#41 Utkarsh 101

A deep-dive on Utkarsh Small Finance Bank

Utkarsh Small Finance Bank files for IPO

Yesterday, another Small Finance Bank (SFB) filed its IPO papers. Whenever a new bank (or any company) files this document, you get a good peak into its business overview, how it makes money, what are its costs, risks and how good (or bad) its financials are.

So let’s dive in.

Disclaimer: I will mostly write about the unique selling point of Utkarsh today. For a background on Small Finance Banks, please read my previous post here.

Although I’ll mostly be just picking up interesting stuff from the document itself, it’s important to realise that these are written by research houses which are known to be paid by the company itself, so expect bias.

Here’s an example.

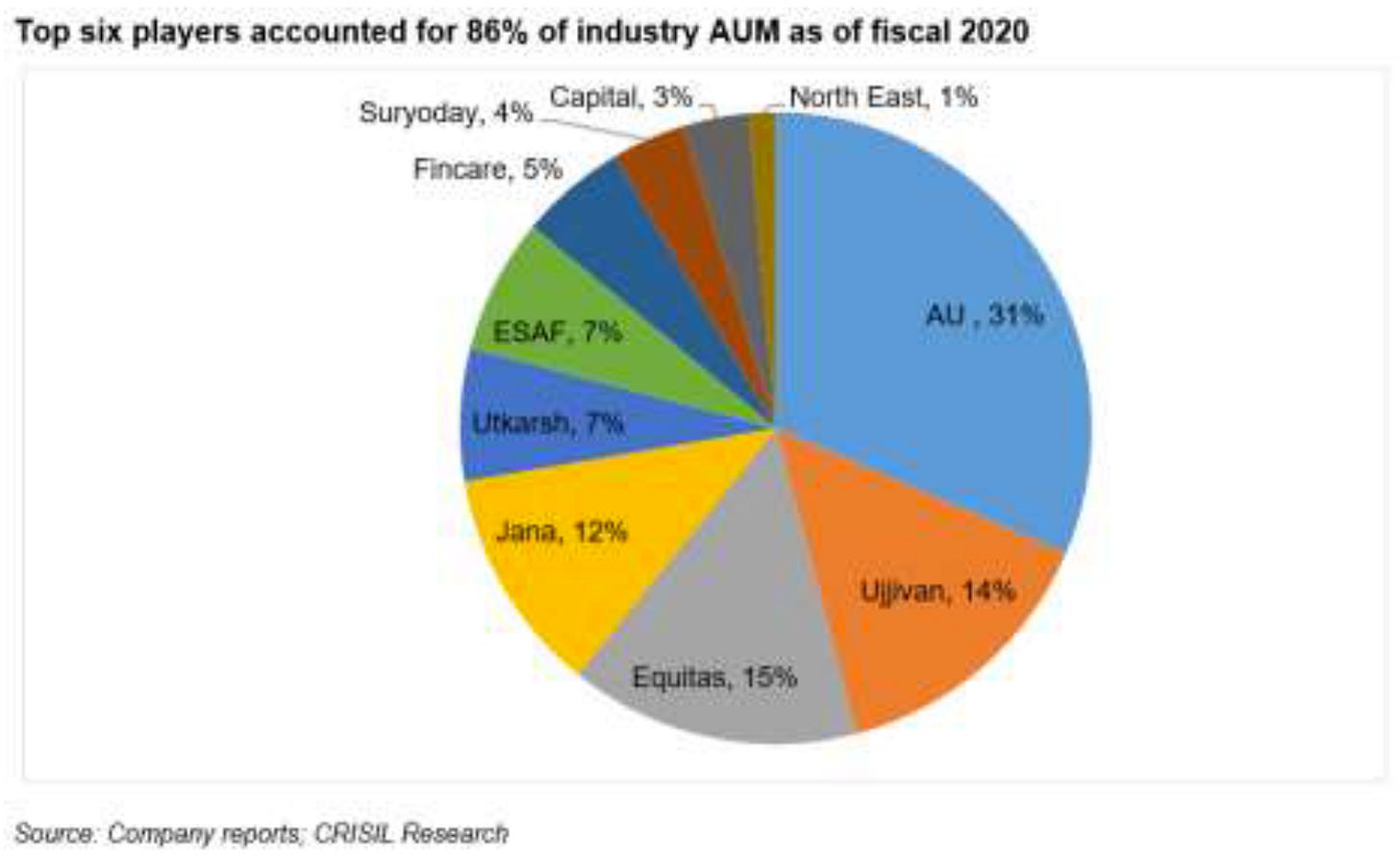

There are about 10 SFBs in the country today. When Ujjivan or Equitas SFB filed their IPO papers back in 2019, this is the image they used to show their market share:

As I am going through Utkarsh’s document, here’s the same picture but with a different heading:

Notice the difference? The same market share image suddenly changed from

“Top 3 players account for 64% of industry AUM”

to

“Top 6 players account for 86% of the industry AUM”

It’s all about the narrative, eh? :)

A bit of History

Utkarsh’s promoter UCL (Utkarsh CoreInvest Limited) started operations ten years ago as a NBFC. Starting out in the micro finance space, it aimed to provide credit to the unserved and underserved segments in Varanasi, UP, where it is headquartered.

