#52 Of Missed Projections & Deadlines

FSR Report July 2021 + Other Reads

What’s up with RBI?

This week, RBI released the Financial Stability Report (FSR), a bi-annual publication who’s claim to fame is predicting NPA levels for the next year.

Unfortunately, as I’ve pointed out earlier, RBI doesn’t really do a good job at it.

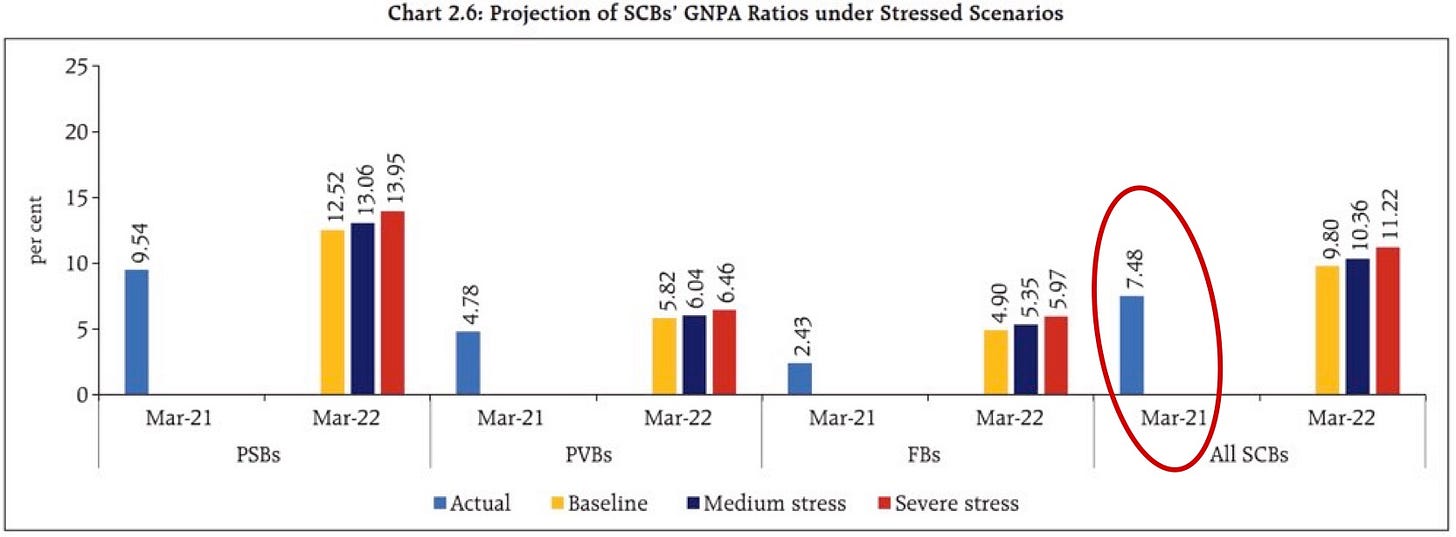

For example, here’s a snapshot from last year’s FSR:

As you can see, RBI predicted NPA levels to rise to 12.5% (this is best case scenario). Worst-case predictions are as high as 14.7% (check last column).

What is the actual NPA level as per the latest FSR? - 7.48%!

This is what RBI Governor had to say:

“As this issue of the Financial Stability Report highlights, the dent on balance sheets and performance of financial institutions in India has been much less than what was projected earlier, although a clearer picture will emerge as the effects of regulatory reliefs fully work their way through. Yet, capital and liquidity buffers are reasonably resilient to withstand future shocks, as the stress tests presented in this report demonstrate”

Translation: “Hey, so I won’t admit we consistently get our projections wrong, but NPAs are lower than we thought, that’s good right? Now that I know banks have been really resilient, let me lower the projections for next year and pray I’m right this time”.

NPA across sectors

Bad things aside, the FSR Report really does have a ton of information on the asset (loan) quality for banks. Here’s my personal favourite:

Tracking this chart on a semi-annual basis helps you understand how cycles play out across industries - industries show varying degrees of stress across years, represented here by the % of bad loans that they have on the books of banks.

Notice how NPAs have risen for personal loans but decreased for every other sector. That, however, did not stop this segment to show the biggest growth.

NPA across countries

Despite NPA levels being a lot lower than what RBI had projected, Covid hit Indian banks a lot harder compared to peers in US and Europe.

Corporate portfolio was most affected by small and medium businesses.

Retail portfolio (affected due to job losses) appeared through decline in loan repayments.

So what worked for the foreign peers that did not work for us?

US and UK put cash directly in the hands of the borrowers, whereas India did not. Instead, we offered loan moratoriums (used by retail mostly) and credit guarantee scheme (offered to small enterprises).

While some strongly believe that India should have followed the foreign model, only time will tell if India’s cautious approach will be a boon or bane for Indian banks.

Summaries from the week

Axis Bank chooses AWS to transform digital experience (Livemint): AWS or Amazon Web Services, has signed a multi-year digital agreement with Axis Bank to leverage cloud technology. As I’ve mentioned previously, Axis has been really focusing on digital for some time. You can get a glimpse of that if you just go through their Investor Presentation. Expect it to make a lot more progress in this area.

India Post Payments Bank, which had the potential to be the biggest bank, is unfortunately in violation of RBI licensing rules: Viswanath Nair writes for BQ:

“As part of its licence, RBI had said that all financial services directly under the Department of Posts, which can be offered by the payments bank, must be folded into India Post Payments Bank (IPPB) within two years of operations. This is in keeping with the regulator's broader thinking that a business which can be conducted by a banking company should not be done outside it by the same set of promoters.”

Did you know that our postal system has access to savings account deposits worth over ₹1.15 lac crore (for context, this is next to the total deposits of Yes Bank, which comes in the Top 20 banks with highest deposit market share).

Note the distinction. As per RBI, only the savings account portion was supposed to be merged with IPPB. Our postal system still has other deposits such as normal fixed deposits (₹1.66 lac crore) and recurring deposits (₹1.14 lac crore). If you include all other schemes (PPF, NSC, KVP, SCSS, Sukanya Samridhi etc), total assets under management stand at over ₹10.66 lac crore, which in fact, makes it just next to SBI and HDFC Bank!

And how much deposits does IPPB have? A paltry ₹855 crore. The transfer has been delayed mostly due to bureaucracy, turf wars, salaries and finally, the questionable business model of payment banks.

I love feedback. If you want me to cover a particular news, want to get featured, write a guest post or wanna simply say hi, do reach out to me at anirudha@bankonbasak.com or LinkedIN or Twitter. Meanwhile, like this post and share it around?

All views and opinions shared in this article and throughout this blog solely represent that of the author and not his employer. All information shared here will contain source links to establish that the author is not sharing any material non-public information to his readers. His opinion or remarks on any news are based on the assumption that the source is genuine; thus he is not liable for any information that may turn out to be incorrect. This blog is purely for educational purposes and no part of it should be treated as investment advice. Using any portion of the article without context and proper authorisation will ensue legal action.