I’ve been writing on traditional banking for some time now; over this period, I’ve observed many changes in the way banks look at FinTech/startups.

From flat-out refusing to acknowledge them to setting up separate teams to evaluate partnerships, we’ve come a long way.

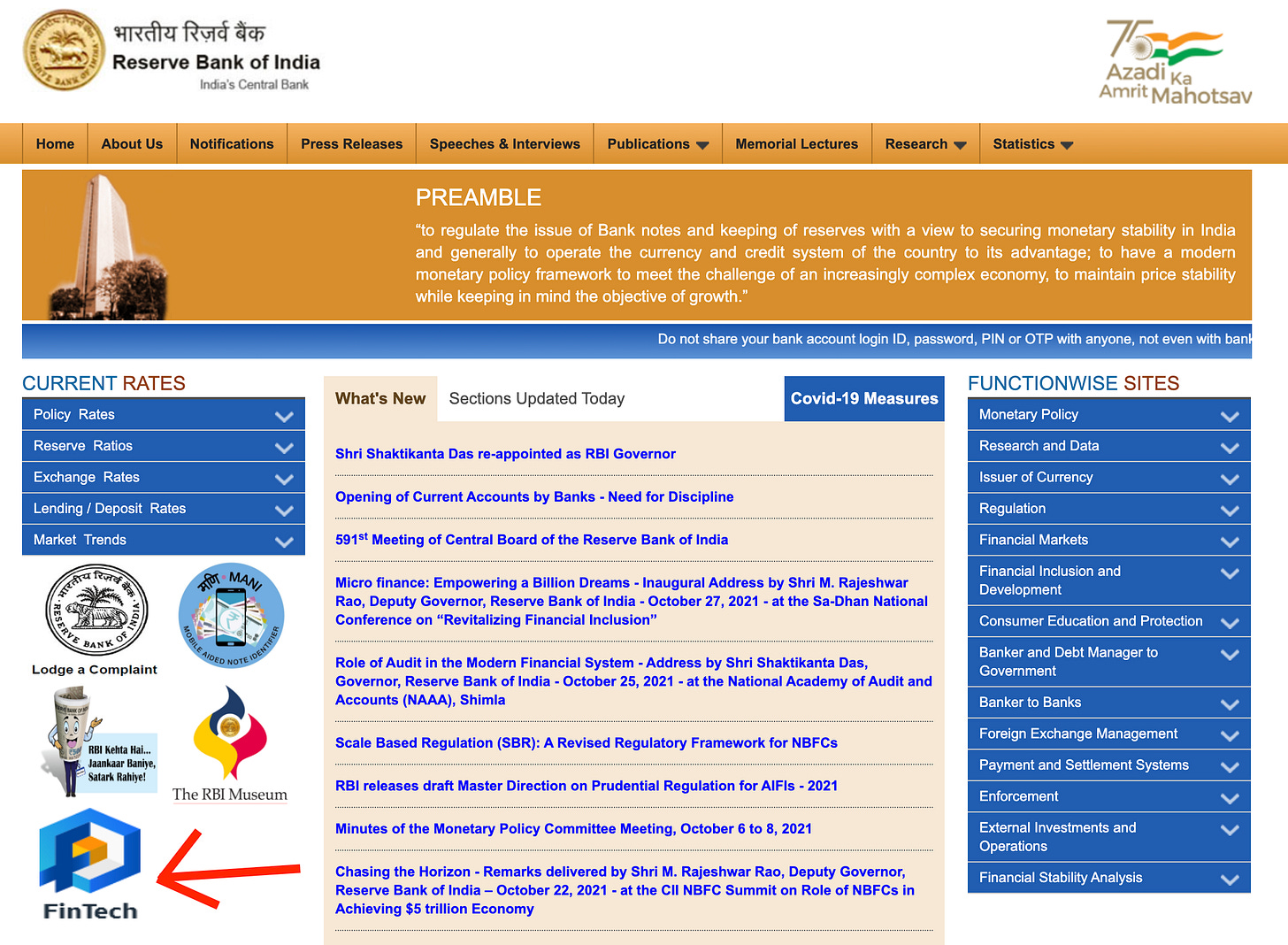

Somewhere between this transition, our regulator provided their stamp of approval as well. 👇

FinTech is so important now that RBI has been actively conducting sandbox experiments with young startups in several themes such as:

Retail Payments

Cross-Border Payments

MSME Lending, and

Prevention and Mitigation of Financial Frauds

I love how our Deputy Governor Rabi Sankar has defined the role of banks and fintechs:

…Banks bridge gaps in space and time between savers and borrowers. The spatial gap occurs when a saver and a borrower do not know each other, or are in different locations. The temporal gap occurs when the needs of the borrower and the lender arise at different points in time - borrower needs money after a month but the saver has money now.