Over the years, it has strategically grown to expand in several other states where they felt micro finance could be implemented efficiently. In 2015, UCL received RBI approval to turn itself into a Small Finance Bank.

“We were included in the second schedule to the RBI Act as a scheduled commercial bank pursuant to a notification dated October 4, 2017 issued by the RBI and published in the Gazette of India (Part III - Section 4) dated November 7, 2017.” (Read about all the implications of being included in the second schedule here)

As of today, this is Utkarsh’s presence in India:

According to regulations, they had to list by June 2021. Now that IPO season is picking up some steam, they’ve released the necessary documents - expect an April IPO if all goes well.

Management

Utkarsh SFB is headed by Mr. Govind Singh, who has two decades of prior experience in ICICI Bank (in the Rural and Micro Credit Segment) and Axis Bank before he joined UCL.

There weren’t many written interviews that seemed interesting, but a couple of video interviews pointed towards the bank having extremely good risk controls since Day 1.

For example, even as a MFI, Utkarsh did not give any incentive to its officers for ticket sizes of the loans.

“The moment you give an incentive for ticket size, people will increase the amount of loan sought. It is important how you source the customer, not what you do after the sourcing. We ensure that the process is always supreme” - Govind Singh

This is visible through the result of an excellent asset quality (as you’d read later).

Also, they were keen to cross-sell and up-sell products to the same set of low-income customers so that they could lead better lives (particular about not giving loans for random stuff like gadgets just to increase book size).

Most of these insights were taken when Utkarsh was a micro finance institute primarily. I couldn’t find a good write-up explaining their turnaround from losses during demonitization (when it was a SFB) to being profitable today, but here’s a company-sponsored one:

It’s a long one, but if you skip through it, you’ll get glimpses of who their customers are. It requires a combination of deep relationships, understanding the needs of the borrower, training the staff and also having a decent digital arm to be able to succeed.

For example, as seen in the video, a woman is surprised when the bank officer informed her that she could use ATM services on Sundays too! Educating the customer goes a long way indeed.

How does Utkarsh actually compare to its peers?

It is one of the fastest growing SFBs in the list (of course, it is has a much smaller base than the top four players)

