Hey everyone,

Apologise for taking an unscheduled break for three weeks! Hopefully things get more regular hereon.

Meanwhile, here is what we were busy building at work:

Dhan is an invite-only platform for those investors/traders who are tired of their existing options and want to try something better. To make sure you’re on the list, signup below:1

Onto today’s topic!

Yesterday, one of the most buzzing fintech companies in India launched a new feature:

For the uninitiated, the technical term for CRED Mint is “P2P lending” or peer-to-peer lending. Even though the name might sound new and fancy, this industry is actually a bit old, even for India.

It all started with a discussion paper by RBI in 2016, which in fact came as a result of proliferation of unregistered P2P lending players across India. RBI quickly brought out the consultation paper so as not to repeat a China fiasco.

In the heydays of P2P lending in China, there were as many as 3,433 companies operating in 2015. That came down to 1,900 by 2018 and 343 by 2019, once China introduced regulations. Regulations were brought in due to a combination of mismanagement and widespread defaults.

The Master Directions (official template guide to register as a P2P player) were brought in 2017. It has since been updated four times.

In the beginning, the largest (and the only registered) P2P player was Faircent.

As of today, there are over 20.

Unfortunately, the transparency ends here.

After repeated attempts by journalists to gather more information through RTI, our central bank has nothing to show for it.

Without individual company data, it is difficult to compare the top players and also map the growth of the industry. Faircent, obviously, claims it has 80% of the Indian P2P lending market, with months disbursals of ~120 crores, but how do we verify?

Other known names include Monexo, i-Lend, i2i Funding, Finzy, LenDen Club and finally LiquiLoans, which is the partner for CRED.

Basics first

Let’s step back for a bit now.

What exactly is P2P lending and how does it work?

Think of it as something sandwiched between organised lending (banks, NBFCs) and unorganised lending (actual human moneylenders).

Just like Uber/Ola matches a rider with a driver (keeping a cut in between), a P2P player acts like a marketplace, matching eligible borrowers with willing lenders.

Let’s take the homepage of Faircent as an example, for simplicity.

As of today, it has registered lenders on its platform with an intent to lend upto 165 crores. Registered borrowers are willing to borrow 252 crores. It is Faircent’s job to match lenders with borrowers. The matching needs to be line with what RBI has prescribed in their rulebook:

No lender can have individual borrower exposure over ₹50,000 (across all P2Ps)

The total exposure of an individual lender cannot be more than ₹50L (across all P2Ps)

The loan taken by an individual borrower, has a cap of ₹10L (across all P2Ps)

The maturity of the loans shall not exceed 3 years.

Amit More, founder of Finzy, another P2P platform, had appeared on a podcast and explained how this looks realistically:

“We have a single borrower of ₹5L who has received money from 131 different lenders. Similarly, one lender of ₹10L has his money spread across 330 different loan accounts”

Quality over Quantity

The match-making itself is quite simple - a decent underlying technology can solve it. The real difference comes in the quality of borrowers that the platform attracts.

How good is the verification standard?

What is the borrower profile?

How many borrowers are on the platform? (a higher number can ensure better diversification for lenders)

All these things play out over a market cycle and that is why you can never know if your money is truly safe, at least, not in the beginning. For example, in the first 21 months of its existence, Finzy did not have a single NPA. CRED is promising almost the same thing (NPA figures of less than 1%).

But look at the feedback for these players today:

This is not surprising, as the model itself is skewed in favour of borrowers rather than lenders. Imagine yourself to be a middle guy. You introduce the borrower to the lender. You take a matchmaking fee and then you can forget about the deal altogether.

RBI regulation does not mandate recovery on behalf of the lender. In fact, P2P lenders are NOT supposed to provide any assurance of recovery of principal/interest. Even RBI doesn’t want any involvement. The central bank has asked P2P platforms to display this message on their website:

“Reserve Bank of India does not accept any responsibility for the correctness of any of the statements or representations made or opinions expressed by the NBFC-P2P, and does not provide any assurance for repayment of the loans lent on it”

RBI has also mandated that P2Ps cannot harass the borrower for collections at all.

Yes, it helps the P2P company’s fate if borrowers don’t flee with the money - but if they were REALLY good with collections and recovery - they would be better off as lenders themselves (bank, NBFC) rather than a marketplace.

