#36 The Niche Players - Part 2

A deep-dive into Small Finance Banks.

Hey there!

For those who’s subscribed this week, Bank on Basak is a newsletter trying to simplify the Indian banking space as well as RBI commentary.

As the title suggests, The Niche Players is a series on financial institutions (banks, non-banks) that serve a particular need, geography or help in last-mile credit delivery.

Last week, we covered NBFCs (or non-banking financial corporations).

Today, it’s all about Small Finance Banks!

What are Small Finance Banks?

Let’s start from scratch. Regular readers would be aware that I frequently talk about “financial inclusion”. Let’s revisit the definition.

Financial inclusion is defined as the availability and equality of opportunities to access financial services. It refers to a process by which individuals and businesses can access appropriate, affordable, and timely financial products and services. These include banking, loan, equity, and insurance products.

I’m quite passionate about this. Needless to say, the government is too. Things have been in discussion since 2005. Finally, in 2014, two things were launched:

From the Government’s end: The Pradhan Mantri Jan Dhan Yojana. Think of like a basic universal bank account for everyone.

From the RBI’s end: Small Finance Banks.

The objectives were simple:

Provide a savings vehicle.

Supply credit to small business units, including small and marginal farmers, micro and small industries; and other unorganised sector entities, and various low income groups and the migrant work force through high technology-low cost operations.

Do remember these objectives. They are the bedrock on which the regulations were formed and how their performance (by RBI) is measured as well.

As of today, we have 10 Small Finance Banks in India (based on RBI database):

Here’s a common misconception: The year of establishment is actually the year the financial entity started operations as a small finance bank. In reality, these players have decades-old history. Consider AU SFB for example. It actually established itself in the year 1996 as AU Financiers, a NBFC-MFI (Check my last post for all the different types of NBFCs).

In fact, apart from Capital SFB (which was a Local Area Bank), all of the other SFBs you see in the list above started out as a Micro Finance Institution.

So why did they suddenly turn into a Small Finance Bank?

Remember the first objective? “Provide a savings vehicle”

The biggest advantage for any financial institution is the ability to accepts deposits from the public, which you otherwise cannot, as a NBFC-MFI. These deposits are also referred to as low-cost deposits, just because they do not need to pay high deposit rates to customers.

Now that we’ve got that clear, what exactly are the regulations for SFBs?

There are a couple of them. Here’s the ones you should really care about:

SFBs have to provide at least 75% of their Adjusted Net Bank Credit (ANBC) to priority sectors as compared to 40% in the case of other scheduled banks.

Translation: Priority Sectors are those sectors in India which often gets neglected by banks, mostly because of high costs in servicing them. Hence, RBI forces banks to prioritize them through minimum limits. For banks, it is 40% of their total loan book. It is higher for SFBs, at 75%, only because these banks were primarily formed to serve the needs of these low-priority sectors, in the quest for financial inclusion (first objective)

At least 50% of their loan portfolio should comprise loans of upto ₹25 lakh.

Translation: Recall the second objective. These banks are supposed to provide loans to small entrepreneurs, farmers, migrants. Hence the name as well. This limit serves to ensure that they money does not end up in the hands of greedy corporate borrowers.

How big are these banks in the overall scheme of things?

Considering they’ve only been around a couple of years, it’s quite small.

As you can see, the lion’s share is with the scheduled banks.

Even in the case of branches, scheduled banks have over a lakh branches across the country, whereas SFBs have less than 5000.

However, that shouldn’t be the focus. Rather, how many of these bank branches are located in places that actually need the presence of a small finance bank?

This is where the concern lies.

As depicted by the chart above, small finance banks are markedly concentrated in the southern, western and northern regions, which are known as the relatively well-banked regions in the country. Their penetration in the north-eastern region, which is known to be the least banked region, remains low :(

Here’s what RBI has to say regarding this, verbatim,

Considering their small finance focus, the limited spread of SFBs at rural centres and even at smaller semi-urban centres leaves much to be desired.

How are they performing in credit delivery?

This is a place where they’re doing a LOT better.

They’ve maintained their target of 75% loans to the Priority Sector. In fact, most SFBs (60%) have gone above this limit.

They’ve maintained their goal of providing credit to the industries that need it.

Finally, they’ve impressively maintained their loan size limits. 99.9% of their total loan accounts had a credit limit upto ₹25 lakh. Even within these, 96% of their total loan accounts had a credit limit of ₹2 lakh.

How are they doing financially?

Remember the point on low-cost deposits? Even though these institutions converted themselves from MFIs to SFBs primarily for this reason, it has been a difficult journey for them lowing the same.

This is primarily because of “access” and “trust”. Due to their relatively new presence, they need to offer high rates to lure customers in. For example, typical fixed deposit rates for HDFC Bank goes as high as 5.5% for the average citizen. Compared to this, Jana Small Finance Bank, the newest entrant in the SFB space, offers 7.25%.

Of course, they can charge higher interest rates on their loans considering the space they work in (high risk individuals and sectors)

What about NPAs?

I was pleasantly surprised to see that NPA ratios of SFBs were in fact lower than that of private banks.

But then, with Covid and the impact it may have on various sectors (especially the ones SFBs are exposed to), these numbers can change anytime.

Let’s get a bit more specific now.

Who are the biggest SFBs now?

The small finance banking market is fairly concentrated as of now.

The top two (AU + Equitas) account for over 40% of total assets and the top three (AU + Equitas + Ujjivan) account for over 60% of total assets.

