Merger? No Merger?

Early this week, markets kind of went abuzz with news of Kotak Bank allegedly acquiring IndusInd Bank. Two things resulted from it:

Coupled with a good Q2 result, it sent up Kotak’s stock price at a record high. (up 12% since the beginning of the week)

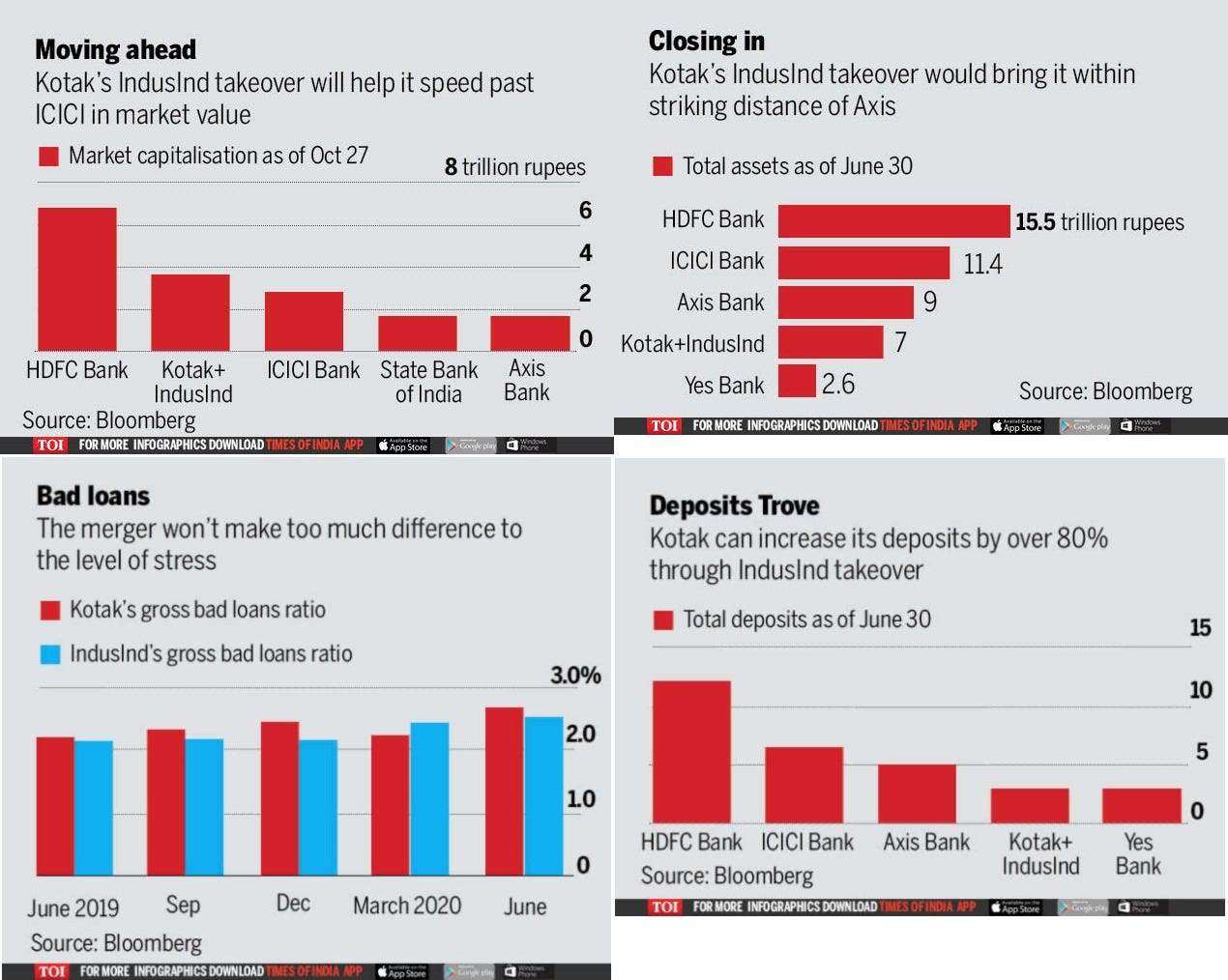

Newspapers went into a frenzy making charts on what a possible merger would like. Of course, it makes my job easier; here is Times of India (actually reposting Bloomberg content):

And here’s Mint:

It was a good run, until Kotak refused to comment on it and IndusInd went one step further to point out that the news was “malicious, untrue and baseless”.

