#30 Lack of Innovation...

Yes Bank doubling down on Cards. Also, Cross-Border Payments!

Why do you choose a bank?

Think about it.

I’ll talk about my decision to help you out.

I honestly don’t remember when I opened it, but I had a joint account with my mother (when I was still a minor) with Bank of Baroda. It was right opposite to our house so it was kind of a no-brainer decision.

As an adult, I had made enough trips to the bank to make a call that I wouldn’t open an account with them - service was slow, with long queues at the teller (one trip easily blocked two hours of my time) and the net-banking experience was terrible. While the queues are gone, the net-banking is worse now.

I really wanted to open an account at a fancy private/foreign bank like HDFC or Standard Chartered. Unfortunately, during those days, they didn’t have a zero-balance account and I ended up choosing SBI.

Fast forward to today. Nothing much has changed. My mother has three accounts today (primary account - Bank of Baroda, secondary - SBI and a third one with IDFC First Bank, the reason for which is a separate post coming soon).

As for me, I still bank with SBI. Additionally, I have a salary account with the bank I work for (sorry, can’t disclose).

My point is - bank accounts are extremely sticky. I see no point in shifting until I receive benefits that really make me want to.

Consider the results of this personal finance survey conducted by D91 Labs, a research lab sponsored by Setu.

Don’t think that these reasons are exclusive to a particular age group. The survey was conducted with over 450 respondents and “benefits” remained the highest factor irrespective of age.

With this in context, I’m hoping it would be easier to understand certain “strategies” that banks deploy to gain customers and consequently, market share.

Consider Yes Bank!

Just this week, I read news about both its debit and credit card expansions.

As per the Business Head of their Credit Card Division, they plan to issue two lakh credit cards per month! Kind of ambitious when you have a total base of only 8 lac CC!

“We hope to issue more than 25,000 cards in December. We will then keep on growing at a very quick pace and we have a plan for the next 24 months. There is a month-wise plan, but we have to move to a run rate of two lakhs issuances per month. It won’t happen in the next six months but it will be a journey”

To be fair, Yes Bank did manage to issue 45,000 CC in February, it’s just that C-19 kind of slowed their growth, but now they’re extra bullish:

“Retail is the focus for the bank and credit cards are an important area of focus. In the next two years, we want to grow the book four times and in the next five years, we want to grow the book by 15 times”

5x in 5 years. This is kind of immature for a couple of reasons:

Yes Bank still has a long way to go in re-building trust

We are yet to understand the true impact of moratoriums that might come out in the open next year, when banks start reporting their figures

Let’s see where they stand among other private banks (RBI figures are updated till September 30, 2020):

Even though it is way ahead of the next guy, I feel Yes Bank needs to do a lot better if they plan to overtake IndusInd.

Meanwhile, they have launched a completely new series of Debit Cards:

The bank only had partnerships with MasterCard and RuPay till now - this E-series variant is more to do with closing the loop with the missing piece - VISA.

Debit cards are all about partnerships (read my post on Federal Bank’s debit card strategy to understand this better). When you have a key partner missing, it slows down your growth.

As you can see, the bank is not even in the Top 10 in this segment.

There’s another reason why banks choose to go down this strategy of beefing up their cards division to gain customers. This is an insight which I’ve gathered from my own experience working in the Wealth Management Division.

When Relationship Managers want to bring new customers on board (who will most likely have an existing relationship with other banks), they cannot really pitch investment products as there is almost zero differentiation. If Customer “X” is investing in “ABC” Mutual Fund through “Y” bank - we can’t offer him better rates if he transfers his funds to our bank. We can offer him two things:

Better service

“Different” products - unique to our bank

Under these circumstances, offering a LTF (life-time free) high-end Credit Card becomes the easiest way to bring him on board. Once that is successful, it is easier to grow the relationship thereon, starting with a savings account.