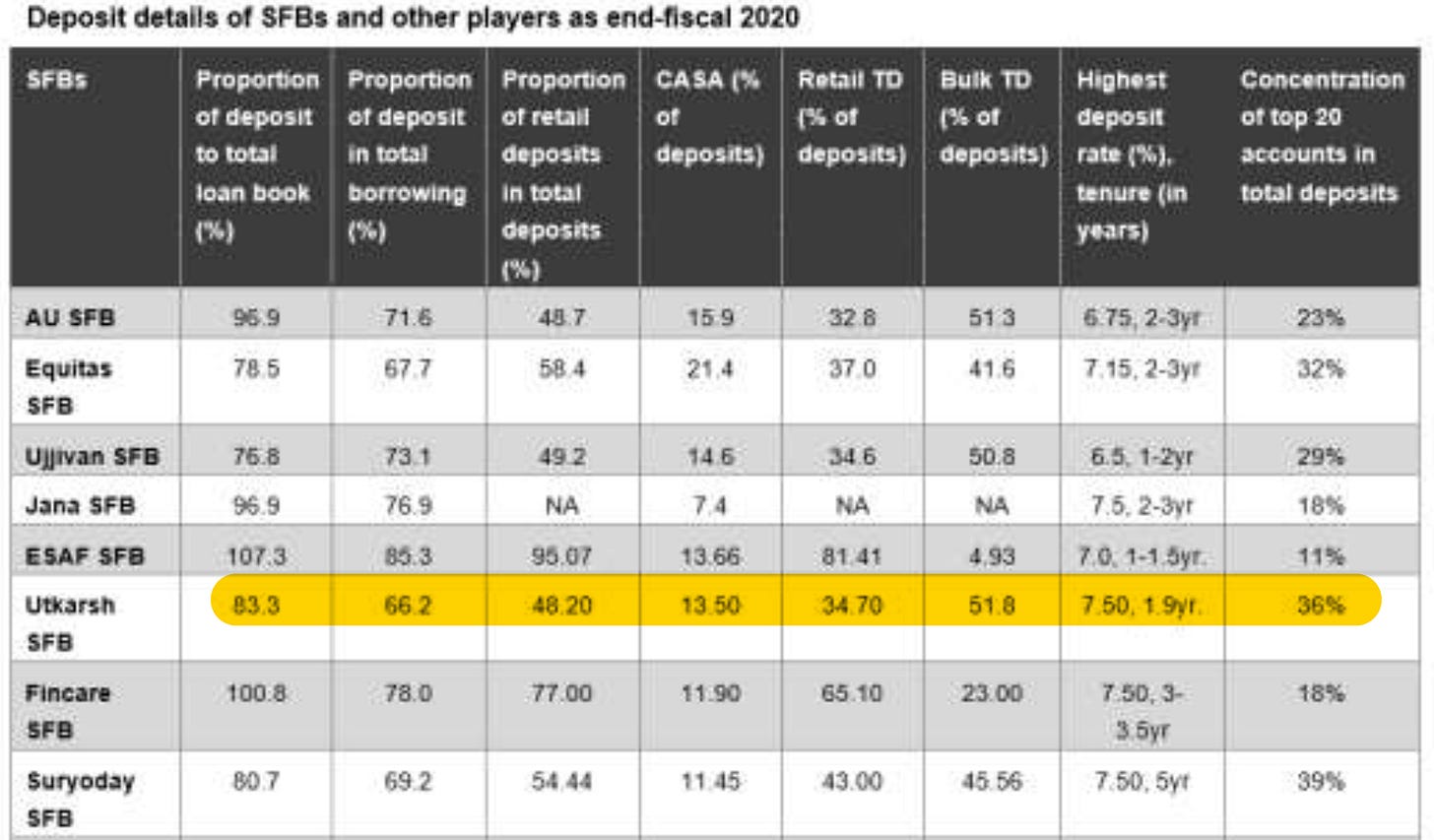

According to the document, “Utkarsh has the highest proportion of bulk term deposits in total deposits at 51.8% amongst the peer set.”

Honestly, I’m not too sure if that’s a good thing. If you recall the regulation, 50% of the portfolio of SFBs should comprise loans of upto ₹25 lakh. This is primarily enforced to meet the objective of lifting up small entrepreneurs, farmers, migrants.

In fact, Utkarsh has the second highest concentration of top 20 accounts - which essentially means, it has lent a LOT of money to very FEW people - kind of opposite to a SFB’s objective. Do note that this may or may not be a cause for concern - it all depends on how credit-worthy the top borrowers are.

Business per employee (measured through loans and deposits) is actually a good measure of how efficient a bank is. Seeing the chart below, it seems Capital, ESAF and AU are leading the pack here. (Ignore Bandhan here - it became a universal bank from a NBFC-MFI years ago)

Here’s how the different SFB stack up against each other in terms of product portfolio. Since most of them have converted from a Micro Finance Institution (MFI), you will see a heavy concentration in that segment. This is where AU and Equitas have a significant advantage. Of course, that doesn’t mean its a disadvantage either. It all depends on how efficient your collections are (loan repayments and pre-payments). Although Utkarsh does state this:

“We have been diversifying our product portfolio to include non-micro banking loans allowing us to reduce dependence on our microfinance business and grow our secured loan portfolio.”

