#28 Too big to fail (scale)?

Bank Glitches, RBI's Payments Push and BaaS 2.0

Biggest Pvt Bank + Biggest PSB = Error

It all started when India’s largest private bank suffered an outage on it’s digital bank front (cards, app, ATM, internet banking).

No, this is not from this week.

This is from 2018.

Then from, 2019:

Finally, this year, last month:

Third Time’s The Charm

Of course, as a regulator, when you see the biggest bank make the same mistake around the same time (November, December) every year like clock-work, you gotta do something.

…and voila!

It is important to note here that this is NOT standard operating procedure for RBI. The regulator is known for fines, and only fines. My first post on this blog talked about the incessant fines that RBI levies EACH MONTH. So there are two reasons why this stands out:

RBI has essentially stopped the source for an important incremental stream of revenue for the bank.

The Governor made a bank-specific comment during a recent press conference:

“In the case of the HDFC bank there were earlier episodes also, and HDFC Bank has an overwhelming presence in the digital payment and internet banking segment, so we have some concerns about certain deficiencies,” said Das.

Equity-market experts are obviously trying to underplay this.

But that’s not the point, is it?

Legacy Infrastructure

There are multiple things that bother me here.

I will re-use my headline at the risk of sounding repetitive: It is the biggest private bank in India! Over 90% of their customers use their digital banking services.

They are a D-SIB (domestic systemically important bank) - code word for “too big to fail” - ironically, RBI maintains this list.

During the 2018 and 2019 outages, there were NO press releases from the bank, highlighting or even addressing/calming their customers.

Hemindra Hazari (an independent analyst) wrote an entire research report on these failures. He had an excellent logical point of view. To quote:

Normally, when a bank’s systems go down, the bank’s disaster recovery plan is meant to take over, but, most worryingly, the bank’s disaster recovery plan did not kick in, resulting in widespread grief for its customers. The RBI’s guidelines on Business Continuity Planning, the equivalent of a Disaster Recovery Plan, are explicit in what the recovery time objective (RTO) should be”

Joke’s on Us

This is not where the story ends.

As if one large bank was not enough, India’s largest public bank suffered the same fate in the same week!

RBI is still “looking into the matter”.

When all of this happens, it doesn’t take a genius to figure out why people hate Indian banks - when their relationship managers quote “trust” for any problem, it is imperative to remind them that “transparency” is equally important. It also sets a solid foundation for payment and neobanks to succeed.

One possible solution - as highlighted by Osborne here:

Example: Check out the status page for Razorpay here.

But then again, do we really believe our banks are ever gonna do this?

What’s up with RBI?

Okay, so I think I’ve covered enough of Monetary Policy Statements (here and here) - it doesn’t make sense as long as RBI keeps the policy rates steady - the only way we can see a movement in this space is if there’s a significant drop in inflation. I’m not saying this. RBI is:

“Accordingly, the MPC decided today to maintain status quo on the policy rate and continue with the accommodative stance as long as necessary – at least during the current financial year and into the next financial year – to revive growth on a durable basis and mitigate the impact of COVID-19 on the economy, while ensuing that inflation remains within the target going forward.”

So let’s focus on the other good stuffs (which for some reason, RBI only waits till the Monetary Policy Announcement to release):

It’s gonna get tougher for NBFCs

I think this was expected. After the Deputy Governor’s speech, the the possibility of NBFCs being allowed to convert to banks - it all converged on the same thing - more regulation for them.

From them,

“…it has been decided to put in place transparent criteria as per a matrix of parameters for declaration of dividends by different categories of NBFCs.”

and,

“…It is felt that a scale-based regulatory approach linked to the systemic risk contribution of NBFCs could be the way forward.”

Their point is - some NBFCs are so large and so dominant, that a huge chunk of the financial system depends on their survival. However, they still enjoy all the lenient regulations and supervision that a bank does not.

My take: Although this is a step in the positive direction, I wonder when RBI will say “Oh god, our plate is full”. With each passing day, they are brining in urban co-op banks, RRB (regional rural bank) and now NBFCs under the same regulatory supervision that a bank is subjected to - all of this requires more manpower and a more efficient system - both of which the regulator has not really been making any announcements on.

On Payments

The limits of contactless card transactions and e-mandates (digital authorisation to deduct money from your bank account) for recurring transactions through cards and UPI have been raised from ₹2,000 to ₹5,000 from January 1, 2021.

This is an interesting development, which eases a customer pain-point massively. Don’t think the numbers are random.

