#51 Fintech <> Bank

On what it means for banks to partner with fintechs.

A Match made in…

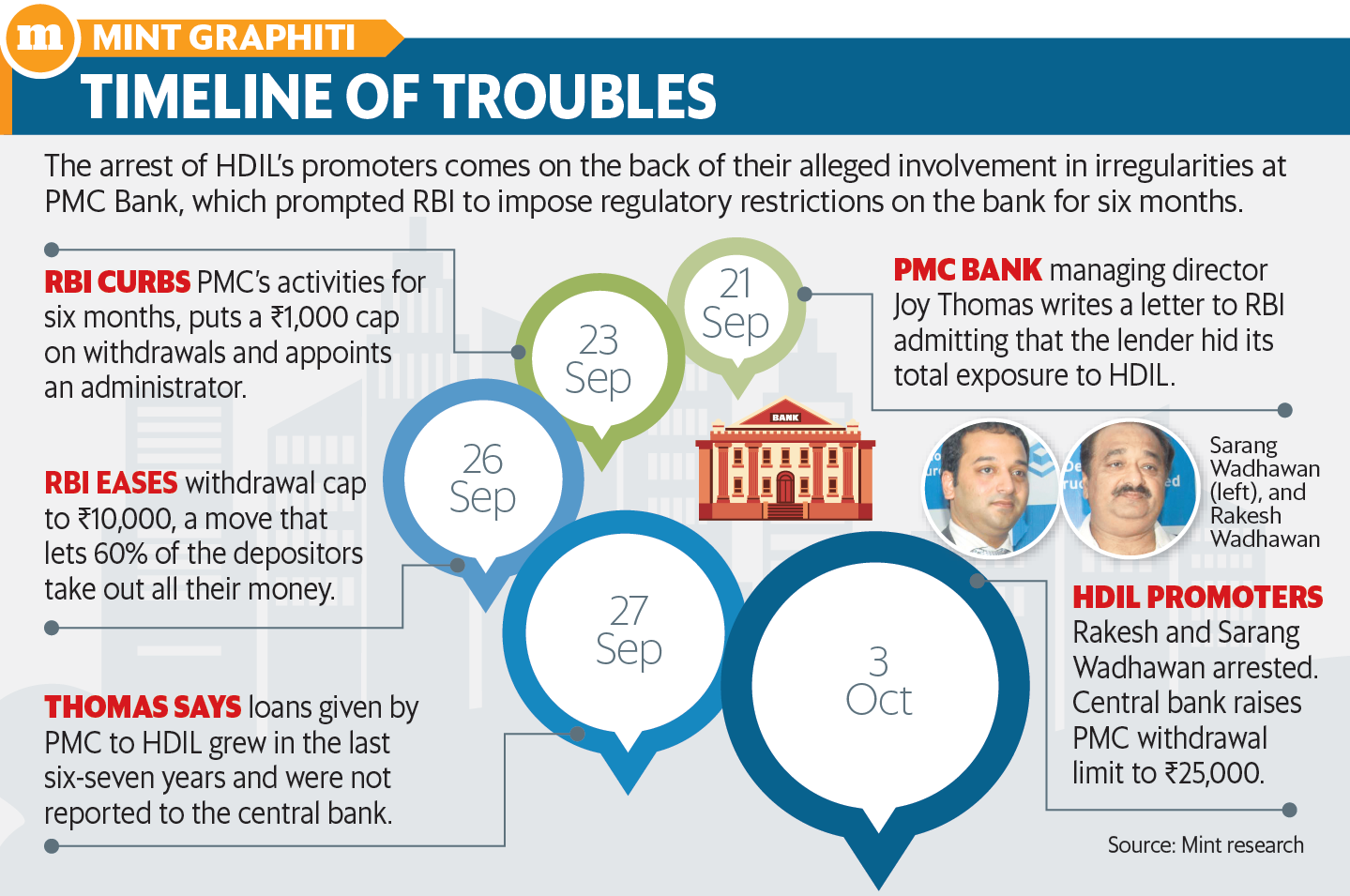

Remember PMC Bank?

If you don’t, here’s a refresher:

Let’s just say, it is one of those type of banks where you shouldn’t keep your money. Of course, that’s easy to figure out in hindsight.

But there’s also a good enough reason why scheduled commercial banks like Yes Bank and Lakshmi Vilas Bank were saved by RBI faster than scheduled co-operative banks like Punjab and Maharashtra Co-operative (PMC) Bank. Unlike commercial banks, multi-state (Punjab, Maharashtra) co-operative banks do not completely come under the ambit of RBI, thus resulting in delays and frozen accounts.

In any case, the sufferer is always the Indian saver.

However, that’s not what today’s post is about.

Today’s post is about the finer nuances of a fintech vying to become (or partner with) a bank.

Let’s cue in the celebrations first.