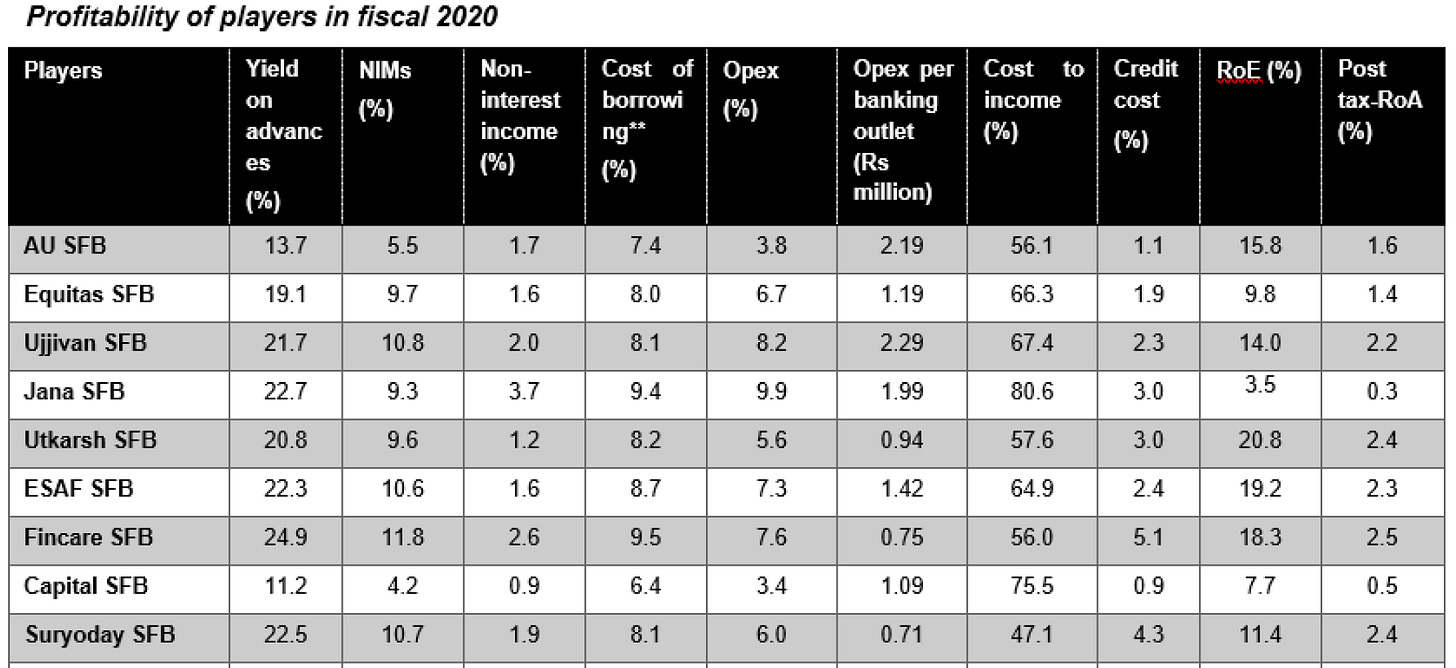

Profitability: So there are a couple of things where Utkarsh is actually leading the pack here: highest return on equity (RoE) and second-highest return on assets (RoA). Although it’s not compared in the image below, it also has the lowest bad loan ratio (gross NPA: 0.7% & net NPA: 0.18%). These are the benefits of having good risk controls which I described earlier.

What are the risks?

Since Utkarsh is predominantly in the Micro Finance space, any changes to this particular industry will have a major impact on Utkarsh as well.

Although the industry has faced multiple challenges since 2008, it has always jumped back. Having said that, the true impact of Covid-19 can only be assessed a couple of quarters down the line.

Let’s understand the MFI segment a bit - think low-income, weak credit profile. They are the ones who have minimum savings. So when lost their livelihood during the pandemic, they couldn’t repay their loans.

“Approximately 70% to 80% of the micro loan borrowers sought moratorium under the ‘COVID-19- Regulatory Package’ announced by the RBI.”

Another downside of the pandemic is that bank agents couldn’t recollect the dues on ground, due to lockdowns across the country.

“…operations of MFIs are field-intensive, involving high personal interactions, such as, home visits and physical collection of cash.”

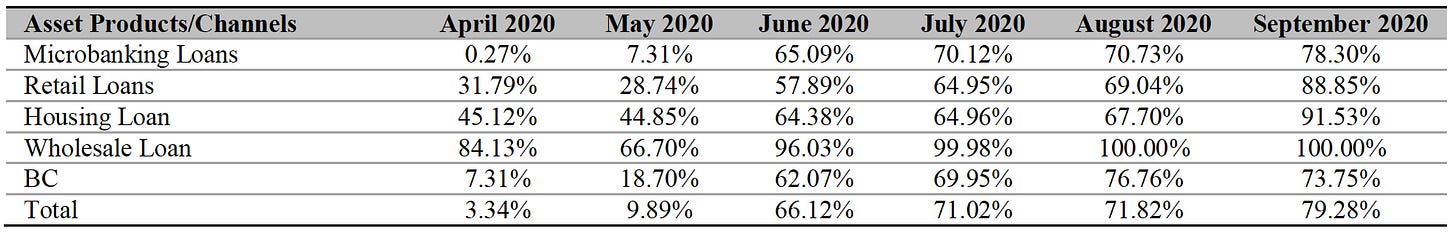

Can you imagine that nationwide collections had gone down to 0% in April 2020? It bounced back to ~70% in July 2020 and ~90% in December 2020.

Here’s a breakdown of their channel-wise collection:

Considering micro banking makes up 85% of the book, collection efficiency of ~78% looks decent, considering data is from September.