We will now understand how having a robust large loan book BEFORE you delve into P2P (like in the case of CRED) is actually advantageous compared to starting out directly as a P2P player - which includes constantly tweaking borrower side (by lowering your borrower standards) or lending side (bringing in institutional money) until you arrive at a favourable number on either side.

The Lending Model

Remember, P2P players cannot lend on their own. They cannot raise deposits, nor provide any credit enhancement/guarantee. They cannot permit secured lending (lending against collateral), they cannot even cross-sell any other product (except loan specific insurance products).

Lastly, they cannot hold any funds on its balance sheet - not funds received from lender and not funds received from borrowers (interest/principal repayment).

So where do the funds reside?

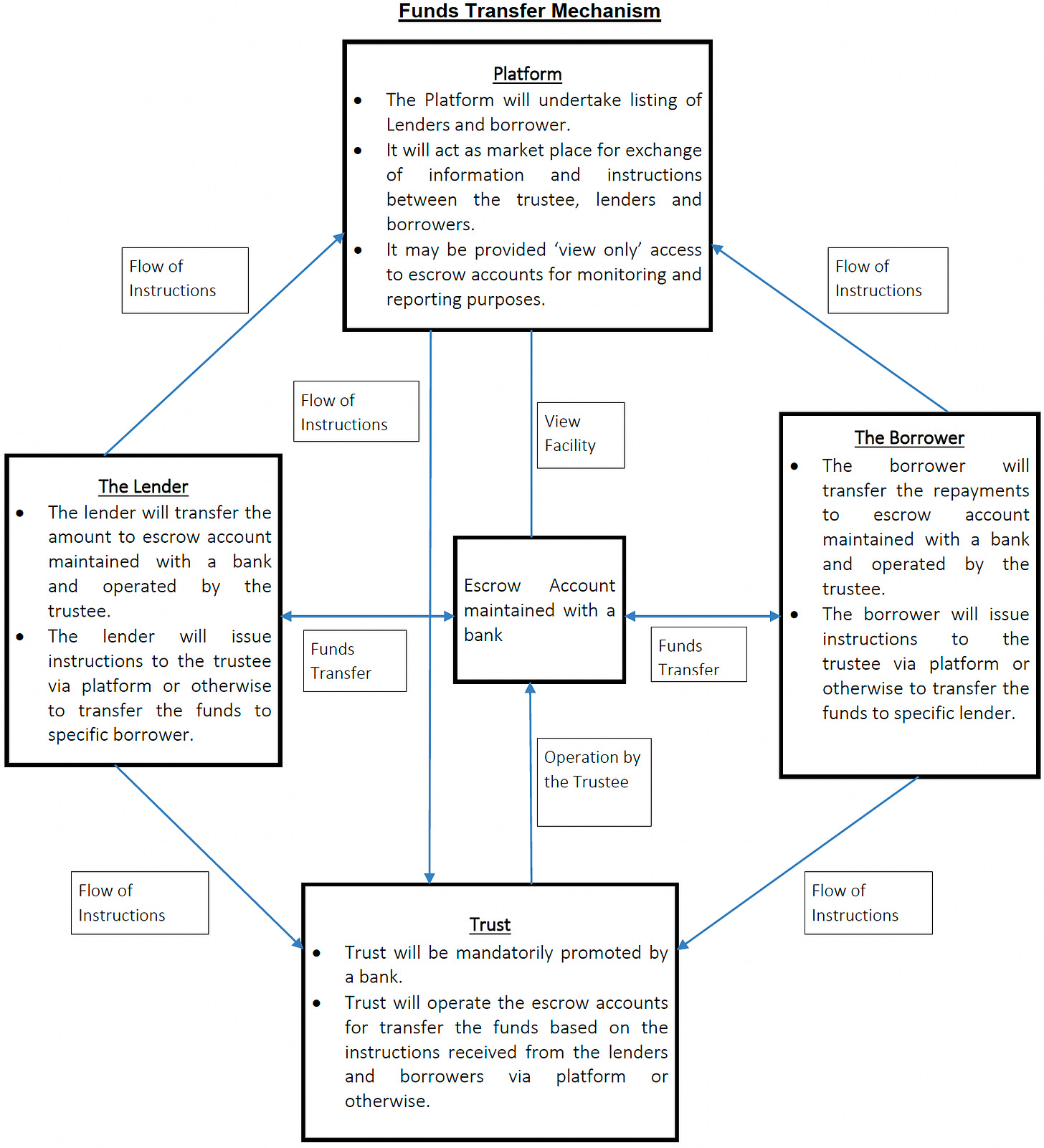

In an escrow (third-party) account. RBI has illustrated how the model should look like:

As you can see, the platform (in this case, the P2P company), should only have “view access” to the funds from the borrower and lender. The escrow account is maintained with a scheduled commercial bank and a trust (promoted by the bank) will operate it based on instructions by the borrower and lender (and the algorithm set by the P2P).