Even the timing is not random. Two weeks ago, I talked about two start-ups who were innovating in the offline payment space. Also, RBI wants the digital payment transaction turnover to go up to 15% of India’s GDP by 2021. (it was 8.5% in 2018)

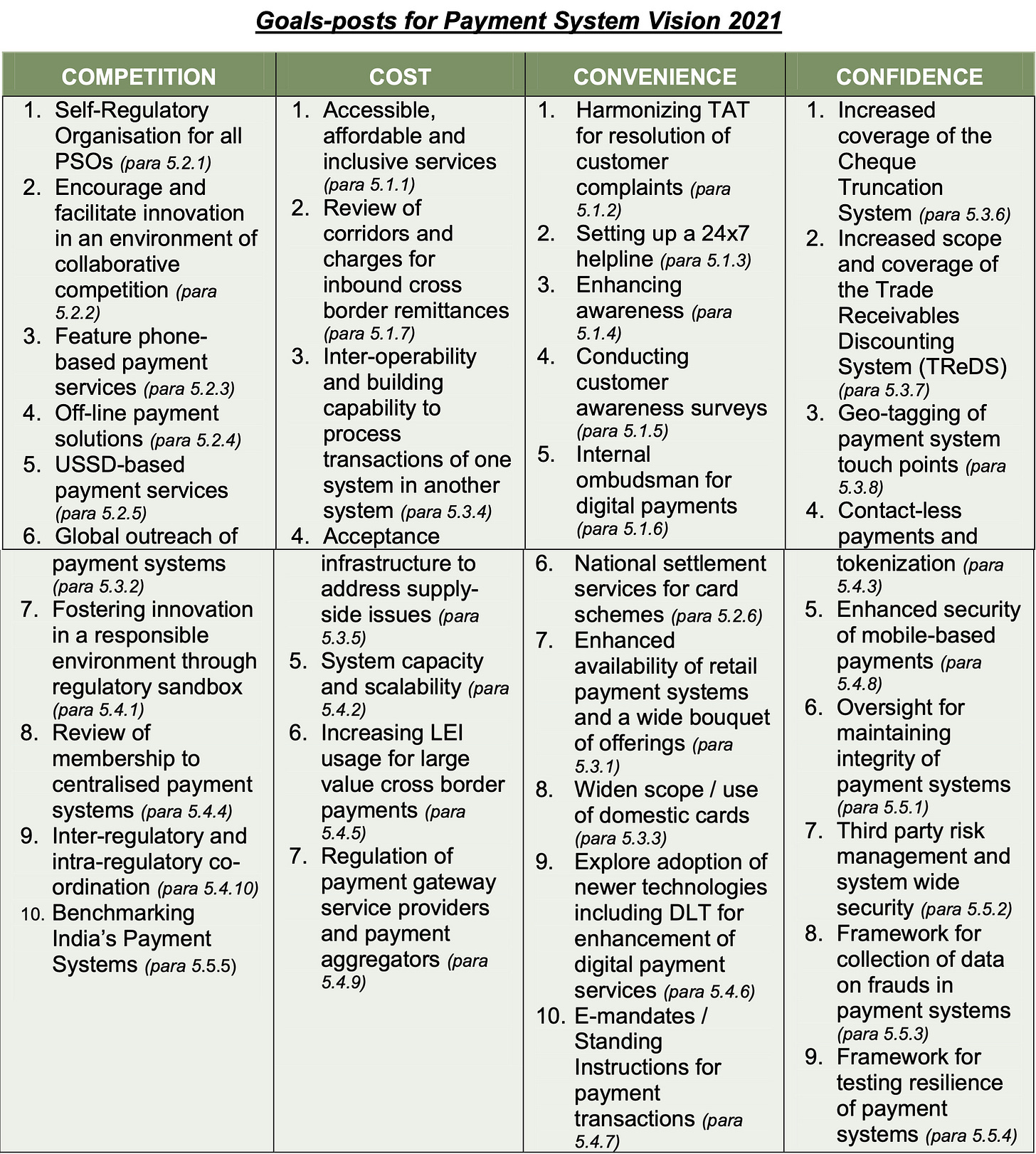

Here’s a quick recap from their Payments Vision document which they released last year.

Did you go through the list?

It’s amazing how they have ticked off almost everything despite Covid.

This upper limit + UPI Autopay will hopefully make it easier for all of us to automate our bill payments and also invest in SIPs through mutual fund platforms.

Give me some videsi drama

Let’s dive deeper into Banking-as-a-Service (BaaS) today.

Please note that this section builds on my first coverage on the same topic here (scroll down to this section). If you have read that, or have a basic idea about BaaS, you can continue.

After Goldman, it is now Stripe’s turn to build it.

