Hey everyone!

Right off the bat, I would like to apologise for not publishing for two consecutive weeks.

Thank you to everyone who messaged me personally out of concern. 😊

Don’t worry, all good things happened. I had to travel on a short notice for my convocation (which took place a year after I graduated) and I also switched jobs - which means, I can finally write about the bank I used to work for! 😎

Also, I’ll release two bonus editions soon to make it up!

On to this week!

Focus on Q4FY21

It’s that time of the year again.

Yup, banks’ quarterly results are going to start pouring in. This time, there’s going to be a tiny (but crucial) difference - we’re going to read about the actual NPA figures now!

Why is that?

Well, the Supreme Court has finally decided it’s time:

All this while, banks were reporting two different NPA (non-performing asset) figures. Even though the Supreme Court had banned them to call any bad loan an “NPA” after August 31 (even if the person or company had not paid back the loan due amount), RBI had forced them to disclose “pro-forma” NPA - essentially, the true NPA figure had there not been any such court announcement.

Here’s an excerpt from HDFC Bank’s last earnings report, which reported 0.81% gross NPA but had pro-forma gross NPA of 1.38%.

You might be wondering - if banks were reporting pro-forma, or simply, actual NPAs in the first place, why does the Supreme Court reversal matter at all?

Three reasons:

Not all banks are as “prudent” as HDFC. When you report NPAs, you’re also supposed to provision i.e. set aside profits to cover for impending losses. Unfortunately, not all banks were provisioning based on their actual (proforma) NPAs. This is going to impact their profits negatively in the next few quarters.

There were high deviation between reported vs pro-forma NPAs for some banks 👇🏽

As you can see, IDFC First Bank will have to brace for some seriously bad accounts.

Bankruptcy proceedings (in which banks could take bad accounts to the court) will resume. No more hiding behind the Supreme Court order. All stressed accounts will come forward.

At a time when credit (loans disbursed by banks) in the country is slowly getting back at pre-pandemic levels, the impending NPAs and bankruptcies can really set us back.

For a more detailed dive on the impact of SC order, read Deepak Shenoy’s piece here.

Sponsored

This week’s Bank on Basak is brought to you by…

Have you ever wanted better returns than a fixed deposit but were clueless about your options? Wint Wealth brings you an investment avenue which were earlier only available to high net-worth individuals. Backed by the founders of Zerodha, CRED and Groww, Wint Wealth aims to deliver 10.25% for their latest asset-backed product. Personally, I went through their website and found it extremely detailed - this is a great case study on how innovation can take place even in debt products!

Disclaimer: Investments are subject to market risk. “Bank on Basak” is not a registered investment advisor and is not associated with the company in any form.

What’s up with RBI?

So I’ve previously harped about the Governor’s speeches. They’re a great indicator on how banking regulation is expected to change over the next few years.

The latest one didn’t disappoint as well. Speaking on the theme “financial sector in a new decade”, here are the key takeaways in case you missed it:

RBI will be more rigorous in their supervision of scheduled banks, co-operative banks and NBFCs, especially the latter. Gone are the days when NBFCs could expect some regulatory leniency for acting as “shadow banks”. With new roles such as CRO (Chief Risk Officer), RBI will soon release new size-based directions for these non-banks. (for more details, read my deep-dive on NBFCs in India)

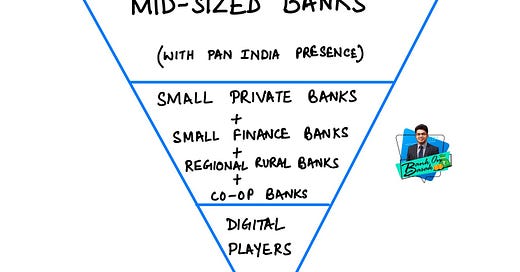

The best part was how the Governor outlined the banking landscape in India, as per his vision:

“I foresee four distinct sets of banking landscapes emerging in the current decade”

The first layer will be dominated by a few large players (think HDFC, SBI, ICICI - the Domestic Systemically Important Banks). The next set will be dominated by the slightly smaller players who are not restricted in any geography (think Axis, Kotak). Right below, you’ll find all the other small players who are either playing on a niche segment or a niche geography. At the bottom, the Governor finally recognises the importance of FinTech. Here’s his exact words:

“The fourth segment would consist of digital players who may act as service providers directly to customers or through banks as their agents. In fact, digital players would increasingly emerge as critical pieces across all segments”

IT systems need to be developed ASAP. Why? UPI took 3 years to reach 1Bn transactions, but only one year to reach 2Bn. So RBI wants platform infrastructure to display “exponential scalability”, not just “incremental scalability”. Our slow banks really need to ramp up.

The Governor gives a timely reminder that banks need to “partner” and work with FinTechs, rather than compete with them. In its own way, RBI is offering them a platform to showcase their skills through the “Regulatory Sandbox” - a closed environment where startups can work on their product without worrying about RBI regulations. This is in addition to the “Innovation Hub”, which has been set up recently to promote new ideas in the financial sector.

Cross-border payments are going to be a key focus in the years to come. This is going to play out in 3 ways:

The current theme of the Regulatory Sandbox revolves exactly around this. Shortlisted startups are going to be announced soon. RBI wants homegrown UPI and RuPay to leverage this.

RTGS currently supports multi-currency support. Now that it works 24x7 (from Dec 2020), RBI will explore whether it could be expanded beyond India.

RBI’s own digital currency - although they are going to take their own sweet time on this.

Finally, digital lending is going to be more formalised. RBI has already acknowledged that new-age credit evaluation is going to change drastically - based on non-financial and transactional data (think Razorpay), rather than balance sheets and corporate history. However, considering the rampant misuse of data, expect stricter regulation from the central bank as well.

Overall, I’m really impressed by our central bank’s thinking and approach. Let’s hope FinTech and financial inclusion go hand in hand, all while protecting customers.

I love feedback. If you want me to cover a particular news, want to get featured, write a guest post or wanna simply say hi, do reach out to me at anirudha@bankonbasak.com or LinkedIN or Twitter. Meanwhile, like this post and share it around?

All views and opinions shared in this article and throughout this blog solely represent that of the author and not his employer. Since the author is employed by a bank, he has consciously chosen not to report any news related to his company to avoid conflicts of interest. All information shared here will contain source links to establish that the author is not sharing any material non-public information to his readers. His opinion or remarks on any news are based on the assumption that the source is genuine, thus he is not liable for any information that may turn out to be incorrect. This blog is purely for educational purposes and no part of it should be treated as investment advice. Using any portion of the article without context and proper authorisation will ensue legal action.