Here’s the context:

After RBI failed to save PMC Bank, depositors were getting impatient. 19 months have elapsed and 15% of depositors are yet to get back their money (due to curbs on withdrawal limits)

Remember, the DICGC scheme, which guarantees ₹5L per bank per depositor, will only kick in if the bank is liquidated or its membership cancelled by RBI, either of which was not done for PMC. Imagine the plight of those who had to wait for a deep-pocketed knight in shining armour to withdraw their own money.

Being helpless, RBI put the bank under the charge of an administrator who invited applications from institutions wishing to rescue the bank. Four potential suitors arrived, out of which three fizzled out. A 50-50 joint application from BharatPe and Centrum remained.

Yesterday, RBI put out a notification granting an approval to Centrum’s NBFC arm to set up a Small Finance Bank. This will finally pave the way for a merger between Centrum and PMC.

As this is a 50-50 joint application with BharatPe (a fintech payment company not associated with Centrum), they too, will indirectly get a banking license now.

Amidst the cheer, it’s important to ask the hard questions as well:

One possible reason for RBI not mentioning BharatPe’s name could be because PMC’s assets are actually getting merged with Centrum’s assets. BharatPe’s payments and lending business will continue outside the small finance bank.

However, even in Centrum’s own press release, BharatPe’s involvement as an “equal partner” is clearly mentioned.

Note: BharatPe is not an NBFC. It partners with other NBFCs/banks to source funds, which it lends to its merchants. As a FinTech company, it has shown remarkable growth, beating the likes of heavyweights such as PhonePe and PayTM in the merchant UPI QR space (You cannot transfer money between friends using BharatPe). To understand more about it’s fascinating journey and the exact niche it has built for itself, I recommend reading the following links:

Here’s the plan:

Once the merger is complete, the new entity (Centrum + PMC) should be up and running and by the fourth quarter of this year, the rest of the depositors should get back their money.

Equity to the tune of $250-300 million will be pumped into the new bank, contributed equally by both BharatPe and Centrum.

There will be new management, led by Centrum’s lead man, Jaspal Bindra, who has prior experience of running a bank.

Here’s what I think: While this is a landmark step, it will not act as a true measure of how a Fintech-turned-bank will perform (because of Centrum’s involvement). In reality, across the world, FinTechs have realised that banking (or lending) is a completely different ballgame and success as a FinTech company may not automatically guarantee success in the field of banking. (Navi is a good example of this)

On the other end, if this merger does end up succeeding, it is important for RBI to acknowledge BharatPe’s involvement if we really want their success to pave the way for future FinTechs.

What do banks think about FinTech?

Now that we have established the significance (and demand) for a FinTech to become a bank, how does the opposite party feel about them?

I take a peek at a few analyst conference transcripts for some banks and note down the current trends. To avoid crossing the email length limit, we’ll stick with Federal Bank today.

Federal Bank

Whenever I think of Federal Bank and FinTech, I get reminded of this tweet:

While it arose from the context of Fi Money’s waitlist opening up, it is just one of over 50 partnerships that Federal is currently involved with.

These are across verticals and offering different needs and solutions for everyone:

Since we’ve already talked quite a lot about BharatPe today, let’s focus on that.

Here’s a fun trivia for you - Federal Bank is the top partner bank for the BharatPe!

Recall that I mentioned BharatPe sources funds from other banks to lend to its merchants. Now we know Federal is one of them.

How does Federal benefit?

I’ve highlighted the relevant portions from the analyst call:

The key takeaway is that transaction history (which BharatPe has a lot of) can provide a lot of information about a merchant, which Federal can utilise to cross-sell a lot of other things, like insurance and short-tenure micro loans.

Of course, good banks like Federal will always remain cautious of such opportunities. As per their CEO, this is what he had to say when asked how soon Federal will start cross-selling:

This is not surprising, as digital lenders had suffered a huge setback due to Covid. Some of them have gross NPAs as high as 10-20% (for comparison, Federal Bank has a gross NPA of 3.41% and a net NPA of 1.19%) but we rarely get to know about them as they’re not listed and not mandated to disclose anything.

Let’s hope BharatPe proves the critics wrong and sets a new path for growth of tech-driven banking.

That’s all for this week!

I love feedback. If you want me to cover a particular news, want to get featured, write a guest post or just want to say Hi👋🏽, do reach out to me at anirudha@bankonbasak.com or LinkedIN or Twitter. Meanwhile, like this post and share it around?

All views and opinions shared in this article and throughout this blog solely represent that of the author and not his employer. All information shared here will contain source links to establish that the author is not sharing any material non-public information to his readers. His opinion or remarks on any news are based on the assumption that the source is genuine; thus he is not liable for any information that may turn out to be incorrect. This blog is purely for educational purposes and no part of it should be treated as investment advice. Using any portion of the article without context and proper authorisation will ensue legal action.

Great post! Used to work at Fi, realized just how much Federal benefits from forging these partnerships. As a bank, they get to stay ahead of the curve by enriching their customer datasets and learning from integration efforts w diff fintech players solving for diff verticals.