If you haven’t heard about the company yet, here’s a good essay to get you up to speed on possibly the greatest internet company in the world.

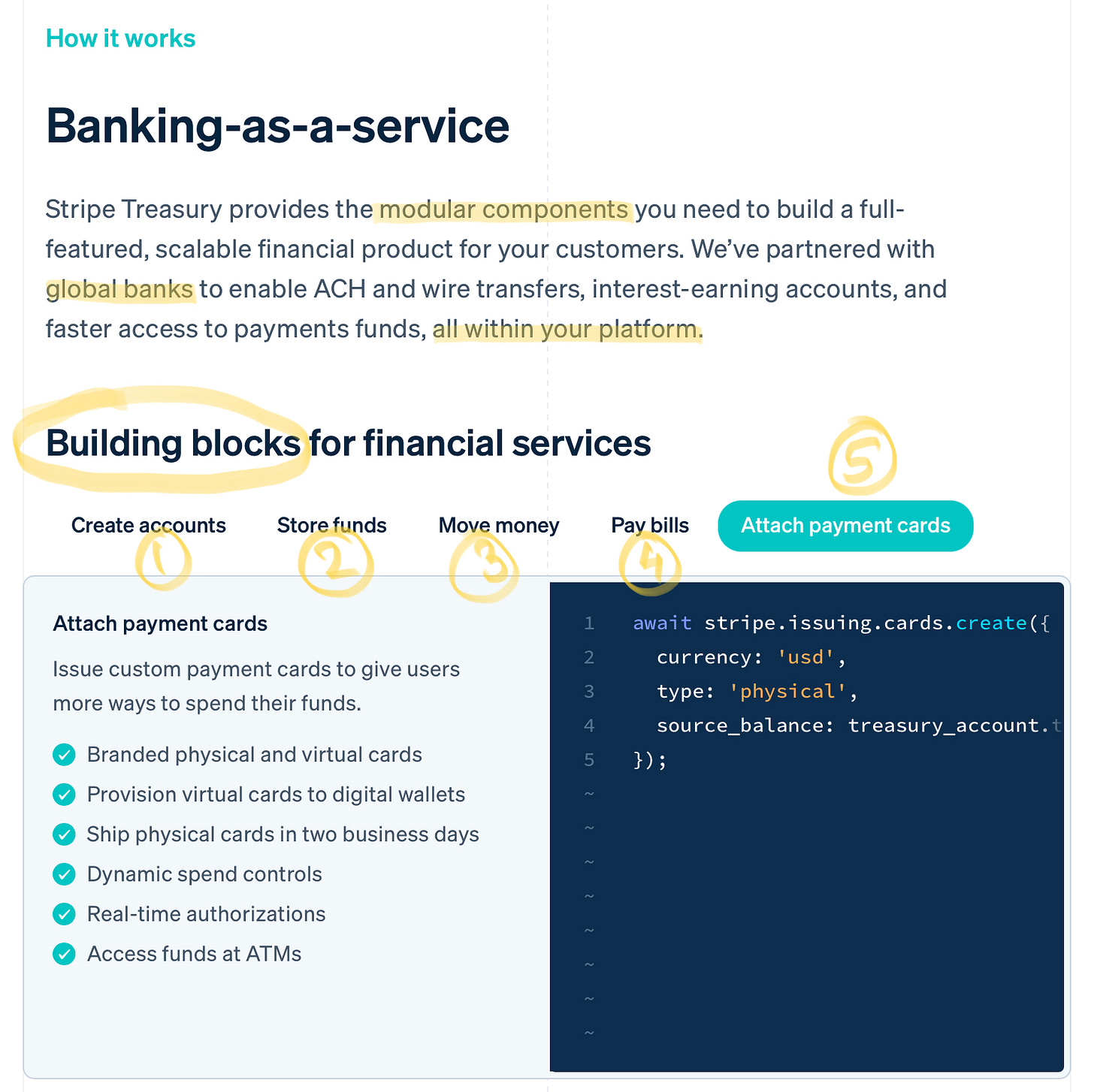

From their product page,

As you can see, Stripe wants to enable it’s customers to be able to do anything that a bank does, without becoming one (no regulatory hassle) or partnering with one (lot of time saved!)

According to their own research,

setting up an account takes 5 and a half days on average (and 7 days on average for online businesses), around one in four (23%) businesses have to send a fax to open an account, and over half of businesses (55%) are required to visit a branch in person to open a bank account. Financial services simply weren’t designed for the modern internet, and this is a pain point for businesses today: nearly half (46%) of companies report that their banking experience has hindered their company growth.