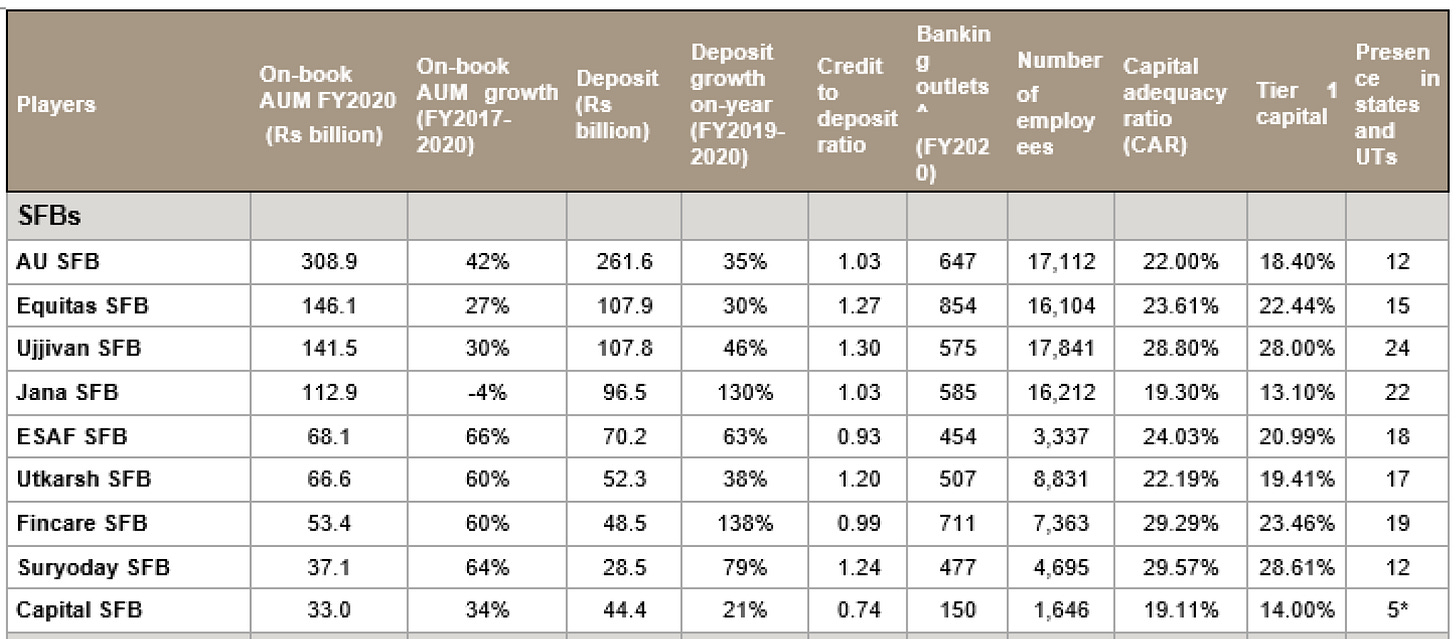

How do all the players stack up against each other?

Here’s how to read the above data.

The on-book AUM should offer a good indication of the size of these SFBs. (Please read my earlier post to understand the difference between AUM and advances/loans)

Don’t focus much on the growth (second column) as it is easier to grow faster on a smaller base compared to a larger one

Again, deposits and deposit growth (third and fourth columns) should only be compared with similar size SFBs. For example, even though Equitas and Ujjivan had similar growth in loans, Ujjivan has been able to amass deposits at a faster rate than the former. This is a good enough reason to focus on “why”. What is the bank doing differently? Are these deposits low-cost or high-cost?

Credit to deposit ratio (fifth column) is a good indicator of how the bank is utilizing its deposits. Too low? Maybe it is not utilizing its deposits fully. Too high? Is it lending more than it can afford to?

The number of banking outlets and presence across states captures its coverage. As you would notice, these do not really have a direct correlation with the size. So a bank with lesser branches and a bigger size may indicate an ability to do good business. (Equitas is half the size yet has 300 odd branches more than AU)

Capital Adequacy Ratio and Tier 1 Capital (eighth and ninth column) indicates the level of equity that the bank has. Higher the better. In any case, SFBs are mandated to have a minimum 15% CRAR.

It’s also very important to know where their loan books are exposed to.

A very high exposure to a single segment might not be helpful. Most of these have a high exposure to MFI due to their history. An SFB actively able to diversify their loan book may come out on top!

Instead of focusing on individual SFBs, I’ve tried to simplify the entire industry in this article. In future posts, I’ll highlight what the listed players are doing differently - focusing more on nuances and linking back to this article for the basics.

Based on email feedback, it seems you guys enjoy deepdives more than my earlier format. I’ll try to stick with it mostly - no promises though ;) Hope you enjoyed this one as well! Let me know!

That’s it for this week.

As always, if you want me to cover a particular news, want to get featured, write a guest post or wanna simply say hi, do reach out to me at anirudha@bankonbasak.com or LinkedIN or Twitter. Meanwhile, like this post and share it around?

All views and opinions shared in this article and throughout this blog solely represent that of the author and not his employer. Since the author is employed by a bank, he has consciously chosen not to report any news related to his company to avoid conflicts of interest. All information shared here will contain source links to establish that the author is not sharing any material non-public information to his readers. His opinion or remarks on any news are based on the assumption that the source is genuine, thus he is not liable for any information that may turn out to be incorrect. This blog is purely for educational purposes and no part of it should be treated as investment advice. Using any portion of the article without context and proper authorisation will ensue legal action.

Also the ticket size of these SFBs is very low because of their MFI nature. RBI has a cap on the MFI loans, which is 1.25 Lakhs. That too over a course of borrowing cycles. Mostly, the MFI loans have a ticket size of Rs. 30,000.

Even in the previous post you had classified some of the NBFCs like MFIs as non systemically important but that depends on the size of the NBFC right? Any NBFC with assets > 500 Cr will become Systemically Important by default. That is my understanding. Please correct me if I am wrong.