#45 An Entry and an Exit!

Citi's exit and Navi's entry

Citibank’s exit!

Since the time Citigroup announced that its consumer banking franchise would exit 13 markets across the world (including India), my Twitter and LinkedIN feed has been filled with nostalgia, from consumers and employees alike.

Since I had no prior experience with the bank (as a customer or through research for this newsletter), it was kind of difficult to gauge an understanding of the same, until I read this beautiful piece from T.R. Ramachandran (Country Manager, VISA, India), who spent 10 years in Citi India, his last role as the Retail Banking Head (yes, this is the division that is wrapping up).

Apart from the environment and the culture that he shared, he wrote on all the things that Citi built from scratch in the country, especially during the post-liberalisation-rise-in-middle-class phase - from Consumer Durables Financing to automobile finance to mortgage to corporate salary accounts to Citigold (wealth management) and finally their lucrative credit card business!

All of this is finally coming to an end! - well, not literally. Citi assures that customers would not be affected, they have no immediate plans to close branches - most likely, someone else will buy the division.

Why are they doing this?

On a global scale, CEO Jane Fraser (whom I wrote on earlier) believes that they do not have the “scale” to either compete with local players in their respective markets or the dollar returns aren’t high enough.

For India, it is both. The market has largely been captured by the private players and their retail book contributed less than 20% of India-arm profits (this is even more negligible on a global scale, contributing only 1.8% of the global portfolio).

Citi will rather double down on wealth management on four major wealth hubs - Singapore, Hong Kong, UAE and London. (Read one of my earlier pieces to understand how wealth/asset management has slowly become a key focus for other global banks as well)

Who will buy it in India?

I feel this is way too early to predict right now, so let’s try to understand how valuable it is.

Let’s start with the credit card portfolio. I downloaded the latest data from RBI and sorted in descending order of outstanding credit cards:

As you can see, Citi commands a strong position at 6th. This number was way higher before all the private players started gaining market share. Even now, the spend per card has been growing at a steady rate of 15-20%, indicating the spending power of customers who hold these cards!

This is just one segment. Others include:

Wealth management - Largest AUM (assets under management) for any foreign bank in India

Deposits - ₹1.6 trillion (March 2020)

Sizeable housing loan business

Each of these is going to be a nice addition for any bank, irrespective of size or origin. Hence, Citi might just sell them off separately rather than dumping it all on one bank.

Do you have a Citi story you’d like to share?

What’s up with RBI?

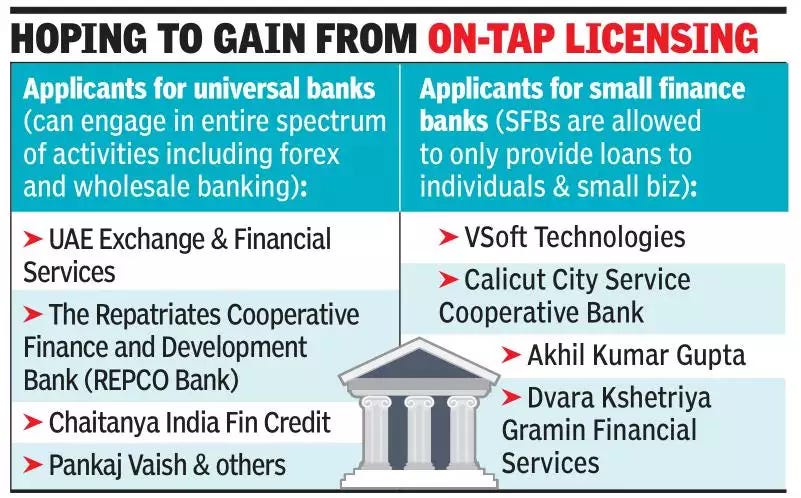

RBI has finally released the names of all the applicants (till date) who want a new banking license!

Four entities have applied for a full (or universal) banking license. Four others have applied for a small banking license.