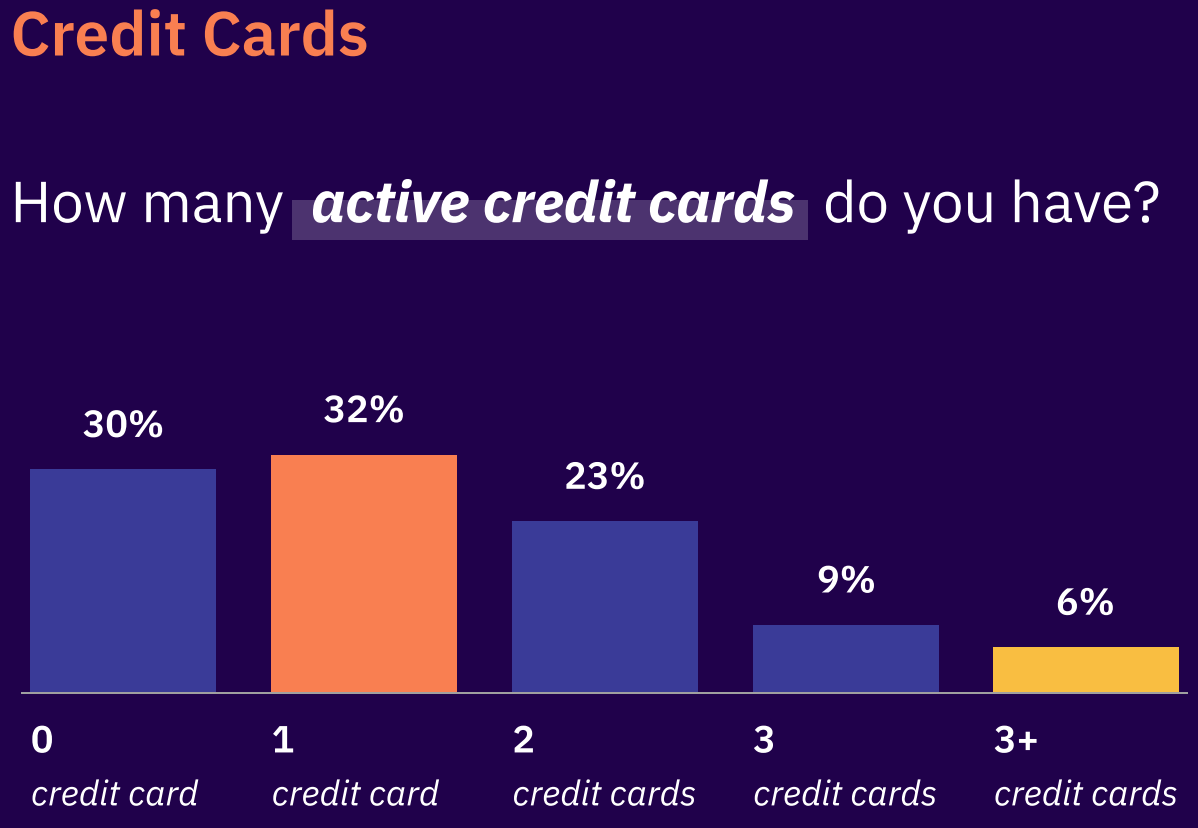

If you go through the results of the survey I talked about earlier, you’ll observe that even though most people have two active debit cards, they have only one active credit card. If you offer a better card, there is a high chance that the customer will make it the active one.

With a move towards a cash-less economy, I feel banks could spend a lot more energy on their mobile applications - as of now, we get to experience it only when we open an account - why not remove that barrier to allow users get a feel of the app?

What do you think? What can make your banking experience better? What is a sore thumb to you?

What’s up with RBI?

The central bank is opening applications for the second cohort of “live-testing” features from startups who are innovating in the financial services space.

From the first cohort, I had written:

I had mentioned about a regulatory sandbox (controlled environment with relaxed rules) that RBI had set up last year, which got a backseat due to C-19. We have the first cohort live now. Out of a whopping 32 entities, only six have been selected for the ‘Test Phase’. The central bank has released the details of the first two…

In that phase, the two companies were mostly focused on offline digital payments, which is very important for greater financial inclusion. The second cohort on the other hand, focuses on the theme - “Cross-Border Payments”.

Personally, I’m very excited to read about the applications for this cohort. It’s a challenging problem to solve. From the RBI text,

India is the largest recipient of inbound remittances across the globe accounting for 15% of global share; in the year 2019, India received $83 bn and in the first half year of 2020, has received $27.4 bn. The Cohort is expected to spur innovations capable of recasting the cross-border payments landscape by leveraging new technologies to meet the needs of a low cost, secure, convenient and transparent system in a faster manner.

RBI has also reduced the net worth requirements so that more participants can apply.

But why is it hard problem to solve?

For starters, there is no “global standard” when it comes to payments. Each country has their own “systems” in place which allow for money transfer in the same currency. In fact, India is leading on this front, with UPI.

UPI has been so successful that it’s developer NPCI, has created an international subsidiary to take the technology to other parts of the world. At a recent conference in Singapore, NPCI CEO Dilip Asbe mentioned that Singapore and India could soon come to an arrangement where real-time transfer of money might be possible between the two nations.

Imagine being able to send money to friends and family in Singapore immediately through Google Pay/PhonePe just like you do here in India.

However, you can’t. Yet. Apart from a global payment standard, you also need to get the regulator on board. Now it might be easy to convince the central bank of Singapore to work on a common payment method with RBI - but that doesn’t solve the problem does it? You need to have an arrangement with every regulator around the world.

