I came across this ad from Yes Bank recently, promoting floating-rate Fixed Deposits. Now we’re usually familiar with the fact that FDs are fixed-rate, providing the same consistent (and often low) returns.

I felt this was a nice segue into the topic for the day, which is linked to personal finance, banking strategy, central bank regulation and of course, the economy.

Today we’ll understand:

Why Deposit Rates are what they are today

How Lending Rates are related

What can you do about it?

We’ve all seen the news. There’s high inflation. Rising interest rates. Loans are in line to get more expensive for customers.

But what about deposit (FD) rates? Are we going to get more interest if we keep our money in banks?

In an environment where equity and crypto are both “crashing”, people usually flock back to more “traditional” forms of savings - hence, the question above becomes even more pertinent.

Understanding Lending Rates

In order to truly appreciate and understand deposit rates in India, we must first look at the history and mechanics of the lending rate.

You may have heard about the term “NIM” or net interest margin. Simplistically put, this is the spread or difference between the bank’s deposit rate (the rate at which it borrows funds from you) and their lending rate (the rate at which it lends money to you). The higher the difference, the more money for the bank.

So it would make sense for banks to keep increasing lending rate without ever raising the deposit rates, right?

Well, it’s a bit more nuanced than that.

Let’s start by understanding how lending rates are calculated.

I have an ongoing education loan from SBI. Considering it is a long term loan, I’ve been given a “floating” rate of interest. Like the name suggests, the interest rate floats or moves along with the interest rates in the economy.

Education loan and home loans are usually floating rate loans, considering the long periods of repayment (over 15 years).1

So if RBI hikes interest rate following a rising inflationary environment (like now), your interest rates move up as well. This benefits banks.

However, if interest rates move down, your monthly EMI payment goes down as well. This benefits you.

An economy (and interest rates) can change a lot over 15-20 years. Floating rates ensure you’re not stuck in a limbo while the world around you shifts.

It’s a win-win situation.

I mean, it’s supposed to be, in theory.

But it isn’t. I’ll explain.

RBI’s Repo Rate

When we’re talking about the central bank raising interest rates, we usually mean the repo rate. Think of it like a benchmark interest rate set by RBI.

By definition, it is the rate at which the central bank of a country (Reserve Bank of India in case of India) lends money to commercial banks.

When are the changes to the repo rate announced? - During RBI’s monetary policy announcements (usually six times a year).

Ever wonder why?

Because the repo rate is supposed to influence the monetary policy. This essentially means that since the central bank itself cannot lend - by tweaking the interest rate at which banks borrow money from it, it expects bank to change their lending rates promptly.

A refresher on how interest rates affect monetary policy: During COVID, when central bank lowered the repo rate, it expected banks to follow suit. Only when you, as a customer, opt for cheap loans to buy stuff, it stimulates growth of the economy. Similarly, during high inflation, by increasing interest rates, RBI wants to de-motivate you from taking fresh loans, thus taming growth and subsequently, inflation. However, when the repo rate changes don’t get quickly reflected (or transmitted) in bank interest rates, it results in inefficient monetary transmission.

So does RBI repo rates and bank lending rates move hand-in-hand?

No.

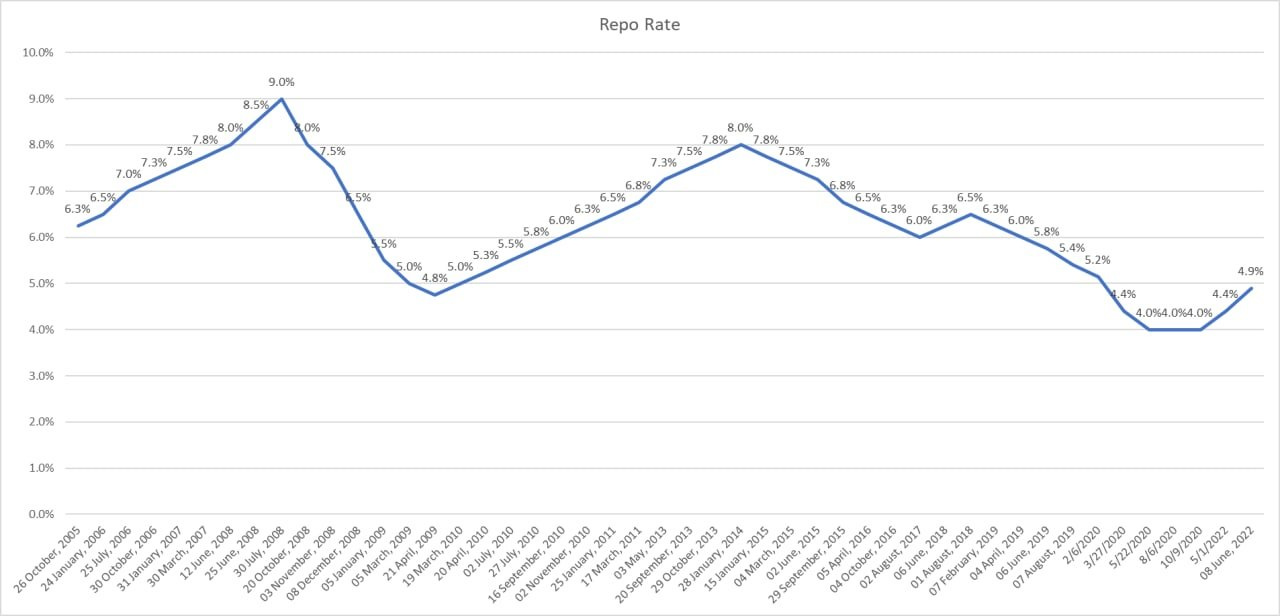

Let’s observe how the repo rate movement has been over the last 20 years.