He goes on to explain how FinTech can solve for the spatial gap, but not for the temporal gap - as banks are the only financial institutions uniquely placed to be the liquidity (money) providers to the economy.

There are two key messages that arise from his speech:

The ideal approach is for banks to partner with FinTech for improving efficiency, speed and reach.

FinTechs that try to become banks should be regulated like them

So yes, smart banks (from small to big) are trying to leverage FinTech better.

The Big Guns

Take HDFC Bank for example. When asked what it sought to achieve with the recent partnership with PayTM, the management mentioned three things:

Embed HDFC Bank’s credit card QR into PayTM’s QR so that they can broaden the base of the merchants that HDFC can tap into (Remember PayTM has over 21 million merchants on its platform)

Cross-sell and up-sell banking products to these wide set of merchants

Provide Business Credit Cards to these merchants in partnership with VISA

Similarly, for Axis Bank and ICICI Bank, partnership with Flipkart and Amazon (not exactly a startup anymore) respectively, has proved immensely beneficial in terms of credit card acquisition.

Here’s what each has to say,

The Axis - Flipkart cobranded Card saw highest ever monthly acquisitions through Flipkart platform in Sep’21. We see growth continuing through both organic acquisitions and partnerships. On the back of increased card spends, the cards book was up 11% QoQ.

The tie up that we have with Amazon has really worked well for us. In terms of growth again, you have seen the growth that we have seen in the cards in force or the credit cards spends and the market shares have also improved for us

The Underdogs

My favourite one in this list is Federal Bank. I’ve already covered some of their partnerships, such as the one with BharatPe, in a previous post.

In their latest analyst conference call, the CEO had a very bullish view on their FinTech partnerships,

The last part and important point, which you may have all observed, we have a fetish and a feverish pitch on digital and fintech. I have personally spent disproportionate time and Shalini as an Executive Director, probably spending a large part of our time on getting this going. We've created exclusive teams that are focused on this. At this point in time, there's a cost element to it. But we are willing to take that cost because we believe that in the long run, this is going to be a Federal Bank, completely differentiating from many other banks.

They’re adding roughly 7500 accounts per day with just two fintech partners (Jupiter, Fi Money).

Federal Bank has also recently launched credit cards (around May 2021) and has been adding around 7000 cards per month. They’re doing this with a partnership through OneCard, which is taking care of the acquisition and servicing.

No numbers were revealed in terms of revenue and costs, but the cost structure is primarily of two types:

Where the FinTech partner is an acquirer (like OneCard) - this is treated as BC cost (Business Correspondent)

Where Federal is a service provider to FinTech - so there’s an acquisition cost that Federal bears

Not just Federal, here’s what South Indian Bank has to say:

We should not really look at Fintechs as competition. We should look at Fintechs as partners. Towards that we have already started associating with the Fintech for our gold loan and we are as I am talking to you we are exploring couple of such opportunities where they are wanting to tie up with people so that we can leverage on their technology capabilities and we can use our distribution spend.

And DCB Bank:

On a monthly basis, we are meeting several fintechs. Some of the fintech companies are good and they can scale up. We are trying our best to make sure that how can we make available APIs so that the fintech company can consume it and we can consume their APIs, such that we can have almost seamless kind of delivery to customers.

Concluding thoughts:

What I’ve covered is a small sample from recent concalls on how management truly feel about FinTech firms. There’s a lot more deals that is happening every. single. day!

A few quarters down the line, banks would soon start revealing numbers as well - and we would have a better clarity on the quality of these relationships.

As DG Rabi Sankar rightly pointed out, “Competition for banks comes not from FinTech firms but from other banks which leverage FinTech better.”

That’s it for this week.

P.S. I love feedback. If you want me to cover a particular news, want to get featured, write a guest post or wanna simply say hi, do reach out to me at anirudha@bankonbasak.com or LinkedIN or Twitter. Meanwhile, like this post and share it around?

All views and opinions shared in this article and throughout this blog solely represent that of the author and not his employer. All information shared here will contain source links to establish that the author is not sharing any material non-public information to his readers. His opinion or remarks on any news are based on the assumption that the source is genuine; thus he is not liable for any information that may turn out to be incorrect. This blog is purely for educational purposes and no part of it should be treated as investment advice. Using any portion of the article without context and proper authorisation will ensue legal action.