If successful, this wouldn’t have been the first acquisition for Kotak. Back in 2014, it acquired ING-Vysya Bank, which served the dual purpose of gaining a southern India presence for Kotak as well as reducing the shareholding of its promoter, Uday Kotak.

The shareholding drama is a long-drawn one (I have covered both the banks’ individuals dramas in two separate posts here and here, if you’re interested) - but super short recap - promoter shareholding limit is 15% set by the RBI. While the promoters of IndusInd are within their limit (unhappily so), Uday Kotak is not (it is at 26%). However, RBI can’t do much about it because Uday took them to court on this issue and he won.

Buying IndusInd would reduce his stake considerably - a valid question, thus arises - Why would he give up his stake which we fought hard to retain? Similarly, IndusInd isn’t very happy that one guy in the industry is getting favourable treatment (maybe that is why their comment on this rumour was a little crude?)

But we’re digressing.

What does Kotak actually gain from a strategic point of view?

I dug up the investor presentations for Kotak and IndusInd just to understand their geographic presence - although both of them have a well distributed pan-India reach, I felt IndusInd had a stronger eastern presence, something Kotak could well tap into.

What about their loan book?

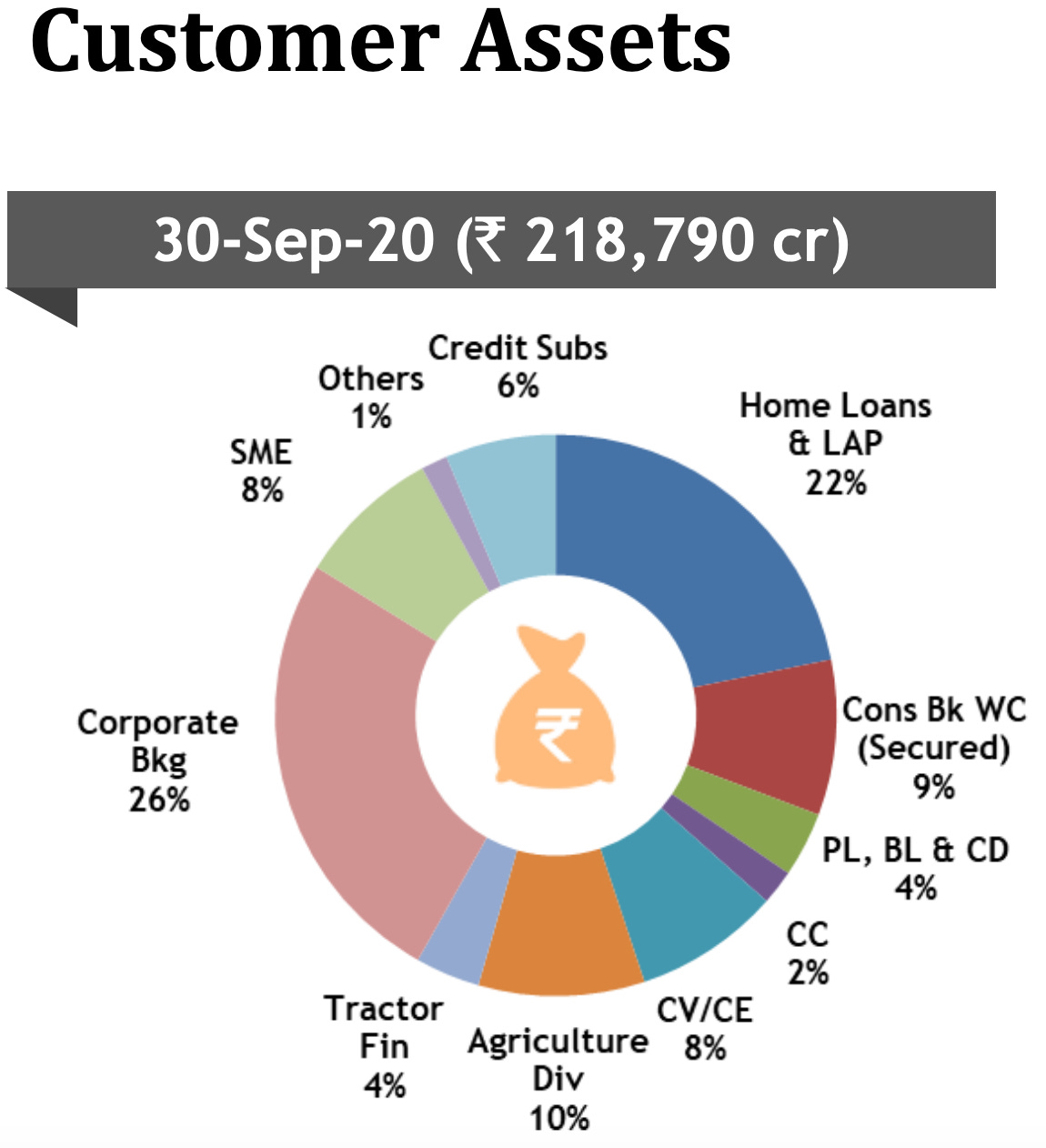

Although I couldn’t find the granular details for Kotak’s corporate loan book (why are the bigger banks so bad with disclosures?), IndusInd had a fairly diverse one:

Kotak’s corporate presence is less (26% vs IndusInd’s 42%) - instead, it is big on Home Loans and Loan Against Property (LAP) as you can see below:

On the other hand, IndusInd is big on Vehicle Loans and Microfinance (this is a segment which is under pressure due to Covid but it seems IndusInd has fairly low NPAs - something that Kotak wouldn’t have an issue dealing with).

Here’s their loan book (excluding their Corporate part):

My take: I was actually amazed to learn that Kotak would still remain the fourth largest private bank even after the alleged acquisition; that says a lot about the current gap between Axis and Kotak. Having said that, I hope this piece helped you understand a bit about the rationale that goes behind a merger - it is not simply about being the largest bank; there are finer nuances as well.