Now for a brief period (2016-2019), let’s observe how the country's largest lender changed their interest rate compared to the repo rate:

As you can see, within a 3 year period, the gap between repo rate and SBI’s lending rate fluctuated between 1.75% and 2.75%.

Why?

Because of the way banks calculate interest rate (MCLR is one of the methods which I explain below)

Because there’s a time lag before banks’ internal rate catches up with the external rates

MCLR

While fixed rate loans seem really simple and transparent, floating-rate loans aren’t. When I opted for my education loan, the existing regime of calculating interest rates were known as MCLR (Marginal Cost of Funds based Lending Rate).

Let’s look at how banks calculate MCLR:

While the calculation itself might appear standardised, banks are allowed to charge a nice little premium over this, depending on two factors:

Business strategy

Credit risk premium

These two factors are so broad and so opaque that RBI has tried to change the way banks calculate lending rate 5 times already!

The Deposit Rate Strategy

Now that we have a basic understanding of how lending rates move, the question to ask is:

Do deposit rates move as slowly and opaquely as lending rates?

Yes.

Let’s observe this chart.

As you can see above, during a brief period between February 2019 and March 2020, the lending rate moved down by 26 basis points only (RBI had slashed rates by 110 basis points during this tenure) while the deposit rate moved down by 52 basis points - double the lending rate!

1 basis point = 0.01%

While it is expected that deposit rates fall in line with lending rates (to keep the NIM same, remember?), are there no RBI guidelines or policies to streamline them, like in the case of lending rates?

No.

RBI de-regulated (stopped telling banks what interest rates to provide to their customers) all deposit rates by October 1997.2

This essentially meant that it became kind of like a free market economy, where banks decided the interest rate best suited to support their NIM and profitability.

Today, the reason why almost all banks offer the same deposit rates is because they’ve realized the following:

With rigidity in lending rate movement, deposit rate movement is slow as well

Almost all banks, irrespective of size, have moved away from rates-led growth to a branch-led growth (read my last post to understand this in detail)

Offering high interest rates is not sustainable for a long time (a rare few private, small finance or foreign banks may have 1-2% higher than the market briefly for acquisition of new customers, but that’s about it)

Their real competition is not mutual fund and their promised returns; it is actually small savings schemes (think post office) in the same risk-return curve, which currently are offering equivalent rates.

Savings Rate vs FD rate

Since we’re on the topic, let’s also briefly touch upon the finer nuance between savings account rates and FD rates.

ET publication has compiled a list of banks which have increased their FD rates post the RBI hike. While the hikes are meaningless (as little as 20bps) and doesn’t really help counter inflation, you would notice that savings account rates almost never get hiked.

Notice the green line below.

Savings account rate has been stagnant at 4% since a very long time.

Why are banks so reluctant to hike it?

This is because any change here immediately impacts the bank’s entire customer base, resulting in direct hit to their profits.

Compare this to FD, which are fixed and different in tenure. So changes in interest rates only affect for “new” incremental deposits that the bank can source.

Yes Bank’s Floating-Rate FD

Circling back to the ad that we started with, why is Yes Bank suddenly launching floating-rate FDs? Is it even a thing?

Yes.

In fact, before deposit rates were de-regulated, they were pegged to the RBI rate.

In a recent report, RBI had actually recommended that banks tie large deposits to repo rate so that it helps bank and their customers both - just like it is supposed to be for lending rates.

While the idea itself is not new or innovative, it is definitely transparent.

Investors follow the news and are informed when RBI changes rate. In a rising interest-rate environment, opting for this may make sense. Unlike loans which are still pegged to MCLR (and gets reset every 12 months), these rates will reset every 3 months, so there won’t be much delay between RBI’s rate hike and your FD interest hike.

However, this may not suit investors looking for regular monthly income as interest is only paid out on maturity. Also, banks are smart. Yes Bank is only offering this for a 1-3 year timeframe.

Are the low rates going to be a concern?

Well, our RBI governor definitely thinks so. In a recent interview with Times of India, he mentioned,

“Also, let us not forget the depositors with whose savings the banks function. In an environment of high inflation, if interest rates are kept artificially low, then the real rate of return for the depositors would become that much more negative and if that happens, depositors may turn to other assets like gold. This will impact financial savings and have an immediate impact on investment.”

This is not (yet) a personal finance newsletter, so I would refrain from suggesting WHAT you should do. However, I hope this helped to understand the WHY.

That’s it for this week.

P.S. I love feedback. If you want me to cover a particular news, want your brand to get featured, write a guest post or simply want to say hi, do reach out to me at anirudha@bankonbasak.com or LinkedIN or Twitter. Meanwhile, please like this post and share it around?

All views and opinions shared in this article and throughout this blog solely represent that of the author and not his employer. All information shared here will contain source links to establish that the author is not sharing any material non-public information to his readers. His opinion or remarks on any news are based on the assumption that the source is genuine; thus he is not liable for any information that may turn out to be incorrect. This blog is purely for educational purposes and no part of it should be treated as investment advice. Using any portion of the article without context and proper authorisation will ensue legal action.

Not all loans are floating-rate. Car, bike or personal loans are fixed-rate loans. Since they are for a shorter duration (1-7 years), banks or customers are not THAT affected if interest rates change.

Savings bank rates were de-regulated on 2011.

Hi Anirudha, your newsletter is really very informative :) I'm joining NIBM's MBA program so I was looking for something that would help me understand the Indian banking sector, now I'm just binge reading your newsletter !