SponsoredWith the rise in Covid cases again, it has become imperative for everyone to get insured. Even without a personal health insurance, it is likely that you are covered by your company health insurance.

However, not all companies have it. Some are often restricted by the number of employees. Too low and possibly no insurer will offer plans.

Introducing Plum Lite.

The perfect package for your early-stage company - bootstrapped teams starting with just 2 members can now get covered. The best part? It starts at Rs. 85 (per member/ per month), which is less than a meal or a single doctor consultation.

Yes, Covid claims are covered as well 🙂

Tweet of the Week

It seems RBI setting up a FinTech Department has opened more questions than when it was just a small unit, such as:

Who will FinTech NBFCs report to?

Will this also regulate BNPL (which is still unregulated)?

Hopefully, we’ll get the answers soon directly from the source.

From the Financial Stability Report…

Last year, around this time, I’d done a deep dive on RBI’s bi-annual Financial Stability Report (FSR).

Quick Recap: FSR’s main highlight is RBI’s projections of NPAs for the next couple of months. We also find out that RBI horribly gets it wrong each time. 🤦♂️ But it also makes a good document to read granular data of NPAs and credit growth across loan categories. So there’s that!

This time, the projection of NPAs for September 2022 for all SCBs (scheduled commercial banks) is 8.1%-9.5% (baseline to extreme).

If you go through the last year data, RBI had projected a whopping NPA of 13.5% in the baseline scenario. That’s the minimum amount of industry-wide NPAs the central bank was expecting due to Covid related stress.

The actual number?

Almost half of that - 6.9%.

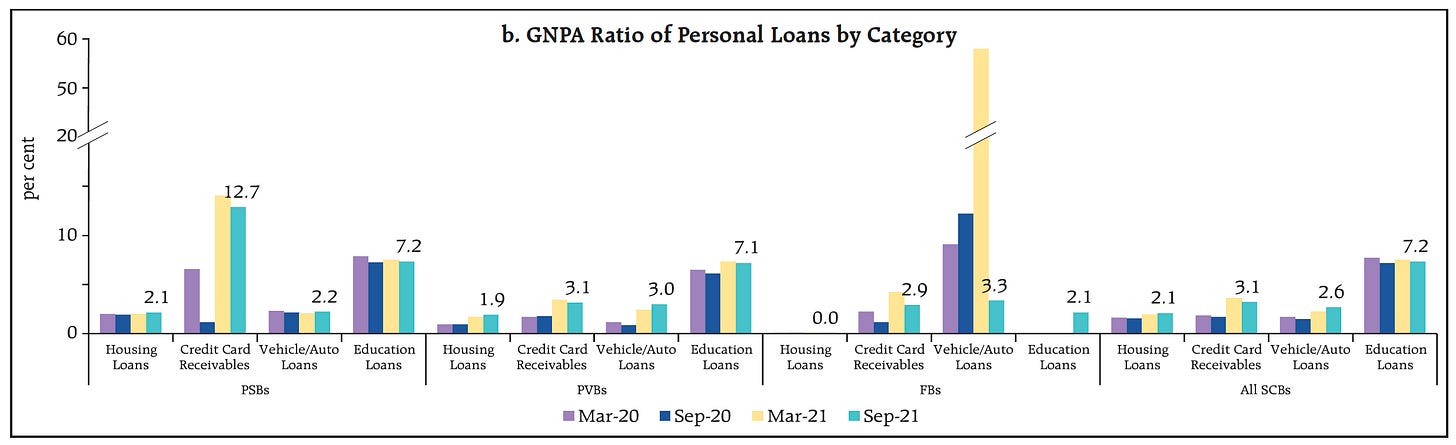

Here’s where it gets interesting though. RBI has introduced new information into my favourite chart - a breakdown of NPA ratios of Personal Loans by Category.

Couple of things that seem interesting here:

NPA ratios for vehicle/auto Loans for Foreign Banks have been unusually high during the middle of last year - I’m yet to find an explanation or an exact source for this

NPA ratios for Credit Cards are higher for Public Sector Banks than any other category of banks (12.7% vs an average of 3% for private and foreign banks)

In fact, this data actually spurred a cautionary article from Moneycontrol:

While the difference in GNPA ratios is stark, lets analyse if it really going to affect the entire credit card industry.

Here’s a breakdown of Credit Cards issued by different banks - their category has been color-coded for easier identification.

As you can see, public sector banks make up less than 1/4th of the industry outstanding. If you remove SBI, that number drops to just 4.4%.

For context, SBI has a GNPA ratio of just 3.36% as on September 2021.

It means the other Public Banks share the bulk of the bad loans. That’s not surprising. These banks have bad loans across most categories, not just credit cards.

Their loan approval rates are almost the same as Private Banks - which indicates lack of due diligence.

This point is proved further if you notice the quality of borrowers they have on their books.