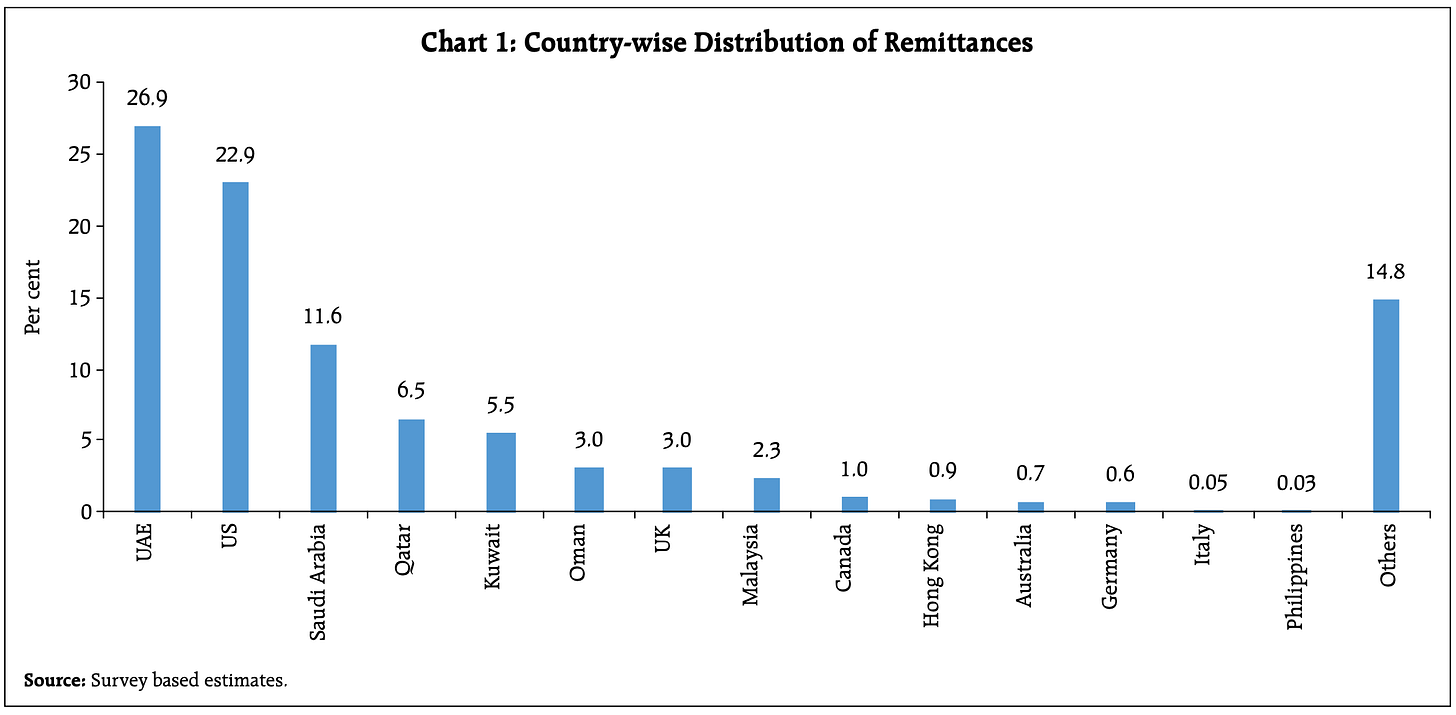

Heck, Singapore doesn’t even come in the Top 15 when it comes to countries we receive the most money from:

As of now, the process is cumbersome, slow and opaque. Among banks, almost three-fourths of the market is captured by private banks.

I found a recent video from India’s largest private bank explaining how “easy” it is to transfer money outside. Watch the video and make a call for yourself. Can’t we do any better?

Apart from the multiple hoops, banks also charge a high markup on the existing forex rates (that you see on Google) and also to cover the cost of compliances that they need to maintain to counter Anti-Money Laundering threats.

Some soft-bound range of costs provided by RBI for different payment methods:

You can read more about RDA here and SWIFT here. Just as a FYI, RDA makes up the bulk of these transactions in India (~75%) - it is a Rupee Drawing Arrangement in which the “Authorised Dealer” banks in India maintain a vostro (an account with another party) account with the verified exchange house in the foreign land.

Do note that Cross-border payments are a lot more complex with different needs for different consumers (for example, a business would care more about speed than cost, an individual may care about both or only on cost). I’ve only scratched the surface to help you understand my point of this being a “challenging” problem.

Stay tuned till I cover the FinTechs trying to solve this!

That’s it for this week.

I love feedback. If you want me to cover a particular news, want to get featured, write a guest post or wanna simply say hi, do reach out to me at anirudha@bankonbasak.com or LinkedIN or Twitter. Meanwhile, like this post and share it around?

All views and opinions shared in this article and throughout this blog solely represent that of the author and not his employer. Since the author is employed by a bank, he has consciously chosen not to report any news related to his company to avoid conflicts of interest. All information shared here will contain source links to establish that the author is not sharing any material non-public information to his readers. His opinion or remarks on any news are based on the assumption that the source is genuine, thus he is not liable for any information that may turn out to be incorrect. This blog is purely for educational purposes and no part of it should be treated as investment advice. Using any portion of the article without context and proper authorisation will ensue legal action.