#27 All the little guys...

A deep-dive into City Union Bank

Okay, you guys are the best! ❤️

Last week, I had asked all of you to click on the “like” button so that I don’t feel like I’m writing to a wall (our teachers used to say this, right?)

I was sure I would at least get ten, since there are a couple of readers who share all my posts on Twitter (and sometimes, LinkedIN) every week.

I was stumped to get 74 (at the time of writing this)! We almost broke the Top 10 Posts on all of Substack - throughout the world!

Thanks a lot everyone! :)

The Old Cub

There’s a popular PMS (Portfolio Management Service) in the country which chooses a concentrated portfolio of 10-15 stocks as a part of the scheme, based on some filters, which primary include the following:

>10% YoY (year-on-year) revenue growth

>15% ROCE (return on capital employed)

The stocks consistently deliver these for a record 10+ years. As expected, popular FMCG companies form a bulk of the portfolio - BUT, the scheme includes banks as well. Two banks glorify the list. While one is quite obvious (HDFC Bank, duh!), the other is not. We’ll talk about the other one today.

But first, let’s see if the filters hold ground. Here’s the YoY revenue growth for the bank, data picked up from the Annual Report:

And here’s the 5 year ROCE growth, as calculated by Tijori:

Now that we have confirmed the data, let’s figure out the Why and the How:

WHY

These filters hold importance because, while a lot of banks have been able to generate excellent YoY growth rate in their revenues, very few have been simultaneously been able to generate such an excellent return on capital. For example, most private banks have less generated less than 10%, with public banks faring even worse. Let’s not forget that banks are not like typical companies - their incomes and profits depend a lot on the economic cycle and is closely tied along with it - this is why so few banks pass this criteria. To be able to generate returns for investors, irrespective of the economic uncertainty is quite a feat!

HOW

I think this is the more important question. Here’s an excellent summary I found in a report,

CUB has all the right ingredients, which include conservative management, unparalleled lending franchise, stable margins, superior return ratios across cycles and a well capitalized balance sheet to deliver steady performance over the years. With ~70% of the branches in rural and semi urban regions, the bank’s asset quality will have a relatively lower impact of the pandemic

Let’s go over these one by one:

Conservative Management

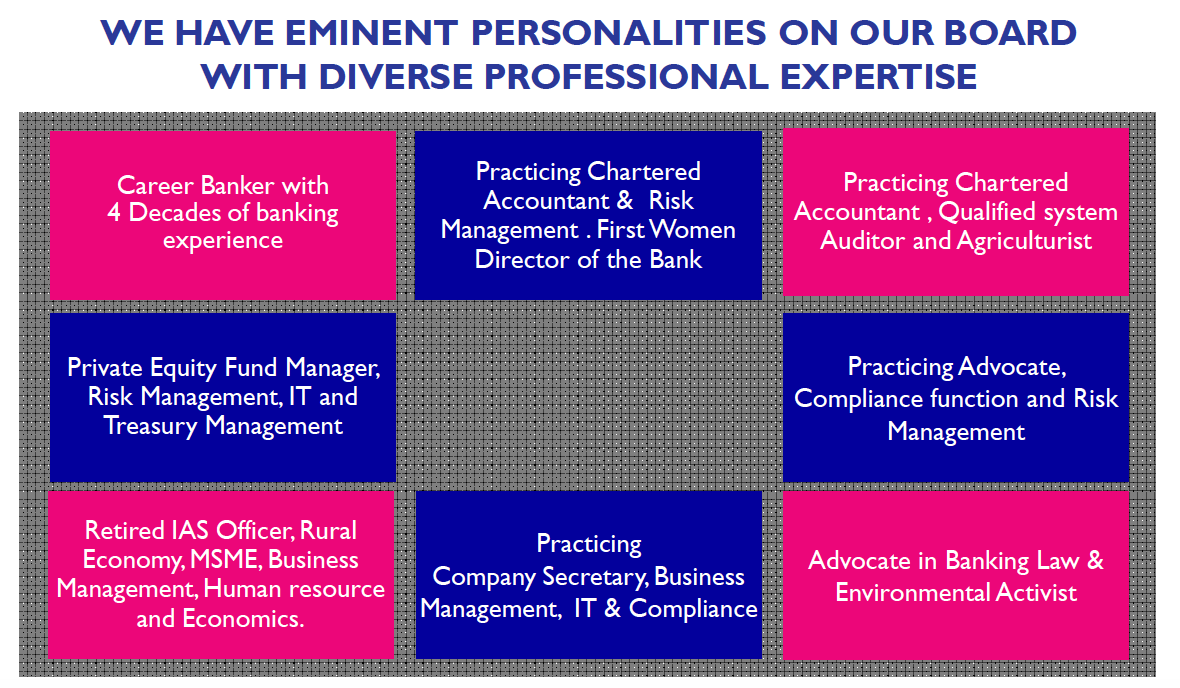

This is something that I’ve seen a lot from Uday Kotak, but not from others. In India, banks have been known to be quite aggressive in their lending - while short-term revenues are boosted, it usually lands up in a truckload of NPAs when the skeletons come out. CUB is proud of it’s management, boldly claiming that they only had seven CEOs in their 100+ history of existence.