For instance, some platforms allow you to pick and choose which borrowers you want to lend to (this is anonymous and you can only see the category and the rate of return- a riskier category will fetch you higher returns). Other platforms do not give you an option and do the matchmaking themselves. Heck, you can even be a borrower and lender at the same time on these platforms, but the algo and the trust will make sure you don’t end up lending to yourself.

Where does CRED sit here?

CRED is the FinTech layer on top of a registered P2P (LiquiLoans). The pool of lenders and borrowers that CRED uses is its own - not of LiquiLoans - thus it is free to set its own T&C. For example, the minimum investment for a lender, if you directly invest via LiquiLoans is ₹50,000. On CRED, it is ₹1,00,000, Similarly, the maximum amount through LiquiLoans is ₹50L. On CRED, it is ₹10L.

In it’s own words,

Considering the fact that CRED Mint is invite only and they can track each new lender closely, the match-making between lenders and borrowers should not be a concern right now.

In terms of income, honestly, I do not have the expertise to accurately estimate it, but if I take just my profile, I can lend to CRED and get 9% (maximum), but I can borrow only at 17% (not sure why I would - apart from convenience). I am assuming this borrower rate is not uniform for all their customers - but the spread is quite large.

Also, disclosure: I have invested in CRED Mint - mostly because I want to experiment with this platform and because they are allowing me to withdraw my full amount any time I wish to (most P2P lenders DO NOT allow this).

Additional info: Their banking partner for the lending side is IDFC First Bank and the trustee managing the escrow account is IDBI.

The Pitch

I think the biggest pet peeve for most folks is the way P2P is pitched to gullible investors.

For example, at one point, BharatPe (which actually came up with the idea of partnering with a P2P player even before CRED) came into the limelight because their sales force tried to mis-sell this product to its merchants as a “savings” product. Merchants were “guaranteed” 12% returns. Compare this to a 4% return on their savings account (or even 0% for merchants in their current account), this seemed like a godsend.

To be clear, pitching this product in such a way is clearly prohibited by RBI - but then again, RBI wants to keep its hands clean anyway.

The Future

P2P players had received a lot of investor interest between 2018-19. Any guesses why it died down? 😉

In any case, now that CRED has picked it up, the industry “might” revive again. I see one other listed player (5 Paisa) also being bullish on this space based on management commentary.

They recently introduced it as a segment, so let’s see how much this contributes to the topline.

That’s it for this week.

P.S. I love feedback. If you want me to cover a particular news, want to get featured, write a guest post or wanna simply say hi, do reach out to me at anirudha@bankonbasak.com or LinkedIN or Twitter. Meanwhile, like this post and share it around?

All views and opinions shared in this article and throughout this blog solely represent that of the author and not his employer. All information shared here will contain source links to establish that the author is not sharing any material non-public information to his readers. His opinion or remarks on any news are based on the assumption that the source is genuine; thus he is not liable for any information that may turn out to be incorrect. This blog is purely for educational purposes and no part of it should be treated as investment advice. Using any portion of the article without context and proper authorisation will ensue legal action.

This is not a sponsored post. Dhan is a product of Raise Financial Services, where I work. The product has no relevance to my newsletter and I am merely sharing it since it is a part of my life now. Readers are free to ignore. :)

There are two big lenders you messed.

Capital float was the biggest in terms of disbursement and had skin in the game. And product wise had the best one. Unfortunate the p2p regulations are a dampner for the sector and doesn't allow platforms to make much money

- Vineet, ex capital float

9% pre tax is 6.3% post tax

If you're lending minimum 1 L you're in top bracket

PF seems better option 7.2% tax free with zero risk

Only downside of PF is that it has little or zero liquidity

Even Debt Funds seem better option than P2P lending

Even CPs seem good till recently Adani Enterprises was borrowing at 8.1% annualized yield for 91 day paper