What’s up with RBI?

Apart from slapping a ₹ 1 CR fine on Jio Payments Bank and a ₹ 22 lac fine on DCB Bank (yup, usual stuff for RBI), nothing major came out through their notifications this week.

So let’s dig into the September 2020 “bank credit” data that got released yesterday.

Understand that banks have tons of real-time information on how a sector is performing - if borrowers are repaying early, as per schedule or late. The loan queries they receive on a daily basis also acts as a good measure to understand where to deploy credit (on a risk-adjusted basis). So they don’t really need economists or the central bank instructing them; they can make that call themselves.

Now let’s understand the chart below. I have removed a couple of columns for simplification (if you want the full data, you can click here). This data tracks the bank credit to particular sectors from the beginning of this financial year to the end of September (it includes 2019 data as a reference point as well).

Traditional media will cover this news in a way to show how there has been a de-growth for this year due to the coronavirus. However, last year data isn’t extremely bullish either.

How to read this chart?

I have previously covered how to read charts on bank credit, but just as a recap, we will not focus on “Food Credit” or “Priority Sector” since these are dependent on government/RBI mandates, not market conditions.

If you observe the rest of the day, trade and tourism has picked up a little, real estate, NBFCs, credit cards, education loans and consumer durables have decelerated.

There are two striking data points - one obvious, one slightly less so.

Credit to medium-sized enterprises is extremely high: This is a direct result of the ECLGS (emergency credit line guarantee scheme), which was announced during the Aatmanirbhar package. Banks lapped up this scheme - why wouldn't they? These MSME loans were guaranteed by the government; and the interest rate was as high as 9.25%, effectively showcasing that incentives do work.