Several years ago, RBI had streamlined the application process, changing it from a “Stop and Go” structure to an “On-Tap” one: basically transitioning from an intermittent process (where you could only apply for a bank license only when RBI allowed it) to a continuous one (where you could apply anytime you wanted it), like it is today.

Did the “On-Tap” concept make things better?

Not really.

Here’s something I wrote on LinkedIn two weeks ago:

So even though the on-tap licensing framework finalised in 2016, it’s been 5 years since then and we’re yet to get a new bank!

Takeaway: Although you can apply anytime now, getting a license still remains tough!

Is that because RBI rejects most applications?

Not really. The high entry barrier hasn’t motivated many players to apply.

In 2017, there was only one application.

In 2019, one more.

As of today, there’s only four total contenders for the big license!

Compare this to 2013 when there were 24 applications!

Here's the full list. You can read more about each of them here.

Note: I’m not stressing on the small finance bank licenses, mostly because they’re relatively easier to get. For instance, co-operative banks (like Calicut City Service) have a net worth requirement of ₹100 crore, compared to ₹200 crore for other players. Likewise, existing NBFCs (like Dvara) need to have a track record of only 5 years, compared to 10 for other players.

In reality, most people, like I mentioned in the LinkedIN post, are only concerned about one major name - Navi!

If you can’t find it in the list above - it goes by the name of “Chaitanya India Fin Credit”.

As it is Sachin Bansal’s (Flipkart co-founder) next venture, a lot of fintech enthusiasts and industry veterans are banking on his success! Although Mr. Bansal believes in running a technology-first company (he expects only 20% of its employees to come from a core financial background), he has smartly acquired an NBFC (Chaitanya) to bypass the promoter restrictions - RBI prescribes a minimum promoter track record of 10 years in the banking or financial service space!

In fact, he has also acquired a General Insurance and a Mutual Fund license - all of this, to come prepared as a full stack financial service provider before knocking on RBI’s doors!

This is primarily the reason why he didn’t apply for a small finance bank license! Although Sachin aims to solve for financial inclusion, his larger goal is to provide a better service to customers, small or large.

From an interview,

If you are Flipkart, you have to deliver that transaction in the best possible manner, with the most cost-efficient manner, most best customer experience but in banking and financial services, what I found is that relationship is a multi-year relationship, it is not about just making a transaction happen or getting an account opened or getting a fixed deposit opened or selling an insurance policy, it is a very long-term relationship. So that mindset shift is something that is the biggest thing that I have learnt.

Navi’s Challenge

All things said, Navi’s current foray (digital lending) is risky:

Navi has a high target of disbursing ₹4200 crore by March 2022. Retail lending has seen increasing NPAs since Covid. There are ways in which Sachin is trying to mitigate it, such as having an approval rate of 5% compared to industry figures of 10%+ and focusing on high ticket long duration loans to quality borrowers, but everything would boil down to repayments. As of December 2020, gross NPA figures were around 4%, almost fully provisioned.

Navi is trying to diversify Chaitanya’s micro finance-heavy loan book, by expanding into home loans. This segment, although lucrative, is very difficult to leverage technology due to manual onboarding processes (resulting in high costs).

A banking license will surely help in both cases - (a) through attracting better borrowers and (b) being able to provide better rates to customers (by the ability to gather low cost FDs and savings/current accounts, which it presently cannot).

Here’s hoping it makes the cut!

I love feedback. If you want me to cover a particular news, want to get featured, write a guest post or wanna simply say hi, do reach out to me at anirudha@bankonbasak.com or LinkedIN or Twitter. Meanwhile, like this post and share it around?

All views and opinions shared in this article and throughout this blog solely represent that of the author and not his employer. All information shared here will contain source links to establish that the author is not sharing any material non-public information to his readers. His opinion or remarks on any news are based on the assumption that the source is genuine; thus he is not liable for any information that may turn out to be incorrect. This blog is purely for educational purposes and no part of it should be treated as investment advice. Using any portion of the article without context and proper authorisation will ensue legal action