In a recent interview, their current CEO Kamakodi (who holds the post for close to ten years now) said, “We run marathons and not 100 meter sprints.”

Unparalleled Lending Franchise

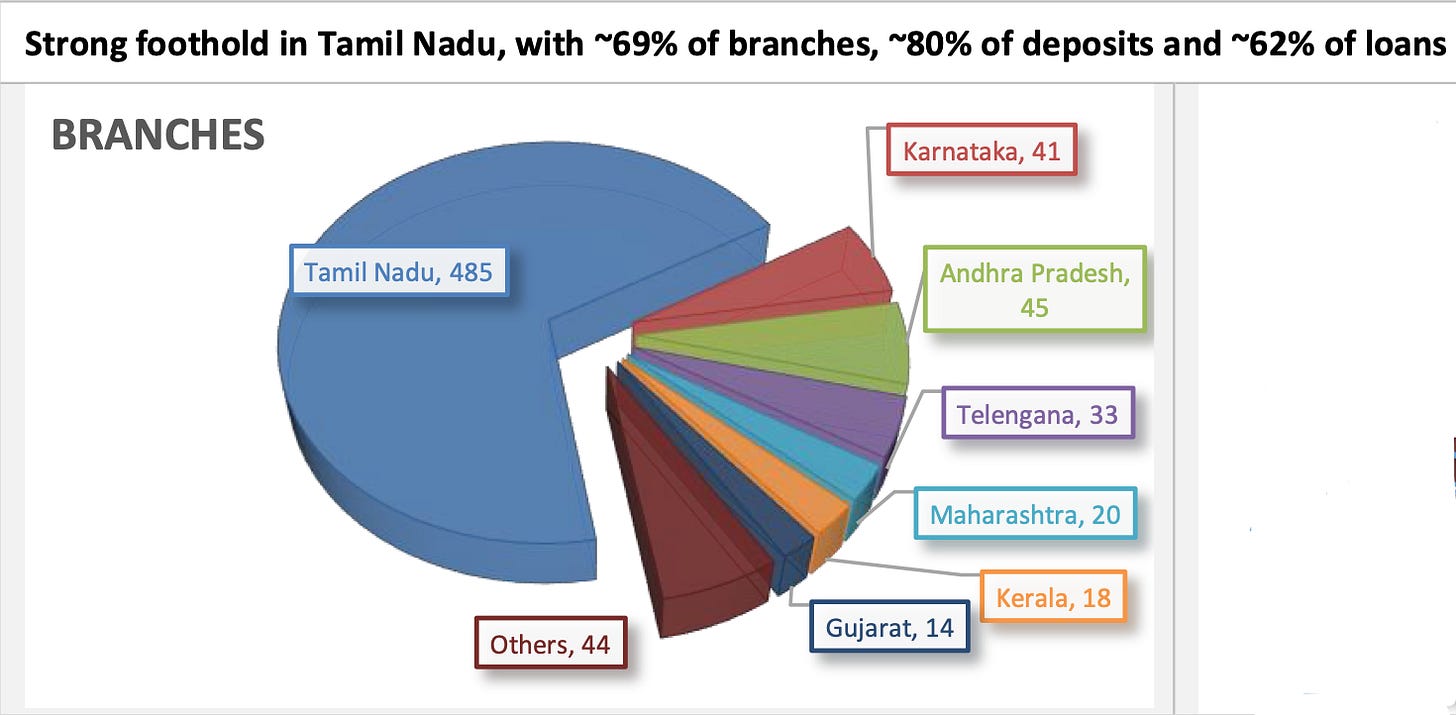

To understand this, we need to know where CUB is located. As you can see from the image below, the bank is a purely regional one.

One of the primary advantages of having a long history in a particular region is the awareness about the business dynamics that are unique to that area, allowing you to leverage on relationship banking. There are two ways in which this plays out:

Due to personal attention, access to top management and quick loan sanctions, small businesses usually choose CUB over other larger banks

Because of the high-risk nature of these small business, CUB can charge a hefty premium on their loans

Win-win!

One-third of their loan book consists of such MSME loans (textile industry forms the bulk) - the rest of their book is quite diversified to minimise risk.

Finally, small ticket loans make a bulk of their portfolio, further minimising risk. Can you imagine that only 9% of their total deposits are above 2CR? Additionally, Top 20 deposits constitutes less than 8.5% of the total deposits!

Stable Margins

In a previous post, I had explained the importance of NIM (or Net Interest Margin) - on a simplistic level, it measures the difference between the interest income generated on its loans and the amount of interest paid out to their depositors. While most private banks struggle to maintain an NIM of over 4%, this tiny CUB has managed to do that quite easily:

Well capitalized balance sheet

When you have a fortress balance sheet, depositors (and investors) are calm because that usually means you can weather a large storm, especially the one thrown by COVID-19. CUB maintains a capital ratio of 17.36%! - comparable to top private banks in the country.

