#34 NPA? What's that?

A deep-dive into RBI's Financial Stability Report

Last week, the central bank released it’s bi-annual Financial Stability Report (FSR). I feel it’s the second most important RBI publication, right after Trends and Progress in Banking, which I covered two weeks ago. So here’s an exclusive post dedicated to it.

But why is it important? Why does everyone panic when there’s a delay in publishing?

What is the Financial Stability Report?

To understand it all, let us start with the basics.

Think of FSR as our very own stress tests (similar to what the Federal Reserve conducts for US banks).

A stress test is just an analysis to gauge whether different banks have the capacity to withstand severe negative economic shock (such as the coronavirus) under various hypothetical situations.

Different central banks conduct these tests in their own way. It’s a very quant-heavy calculation. RBI uses a couple of system-specific (such as nominal GDP growth) and bank-specific (slippage ratio) variables to arrive at a figure. It represents the most likely trajectory of these variables for the subsequent 12-18 months. If you’re really interested, here’s the equation:

As you can see, the objective remains the same. Calculate a projected level of GNPA. That’s all anyone cares about it seems: bankers, fund managers, regulators - almost any person anywhere.

So what’s the verdict this time?

To be clear, the “Baseline” GNPA estimates represent their most likely future levels. However, adverse scenarios (such as the ones indicates by “Medium Stress” and “Severe Stress”) are not predictive in nature and have no specific likelihood of occurrence associated with them. They represent different levels of severity for ‘what-if’ analysis to estimate GNPA.

So when you read news such as the one below, the numbers quoted will always be the Baseline GNPA.

Now the next important question is:

How has RBI fared in predicting these outcomes in previous instances?

As the picture depicts, it’s not an easy science. RBI has been somewhat close one time (as in March ‘20) and way off the mark for the other two instances.

Experts feel that the central bank needs to up its game. In a big way.

RBI itself has inserted a very prominent caveat below it’s projections:

These GNPA projections are indicative of the possible economic impairment latent in banks’ portfolios, with implications for capital planning. A caveat is in order, though: considering the uncertainty regarding the unfolding economic outlook, and the extent to which regulatory dispensation under restructuring is utilised, the projected ratios are susceptible to change in a non-linear fashion.

Non-linear fashion. Wow. Since the RBI is hiding behind jargon, I think what they really mean is:

Honestly, we have NO idea what we’re doing. We HAVE to publish this twice a year. We were wrong anyway before COVID hit and disrupted all our pretty mathematical models. Now we just don’t know. So we’re winging it. Ok bye.

I really don’t see the point when journalists run into a frenzy each time some market “expert” or credit rating body predicts the GNPA ratios for the subsequent quarters. When the central bank, even with access to information that banks do not reveal to anyone else, can’t predict the future - why do you even try?

With all the COVID-19 consequences such as moratoriums and restructuring, it gets even more difficult.

Here’s an example.

Way back in June 2020, I had predicted that we’ll only start seeing the actual NPA figures in January 2021. I was so naive.

