free cash deposits and withdrawals, had been reduced from 5 each per month to 3 each per month, with no change in the charges for transactions in excess of these free transactions). However, this got blown out of proportion in media and finally the Finance Minister intervene and forced BoB to pull back these changes. Then we wonder how PSBs are in such a mess!

That’s it for this week.

I love feedback. If you want me to cover a particular news, want to get featured, write a guest post or wanna simply say hi, do reach out to me at anirudha@bankonbasak.com. Meanwhile, share this around?

All views and opinions shared in this article and throughout this blog solely represent that of the author and not his employer. Since the author is employed by a bank, he has consciously chosen not to report any news related to his company to avoid conflicts of interest. All information shared here will contain source links to establish that the author is not sharing any material non-public information to his readers. His opinion or remarks on any news are based on the assumption that the source is genuine, thus he is not liable for any information that may turn out to be incorrect. This blog is purely for educational purposes and no part of it should be treated as investment advice. Using any portion of the article without context and proper authorisation will ensue legal action.

Hi Anirudha, I have been following your newsletter for couple of months now. Can you tell me where I can read up on the lifecycle of a credit card, and how it works? From issuance, underwriting, risk management to debt collection process. I want to learn about the complete lifecycle of credit card. Much thanks, Javi

Great read as always. Just a small suggestion that keep the unit system of both the banks same, as in first glance, the ratio looks quite big. I thought that SBI is having 23.83 l crore and HDFC is having 1.03 l crore, then realised I am reading wrong :)

SBI: ₹23,83,624 Cr (~23% market share)

HDFC: ₹1,038,335 Cr (~10% market share)