This problem is actually worse in India. Our regulator (and consequently banks) is extremely strict and Stripe-equivalent companies (like Razorpay) have to jump through multiple hoops to make the end-result smooth for their customers.

But wait, how is Stripe different from traditional BaaS?

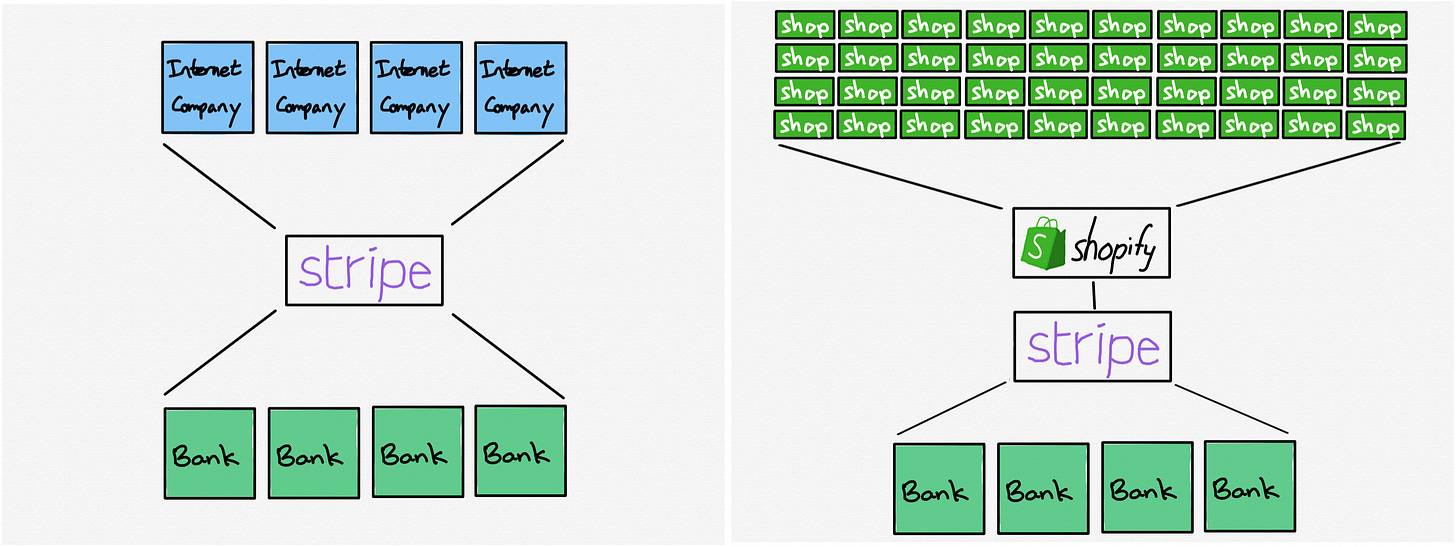

As Ben Thompson from Stratechery explains it, Stripe is a Platform for Platforms.

What does that mean? Stripe uses Shopify as a case study to explain this point and Ben illustrates it perfectly:

If Goldman does BaaS, it will only partner with one bank, their own! Other BaaS players are slowing getting their own license so that they can streamline the process. Instead, Stripe wants the best of all banks.

“Stripe isn’t exposing banking-as-a-service to customers directly on Stripe (like Shopify), but rather making an API (think of like a plug-and-play infrastructure) available to those customers to offer to their customers.” (essentially, Shopify’s customers, who are small and medium business owners)