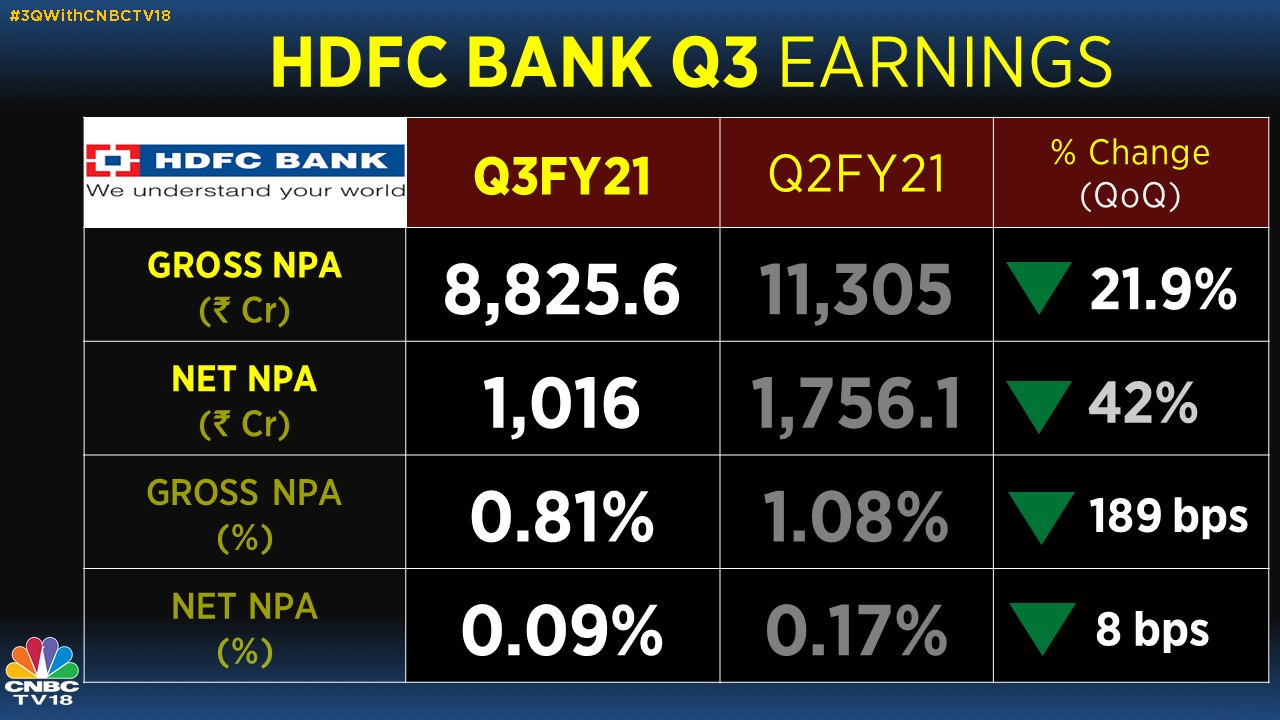

Today, HDFC Bank released their Q3 results. Here’s a snapshot.

Quite counter-intuitively, the NPA figures have actually come down.

Doesn’t make sense, does it? It will, when you read their Press Release. Here’s an excerpt:

The Honourable Supreme Court of India, in a public interest litigation (Gajendra Sharma Vs Union of India & Anr), vide an interim order dated September 3, 2020, directed that accounts which were not declared NPA till August 31, 2020 shall not be declared as such until further orders. Pursuant to the said interim order, accounts that would have otherwise been classified as NPA have not been and will not be, classified as NPA till such time that the Honourable Supreme Court rules finally on the matter.

How can there be more NPAs when banks can’t even classify an actual NPA as so?

Thus, the wait continues…

Meanwhile, let us learn some other interesting things from the FSR itself.

Reverse Stress-Test

Did you know that there’s a reverse stress test as well?

Here, instead of predicting the GNPA ratio, it predicts the capital that banks will be left with in case of the same baseline, medium and severe stress environments.

I feel this test is a lot more insightful one than the one above, which does not reveal individual numbers. If you notice the image on the right, it indicates that four banks (yellow line at extreme left) may fail to meet the minimum capital levels (9%) by September 2021 under the Baseline scenario.

Here’s a fun exercise: RBI did not reveal the names of the banks in the report. Try and guess in the comments?

Other Stuff from the FSR

Apart from the stress tests, there’s other depressing things to note as well.

Like how the credit growth by banks (loans given out) continues to suffer a drop despite huge uptick in deposits (apparently public banks have seen the largest surge in deposits in the last 5 years). Credit growth can be used as a very good estimate of the growth in the economy - why? - because companies borrow money to grow their business (mostly) - more loans, more growth!

Of course, all loans are not created equal. After a decline in new credit in almost every sector during Quarter 1, we can notice that there has been an uptick in several segments, such as Agriculture and Personal Loans.