Is ANYTHING wrong with the bank?

As always, not everyone is perfect. With conservative lending, comes decreased profitability. The bank’s CASA (low cost deposits, in which banks pay low interest rates in the region of 0-4%) has been fairly low, which might decrease the NIM.

Apart from this, the management proudly claims that they have never missed a dividend payout in the last 115 years - but should banks really pay a dividend? What do you think?

What’s up with RBI?

I do wonder why RBI speeches are not covered by newspapers more actively. There is so much to learn from each of them.

Take the most recent one, for example, conducted at FEDAI (Foreign Exchange Dealers’ Association of India). I tried to look this one up - and the only coverage was this:

I agree that the economy recovering is an important issue, but we really need to look beyond sometimes.

For some background - banks who deal in foreign exchange (or currency) are known as Authorised Dealers (AD). RBI maintains a list of all the ADs in the country, dividing them into three Categories with each one having a slightly lesser importance than the other.

Way back in 1958, when there were a LOT lesser ADs than they are now, couple of them had gathered around and set up FEDAI - typically as a self-regulatory body, kind of like the IBA (Indian Banks’ Association).

FEDAI’s current job includes setting guidelines and rules for the Forex Business, Training of Bank Personnel, Accreditation of Forex Brokers, Represent member banks on Government/Reserve Bank of India and Announcement of daily and periodical rates to member banks.

But wait! What does the RBI do then?

Well, of course, RBI’s role holds much more importance than FEDAI, who’s rules need to pass RBI’s lens anyway! In fact, the big daddy of forex law - FEMA (Foreign Exchange Management Act) - is a regulatory mechanism by the Government of India, that enables RBI to pass regulations relating to foreign exchange in tune with the Foreign Trade policy of India.

Although this includes a lot of things - the ones that are important and get talked about the most often are - (1) RBI’s forex reserves and (2) the value of Indian currency (Rupee) vis-a-vis the US Dollar.

Unfortunately, both of these are big topics, which I’ll tackle in another day, so lets’ focus on the speech itself.

The broad reforms that the speech talked about are:

Liberalising financial markets and simplifying market regulation

It is well known that India’s bond and forex markets are not as active as their US counterparts or even our own equity markets. Participation is usually restricted to the big players with retail investors (like us) usually not having a clue about the processes. So apart from bringing in foreign participants, the job is also to simplify the regulations and procedures for everyone, big and small. The most recent example of this would be Bilateral Netting of Qualified Financial Contracts Act, 2020 (click here for further reading)

Internationalising financial markets

Like I explained above, our markets are being opened wider for foreign participation, with certain limits being revised upwards. For example, NRIs can now invest in specified government bonds without being subject to any upper limits - this is known as FAR (Fully Accessible Route).

Safeguarding the “buy side” – user protection

There is now a “User Classification Framework” - a nifty feature which ensures that only non-complex products can be offered to retail investors, leading the complex ones for the big players. A platform FX-Retail has also been introduced to help small business pay lesser fees for their forex transactions - unfortunately, banks aren’t really pushing this platform because as expected, they want those damn margins. (The Ken wrote a lovely story on this four months ago)

Ensuring resilience and safety

Here is where FEDAI comes in, to guide participants in the forex markets. RBI also talks about the smooth transition from the LIBOR benchmark to an alternate benchmark to be developed by the IBA. (click here to read my explanation on this transition)

That’s all folks. Indians should have a far more reach and knowledge about the financial markets through these initiatives - with the increased participation in stock markets since the lockdown, let us just hope retail investors not burn our hands in the equity markets and become risk-averse again! Diversify, diversify, diversify!

That’s it for this week.

I love feedback. If you want me to cover a particular news, want to get featured, write a guest post or wanna simply say hi, do reach out to me at anirudha@bankonbasak.com. Meanwhile, share this around?

All views and opinions shared in this article and throughout this blog solely represent that of the author and not his employer. Since the author is employed by a bank, he has consciously chosen not to report any news related to his company to avoid conflicts of interest. All information shared here will contain source links to establish that the author is not sharing any material non-public information to his readers. His opinion or remarks on any news are based on the assumption that the source is genuine, thus he is not liable for any information that may turn out to be incorrect. This blog is purely for educational purposes and no part of it should be treated as investment advice. Using any portion of the article without context and proper authorisation will ensue legal action.

Low CASA is their strategy. Major part of the book is OD & WC loans. Cannot borrow short term & lend short term. So to avoid ALM, CUB maintains low CASA. They earn a premium on these loans and hence able to maintain NIMs.

as usual very interesting post... One question.. If you compare CUB and DCB bank.. DCB bank do not have much working capital loans. In fact, DCB says with in working capital loans where is no limited due payment, there is a high possibility of evergreening so it sticks to LAP.. Any comments...