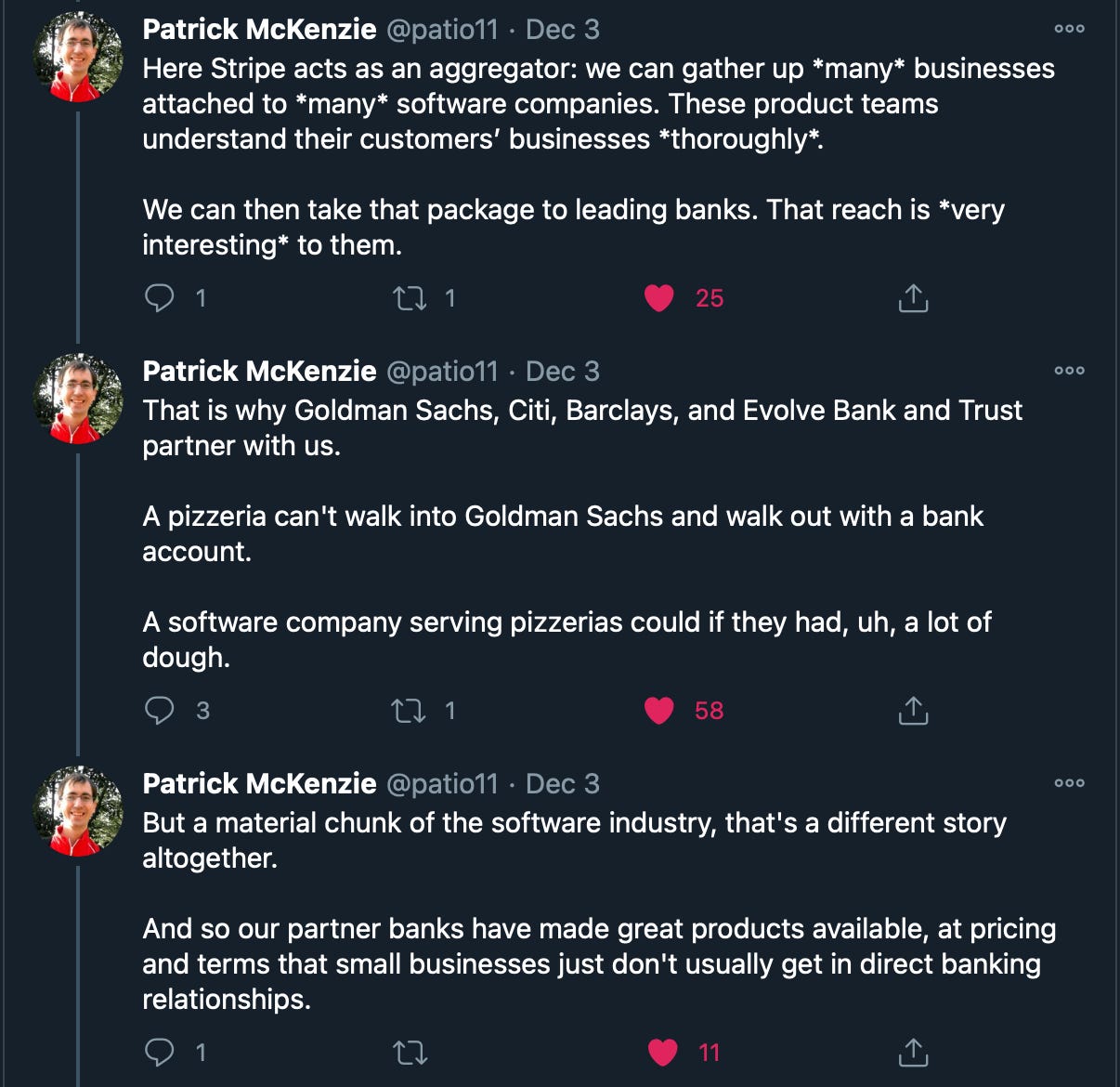

Patrick McKenzie (Stripe employee) has written a really long thread explaining the proposition, but here’s a screenshot that captures it largely:

Brilliant right? I thought so too.

And then I discovered Moov. (hat tip: Rahul)

Moov is another company in the same space that got attention this week due to a funding round by none other than Andreessen Horowitz.

I learnt that there’s now something called Banking “Primitives” as a service. (BPaaS?)

I’m yet to learn about all the details but here’s how it’s different from Stripe:

Moov’s software is open source: whereas Stripe’s is proprietary. Because of Stripe’s prowess, they can afford to take that call - they started with payments, and is now building one product on top of the other - all of it to lock you in.

Stripe is offering the full suite of products through BaaS - Moov’s proposition is that you don’t need everything. Maybe your company only needs expense management, or a credit card or payments. You can selectively pick and choose what you want - that way, it’ll be cheaper to avail this service as well.

BaaS is pretty exciting right now, evolving each day. The basic premise remains the same - nobody wants to interact with the bank. Everyone would rather work with a software company which makes it super easy for them, all remotely done online and without caring about the regulations at the back-end. This convenience, at the very essence, is a timeless proposition - which makes BaaS future-proof. Let’s see how it evolves from here.

That’s it for this week.

I love feedback. If you want me to cover a particular news, want to get featured, write a guest post or wanna simply say hi, do reach out to me at anirudha@bankonbasak.com. Meanwhile, share this around?

All views and opinions shared in this article and throughout this blog solely represent that of the author and not his employer. Since the author is employed by a bank, he has consciously chosen not to report any news related to his company to avoid conflicts of interest. All information shared here will contain source links to establish that the author is not sharing any material non-public information to his readers. His opinion or remarks on any news are based on the assumption that the source is genuine, thus he is not liable for any information that may turn out to be incorrect. This blog is purely for educational purposes and no part of it should be treated as investment advice. Using any portion of the article without context and proper authorisation will ensue legal action.