If you’re wondering how the collection jumped back up so fast - that is because these borrowers depend on the money for their daily life. If they do not repay the EMIs, they will not get any more loans. Their options are limited too (local moneylenders charge a much higher rate of interest than what a bank would). Also, due to the Joint Lending Structure (which I’ll explain shortly), other borrowers in the group motivate or compensate for the missed payments.

Opportunity

Keeping these things in mind, it is imperative that SFBs look to increase the pie to identify new opportunities. As you can see from the image below, there are a lot of states which are under-penetrated right now (shown in green).

It is good that Utkarsh is predominantly present in under-penetrated (Uttar Pradesh) and moderately penetrated states (Bihar and Jharkhand) but it would serve it well to slowly establish itself in the neighbouring under/semi penetrated regions as well.

In the document, Utkarsh has outlined plans to expand to the Top 100 cities in India.

The other way to grow would be to diversify the book and look for more opportunities; however, considering that almost 90% of the book is still Microfinance, it’ll take some time for Utkarsh to find its footing.

Understanding Utkarsh’s Business Model

While as a micro financing institution, erstwhile UCL’s business was primarily based on the joint liability group (JLG) lending model for providing collateral-free, small ticket-size loans to economically active poor women for income generation purposes.

FYI: A JLG is an informal group comprising of 4-10 individuals coming together for the purpose of availing bank loan on individual basis or through group mechanism against a mutual guarantee. Generally, the members of a JLG would engage in a similar type of economic activity. - RBI

From starting with 8,000 customers back in 2008-09, today it boasts over 20,75,000 customers. Considering the massive opportunity in UP and Bihar, it grew slowly, building and deepening its presence in these states (Apparently, these two states also have lower risk than the pan-India average).

Turning into a SFB requires an additional burden of lending 75% of the loan book to Priority Sectors only. Utkarsh faces no problem here - considering it has close to 90% of the book in these sectors.

Apart from their Banking Outlets, this is how they source new business:

“We have also leveraged BCs and DSAs and their network to grow our asset portfolio. As of September 30, 2020, we have arrangements with seven BCs to grow our asset portfolio and had tie-ups with 74 DSAs to primarily source retail loan against properties across various locations.”

BCs or the Business Correspondent Model was introduced by RBI on 2016; it permits banks to use third-party agents (for example, an NGO) to source business on their behalf.

DSA are direct selling agents. They just refer loans to the bank and get a cut of the profits.

Let’s focus on their Microbanking segment:

Interest rate: 23% per annum. (fixed)

Average tenure: 12-24 months.

Model: JLG

Average ticket size: ₹20,000

Cost structure:

If you’re wondering that the spread (difference between interest earned on loans and interest expended on deposits) of Utkarsh is, well - it is more than double (9.6%) that of large banks such as HDFC (4.3%), but you’ll also have to consider that the Cost-to-Income Ratio (all operating expenses divided by net operating income) of SFBs, including Utkarsh, is as high as 52%, compared to HDFC’s 39%.

Unlike a large bank, a Small Finance Bank has to devote considerable chunk of money developing reach (through outlets), training, education, marketing to realise the benefits of scale. Also, the nature of micro-lending is small ticket sizes, which are low value; so you work on volume, which again, needs resources, which needs money.

“As our Banking Outlets and general banking operations mature, we expect that over the long-term, our cost-to-income ratio will decrease as we achieve benefit of scale and due to a relative shift towards non-micro lending, which tend to be lower margin products than micro loans.”

Closing thoughts

I’ll leave the financials and future prospects to the equity research experts, but as of now, it seems that Utkarsh still needs to prove itself as a SFB in order to make people believe and invest in its future potential.

Hopefully, this is the first place you’re reading about it - As I’m not authorised to shell out financial advice, I’ll update you guys closer to the listing date, with resources from people who actually guide people on IPOs for a living.

Hope you enjoyed this piece!

That’s it for this week. If you want me to cover a particular news, want to get featured, write a guest post or wanna simply say hi, do reach out to me at anirudha@bankonbasak.com or LinkedIN or Twitter. Meanwhile, like this post and share it around?

All views and opinions shared in this article and throughout this blog solely represent that of the author and not his employer. Since the author is employed by a bank, he has consciously chosen not to report any news related to his company to avoid conflicts of interest. All information shared here will contain source links to establish that the author is not sharing any material non-public information to his readers. His opinion or remarks on any news are based on the assumption that the source is genuine, thus he is not liable for any information that may turn out to be incorrect. This blog is purely for educational purposes and no part of it should be treated as investment advice. Using any portion of the article without context and proper authorisation will ensue legal action.