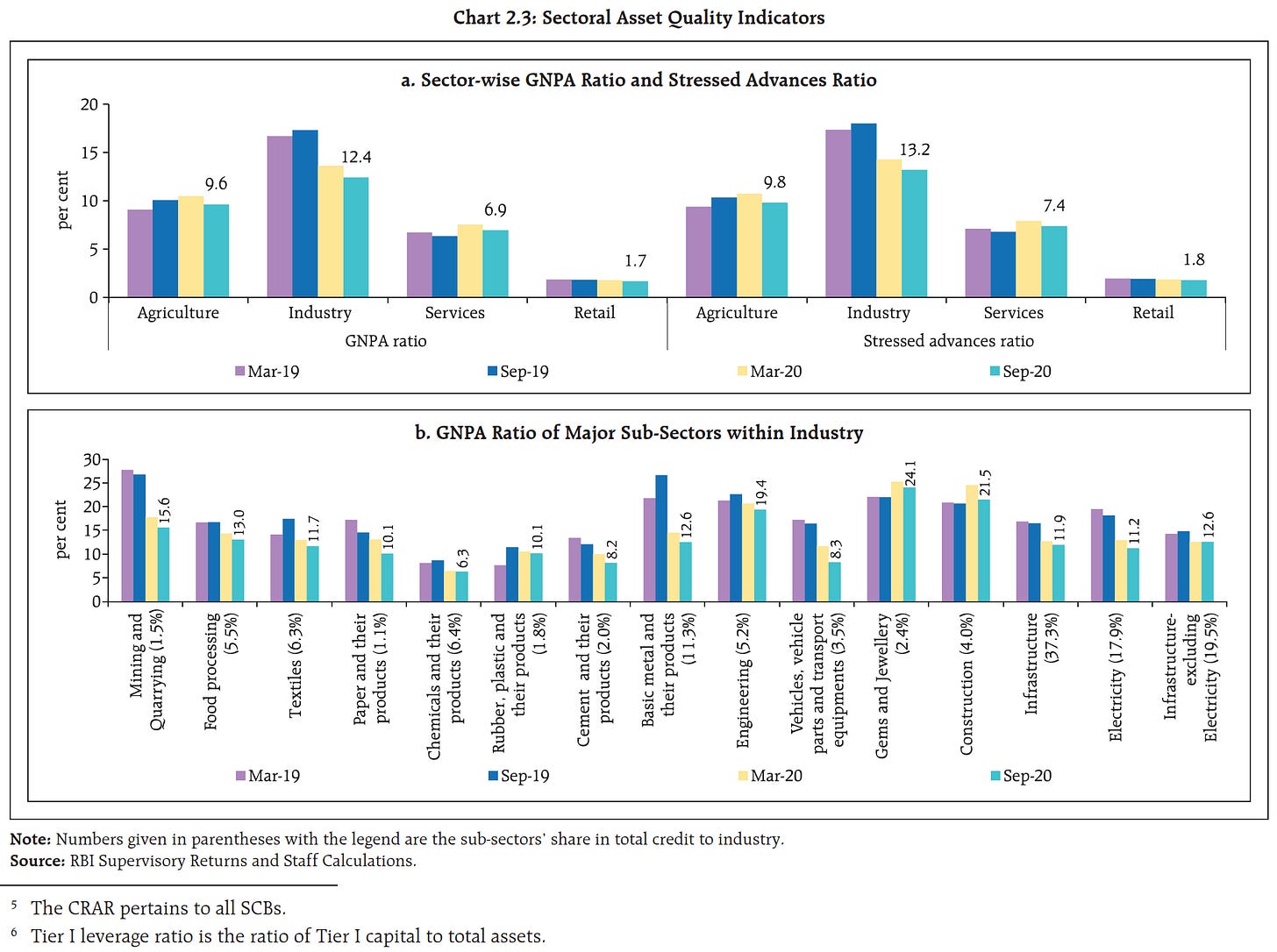

One of the most detailed (and also my favourite) chart from the entire FSR is this:

This chart provides a bird’s-eye view of where actually the stress lies. Since industry is the most affected sector, RBI provides an individual break-up within industry as well. A few of the high-risk areas to lend are in the businesses of construction, gems and jewellery and engineering. This always changes with credit cycles.

Deposit Insurance

Here’s another interesting chart I found:

First, let’s get you up to speed. Amid scares of defaults, the Government hiked the insurance payout on your bank FDs this year, in case there’s trouble at your bank - from ₹1 lac to ₹5 lacs.

With this hike, insured deposits now constitute 50.9% of total assessable deposits or 98.3% of the total number of accounts.

So the hike has really covered a lot of base.

But as I’ve mentioned earlier, there’s a key thing to note here:

You’ll only be eligible for the insurance if the bank goes into liquidation, not when it is placed under suspension, like in the case of PMC.

So there’s no harm in diversifying your assets (or banks), even if you just stick to FDs. :)

That’s it for this week. With this, I’ve covered both the major RBI publications. The next time the central bank publishes them, you can always refer these posts to know what to search for.

I love feedback. If you want me to cover a particular news, want to get featured, write a guest post or wanna simply say hi, do reach out to me at anirudha@bankonbasak.com or LinkedIN or Twitter. Meanwhile, like this post and share it around?

All views and opinions shared in this article and throughout this blog solely represent that of the author and not his employer. Since the author is employed by a bank, he has consciously chosen not to report any news related to his company to avoid conflicts of interest. All information shared here will contain source links to establish that the author is not sharing any material non-public information to his readers. His opinion or remarks on any news are based on the assumption that the source is genuine, thus he is not liable for any information that may turn out to be incorrect. This blog is purely for educational purposes and no part of it should be treated as investment advice. Using any portion of the article without context and proper authorisation will ensue legal action.