Advances to Individuals against shares, bonds etc: The volatility of the market has allowed some people to utilise this opportunity to borrow against their financial securities - just like there has been a massive growth in gold loans as well.

How do you see this chart playing out for the rest of the year?

Give me some videsi drama

This week, we learn about BaaS (Banking-as-a-Service).

Imagine you run a business - it could be any traditional business. Let’s pick up something I wanted to do - own a restaurant.

Suppose the restaurant is really fancy - you have extremely fine wine and food, something that attracts the elite. However, you want others to experience the place as well. You also want your existing customers to keep coming back.

What if you could offer your customers a card? It could be a prepaid card, a debit card or even a co-branded credit card, but the basic premise is this - if customers use this card to pay for their meal, they get rewards which they can later use it for a second meal, or even a dessert.

Let’s imagine something wilder. You want to offer your customer a loan so that he/she can buy the most expensive wine at your restuarant.

Apart from just these offerings, imagine the amount of information that you can gather on your customers each time they decide to use the card or that loan - effectively increasing the engagement with your brand - and you can offer better targeted offerings based on this data.

BUT - all of these extra “services” are not part of your traditional business (which is simply offering the best food) - so you ideally want to outsource them. Even if you did try to offer them, you simply couldn’t - since you don’t have a banking license (come on, wasn’t getting that liquor license hard enough?)

Enter banks (or fintechs) - they directly integrate their “services” into the products of other non-bank businesses, such as your restaurant.

Let’s see how it looks like:

Here, the license holder is the bank, effectively providing all those services to your brand - voila! Banking as a Service!

So why are we talking about this today?

Because Goldman Sachs has decided to finally enter this segment. You understood how YOUR business can benefit from these services. But how does a bank benefit?

For starters, this is apparently a $32B a year industry. It could help Goldman accelerate it’s growth into the corporate and consumer transaction banking, a place where Citi and JP Morgan are already leading (albeit in different ways).

This makes so much sense with Goldman’s new strategy, which I talked about just two weeks ago. You can check out Goldman’s landing page where the bank explains the feature in detail.

Typically, BaaS was led in charge by smaller banks and fintechs in the US such as BBVA and GreenDot, but here’s why it’s gaining momentum.

[Shout out to Akshat for introducing me to the Durbin amendment last month]

My take: A big bank offering BaaS is definitely going to make a huge difference, if they play their cards right. Generally, smaller players have taken the lead because of their agility and ability to understand the pain points of customers. Is Goldman too large to understand those? Or will it cut out all the small guys?

What else happened this week?

International

Each week, I try to highlight racial and gender discrimination/upliftment in banking. PayPal has pledged $530M to support Black-owned businesses and minority communities in the U.S. PayPal had been thinking about how to erase the racial wealth gap, and hit upon supporting Black and Latino-led venture firms. These investors provide crucial capital to entrepreneurs at a stage that PayPal itself can’t (since it only invests in later stage companies).

National

I keep referencing Vivek Kaul here as well as on other social media platforms - because his work largely resonates with mine; he tries to simplify the Indian economy just as I’m trying to do with Indian banking. Sometimes, his posts extend to banking-related economy as well - such as this week, when he first talked about how Indian savers are at a loss due to decreasing bank interest rates - or when he talked about how mis-selling has gone up by banks - is it due to covid? Hope you enjoy these two weekend reads.

That’s it for this week.

I love feedback. If you want me to cover a particular news, want to get featured, write a guest post or wanna simply say hi, do reach out to me at anirudha@bankonbasak.com. Meanwhile, share this around?

All views and opinions shared in this article and throughout this blog solely represent that of the author and not his employer. Since the author is employed by a bank, he has consciously chosen not to report any news related to his company to avoid conflicts of interest. All information shared here will contain source links to establish that the author is not sharing any material non-public information to his readers. His opinion or remarks on any news are based on the assumption that the source is genuine, thus he is not liable for any information that may turn out to be incorrect. This blog is purely for educational purposes and no part of it should be treated as investment advice. Using any portion of the article without context and proper authorisation will ensue legal action.