Before you jump onto this chart, a primer on borrower categories:

Do you recall your credit score? CIBIL categorises them in the following way:

Subprime borrowers: 300-680

Near prime borrowers: 681-730

Prime borrowers: 731-770

Prime plus borrowers: 771-790

Super prime borrowers: 791-900.“Below Prime” includes “Near Prime” and “Subprime” borrowers and are treated as low quality.

As per this data, public banks have the highest share of below prime borrowers in the entire industry.

One final chart that I’ll like to point out from the FSR today is called “Borrower Risk Migration”

It indicates the movement of borrowers across risk categories over a time period. I’ve highlighted the portion that you should look into. If you notice, compared to September 2019, “Below Prime” categories shot up in June 2020. However, within the last year (Sep 2020 to Sep 2021), they have more or less stabilised.

Summary:

If all of this went over your head or was simply too boring, here’s the TLDR:

RBI failed to project GNPA ratios correctly again

Public sector banks have a higher GNPA ratio in credit cards (among personal loans) compared to other categories of banks - this has minimal impact on credit card industry but nevertheless, indicates that it is high time they tighten their loan approval process

This is a caution for not only public banks, but also other banks because over the past two years, lower quality of borrowers have creeped into the system and have access to personal loans.

Other Cool Stuff I’ve Read

HDFC Bank seems to be in trouble: Finshots has put together an easy-breezy read on what’s troubling the top bank in the country. Apart from tech issues, it seems to be struggling with hiding it’s larger-than-usual “restructured book” - which, if you add up to their actual loan defaults, bring NPA ratio to as high as 3.5%. I’ve previously explained how restructuring works - in short, there are multiple ways to dress up a loan book - if history is any indication, the skeletons do come out one day. The bank has also performed worse than a Fixed Deposit (in terms of returns) in 2021 - does the market know more than us? 🤔

Federal Bank ED talks about their FinTech strategy: My favourite FinTech journalist Arti Singh has interviewed Shalini Warrier (this is going to be a familiar name if you follow Federal Bank concalls). Shalini looks into digital banking and FinTech partnerships at the bank. Couple of things that she wants Federal to focus on: high-margin unsecured lending products (through FinTechs such as OneCard, Paisabazaar, Pine Labs), having a distributed deposit base (through neobanks such as Jupiter and epiFi), gold loans (through Rupeek) and non-resident customer base (through remittances - will find out who they partner with here).

On Capital Small Finance Bank (SFB): Shiven Tandon returns to writing with a banger piece on Capital SFB, which recently published it’s IPO Document on SEBI. Did you know Capital is the only SFB that had its roots as a Local Area Bank? It can only operate in three adjacent districts, while focusing on rural and semi-urban areas. Shiven goes on to explain how this restriction could have been a blessing a disguise for the bank. As always, if you need a refresher on Small Finance Banks, you can always read it here.

Bringing Offline Digital Payments to 500Mn people: Prince Jain from Unit Economics writes a well-rounded piece on RBI’s attempt to solve offline digital payments. Imagine 39% of India’s population is still without internet. My uncle works in one of the companies trying to innovate in this space (Ubona). It offers UPI transactions over IVR. If your UPI is registered, each transaction takes about 1.5minutes of call duration to complete. While that may seem like a nightmare to us - it is going to make a difference to the target market. But will it really replace cash?

Introducing Banking 2.0

For the longest while, I’ve wondered how to expand “Bank on Basak”. The objective has always remained the same - to expand my own understanding and hopefully, help the ecosystem in a better way.

With this thought, I’ve started a new live webinar series lazily titled “Banking 2.0”, in partnership with a friend who also runs her own platform.

Theme: To highlight niche FinTech startups who are innovating at the intersection of Banking and FinTech.

It’s a new thing and we’ve done three episodes till now. If you’re a FinTech operator/founder who’s innovating in this space, do fill out this interest form and we’ll get back to you.

Here are the links to the past three episodes:

If you want to receive updates before the next episode, the only way to track it is through this Whatsapp group.1 (please read the disclaimer at the bottom of this post/email before you join)

Wish me luck!

That’s it for this week.

P.S. I love feedback. If you want me to cover a particular news, want your brand to get featured, write a guest post or simply want to say hi, do reach out to me at anirudha@bankonbasak.com or LinkedIN or Twitter. Meanwhile, please like this post and share it around?

All views and opinions shared in this article and throughout this blog solely represent that of the author and not his employer. All information shared here will contain source links to establish that the author is not sharing any material non-public information to his readers. His opinion or remarks on any news are based on the assumption that the source is genuine; thus he is not liable for any information that may turn out to be incorrect. This blog is purely for educational purposes and no part of it should be treated as investment advice. Using any portion of the article without context and proper authorisation will ensue legal action.

Whatsapp groups are always risky. Even though the group has one-way communication through admins only, your number is visible to other members of the group, whom I do not screen or verify - so fraudsters or indecent folks can always show up. Members are advised to turn their Whatsapp profile photo, status, about, last seen, groups to “My Contacts Only” from the Privacy Settings. The group (for now) will only serve as an update to new episodes of Banking 2.0, until I decide to change the objective, which will be duly informed.